Active Management: Andrew Slimmon Shares His

... professor of finance at the University of Notre Dame, states a truly active fund should have at least 80% of its portfolio different from the benchmark. Yet, in 2010, only about 25% of assets that were in U.S. funds met this “truly active” hurdle.1 Among the funds purported to be actively managed in ...

... professor of finance at the University of Notre Dame, states a truly active fund should have at least 80% of its portfolio different from the benchmark. Yet, in 2010, only about 25% of assets that were in U.S. funds met this “truly active” hurdle.1 Among the funds purported to be actively managed in ...

Outsourced investment management: what it offers the long

... over the years, and many different kinds of firms now tout their outsourcing capabilities. However, their services can vary markedly from each other, leading to valid questions about what actually constitutes outsourcing. Yet one trend is clear: More and more organizations are outsourcing the manage ...

... over the years, and many different kinds of firms now tout their outsourcing capabilities. However, their services can vary markedly from each other, leading to valid questions about what actually constitutes outsourcing. Yet one trend is clear: More and more organizations are outsourcing the manage ...

TEMPLETON GLOBAL SMALLER COMPANIES FUND

... distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information, even if these damages or losses are due to Morningstar or its content providers’ negligence. Pas ...

... distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information, even if these damages or losses are due to Morningstar or its content providers’ negligence. Pas ...

Ib Modl-4 - Amity

... include tax breaks, low interest rates and grants. Outward FDI, also referred to as "direct investment abroad", is backed by the government against all associated risk. Prof srikanth venkataswamy ...

... include tax breaks, low interest rates and grants. Outward FDI, also referred to as "direct investment abroad", is backed by the government against all associated risk. Prof srikanth venkataswamy ...

The Benefits of Diversification with Real Estate

... of an investment portfolio to a long-term investment in commercial real estate can help diversify a portfolio of stocks and bonds and smooth risk. This type of investment may also provide an income stream and hedge against inflation. Take a deeper look at the benefits of investing in commercial real ...

... of an investment portfolio to a long-term investment in commercial real estate can help diversify a portfolio of stocks and bonds and smooth risk. This type of investment may also provide an income stream and hedge against inflation. Take a deeper look at the benefits of investing in commercial real ...

Il est possible, en s`appuyant sur le récent rapport Sutherland au

... allows for adaptation and benefits from the liberalization of global commerce. The absence of a coherent policy for development is often an important factor in the lack of growth. It is necessary to anchor both the position and the role of commerce in the developmental process. Commerce is an import ...

... allows for adaptation and benefits from the liberalization of global commerce. The absence of a coherent policy for development is often an important factor in the lack of growth. It is necessary to anchor both the position and the role of commerce in the developmental process. Commerce is an import ...

Financial Results

... financial instrument or the provision of an offer to provide investment services. Information, opinions and comments contained in this material are not under the scope of investment advisory services. Investment advisory services are given according to the investment advisory contract, signed betwee ...

... financial instrument or the provision of an offer to provide investment services. Information, opinions and comments contained in this material are not under the scope of investment advisory services. Investment advisory services are given according to the investment advisory contract, signed betwee ...

European Fund for Strategic Investment (EFSI) and EFSI

... Bank’s main lending activity in addition to enhancing the implementation of financial instruments. ...

... Bank’s main lending activity in addition to enhancing the implementation of financial instruments. ...

Investment Grade Debt Offerings

... personnel from finance and/or treasury and legal to devote a fair amount of time to the offering during the preparation period. Depending on the size of the issuer, that may mean heavy involvement from the Treasurer and securities counsel of the issuer, or, for companies with bigger finance and le ...

... personnel from finance and/or treasury and legal to devote a fair amount of time to the offering during the preparation period. Depending on the size of the issuer, that may mean heavy involvement from the Treasurer and securities counsel of the issuer, or, for companies with bigger finance and le ...

Opportunistic Portfolios

... Before investing carefully consider the underlying funds’ objectives, risks, charges, and expenses. For a prospectus containing this and other important information about each fund, contact us at 888-310-7921. Please read the prospectus carefully before investing. The investment return and principal ...

... Before investing carefully consider the underlying funds’ objectives, risks, charges, and expenses. For a prospectus containing this and other important information about each fund, contact us at 888-310-7921. Please read the prospectus carefully before investing. The investment return and principal ...

North America Enhanced Index Fund G (AIF)

... equity-linked securities of North American companies. The fund is a non-UCITS fund, whose assets can be less diversified than in an ordinary mutual fund. The returns, such as dividends and interest, will be reinvested. The fund’s base currency is the euro. The fund is intended for institutional inve ...

... equity-linked securities of North American companies. The fund is a non-UCITS fund, whose assets can be less diversified than in an ordinary mutual fund. The returns, such as dividends and interest, will be reinvested. The fund’s base currency is the euro. The fund is intended for institutional inve ...

Center for North American Studies CNAS), American University

... conclusions of the paper, noted that some of the regulatory issues are simply too contentious for elected officials to tackle. It was also observed that the private sector itself is not always supportive of a common regulatory system, since differences in regulation can create isolated markets which ...

... conclusions of the paper, noted that some of the regulatory issues are simply too contentious for elected officials to tackle. It was also observed that the private sector itself is not always supportive of a common regulatory system, since differences in regulation can create isolated markets which ...

Hiding in Plain Sight

... This material is for informational purposes only and is not intended to be an offer or solicitation to purchase or sell any security or to employ a specific investment strategy. It is intended solely for the information of those to whom it is distributed by Fieldpoint Private. No part of this materi ...

