Chapter 2 Securities Markets TRUE/FALSE T 1. A major function of

... T 37. A direct transfer of funds from savers to firms occurs when new securities are issued in the primary market. T 38. The direct sale of new securities to a pension plan is a private placement, and the securities do not have to be registered with the SEC. T 39. In an "underwriting" the investmen ...

... T 37. A direct transfer of funds from savers to firms occurs when new securities are issued in the primary market. T 38. The direct sale of new securities to a pension plan is a private placement, and the securities do not have to be registered with the SEC. T 39. In an "underwriting" the investmen ...

Free Sample

... F 36. The primary role of organized securities exchanges is to raise capital (money) for firms. T 37. A direct transfer of funds from savers to firms occurs when new securities are issued in the primary market. T 38. The direct sale of new securities to a pension plan is a private placement, and the ...

... F 36. The primary role of organized securities exchanges is to raise capital (money) for firms. T 37. A direct transfer of funds from savers to firms occurs when new securities are issued in the primary market. T 38. The direct sale of new securities to a pension plan is a private placement, and the ...

Document

... this and other important information, obtain a fund prospectus by visiting www.usfunds.com or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Distributed by U.S. Global Brokerage, Inc. All opinions expressed and data provided are subject to change without notice. Some ...

... this and other important information, obtain a fund prospectus by visiting www.usfunds.com or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Distributed by U.S. Global Brokerage, Inc. All opinions expressed and data provided are subject to change without notice. Some ...

Investment Fund Sample Portfolios

... accurate, complete or timely. Neither Morningstar, ADP, nor their content providers, are responsible for any damages or losses arising from any use of this information. For complete information about a fund, including its objective, risks, fees and expenses, please see the prospectus or, in the case ...

... accurate, complete or timely. Neither Morningstar, ADP, nor their content providers, are responsible for any damages or losses arising from any use of this information. For complete information about a fund, including its objective, risks, fees and expenses, please see the prospectus or, in the case ...

ECN 111 Chapter 9 Lecture Notes

... b. The saving supply curve is upward sloping, showing the positive relationship between the real interest rate and the quantity of saving supplied. 2. Changes in Saving Supply When any influence on saving other than the real interest rate changes, saving supply changes. The three main factors that i ...

... b. The saving supply curve is upward sloping, showing the positive relationship between the real interest rate and the quantity of saving supplied. 2. Changes in Saving Supply When any influence on saving other than the real interest rate changes, saving supply changes. The three main factors that i ...

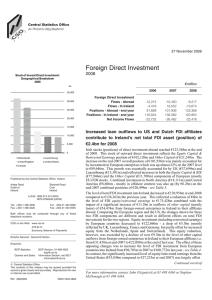

Foreign Direct Investment Annual (PDF 239KB)

... Irish stocks (positions) of direct investment abroad reached €123,368m at the end of 2008. This stock of outward direct investment reflects the Equity Capital & Reinvested Earnings position of €102,120m and Other Capital of €21,248m. The increase on the end-2007 overall position of €101,936m was mai ...

... Irish stocks (positions) of direct investment abroad reached €123,368m at the end of 2008. This stock of outward direct investment reflects the Equity Capital & Reinvested Earnings position of €102,120m and Other Capital of €21,248m. The increase on the end-2007 overall position of €101,936m was mai ...

Appendix 6(ii) Investor`s Statement (legal person) First name and

... 2.3. A) the fulfilment of the Investor’s commitment to make a private contribution does not depend on the Investor’s obtaining any consent, approval, notice or registration by any public, self-government administration authority or any other authority and/or third party (including under any contrac ...

... 2.3. A) the fulfilment of the Investor’s commitment to make a private contribution does not depend on the Investor’s obtaining any consent, approval, notice or registration by any public, self-government administration authority or any other authority and/or third party (including under any contrac ...

IJER v4i5 so (3)

... Second, the illegality of corruption and the need for secrecy make it much more distortionary and costly than its sister activity, taxation. These results may explain why, in some less developed countries, corruption is so high and so costly to development. Hall and Jones (1996) aim investigate why ...

