Methodology of Exchange Design

... – Algorithmic complexity can make sensible participation difficult and should be minimized ...

... – Algorithmic complexity can make sensible participation difficult and should be minimized ...

problem set 3 - Shepherd Webpages

... If the decrease in the trade deficit was expected, then there is no true news here, and the effect on the dollar’s exchange value now (in the very short-run) should be small. If it is unexpected, then this is news, and it can have an impact now (in the very short-run) on the dollar’s value. Most lik ...

... If the decrease in the trade deficit was expected, then there is no true news here, and the effect on the dollar’s exchange value now (in the very short-run) should be small. If it is unexpected, then this is news, and it can have an impact now (in the very short-run) on the dollar’s value. Most lik ...

Why YOU Should Trade CME Currency Futures Instead

... They say: The cash currency market averages over $13 trillion a day This apparently implies that the total volume traded in the cash currency markets works in your favor. But the truth is in the actual execution. What do I mean by that? Just this: Will YOU get better prices and have your limit orde ...

... They say: The cash currency market averages over $13 trillion a day This apparently implies that the total volume traded in the cash currency markets works in your favor. But the truth is in the actual execution. What do I mean by that? Just this: Will YOU get better prices and have your limit orde ...

Secondary Market Regulations of Government Bonds

... Over a yield curve ranging from 3% for 1 year to 8% for 10 years ...

... Over a yield curve ranging from 3% for 1 year to 8% for 10 years ...

On floating exchange rates, currency depreciation and effective

... and I.P.] British wages had declined as a result of unemployment, the resultant lowering in the cost of production would have permitted the establishment of new industries and guaranteed those already in existence, without any need for the deliberate reduction in the import coefficient [achieved tha ...

... and I.P.] British wages had declined as a result of unemployment, the resultant lowering in the cost of production would have permitted the establishment of new industries and guaranteed those already in existence, without any need for the deliberate reduction in the import coefficient [achieved tha ...

Sheng(340).pdf

... GDP), and GDP (US$3.1 trillion) overtook Germany in size (third largest in world). As for the Indian equity market, it is 10th largest in world in market capitalization, totalling US$1.8 trillion at end of 2007 or 180% of GDP. The Indian bank assets of US$1 trillion consist of 100% of GDP in March 2 ...

... GDP), and GDP (US$3.1 trillion) overtook Germany in size (third largest in world). As for the Indian equity market, it is 10th largest in world in market capitalization, totalling US$1.8 trillion at end of 2007 or 180% of GDP. The Indian bank assets of US$1 trillion consist of 100% of GDP in March 2 ...

contracts 9,899,780,283 traded

... Predecessors of today’s Euronext group participated in the top five list all six years. Monep, which became part of Paris Bourse, was in fifth place in 1999; Paris Bourse was in third and fourth place in 2000 and 2001 respectively. Euronext appeared first on the list in 2002 in the number three spot ...

... Predecessors of today’s Euronext group participated in the top five list all six years. Monep, which became part of Paris Bourse, was in fifth place in 1999; Paris Bourse was in third and fourth place in 2000 and 2001 respectively. Euronext appeared first on the list in 2002 in the number three spot ...

europe`s paradoxes

... (purposely?) misunderstood link between fixed exchange rates and austerity policies. The second section moves a step forward, by examining the economic logic of the Optimum Currency Areas theory – which provides the economic rationale for a further political integration in Europe. Against this backd ...

... (purposely?) misunderstood link between fixed exchange rates and austerity policies. The second section moves a step forward, by examining the economic logic of the Optimum Currency Areas theory – which provides the economic rationale for a further political integration in Europe. Against this backd ...

Parallel market

... with unstable political and social conditions, this monetary situation led the people to lose confidence in the national currency and most of the transactions were made in US dollars or in gold sovereigns. This situation continued even after the implementation of the major reconstruction plan in the ...

... with unstable political and social conditions, this monetary situation led the people to lose confidence in the national currency and most of the transactions were made in US dollars or in gold sovereigns. This situation continued even after the implementation of the major reconstruction plan in the ...

IOSR Journal Of Humanities And Social Science (IOSR-JHSS)

... The exchange rate policy was established from the aggregate aims of achieving macroeconomic management to ensure internal and external balance in the medium and long term. Internal balance refers to the level of economic activities that is in line with checking the side effects of inflation [4], whi ...

... The exchange rate policy was established from the aggregate aims of achieving macroeconomic management to ensure internal and external balance in the medium and long term. Internal balance refers to the level of economic activities that is in line with checking the side effects of inflation [4], whi ...

Is Currency Devaluation Overrated?

... he International Economy magazine has asked whether “currency devaluations are overrated as a means of enhancing national prosperity.” There are two parts to this question: do currency devaluations continue to have an impact on trade, and do devaluations enhance national prosperity? Regarding the fi ...

... he International Economy magazine has asked whether “currency devaluations are overrated as a means of enhancing national prosperity.” There are two parts to this question: do currency devaluations continue to have an impact on trade, and do devaluations enhance national prosperity? Regarding the fi ...

household debt and foreign currency borrowing in new

... per capita, bank credit to the public sector, nominal lending rates, inflation rates, the spread, and house prices. Their results suggest a number of Central and Eastern European countries are very close or above the equilibrium levels, whereas others are still below the equilibrium. Kiss and Vonnak ...

