Chapter 2 & 9

... When computing a gain, both the partner’s basis in his interest, and the partnership’s basis in its assets, include the contributor’s entire basis. When computing gain on the receipt of money in excess of the partner’s basis in the partnership interest, the exchanged basis should be the carryover ba ...

... When computing a gain, both the partner’s basis in his interest, and the partnership’s basis in its assets, include the contributor’s entire basis. When computing gain on the receipt of money in excess of the partner’s basis in the partnership interest, the exchanged basis should be the carryover ba ...

Alternative Investment Funds 2015 - Skadden, Arps, Slate, Meagher

... funds advised by the investment adviser; (iii) have less than $25 million in aggregate assets under management that are attributable to clients in the United States and investors in the United States in private funds advised by the investment adviser; and (iv) neither hold itself out generally to t ...

... funds advised by the investment adviser; (iii) have less than $25 million in aggregate assets under management that are attributable to clients in the United States and investors in the United States in private funds advised by the investment adviser; and (iv) neither hold itself out generally to t ...

NBER WORKING PAPER SERIES COMPETING LIQUIDITIES: CORPORATE SECURITIES, REAL BONDS AND BUBBLES

... have hampered productive investment when the public debt rose sharply during the 1980s, or during the Internet bubble; interest rates1 and investment fell when the latter burst. This paper provides a new and richer view on how rational bubbles impact economic activity. It builds on the idea that bub ...

... have hampered productive investment when the public debt rose sharply during the 1980s, or during the Internet bubble; interest rates1 and investment fell when the latter burst. This paper provides a new and richer view on how rational bubbles impact economic activity. It builds on the idea that bub ...

shortfall savings: the all-important financial

... how much money will be coming in one week to the next – one of income volatility’s defining features – makes deciding how much to save even more challenging.13 For example, one study found that households in the lowest income quintile believed they had annual emergency savings needs of $1,500 while ...

... how much money will be coming in one week to the next – one of income volatility’s defining features – makes deciding how much to save even more challenging.13 For example, one study found that households in the lowest income quintile believed they had annual emergency savings needs of $1,500 while ...

colgate-palmolive company

... upon achievement of performance targets under a distribution services agreement. Sale of Land in Mexico On September 13, 2011, the Company’s Mexican subsidiary entered into an agreement to sell to the United States of America (the “Purchaser”) the Mexico City site on which its commercial operations, ...

... upon achievement of performance targets under a distribution services agreement. Sale of Land in Mexico On September 13, 2011, the Company’s Mexican subsidiary entered into an agreement to sell to the United States of America (the “Purchaser”) the Mexico City site on which its commercial operations, ...

State enterprises exposed to privatisation

... serious investor, providing comprehensive financial information on a company’s performance, position and cash flows over the past 3 years. This information, extracted from reported financial statements, forms the building blocks for any analysis undertaken by investment professionals. The informatio ...

... serious investor, providing comprehensive financial information on a company’s performance, position and cash flows over the past 3 years. This information, extracted from reported financial statements, forms the building blocks for any analysis undertaken by investment professionals. The informatio ...

Property Portfolio - Falcon Real Estate Investment

... Wall Street area since both office and residential space is available there at roughly half the price as in Manhattan • 77 Hudson is being developed in partnership with one of the largest homebuilders in the US ...

... Wall Street area since both office and residential space is available there at roughly half the price as in Manhattan • 77 Hudson is being developed in partnership with one of the largest homebuilders in the US ...

research paper series Research Paper 2007/16

... more than the amount of FDI. In contrast, crowding-out implies that total investment increases by less than the FDI, as other (private) investment is reduced. In terms of access to finance and skilled labour, the presence of foreign firms raises costs to local firms of obtaining finance or employing ...

... more than the amount of FDI. In contrast, crowding-out implies that total investment increases by less than the FDI, as other (private) investment is reduced. In terms of access to finance and skilled labour, the presence of foreign firms raises costs to local firms of obtaining finance or employing ...

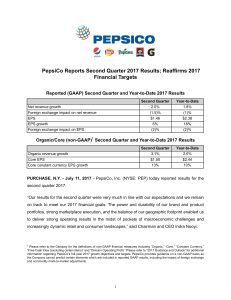

Merrill Document Readback

... “Company,” “we,” “our” or “TRAC”) are unaudited and have been prepared pursuant to U.S. generally accepted accounting principles (“U.S. GAAP”) and the rules and regulations of the Securities and Exchange Commission (the “SEC”) for interim financial reporting and, in our opinion, reflect all adjustme ...

