Appreciation of the exchange rate

... In Russia, oil can be produced cheaper than in Scotland (Russia only sacrifices 1 litre of whisky to produce 2 extra barrels of oil whereas Scotland would have to sacrifice 2 litres of whisky to produce 1 barrel of oil. ...

... In Russia, oil can be produced cheaper than in Scotland (Russia only sacrifices 1 litre of whisky to produce 2 extra barrels of oil whereas Scotland would have to sacrifice 2 litres of whisky to produce 1 barrel of oil. ...

Exchange Rate and Currency Depreciation

... Table 1 illustrates how the rand performed against major international currencies. As can be seen, the rand depreciated on a quarterly basis. The rand has however been gaining strength; it gained significant strength and closed at R10.33 on Friday the 26th of May 2014 (table2). Table 2: The volatili ...

... Table 1 illustrates how the rand performed against major international currencies. As can be seen, the rand depreciated on a quarterly basis. The rand has however been gaining strength; it gained significant strength and closed at R10.33 on Friday the 26th of May 2014 (table2). Table 2: The volatili ...

dr Bartłomiej Rokicki Chair of Macroeconomics and International

... a price index, which is derived by subtracting the futures' interest rate from 100.00. For instance, an interest rate of 5.00 percent translates to an index price of 95.00 (100.00 - 5.00 = 95.00). • In case of Eurodollar contracts (which reflect the yield on a bank deposit for three months for $1 mi ...

... a price index, which is derived by subtracting the futures' interest rate from 100.00. For instance, an interest rate of 5.00 percent translates to an index price of 95.00 (100.00 - 5.00 = 95.00). • In case of Eurodollar contracts (which reflect the yield on a bank deposit for three months for $1 mi ...

course syllabus

... – Jay R. Ritter. Differences between European and American IPO Markets / European Financial Management. Vol. 9, № 4. December 2003. Pp. 421-434. – Simeon Djankov. When Will Stocks Rebound in Eastern Europe? / World Bank. January, 22. 2009. – Mini-case: San Pico’s New Stock Exchange, p. 335 ...

... – Jay R. Ritter. Differences between European and American IPO Markets / European Financial Management. Vol. 9, № 4. December 2003. Pp. 421-434. – Simeon Djankov. When Will Stocks Rebound in Eastern Europe? / World Bank. January, 22. 2009. – Mini-case: San Pico’s New Stock Exchange, p. 335 ...

Currency Board and Crawling Peg

... rather expensive. Usually, the issuing of high powered money is the source of seignorage, because the central bank can exchange it for interest bearing assets although the "production costs" are very low. A currency board, however, has to buy non-interest ...

... rather expensive. Usually, the issuing of high powered money is the source of seignorage, because the central bank can exchange it for interest bearing assets although the "production costs" are very low. A currency board, however, has to buy non-interest ...

Expanding Economic Relations between China and New Zealand

... renminbi operates under a managed float regime against a basket of currencies. 1 While the Chinese current account is fully convertible, its capital account currently has restricted convertibility, with some controls on capital flows in and out of China. China is currently in the process of reducing ...

... renminbi operates under a managed float regime against a basket of currencies. 1 While the Chinese current account is fully convertible, its capital account currently has restricted convertibility, with some controls on capital flows in and out of China. China is currently in the process of reducing ...

Volatility Spillovers between Stock Returns and Foreign Exchange

... domestic and foreign assets including currencies in their portfolio. An increase in domestic stock prices leads individuals to demand more domestic assets. To buy more domestic assets, they are required to sell foreign assets as they are relatively less attractive now. As a result of which there i ...

... domestic and foreign assets including currencies in their portfolio. An increase in domestic stock prices leads individuals to demand more domestic assets. To buy more domestic assets, they are required to sell foreign assets as they are relatively less attractive now. As a result of which there i ...

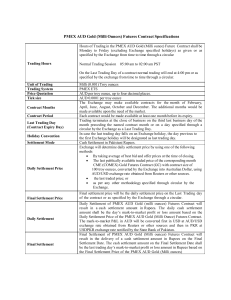

PMEX AUD Gold Futures Contract

... Final settlement price will be the daily settlement price on the Last Trading day of the contract or as specified by the Exchange through a circular. Daily Settlement of PMEX AUD Gold (milli ounces) Futures Contract will result in a cash settlement amount in Rupees. The daily cash settlement amount ...

... Final settlement price will be the daily settlement price on the Last Trading day of the contract or as specified by the Exchange through a circular. Daily Settlement of PMEX AUD Gold (milli ounces) Futures Contract will result in a cash settlement amount in Rupees. The daily cash settlement amount ...

Devaluations

... policy & went into a recession. The $ appreciated, US goods became more expensive, the demand for US goods , & the demand for foreign goods . This policy helped bring inflation down in the US, but increased inflation in the ROW. ...

... policy & went into a recession. The $ appreciated, US goods became more expensive, the demand for US goods , & the demand for foreign goods . This policy helped bring inflation down in the US, but increased inflation in the ROW. ...

Powerpoint slides

... specialized (engages in trade but cannot influence global macroeconomic conditions) ...

... specialized (engages in trade but cannot influence global macroeconomic conditions) ...

Answers - University of California, Berkeley

... means it is just expected to go up in the future. Since it has not changed yet, the only thing we know is that the future expected exchange rate is higher. This shift in the expected exchange rate means that the exchange rate depreciates today. A good way to answer the question is to present two for ...

... means it is just expected to go up in the future. Since it has not changed yet, the only thing we know is that the future expected exchange rate is higher. This shift in the expected exchange rate means that the exchange rate depreciates today. A good way to answer the question is to present two for ...

