Mac. Income securities perspec

... comprising a Preference Share and a Holder’s Interest. A Holder’s Interest is the beneficial interest in a Note issued to the Trustee by Macquarie Finance Limited, a wholly owned subsidiary of Macquarie. Only the Trustee may bring proceedings against Macquarie Finance Limited in order to enforce the ...

... comprising a Preference Share and a Holder’s Interest. A Holder’s Interest is the beneficial interest in a Note issued to the Trustee by Macquarie Finance Limited, a wholly owned subsidiary of Macquarie. Only the Trustee may bring proceedings against Macquarie Finance Limited in order to enforce the ...

2016 10-K Report

... Ventas, Inc., an S&P 500 company, is a REIT with a highly diversified portfolio of seniors housing and healthcare properties located throughout the United States, Canada and the United Kingdom. As of December 31, 2016, we owned approximately 1,300 properties (including properties owned through inves ...

... Ventas, Inc., an S&P 500 company, is a REIT with a highly diversified portfolio of seniors housing and healthcare properties located throughout the United States, Canada and the United Kingdom. As of December 31, 2016, we owned approximately 1,300 properties (including properties owned through inves ...

Chapter F8

... reporting, which is separate and distinct from tax law. Differences in methods used for financial reporting do not directly affect a company=s taxes because MACRS is used for tax purposes regardless of the financial method used. 8-11. The short answer is that the 2007 figures in Exhibit 8-8 are not ...

... reporting, which is separate and distinct from tax law. Differences in methods used for financial reporting do not directly affect a company=s taxes because MACRS is used for tax purposes regardless of the financial method used. 8-11. The short answer is that the 2007 figures in Exhibit 8-8 are not ...

AON CORP (Form: 10-K, Received: 03/01/2007 17

... Corporation ("Aon" or the "Company") is restating in this Annual Report on Form 10-K, its consolidated prior year financial statements arising from errors made in the measurement of equity compensation. On February 8, 2007, the Company announced that incorrect measurement dates for certain stock opt ...

... Corporation ("Aon" or the "Company") is restating in this Annual Report on Form 10-K, its consolidated prior year financial statements arising from errors made in the measurement of equity compensation. On February 8, 2007, the Company announced that incorrect measurement dates for certain stock opt ...

SECURITIES AND EXCHANGE COMMISSION Washington, D.C.

... approximately three-fourths of the TiO 2 we produce and the majority of our volume growth is chloride based rutile. For the overall TiO 2 industry, chloride based TiO 2 sales have increased relative to sulfate process pigments over the last several years. In 2006, industry wide chloride process prod ...

... approximately three-fourths of the TiO 2 we produce and the majority of our volume growth is chloride based rutile. For the overall TiO 2 industry, chloride based TiO 2 sales have increased relative to sulfate process pigments over the last several years. In 2006, industry wide chloride process prod ...

0000950130-02-001093 - Lasalle Hotel Properties

... the underwriters have not, authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where ...

... the underwriters have not, authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where ...

SECURITIES AND EXCHANGE COMMISSION Washington, D.C.

... property/casualty domestic insurers have adjusted capital amounts in excess of NAIC Company Action Levels. ...

... property/casualty domestic insurers have adjusted capital amounts in excess of NAIC Company Action Levels. ...

American International Group, Inc. 2016 Annual Report

... transaction in history. The agreement radically reduces AIG’s risk of significant future adverse development and covers our most unpredictable, long-tail U.S. Commercial exposures for accident years 2015 and prior, whereby Berkshire is responsible for 80% of future potential losses, up to a limit of ...

... transaction in history. The agreement radically reduces AIG’s risk of significant future adverse development and covers our most unpredictable, long-tail U.S. Commercial exposures for accident years 2015 and prior, whereby Berkshire is responsible for 80% of future potential losses, up to a limit of ...

FORM 10-K - Manhattan Calumet Value Stock

... of operations or liquidity could be materially adversely affected and investors in our securities could lose part or all of their investments. Accordingly, our investors are cautioned not to place undue reliance on these forward-looking statements because, while we believe the assumptions on which t ...

... of operations or liquidity could be materially adversely affected and investors in our securities could lose part or all of their investments. Accordingly, our investors are cautioned not to place undue reliance on these forward-looking statements because, while we believe the assumptions on which t ...

