DMF model and exchange rate overshooting

... These said to i) fall as the opportunity cost of holding them [the interest rate on a bank account, say] rises; ii) increase as expenditure increases. This is the same as the demand for any other good that you might eat, which has a complement. So if the price goes up, you eat less; and if you expec ...

... These said to i) fall as the opportunity cost of holding them [the interest rate on a bank account, say] rises; ii) increase as expenditure increases. This is the same as the demand for any other good that you might eat, which has a complement. So if the price goes up, you eat less; and if you expec ...

Slide 1 - UTA.edu

... Currency options…continued – Currency options sold on a centralized exchange have specific delivery dates. In particular, a currency option bought or sold on the Philadelphia Stock Exchange matures on the Friday before the third Wednesday of the expiration month. Contracts on the exchange have a tr ...

... Currency options…continued – Currency options sold on a centralized exchange have specific delivery dates. In particular, a currency option bought or sold on the Philadelphia Stock Exchange matures on the Friday before the third Wednesday of the expiration month. Contracts on the exchange have a tr ...

Eco-30004 Tutorial 1

... exchange rate is $1.70£. What final profit or loss would the fund have realized, in terms of dollars, had it originally hedged its initial investment in British stocks? What was its dollar based annualized rate of return? What would have been its dollar denominated profit and rate of return, had it ...

... exchange rate is $1.70£. What final profit or loss would the fund have realized, in terms of dollars, had it originally hedged its initial investment in British stocks? What was its dollar based annualized rate of return? What would have been its dollar denominated profit and rate of return, had it ...

3 - Les Leba.

... The recent decision by our Central Bank to refrain from changing the Dollar component of monthly distributable revenue to Naira before sharing to the tiers of government is a tacit admission that the erstwhile exalted monetary and economic blueprints, a la NEEDS, SEEDS, LEEDS, etc, were founded on a ...

... The recent decision by our Central Bank to refrain from changing the Dollar component of monthly distributable revenue to Naira before sharing to the tiers of government is a tacit admission that the erstwhile exalted monetary and economic blueprints, a la NEEDS, SEEDS, LEEDS, etc, were founded on a ...

The Power of the US Dollar/Currency Exchange

... In international Towne each country will use one of four regional currencies. Citizens are paid in the currency of the country where they work. You must visit the international bank in Singapore to exchange your currency for that of the other three regions. Or for a fee you can exchange your currenc ...

... In international Towne each country will use one of four regional currencies. Citizens are paid in the currency of the country where they work. You must visit the international bank in Singapore to exchange your currency for that of the other three regions. Or for a fee you can exchange your currenc ...

Chapter 5

... domestic prices for all traded goods are 10% higher than the border price. The export product is not subject to a tax or a subsidy and sells in the domestic market for Rs. 8000. In financial prices, the import substitute product has a higher prices, although the value to the national economy at worl ...

... domestic prices for all traded goods are 10% higher than the border price. The export product is not subject to a tax or a subsidy and sells in the domestic market for Rs. 8000. In financial prices, the import substitute product has a higher prices, although the value to the national economy at worl ...

Week 12

... elements required to analyse an open economy The current account: imports and exports The capital account: saving/investment flows The balance of payments equilibrium as a combination of the two The role of exchange rates ...

... elements required to analyse an open economy The current account: imports and exports The capital account: saving/investment flows The balance of payments equilibrium as a combination of the two The role of exchange rates ...

Full Text

... there is no unique methodology for determining the “correct” equilibrium rate, but also that it is not possible to make later adjustments, generate risks of under- or over-valued exchange rate. Consequently, in longer term there is a negative impact on balance-of-payment and the economy is more sens ...

... there is no unique methodology for determining the “correct” equilibrium rate, but also that it is not possible to make later adjustments, generate risks of under- or over-valued exchange rate. Consequently, in longer term there is a negative impact on balance-of-payment and the economy is more sens ...

The Foreign Currency Market

... • What is the label on the horizontal axis? The quantity of dollars • What is the label on the vertical axis? The price of one dollar If it’s the dollar-euro market, then it’s the number of Euros to buy one dollar, €/$, i.e., ...

