open economy

... U.S. Company. Notice that two things have occurred simultaneously. The U.S. has sold to a foreigner some of its output(the planes), and this sale increases U.S. Net exports. In addition, the U.S. has acquired some foreign assets(the yen), and this ...

... U.S. Company. Notice that two things have occurred simultaneously. The U.S. has sold to a foreigner some of its output(the planes), and this sale increases U.S. Net exports. In addition, the U.S. has acquired some foreign assets(the yen), and this ...

1. Setting the exchange rate

... One reason, why the discussion over the choice of an appropriate exchange rate arrangement continus, is that the number of countries integrated in global market has increased in recent years. Countries are involved in international environment with increasing trade, foreign investment and internatio ...

... One reason, why the discussion over the choice of an appropriate exchange rate arrangement continus, is that the number of countries integrated in global market has increased in recent years. Countries are involved in international environment with increasing trade, foreign investment and internatio ...

, Institute Di de

... is expected to prevail. Therefore the expectation formation equation, n = i / e , is part of the system; e represents the exchange rate. Since no jumps in the state variables are allowed, these expectations need not be rational. Total private wealth, U: is the sum of the values of these assets, W = ...

... is expected to prevail. Therefore the expectation formation equation, n = i / e , is part of the system; e represents the exchange rate. Since no jumps in the state variables are allowed, these expectations need not be rational. Total private wealth, U: is the sum of the values of these assets, W = ...

National Institute of Securities Markets

... Explain the importance of debt market for the economic development of a country and know the relative size of debt and equity markets globally and in India 2.4 Introduction to “Interest Rate” Understand the concept of interest rate and interest rate as rent on money Explain the importance of risk-fr ...

... Explain the importance of debt market for the economic development of a country and know the relative size of debt and equity markets globally and in India 2.4 Introduction to “Interest Rate” Understand the concept of interest rate and interest rate as rent on money Explain the importance of risk-fr ...

The Case Against Floating Exchange Rates

... Why did central banks continue to intervene even in the absence of any formal obligation to do so? ...

... Why did central banks continue to intervene even in the absence of any formal obligation to do so? ...

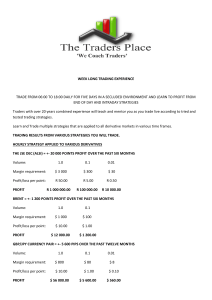

week long trading experience trade from 06:00 to 18:00 daily for five

... Start each day with an edge. Each morning begins with learning to complete a matrix so that you know the strongest currency pairs to trade for the day. YOU WILL RECEIVE CONTINUED SUPPORT IN THE FORM OF: ...

... Start each day with an edge. Each morning begins with learning to complete a matrix so that you know the strongest currency pairs to trade for the day. YOU WILL RECEIVE CONTINUED SUPPORT IN THE FORM OF: ...

International Coordination Jeffrey Frankel 2015 Asia Economic Policy Conference

... – If i were the only domestic monetary instrument, then its loss would leave only the exchange rate and would thus turn monetary policy into a zero-sum game. – But there are other domestic monetary channels: • long-term interest rates, corporate interest rates, equity prices, real estate prices and ...

... – If i were the only domestic monetary instrument, then its loss would leave only the exchange rate and would thus turn monetary policy into a zero-sum game. – But there are other domestic monetary channels: • long-term interest rates, corporate interest rates, equity prices, real estate prices and ...

The Dollar-Euro Exchange Rate and the Limits to

... price fluctuations as the interplay between both bulls and bears – a basic feature of markets that contemporary models find difficult to explain without assuming irrationality on the part of market participants. 4.4 Coming to Terms with Imperfect Knowledge Economists are trained early on to believe ...

... price fluctuations as the interplay between both bulls and bears – a basic feature of markets that contemporary models find difficult to explain without assuming irrationality on the part of market participants. 4.4 Coming to Terms with Imperfect Knowledge Economists are trained early on to believe ...

foreign exchange rate regimes and foreign exchange markets in

... in the fundamental factors of the economy. A limited oscillation band, then, is not credible, and leads either to the expansion of the oscillation band, or to the devaluation of the currency, even to changes in the regime. On the other hand, even economies which use floating exchange rate regimes do ...

... in the fundamental factors of the economy. A limited oscillation band, then, is not credible, and leads either to the expansion of the oscillation band, or to the devaluation of the currency, even to changes in the regime. On the other hand, even economies which use floating exchange rate regimes do ...

Chapter 16

... • LR models are useful when all prices of inputs and outputs have time to adjust. • In the SR, some prices of inputs and outputs may not have time to adjust, due to labor contracts, costs of adjustment or imperfect information about market demand. • This chapter builds on the previous models of exch ...

... • LR models are useful when all prices of inputs and outputs have time to adjust. • In the SR, some prices of inputs and outputs may not have time to adjust, due to labor contracts, costs of adjustment or imperfect information about market demand. • This chapter builds on the previous models of exch ...

Regional Symposium: Policies and Environment Conducive to

... – and part of the cause in others. Interest rates which influence the carry trade, and the carry trade's influence on the market, are important factors. Longer term movements in exchange rates are more likely to be caused by the strength or weakness of particular economies and by monetary measures u ...