Nomad Foods Ltd (Form: POS AM, Received: 04/20/2016

... free writing prospectus prepared by or on our behalf. Neither we, nor the selling shareholders, have authorized any other person to provide you with different or additional information. Neither we, nor the selling shareholders, take responsibility for, nor can we provide assurance as to the reliabil ...

... free writing prospectus prepared by or on our behalf. Neither we, nor the selling shareholders, have authorized any other person to provide you with different or additional information. Neither we, nor the selling shareholders, take responsibility for, nor can we provide assurance as to the reliabil ...

Trustees Beware

... because this would be treated as a release of a general power of appointment, rather than a lapse, with potentially adverse transfer ...

... because this would be treated as a release of a general power of appointment, rather than a lapse, with potentially adverse transfer ...

OUTERWALL INC (Form: 10-K, Received: 02/06

... floor space could be used for other purposes. In addition, retailers, some of which have significantly more resources than we do, may decide to enter the coin-counting market. Some banks and other competitors already provide coin-counting free of charge or for an amount that yields very low margins ...

... floor space could be used for other purposes. In addition, retailers, some of which have significantly more resources than we do, may decide to enter the coin-counting market. Some banks and other competitors already provide coin-counting free of charge or for an amount that yields very low margins ...

notes to the financial statements

... are to be measured at fair value except for debt instruments that qualify for amortised cost accounting. It allows an option to present fair value changes in equity instruments in profit or loss or other comprehensive income and it is an irrevocable election on initial recognition. Reclassification ...

... are to be measured at fair value except for debt instruments that qualify for amortised cost accounting. It allows an option to present fair value changes in equity instruments in profit or loss or other comprehensive income and it is an irrevocable election on initial recognition. Reclassification ...

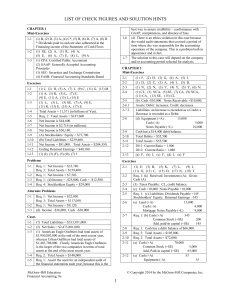

chapter 2 - McGraw Hill Higher Education - McGraw

... activities section of the statement of cash flows. Req. 2: (b) The total cash flows provided by financing activities were $34,157, mostly from the “Excess tax benefit on stock-based compensation” of $73,652. The major deficiency in this balance sheet is the inclusion of the owner’s personal residenc ...

... activities section of the statement of cash flows. Req. 2: (b) The total cash flows provided by financing activities were $34,157, mostly from the “Excess tax benefit on stock-based compensation” of $73,652. The major deficiency in this balance sheet is the inclusion of the owner’s personal residenc ...

Chubb Ltd (Form: 10-K, Received: 02/26/2016 20:30

... On January 14, 2016, we completed the acquisition of The Chubb Corporation, creating a global leader in property and casualty insurance. We have changed our name from ACE Limited to Chubb Limited and plan to adopt the Chubb name globally, although some subsidiaries may continue to use ACE as part of ...

... On January 14, 2016, we completed the acquisition of The Chubb Corporation, creating a global leader in property and casualty insurance. We have changed our name from ACE Limited to Chubb Limited and plan to adopt the Chubb name globally, although some subsidiaries may continue to use ACE as part of ...

VORNADO REALTY LP (Form: 10-K, Received: 02/23/2015 16:44:41)

... Acquiring quality properties at a discount to replacement cost and where there is a significant potential for higher rents Investing in retail properties in select under-stored locations such as the New York City metropolitan area Developing and redeveloping our existing propert ...

... Acquiring quality properties at a discount to replacement cost and where there is a significant potential for higher rents Investing in retail properties in select under-stored locations such as the New York City metropolitan area Developing and redeveloping our existing propert ...

Main Street Capital CORP (Form: 10-K, Received: 02

... MSCC has elected to be treated for U.S. federal income tax purposes as a regulated investment company ("RIC") under Subchapter M of the Internal Revenue Code of 1986, as amended (the "Code"). As a result, MSCC generally will not pay corporate-level U.S. federal income taxes on any net ordinary incom ...

... MSCC has elected to be treated for U.S. federal income tax purposes as a regulated investment company ("RIC") under Subchapter M of the Internal Revenue Code of 1986, as amended (the "Code"). As a result, MSCC generally will not pay corporate-level U.S. federal income taxes on any net ordinary incom ...

words - Investor Relations Solutions

... may be deemed to be, “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements can generally be identified by the use of forward-looking terminology, i ...

... may be deemed to be, “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements can generally be identified by the use of forward-looking terminology, i ...