... This material is for informational purposes only and is not intended to be an offer or solicitation to purchase or sell any security or to employ a specific investment strategy. It is intended solely for the information of those to whom it is distributed by Fieldpoint Private. No part of this materi ...

Columbia FDI Perspectives - Columbia Center on Sustainable

... evidence that suggests that host country benefits from inward investment are not the same across all industries. Moreover, a country cannot support the development of all industries nor can it have a comparative advantage in all areas. Therefore, a number of investment promotion agencies have focuse ...

... evidence that suggests that host country benefits from inward investment are not the same across all industries. Moreover, a country cannot support the development of all industries nor can it have a comparative advantage in all areas. Therefore, a number of investment promotion agencies have focuse ...

Stubbs

... earlier then the date agreed upon by the parties.48 The Concession Agreement underwent several amendments that resulted increasing the amount in taxes and royalties owed to the Kuwaiti government. In 1977, Kuwait and Aminoil were in the embroiled in a dispute over the increased amounts owed when Kuw ...

... earlier then the date agreed upon by the parties.48 The Concession Agreement underwent several amendments that resulted increasing the amount in taxes and royalties owed to the Kuwaiti government. In 1977, Kuwait and Aminoil were in the embroiled in a dispute over the increased amounts owed when Kuw ...

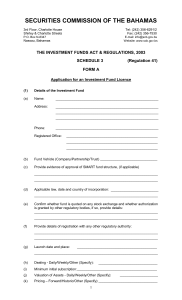

The Investment Funds Act, 2003 - Securities Commission of the

... Constitutive Documents (Certified copies of Memorandum & Articles of Association, including copies of all material agreements) Copies of certificates and other documents of proof for information contained in submitted resumes. Financial statements Prescribed Application Fee (non-refundable) ...

... Constitutive Documents (Certified copies of Memorandum & Articles of Association, including copies of all material agreements) Copies of certificates and other documents of proof for information contained in submitted resumes. Financial statements Prescribed Application Fee (non-refundable) ...

Rules regarding PowerPoint

... minor one. An intermediate correction is one in which the market declines 10% to 20%. And normally any market decline of 20% or more is considered a bear market. But for weeks, stocks have been under selling pressure, which finally knocked the NASDAQ to its first 10% correction since the March 2003 ...

... minor one. An intermediate correction is one in which the market declines 10% to 20%. And normally any market decline of 20% or more is considered a bear market. But for weeks, stocks have been under selling pressure, which finally knocked the NASDAQ to its first 10% correction since the March 2003 ...

Successful investment strategy for pension schemes

... To help you meet this target in the right way for you. But what fully-funded means for each scheme, and the timescale in which to achieve it, varies greatly, which means that investment strategies need to vary too. A robust investment strategy for a pension fund does not happen overnight. It require ...

... To help you meet this target in the right way for you. But what fully-funded means for each scheme, and the timescale in which to achieve it, varies greatly, which means that investment strategies need to vary too. A robust investment strategy for a pension fund does not happen overnight. It require ...

Prudent Practices for Investment Managers

... written investment policy statements Practice No. 1.2 Fiduciaries are aware of their duties and responsibilities Practice No. 1.3 Fiduciaries and parties in interest are not involved in self-dealing Practice No. 1.4 Service agreements and contracts are in writing, and do not contain provisions that ...

... written investment policy statements Practice No. 1.2 Fiduciaries are aware of their duties and responsibilities Practice No. 1.3 Fiduciaries and parties in interest are not involved in self-dealing Practice No. 1.4 Service agreements and contracts are in writing, and do not contain provisions that ...

News Release - First American Funds

... Bancorp affiliate, nor are they insured by the Federal Deposit Insurance Corporation, the Federal Reserve Board, or any other agency. An investment in such products involves investment risk, including possible loss of principal. A Fund’s sponsor has no legal obligation to provide financial support t ...

... Bancorp affiliate, nor are they insured by the Federal Deposit Insurance Corporation, the Federal Reserve Board, or any other agency. An investment in such products involves investment risk, including possible loss of principal. A Fund’s sponsor has no legal obligation to provide financial support t ...

Session 4 Discussion Session - Agricultural and Food Marketing

... Maputo Development Corridor: Championship and balancing the roles of the public and private sectors Mozambique has been the focus of several spatial development initiatives. The Maputo Development Corridor (MDC) was the original development, starting in 1995. Soderbaum (2001) observes that the MDC’ ...

... Maputo Development Corridor: Championship and balancing the roles of the public and private sectors Mozambique has been the focus of several spatial development initiatives. The Maputo Development Corridor (MDC) was the original development, starting in 1995. Soderbaum (2001) observes that the MDC’ ...

Revolutionizing DC Plan Design

... Although the white-label concept has not been implemented across the board, there now are certain smaller plan providers that have packaged white-label f unds on their platf orm. As the technology advances, this idea surely will continue to evolve. But whether or not the plan has white-label capabil ...

... Although the white-label concept has not been implemented across the board, there now are certain smaller plan providers that have packaged white-label f unds on their platf orm. As the technology advances, this idea surely will continue to evolve. But whether or not the plan has white-label capabil ...

- Covenant University Repository

... development. Generally, policy strategies of the Nigerian government towards foreign investments are shaped by two principa l objectives of th e desire for economic independence and the demand for economic development. An analysis of foreign flow into the country so far have revealed that only a lim ...

... development. Generally, policy strategies of the Nigerian government towards foreign investments are shaped by two principa l objectives of th e desire for economic independence and the demand for economic development. An analysis of foreign flow into the country so far have revealed that only a lim ...