... per capita, bank credit to the public sector, nominal lending rates, inflation rates, the spread, and house prices. Their results suggest a number of Central and Eastern European countries are very close or above the equilibrium levels, whereas others are still below the equilibrium. Kiss and Vonnak ...

Risk Management: An Introduction to Financial Engineering

... to those of forwards The margin requirements and marking-to-market require an upfront cash outflow and liquidity to meet any margin calls that may occur Futures contracts are standardized, so the firm may not be able to hedge the exact quantity it desires Credit risk is virtually nonexistent ...

... to those of forwards The margin requirements and marking-to-market require an upfront cash outflow and liquidity to meet any margin calls that may occur Futures contracts are standardized, so the firm may not be able to hedge the exact quantity it desires Credit risk is virtually nonexistent ...

the determination of exchange rates

... Exchange rates can be for spot or forward delivery. A spot rate is the price at which currencies are traded for immediate delivery, or in two days in the interbank market. A forward rate is the price at which foreign exchange is quoted for delivery at a specified future date. To understand how excha ...

... Exchange rates can be for spot or forward delivery. A spot rate is the price at which currencies are traded for immediate delivery, or in two days in the interbank market. A forward rate is the price at which foreign exchange is quoted for delivery at a specified future date. To understand how excha ...

spot exchange rate

... Since the expected value of YTL next year is smaller, current demand for YTL assets decline. Causes YTL to depreciate. ...

... Since the expected value of YTL next year is smaller, current demand for YTL assets decline. Causes YTL to depreciate. ...

Faculty Research Working Papers Series

... The euro soon after its debut came into wide use to denominate bonds. Within Europe there was a tremendous increase in issues of corporate bonds, denominated in euros, together with a rapid integration of money markets, government bond markets, equity markets, and banking. While the frenetic activit ...

... The euro soon after its debut came into wide use to denominate bonds. Within Europe there was a tremendous increase in issues of corporate bonds, denominated in euros, together with a rapid integration of money markets, government bond markets, equity markets, and banking. While the frenetic activit ...

32 Power Point

... In an open economy, the real interest rate adjusts to balance the supply of loanable funds (saving) with the demand for loanable funds (domestic investment and net capital outflow). ...

... In an open economy, the real interest rate adjusts to balance the supply of loanable funds (saving) with the demand for loanable funds (domestic investment and net capital outflow). ...

E 1

... In an open economy, the real interest rate adjusts to balance the supply of loanable funds (saving) with the demand for loanable funds (domestic investment and net capital outflow). ...

... In an open economy, the real interest rate adjusts to balance the supply of loanable funds (saving) with the demand for loanable funds (domestic investment and net capital outflow). ...

2. chapter currency crisis models and predicting a currency crisis

... countries during the period of 1959 and 1973, 77 crises. They built a currency crisis index constructed by changes in three variables international reserves, Exchange rate and interest rates. Findings are speculative attacks on fixed exchange rates play a significant role in currency crises. Krugman ...

... countries during the period of 1959 and 1973, 77 crises. They built a currency crisis index constructed by changes in three variables international reserves, Exchange rate and interest rates. Findings are speculative attacks on fixed exchange rates play a significant role in currency crises. Krugman ...

The Currency Hierarchy and the Center-Periphery - LaI FU

... deterioration of the terms of trade, i.e., the ratio of the unit price of exports and the unit price of imports from the periphery. Dualism, or more precisely, the structural heterogeneity, that appears in the periphery, is a necessary element of each of these trends. Employment in the periphery is ...

... deterioration of the terms of trade, i.e., the ratio of the unit price of exports and the unit price of imports from the periphery. Dualism, or more precisely, the structural heterogeneity, that appears in the periphery, is a necessary element of each of these trends. Employment in the periphery is ...

Chap023

... similar to those of forwards • The margin requirements and marking-to-market require an upfront cash outflow and liquidity to meet any margin calls that may occur • Futures contracts are standardized, so the firm may not be able to hedge the exact quantity it desires • Credit risk is virtually nonex ...

... similar to those of forwards • The margin requirements and marking-to-market require an upfront cash outflow and liquidity to meet any margin calls that may occur • Futures contracts are standardized, so the firm may not be able to hedge the exact quantity it desires • Credit risk is virtually nonex ...

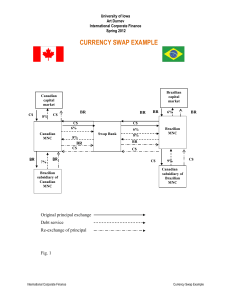

E4 - Art Durnev

... A Canadian MNC desires to finance a capital expenditure of its Brazilian subsidiary. The project has economic life of five years. The cost of the projects is BR40,000,000. At the current exchange rate of BR1.60/C$1.00, the parent firm could raise C$25,000,000 in Canadian capital market by issuing fi ...

... A Canadian MNC desires to finance a capital expenditure of its Brazilian subsidiary. The project has economic life of five years. The cost of the projects is BR40,000,000. At the current exchange rate of BR1.60/C$1.00, the parent firm could raise C$25,000,000 in Canadian capital market by issuing fi ...

CHAPTER 18. OPENNESS IN GOODS

... It has two components. The first, the current account, is the sum of the trade balance, net investment income received from abroad, and transfers. As such, the current account is a record of net income received from the rest of the world. The second component of the balance of payments, the capital ...

... It has two components. The first, the current account, is the sum of the trade balance, net investment income received from abroad, and transfers. As such, the current account is a record of net income received from the rest of the world. The second component of the balance of payments, the capital ...