... – and part of the cause in others. Interest rates which influence the carry trade, and the carry trade's influence on the market, are important factors. Longer term movements in exchange rates are more likely to be caused by the strength or weakness of particular economies and by monetary measures u ...

S - Binus Repository

... the future at prices agreed upon today. Bank quotes for 1, 3, 6, 9, and 12 month maturities are readily available for forward contracts. Longer-term swaps are available. ...

... the future at prices agreed upon today. Bank quotes for 1, 3, 6, 9, and 12 month maturities are readily available for forward contracts. Longer-term swaps are available. ...

the choice of exchange rate regime

... spectrum from free floating to indefinite fixing, or even surrendering one’s own currency. The role of official intervention in the exchange market is reviewed, as is the case for and against controls on foreign exchange transactions. ...

... spectrum from free floating to indefinite fixing, or even surrendering one’s own currency. The role of official intervention in the exchange market is reviewed, as is the case for and against controls on foreign exchange transactions. ...

CMC-Q1-2016-New Complaints Management Framework

... Complaints relating to transactions spanning up to 7 years or beyond may require more time to enable firms respond to allegations. Complaints that include criminal elements which are referred to the Exchange, these complaints are not likely to be concluded within 20 working days. Appeals against dir ...

... Complaints relating to transactions spanning up to 7 years or beyond may require more time to enable firms respond to allegations. Complaints that include criminal elements which are referred to the Exchange, these complaints are not likely to be concluded within 20 working days. Appeals against dir ...

A Macroeconomic Theory of the Open Economy

... A policy that restricts imports does not affect net capital outflow, so it cannot affect net exports or improve a country’s trade deficit. Instead, it appreciates the exchange rate and reduces ...

... A policy that restricts imports does not affect net capital outflow, so it cannot affect net exports or improve a country’s trade deficit. Instead, it appreciates the exchange rate and reduces ...

A Model of Currency Exchange Rates

... A volume-independent model for currencyexchange rates in international business gaming simulations is presented that is shown to be stable, simple, and fair. Based on foreign holdings of money, the model pegs exchange rates to allow for currency speculation. The effect of international trade, deposi ...

... A volume-independent model for currencyexchange rates in international business gaming simulations is presented that is shown to be stable, simple, and fair. Based on foreign holdings of money, the model pegs exchange rates to allow for currency speculation. The effect of international trade, deposi ...

The Canadian Dollar is Rising Along with Oil Prices

... NOTE TO READERS: The letters k, M and B are used in texts and tables to refer to thousands, millions and billions respectively. IMPORTANT: This document is based on public information and may under no circumstances be used or construed as a commitment by Desjardins Group. While the information provi ...

... NOTE TO READERS: The letters k, M and B are used in texts and tables to refer to thousands, millions and billions respectively. IMPORTANT: This document is based on public information and may under no circumstances be used or construed as a commitment by Desjardins Group. While the information provi ...

Prices and Wages in Transitions to a Market Economy

... economy. If forward markets for their currencies arise, they are likely to have relatively large risk premia and wide spreads between buying and selling rates, given the uncertainty about future policies and future development. Without much history on which to base anticipations, greater weight is p ...

... economy. If forward markets for their currencies arise, they are likely to have relatively large risk premia and wide spreads between buying and selling rates, given the uncertainty about future policies and future development. Without much history on which to base anticipations, greater weight is p ...

PDF Download

... become members of the EU at any time and that fulfil the Maastricht criteria most of the time (e.g. Switzerland and Estonia) gain from pegging to the euro because the EU is anyway their major trading partner. Moreover, pegging to the euro gives financial markets an anchor for longer-term expectation ...

... become members of the EU at any time and that fulfil the Maastricht criteria most of the time (e.g. Switzerland and Estonia) gain from pegging to the euro because the EU is anyway their major trading partner. Moreover, pegging to the euro gives financial markets an anchor for longer-term expectation ...

Perfect Competition – Economics of Competitive Markets

... Currency values are determined solely by market demand and supply factors. ...

... Currency values are determined solely by market demand and supply factors. ...

to see details - Economic Affairs Division

... Departments, Autonomous Bodies and Development Financial Institutions [DFIs] on foreign loans/credits contracted and relent w.e.f. 03/03/2009. The revised terms pertaining to interest rate and exchange risk coverage fee [ERC] shall be fixed as per table given below: AGENCY ...

... Departments, Autonomous Bodies and Development Financial Institutions [DFIs] on foreign loans/credits contracted and relent w.e.f. 03/03/2009. The revised terms pertaining to interest rate and exchange risk coverage fee [ERC] shall be fixed as per table given below: AGENCY ...

The evolving international monetary system

... slipped into non-priority status as a focus for reform after the collapse of the Bretton Woods regime in the early 1970s. President Richard Nixon’s decision to end the dollar’s convertibility into gold ushered in a new international monetary system in which international payments would be made by pr ...

... slipped into non-priority status as a focus for reform after the collapse of the Bretton Woods regime in the early 1970s. President Richard Nixon’s decision to end the dollar’s convertibility into gold ushered in a new international monetary system in which international payments would be made by pr ...