Chapter 4

... Through the process of globalization, the world market is rapidly evolving into a single interdependent economic system. The three major marketplaces within this system are North America, Europe, and Pacific Asia. Business success in the international arena is largely dependent on competitive advant ...

... Through the process of globalization, the world market is rapidly evolving into a single interdependent economic system. The three major marketplaces within this system are North America, Europe, and Pacific Asia. Business success in the international arena is largely dependent on competitive advant ...

Price Adjustments and Balance-of

... demand curves, the market for foreign exchange is stable. If U.S. income rises, demand for imports rises and so does demand for foreign exchange. The rightward shift of the demand for foreign exchange creates a current account deficit and an increase in the price of pounds (a depreciation of the ...

... demand curves, the market for foreign exchange is stable. If U.S. income rises, demand for imports rises and so does demand for foreign exchange. The rightward shift of the demand for foreign exchange creates a current account deficit and an increase in the price of pounds (a depreciation of the ...

Why Study Money, Banking, and Financial Markets?

... the transactions between investors and companies or other market participants that act as investors or intermediaries. Direct & Indirect Markets Primary & Secondary Markets Money & Capital Markets ...

... the transactions between investors and companies or other market participants that act as investors or intermediaries. Direct & Indirect Markets Primary & Secondary Markets Money & Capital Markets ...

Section One - Pearson Education

... You become party to some inside information which suggests that US interest rates will rise by 1 per cent per annum during the next month. The bank has a rule that in the foreign exchange markets ‘buy equals sell’. This means that for any currency the total of long positions must equal the total of ...

... You become party to some inside information which suggests that US interest rates will rise by 1 per cent per annum during the next month. The bank has a rule that in the foreign exchange markets ‘buy equals sell’. This means that for any currency the total of long positions must equal the total of ...

exchange_rate_determination

... currency and a strengthening of the currency. This result obtains because it is assumed that people do not alter their savings and their demands for funds. In practice, it is likely that people will increase their savings in anticipation of higher taxes in the future; this will reduce the domest ...

... currency and a strengthening of the currency. This result obtains because it is assumed that people do not alter their savings and their demands for funds. In practice, it is likely that people will increase their savings in anticipation of higher taxes in the future; this will reduce the domest ...

International Political Economy

... • Free trade relied on the free convertibility of currencies. Negotiators at the Bretton Woods conference, fresh from what they perceived as a disastrous experience with floating rates in the 1930s, concluded that major monetary fluctuations could stall the free flow of trade. • The liberal economic ...

... • Free trade relied on the free convertibility of currencies. Negotiators at the Bretton Woods conference, fresh from what they perceived as a disastrous experience with floating rates in the 1930s, concluded that major monetary fluctuations could stall the free flow of trade. • The liberal economic ...

M16_KRUG8283_08_IM_C16

... concludes with a discussion of exchange-rate pass-through, that is, the response of import prices to exchange rate movements. The chapter begins with the development of an open-economy fixed-price model (an online Appendix discusses the relationship between the IS-LM model and the analysis in this c ...

... concludes with a discussion of exchange-rate pass-through, that is, the response of import prices to exchange rate movements. The chapter begins with the development of an open-economy fixed-price model (an online Appendix discusses the relationship between the IS-LM model and the analysis in this c ...

Balance –of-Payments Adjustments with Exchange Rate Changes

... Left panel of figure 16.3 repeats D€ and S€ from Figure 16.1. With D€ and S€ , the equilibrium exchange rate is R=$1.20/ €1, at which the quantity of euros demanded and the quantity supplied are equal at €10billion per year (point E). If the exchange rate fell to R=$1/ €1, there would be an excess ...

... Left panel of figure 16.3 repeats D€ and S€ from Figure 16.1. With D€ and S€ , the equilibrium exchange rate is R=$1.20/ €1, at which the quantity of euros demanded and the quantity supplied are equal at €10billion per year (point E). If the exchange rate fell to R=$1/ €1, there would be an excess ...

Document

... domestic and foreign exchange rates • Examine the many possible exchange rate systems a country can adopt • Understand the interaction of an exchange rate system, government policy, and the world economy Copyright © 2005 Pearson Addison-Wesley. All rights reserved. ...

... domestic and foreign exchange rates • Examine the many possible exchange rate systems a country can adopt • Understand the interaction of an exchange rate system, government policy, and the world economy Copyright © 2005 Pearson Addison-Wesley. All rights reserved. ...

Final - Second Semester 2011/2012 International Accounting The

... c. Modified accrual basis. d. Modified cash basis. 2. Which of the following international activities may expose a domestic company to exchange rate risks? a. Exporting or importing goods. b. Establishing a foreign branch. c. Holding an equity investment in a foreign company. d. All of the above. 3. ...

... c. Modified accrual basis. d. Modified cash basis. 2. Which of the following international activities may expose a domestic company to exchange rate risks? a. Exporting or importing goods. b. Establishing a foreign branch. c. Holding an equity investment in a foreign company. d. All of the above. 3. ...

DOC

... 6. Suppose that a Swiss watch that costs 400 francs in Switzerland costs $200 in the United States. The exchange rate between the franc and the dollar is: a) b) c) d) ...

... 6. Suppose that a Swiss watch that costs 400 francs in Switzerland costs $200 in the United States. The exchange rate between the franc and the dollar is: a) b) c) d) ...

Price Adjustment Mechanism with the Gold Standard

... demand curves, the market for foreign exchange is stable. If U.S. income rises, demand for imports rises and so does demand for foreign exchange. The rightward shift of the demand for foreign exchange creates a current account deficit and an increase in the price of pounds (a depreciation of the ...

... demand curves, the market for foreign exchange is stable. If U.S. income rises, demand for imports rises and so does demand for foreign exchange. The rightward shift of the demand for foreign exchange creates a current account deficit and an increase in the price of pounds (a depreciation of the ...