Country Commerce Turkey Brochure

... In 2015 the government raised about US$2.0bn in revenue from privatisations, continuing its policy of focusing on sales of power plants and infrastructure. Most proceeds came from the sale of four assets. Three thermal power plants owned by SEAS (Soma Elektrik Uretim-electricity generation) and EUAS ...

... In 2015 the government raised about US$2.0bn in revenue from privatisations, continuing its policy of focusing on sales of power plants and infrastructure. Most proceeds came from the sale of four assets. Three thermal power plants owned by SEAS (Soma Elektrik Uretim-electricity generation) and EUAS ...

Country Commerce Brazil Brochure

... Petróleo Brasileiro (Petrobras, the state-controlled oil company) is heavily indebted, and its capacity to raise additional financing has been hurt by mismanagement and a huge corruption scandal. In February 2015 Moody's, the US-based ratings agency, lowered Petrobras's bond ratings to junk s ...

... Petróleo Brasileiro (Petrobras, the state-controlled oil company) is heavily indebted, and its capacity to raise additional financing has been hurt by mismanagement and a huge corruption scandal. In February 2015 Moody's, the US-based ratings agency, lowered Petrobras's bond ratings to junk s ...

January 2012

... Expectations that central banks may delay interest rate rises, given recent economic data and an increasingly benign inflation outlook, appear to be encouraging some investment professionals to reconsider the relative value of debt and equity investments. With both the FTSE and S&P indices hovering ...

... Expectations that central banks may delay interest rate rises, given recent economic data and an increasingly benign inflation outlook, appear to be encouraging some investment professionals to reconsider the relative value of debt and equity investments. With both the FTSE and S&P indices hovering ...

During August 2012, company produced and sold 3000 boxes of

... The most suitable investment proposals are passed to the relevant level of authority for consideration and approval. Very large proposals may require approval by the board of directors, while smaller proposals may be approved at divisional level, and so on. Once approval has been given, implementati ...

... The most suitable investment proposals are passed to the relevant level of authority for consideration and approval. Very large proposals may require approval by the board of directors, while smaller proposals may be approved at divisional level, and so on. Once approval has been given, implementati ...

MS Word - Securities Commission Malaysia

... APPLICATION FOR ESTABLISHMENT OF A NEW EXCHANGE-TRADED FUND The Capital Markets and Services Act 2007 and the Securities Commission guidelines governing collective investment schemes require person(s) submitting or cause to be submitted, any statement or information to the Commission to ensure that ...

... APPLICATION FOR ESTABLISHMENT OF A NEW EXCHANGE-TRADED FUND The Capital Markets and Services Act 2007 and the Securities Commission guidelines governing collective investment schemes require person(s) submitting or cause to be submitted, any statement or information to the Commission to ensure that ...

Australia`s Foreign Investment Policy

... Review Board (FIRB), which examines foreign investment proposals and advises on the national interest implications. FIRB is a non-statutory advisory body. Responsibility for making decisions rests with the Treasurer. FIRB is supported by a secretariat located in Treasury and by the Australian Taxati ...

... Review Board (FIRB), which examines foreign investment proposals and advises on the national interest implications. FIRB is a non-statutory advisory body. Responsibility for making decisions rests with the Treasurer. FIRB is supported by a secretariat located in Treasury and by the Australian Taxati ...

Investor Brochure - Mackenzie Global Low Volatility Fund

... Irish Life Investment Managers (ILIM) has approximately $80 billion in assets under management and a client base of more than 3,000 employer-sponsored pension plans and 700,000 individuals. ILIM focuses on delivering a market return for clients while reducing volatility and minimizing the portfolio ...

... Irish Life Investment Managers (ILIM) has approximately $80 billion in assets under management and a client base of more than 3,000 employer-sponsored pension plans and 700,000 individuals. ILIM focuses on delivering a market return for clients while reducing volatility and minimizing the portfolio ...

Diasporas: Exploring their Development Potential

... as restaurants, retail chains, consulting companies, or as higher incomes may result in greater amounts of distourism-oriented enterprises. Others create manufacturing posable income available for economic investment. This facilities in their home country, producing goods for local is particularly t ...

... as restaurants, retail chains, consulting companies, or as higher incomes may result in greater amounts of distourism-oriented enterprises. Others create manufacturing posable income available for economic investment. This facilities in their home country, producing goods for local is particularly t ...