... Second, the illegality of corruption and the need for secrecy make it much more distortionary and costly than its sister activity, taxation. These results may explain why, in some less developed countries, corruption is so high and so costly to development. Hall and Jones (1996) aim investigate why ...

OPIC Presentation

... • Complement the private sector and capital markets • Assure that the projects it supports are consistent with sound environmental and worker rights standards • Take into account guidance from the Administration and Congress on a country’s observance of, and respect for, human rights ...

... • Complement the private sector and capital markets • Assure that the projects it supports are consistent with sound environmental and worker rights standards • Take into account guidance from the Administration and Congress on a country’s observance of, and respect for, human rights ...

Chapter 32: The Global Economy

... argument on behalf of opening international trade is discussed in detail in Chapter 28 of the Microeconomics textbook on my web site. That argument will not be repeated here. However, it would help for you to examine the argument there. Economists are almost universally in favor free international t ...

... argument on behalf of opening international trade is discussed in detail in Chapter 28 of the Microeconomics textbook on my web site. That argument will not be repeated here. However, it would help for you to examine the argument there. Economists are almost universally in favor free international t ...

Las Vegas Valley Water District Investment Policy

... not exceed more than 10 percent of the total portfolio, including the securities lending portfolio. The underlying security for any Repo may not exceed 10 years at the time of purchase. The District’s custodian bank(s) holding accounts in which repos are transacted must enter into a written contract ...

... not exceed more than 10 percent of the total portfolio, including the securities lending portfolio. The underlying security for any Repo may not exceed 10 years at the time of purchase. The District’s custodian bank(s) holding accounts in which repos are transacted must enter into a written contract ...

Why the Mutual Fund Scandal Matters

... trading” and “market timing.” As the news reports generally have it, late trading, if proved, is illegal. Market timing, while not necessarily illegal, often does violate individual funds’ policies, as set forth in their registration statements and prospectuses. Since the initial announcement, a sta ...

... trading” and “market timing.” As the news reports generally have it, late trading, if proved, is illegal. Market timing, while not necessarily illegal, often does violate individual funds’ policies, as set forth in their registration statements and prospectuses. Since the initial announcement, a sta ...

Philanthropy + Finance= Mission Investing for Private Foundations

... distribute five-percent of their assets each year and how this can drive the discussion about the purpose of the foundation. What we do know is that the mandatory five percent distribution came into being with the Tax Reform Act of 1969, along with a host of rules prohibiting self-dealing, jeopardizin ...

... distribute five-percent of their assets each year and how this can drive the discussion about the purpose of the foundation. What we do know is that the mandatory five percent distribution came into being with the Tax Reform Act of 1969, along with a host of rules prohibiting self-dealing, jeopardizin ...

Our Beliefs About Investing

... Diversification is analogous simply to the age-old adage, “Don’t put all your eggs in one basket.” Naïve investors often practice diversification by selecting more than one financial advisor, and naïve financial advisors often practice diversification through product proliferation. At its core, dive ...

... Diversification is analogous simply to the age-old adage, “Don’t put all your eggs in one basket.” Naïve investors often practice diversification by selecting more than one financial advisor, and naïve financial advisors often practice diversification through product proliferation. At its core, dive ...

IOSR Journal of Business and Management (IOSR-JBM) ISSN: 2278-487X.

... investment was more attracted towards the larger countries. The reason for such attraction was the autonomy of prices to be charged by the investor though the tax structures in the larger country were comparatively higher. Basically, smaller sized countries offering smaller tariff rates is basically ...

... investment was more attracted towards the larger countries. The reason for such attraction was the autonomy of prices to be charged by the investor though the tax structures in the larger country were comparatively higher. Basically, smaller sized countries offering smaller tariff rates is basically ...

Mineral Resource Endowments and Investment Destinations: A

... markets and availability of inputs in a region attract manufacturing industries, and immobile factors are the forces opposing concentration. The theoretical literature on the New Economic Geography (NEG) theory focuses mostly on market size effects (forward and backward linkages) that attract the co ...