... “Company,” “we,” “our” or “TRAC”) are unaudited and have been prepared pursuant to U.S. generally accepted accounting principles (“U.S. GAAP”) and the rules and regulations of the Securities and Exchange Commission (the “SEC”) for interim financial reporting and, in our opinion, reflect all adjustme ...

First Home Ownership - Productivity Commission

... — generally and for first home buyers — it is unclear where it stands historically. Notwithstanding their popular usage, the available indexes all suffer from methodological and data problems that preclude precise conclusions, particularly concerning first home buyers. In the Commission’s view, the ...

... — generally and for first home buyers — it is unclear where it stands historically. Notwithstanding their popular usage, the available indexes all suffer from methodological and data problems that preclude precise conclusions, particularly concerning first home buyers. In the Commission’s view, the ...

Asymmetric Timely Loss Recognition, Earnings Smoothness and

... the demand for, and the provision of, a conservative reporting strategy. Additionally, Lawrence et al. 2013 provides evidence that there is variation in the level of mandatory conservatism across firms. When conservatism is more pronounced for a firm, economic losses are more likely to be recognized ...

... the demand for, and the provision of, a conservative reporting strategy. Additionally, Lawrence et al. 2013 provides evidence that there is variation in the level of mandatory conservatism across firms. When conservatism is more pronounced for a firm, economic losses are more likely to be recognized ...

Heading D

... In the Netherlands, underlying earnings totaled EUR 129 million, including a one-time EUR 20 million release of provisions. Underlying earnings in the United Kingdom, meanwhile, totaled GBP 17 million, lower than Q2 2008, due primarily to the impact of lower equity and corporate bond markets on fund ...

... In the Netherlands, underlying earnings totaled EUR 129 million, including a one-time EUR 20 million release of provisions. Underlying earnings in the United Kingdom, meanwhile, totaled GBP 17 million, lower than Q2 2008, due primarily to the impact of lower equity and corporate bond markets on fund ...

An Economic Perspective on Double Tax Treaties with(in)

... There are about 2,600 double tax treaties worldwide.1 Such a double tax treaty (DTT henceforth) is a bilateral agreement between two governments to assign taxing rights of cross-border transactions between the two signature states.2 Undoubtedly, every DTT has a particular reason why it came into exi ...

... There are about 2,600 double tax treaties worldwide.1 Such a double tax treaty (DTT henceforth) is a bilateral agreement between two governments to assign taxing rights of cross-border transactions between the two signature states.2 Undoubtedly, every DTT has a particular reason why it came into exi ...

Cheon, Byung You, Chang, Jiyeun Hwang, Gyu Seong Shin, Jin

... Going through the financial crisis calling for economic restructuring, not only potential economic growth rate, but also population growth rate and fertility rate have decreased, which deteriorate performance of labour market. Moreover, employment was the most hard-hit by the financial crisis. While ...

... Going through the financial crisis calling for economic restructuring, not only potential economic growth rate, but also population growth rate and fertility rate have decreased, which deteriorate performance of labour market. Moreover, employment was the most hard-hit by the financial crisis. While ...

Capital Gains Taxation and Cross-border M&As

... decreased returns after their qualification date consistent with a lock-in effect, while stocks that depreciated prior to long-term qualification exhibit lower returns just prior to their qualification date consistent with a capitalization effect. Several papers mainly are concerned with identifying ...

... decreased returns after their qualification date consistent with a lock-in effect, while stocks that depreciated prior to long-term qualification exhibit lower returns just prior to their qualification date consistent with a capitalization effect. Several papers mainly are concerned with identifying ...

Expert Managed Solutions

... of the payment that you make. If you invest a single amount it ranges from 3% to 5%. So, for example, if you invested £10,000 and the Initial Charge was 5%, £500 would be taken from that sum when you invest. The Annual Management Charge (AMC) – this charge covers the cost of managing the funds, payi ...

... of the payment that you make. If you invest a single amount it ranges from 3% to 5%. So, for example, if you invested £10,000 and the Initial Charge was 5%, £500 would be taken from that sum when you invest. The Annual Management Charge (AMC) – this charge covers the cost of managing the funds, payi ...

Pathways PDS - North Online

... including responding to investor enquiries and the preparation of this PDS on behalf of the Responsible Entity. The Responsible Entity, the Portfolio Manager and AMP Capital are each members of the AMP Group. AMP Capital and the Portfolio Manager have each provided consent to the statements made by ...

... including responding to investor enquiries and the preparation of this PDS on behalf of the Responsible Entity. The Responsible Entity, the Portfolio Manager and AMP Capital are each members of the AMP Group. AMP Capital and the Portfolio Manager have each provided consent to the statements made by ...