Chapt17

... of capital), then the tax doesn’t affect investment. • In our definition, depreciation cost is measured using the current price of capital. • But, legal definition uses the historical price of capital. • If PK rises over time, then the legal definition understates the true cost and overstates profit ...

... of capital), then the tax doesn’t affect investment. • In our definition, depreciation cost is measured using the current price of capital. • But, legal definition uses the historical price of capital. • If PK rises over time, then the legal definition understates the true cost and overstates profit ...

28-2

... Pension Funds • The tax status of pension funds makes them favor assets with the largest spread between pretax and after-tax rates of return. • Pension funds make use of immunization. • Investing in equities occurs for both correct and wrong reasons. INVESTMENTS | BODIE, KANE, MARCUS ...

... Pension Funds • The tax status of pension funds makes them favor assets with the largest spread between pretax and after-tax rates of return. • Pension funds make use of immunization. • Investing in equities occurs for both correct and wrong reasons. INVESTMENTS | BODIE, KANE, MARCUS ...

Seed Equity uses LinkedIn targeting, Spotlight Ads and Sponsored

... Sponsored Updates also helped introduce Seed Equity to investors by touting the opportunity to invest in early-stage startups. “We can raise awareness of our company in several places at once on LinkedIn,” Crosland says of using both Sponsored Updates and Spotlight Ads. “It improves the chances that ...

... Sponsored Updates also helped introduce Seed Equity to investors by touting the opportunity to invest in early-stage startups. “We can raise awareness of our company in several places at once on LinkedIn,” Crosland says of using both Sponsored Updates and Spotlight Ads. “It improves the chances that ...

2 January 2008

... HarbourVest is an independent global private equity investment firm and an SEC registered investment advisor, providing vehicles for institutional investors to invest in the venture capital and buyout markets in the U.S., Europe, and elsewhere through primary partnerships, secondary purchases, and d ...

... HarbourVest is an independent global private equity investment firm and an SEC registered investment advisor, providing vehicles for institutional investors to invest in the venture capital and buyout markets in the U.S., Europe, and elsewhere through primary partnerships, secondary purchases, and d ...

MFG Investment Policy - Mersberger Financial Group, Inc.

... The firm tries to use liquid accounts wherever possible, meaning the client will pay no fee to enter an account and no fee to exit an account. In addition, MFG does not accept up-front commissions wherever possible, unless no other compensation option is available. MFG financial advisors intend to t ...

... The firm tries to use liquid accounts wherever possible, meaning the client will pay no fee to enter an account and no fee to exit an account. In addition, MFG does not accept up-front commissions wherever possible, unless no other compensation option is available. MFG financial advisors intend to t ...

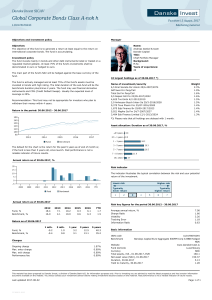

Global Corporate Bonds Class A-nok h

... The fund invests mainly in bonds and other debt instruments listed or traded on a regulated market globally. At least 75% of the fund's investments shall be denominated in euro or hedged to euro. The main part of the fund's NAV will be hedged against the base currency of the fund. The fund is active ...

... The fund invests mainly in bonds and other debt instruments listed or traded on a regulated market globally. At least 75% of the fund's investments shall be denominated in euro or hedged to euro. The main part of the fund's NAV will be hedged against the base currency of the fund. The fund is active ...

executive summary

... expected to be financed by domestic private sources; – About USD 3 billion is estimated to be needed for research and development (R&D) and extension activities. Based on current trends, it can be expected that public sources of funding will need to cover a large part of this additional need. The ad ...

... expected to be financed by domestic private sources; – About USD 3 billion is estimated to be needed for research and development (R&D) and extension activities. Based on current trends, it can be expected that public sources of funding will need to cover a large part of this additional need. The ad ...

AIC guidance on the requirements of the Listing Rules August 2008

... The rules setting out these requirements have been prepared according to the FSA’s new ‘principlesbased’ approach. They represent a departure from the way in which the listing requirements have traditionally been constructed. Rather than relying on detailed – and potentially commerciallyrestrictive ...

... The rules setting out these requirements have been prepared according to the FSA’s new ‘principlesbased’ approach. They represent a departure from the way in which the listing requirements have traditionally been constructed. Rather than relying on detailed – and potentially commerciallyrestrictive ...