... markets and availability of inputs in a region attract manufacturing industries, and immobile factors are the forces opposing concentration. The theoretical literature on the New Economic Geography (NEG) theory focuses mostly on market size effects (forward and backward linkages) that attract the co ...

FI360

... them.” Enacting and fully and publicly enforcing a tough fiduciary standard will go a long way to restore public trust in both Wall Street and in regulators. Their remarks were made during the IA Compliance Summit 2009 being held at the Omni Shoreham Hotel in Washington, DC. Recent public opinion su ...

... them.” Enacting and fully and publicly enforcing a tough fiduciary standard will go a long way to restore public trust in both Wall Street and in regulators. Their remarks were made during the IA Compliance Summit 2009 being held at the Omni Shoreham Hotel in Washington, DC. Recent public opinion su ...

Making Lifetime Investing Planning a Reality

... considerations that are difficult to reduce to the familiar two-parameter Markowitz problem. – For example, a family planning to live abroad after retirement would have a different preference for holding investments outside their home currency. • There may be many other issues of a non-economic natu ...

... considerations that are difficult to reduce to the familiar two-parameter Markowitz problem. – For example, a family planning to live abroad after retirement would have a different preference for holding investments outside their home currency. • There may be many other issues of a non-economic natu ...

4 mei 2017 AXA Investment Managers divests from

... portfolio managers will be working closely with AXA IM’s Responsible Investment team to ensure that all funds are in line with the coal policy and all clients impacted have a smooth transition in their portfolios. Clients in segregated mandates may choose to opt out of this policy should they wish t ...

... portfolio managers will be working closely with AXA IM’s Responsible Investment team to ensure that all funds are in line with the coal policy and all clients impacted have a smooth transition in their portfolios. Clients in segregated mandates may choose to opt out of this policy should they wish t ...

PCCF Investment Consulting RFP 2015

... sufficient to provide a complete, accurate and reliable presentation. 3. The Foundation reserves the right, in its sole discretion, to reject any and all responses and to waive any irregularity or informality in any response. 4. The Foundation shall not be liable for any costs and/or expenses incurr ...

... sufficient to provide a complete, accurate and reliable presentation. 3. The Foundation reserves the right, in its sole discretion, to reject any and all responses and to waive any irregularity or informality in any response. 4. The Foundation shall not be liable for any costs and/or expenses incurr ...

Intermediate-Term Municipal Bond

... municipal bond average credit quality (“ACQ”): ratings are from nationally recognized statistical rating organizations (“NRSRO”). Split-rated securities receive the highest rating. ACQ is calculated by NAM, using statistical tools and the most current ratings available from third-party sources on al ...

... municipal bond average credit quality (“ACQ”): ratings are from nationally recognized statistical rating organizations (“NRSRO”). Split-rated securities receive the highest rating. ACQ is calculated by NAM, using statistical tools and the most current ratings available from third-party sources on al ...

Promoting and supporting SME development – the case of Kenya

... - Transport - Telecommunication - Energy - Information Sensible financial institutions/ financial products for RISK FINANCE ...

... - Transport - Telecommunication - Energy - Information Sensible financial institutions/ financial products for RISK FINANCE ...

Community Capital Management

... under the Investment Advisors Act of 1940. The performance data quoted represents past performance. Past performance does not guarantee future results.The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than ...

... under the Investment Advisors Act of 1940. The performance data quoted represents past performance. Past performance does not guarantee future results.The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than ...

Chapter 26: International Economic Relations of 1970 to 2000

... People 100 years ago were facing the same forces, and fearing the same fears, as people today. This trend toward integration began to reverse with World War I. The countries of the world became more isolated from each other between the beginning of World War I (1914) and shortly after the end of Wor ...

... People 100 years ago were facing the same forces, and fearing the same fears, as people today. This trend toward integration began to reverse with World War I. The countries of the world became more isolated from each other between the beginning of World War I (1914) and shortly after the end of Wor ...