1 - London.gov.uk

... GIS to external fund managers if this is deemed prudent. As a result of very large scale pooling, such managers may be able to engage in trading which is impractical for the GLA. Therefore, a slightly broader range of instruments are available to those managers. However, any delegation would be with ...

... GIS to external fund managers if this is deemed prudent. As a result of very large scale pooling, such managers may be able to engage in trading which is impractical for the GLA. Therefore, a slightly broader range of instruments are available to those managers. However, any delegation would be with ...

CHAP17

... depreciation cost is measured using current price of capital, and the CIT would not affect investment But, the legal definition uses the historical price of capital. If PK rises over time, then the legal definition understates the true cost and overstates profit, so firms could be taxed even if ...

... depreciation cost is measured using current price of capital, and the CIT would not affect investment But, the legal definition uses the historical price of capital. If PK rises over time, then the legal definition understates the true cost and overstates profit, so firms could be taxed even if ...

IOSR Journal of Business and Management (IOSR-JBM)

... Varghese (2009) explored the link between globalization and higher education by explaining crossborder movement of the institutions, teachers and students.Varghese (2009) argues that proper regulations and framework is required to be there for multiple operators from private and cross-border institu ...

... Varghese (2009) explored the link between globalization and higher education by explaining crossborder movement of the institutions, teachers and students.Varghese (2009) argues that proper regulations and framework is required to be there for multiple operators from private and cross-border institu ...

Table of Contents - Massachusetts Collectors and Treasurers

... Retirement Fund: (MGL, Ch. 40, sec. 5D) The policy adopted restricts investment in exclusively US Treasuries for terms not exceeding 5 years. A combination of notes and bills will be used to ensure cash flow requirements are met and the annual yield is achieved. Principal will be tapped as required ...

... Retirement Fund: (MGL, Ch. 40, sec. 5D) The policy adopted restricts investment in exclusively US Treasuries for terms not exceeding 5 years. A combination of notes and bills will be used to ensure cash flow requirements are met and the annual yield is achieved. Principal will be tapped as required ...

Agreement on encouragement and reciprocal protection of

... a third State as Chairman of the tribunal. Each party to the dispute shall appoint its member of the tribunal within two months, and the Chairman shall be appointed within three months from the date on which the investor has notified the other Contracting Party of his decision to submit the dispute ...

... a third State as Chairman of the tribunal. Each party to the dispute shall appoint its member of the tribunal within two months, and the Chairman shall be appointed within three months from the date on which the investor has notified the other Contracting Party of his decision to submit the dispute ...

Chapter 2: The Data of Macroeconomics

... of capital), then the tax doesn’t affect investment. • In our definition, depreciation cost is measured using the current price of capital. • But, legal definition uses the historical price of capital. • If PK rises over time, then the legal definition understates the true cost and overstates profit ...

... of capital), then the tax doesn’t affect investment. • In our definition, depreciation cost is measured using the current price of capital. • But, legal definition uses the historical price of capital. • If PK rises over time, then the legal definition understates the true cost and overstates profit ...

Improving the Housing Investment in Western China

... optional consideration for housing investment, sustainability should be highlighted in any compelling investment case. To be specific, sustainability, as the crucial policy goal, entails the viability of natural systems, such as the global climate, and societal and economic issues that may impinge u ...

... optional consideration for housing investment, sustainability should be highlighted in any compelling investment case. To be specific, sustainability, as the crucial policy goal, entails the viability of natural systems, such as the global climate, and societal and economic issues that may impinge u ...

35 Specific Real Estate Issues - So. Korea

... – Ex: Some countries REQUIRE entity establishment before allowing purchase of real estate by foreign investors – Ex: Other countries may require establishment of host country Foreign Direct Investment Company or registration of Branch Office if real estate acquired for profit-making activities, but ...

... – Ex: Some countries REQUIRE entity establishment before allowing purchase of real estate by foreign investors – Ex: Other countries may require establishment of host country Foreign Direct Investment Company or registration of Branch Office if real estate acquired for profit-making activities, but ...

AS 13 - CAalley.com

... Interest, dividends and rentals receivables in connection with an investment are generally regarded as income, being the return on the investment. However, in some circumstances, such inflows represent a recovery of cost and do not form part of income. For example, when unpaid interest has accrued b ...

... Interest, dividends and rentals receivables in connection with an investment are generally regarded as income, being the return on the investment. However, in some circumstances, such inflows represent a recovery of cost and do not form part of income. For example, when unpaid interest has accrued b ...