... • What is the label on the horizontal axis? The quantity of dollars • What is the label on the vertical axis? The price of one dollar If it’s the dollar-euro market, then it’s the number of Euros to buy one dollar, €/$, i.e., ...

Trapped by the International Dollar Standard Ronald I. McKinnon Stanford University

... in international portfolios, U.S. Treasury bonds are generally treated as the world’s “riskfree” financial assets against which risk premia in bonds denominated in other currencies are measured. And, with the big proviso that the U.S. price level remains stable, foreign central banks are loathe to s ...

... in international portfolios, U.S. Treasury bonds are generally treated as the world’s “riskfree” financial assets against which risk premia in bonds denominated in other currencies are measured. And, with the big proviso that the U.S. price level remains stable, foreign central banks are loathe to s ...

inflation rate

... away from those goods and services rising the most quickly, and purchase more of the relatively lower-cost items. – A fixed-weight price index tends to overstate the true cost of living. ...

... away from those goods and services rising the most quickly, and purchase more of the relatively lower-cost items. – A fixed-weight price index tends to overstate the true cost of living. ...

NBER WORKING PAPER SERIES MANAGING CURRENCY PEGS Stephanie Schmitt-Grohé Martín Uribe

... causes the demand schedule to shift down and to the left as shown by the downward sloping dashed line. Because the nominal exchange rate is pegged and because nominal wages are downwardly rigid (we are assuming for simplicity that γ = 1), the supply schedule does not move. As a result, the new inter ...

... causes the demand schedule to shift down and to the left as shown by the downward sloping dashed line. Because the nominal exchange rate is pegged and because nominal wages are downwardly rigid (we are assuming for simplicity that γ = 1), the supply schedule does not move. As a result, the new inter ...

Document

... dollars into gold. This would lead to a confidence problem: central bank, knowing that their dollars were no longer “as good as gold ”, might become unwilling to accumulate more dollars and might even bring down the system by attempting to cash in the dollars they already held. ...

... dollars into gold. This would lead to a confidence problem: central bank, knowing that their dollars were no longer “as good as gold ”, might become unwilling to accumulate more dollars and might even bring down the system by attempting to cash in the dollars they already held. ...

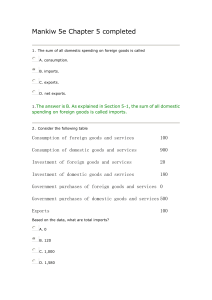

Mankiw 5e Chapter 5 completed

... 8、If a Canadian investor buys one million dollars worth of stock in an American company, how does this transaction appear in the national income accounts of the United States? A. The balance of trade rises as we export $1 million of stock. B. The balance of trade falls as we import Canadian investme ...

... 8、If a Canadian investor buys one million dollars worth of stock in an American company, how does this transaction appear in the national income accounts of the United States? A. The balance of trade rises as we export $1 million of stock. B. The balance of trade falls as we import Canadian investme ...

PDF

... Of the 22 sub-Saharan African countries that have been undertaking structural adjustment since 1980 through World Bank and/or International Monetary Fund auspices, Kenya fits the above profile as a gradually liberalizing economy, while Cameroon is an example of a non-liberalized economy. ...

... Of the 22 sub-Saharan African countries that have been undertaking structural adjustment since 1980 through World Bank and/or International Monetary Fund auspices, Kenya fits the above profile as a gradually liberalizing economy, while Cameroon is an example of a non-liberalized economy. ...

International Economics, 7e (Husted/Melvin)

... balance of trade effects of a devaluation will appear on quantities traded. Answer: False Explanation: None Given 3) The evidence available suggests that the effects of devaluation appear to differ across countries and time so that no strong generalizations regarding the effects of devaluation on th ...

... balance of trade effects of a devaluation will appear on quantities traded. Answer: False Explanation: None Given 3) The evidence available suggests that the effects of devaluation appear to differ across countries and time so that no strong generalizations regarding the effects of devaluation on th ...

DEPARTMENT OF ECONOMICS WORKING

... the rising local currency price of exports relative to the local currency price of inputs. All imports used in production increase in price (in local currency) by the amount of devaluation. Therefore, exporting becomes more profitable to the extent that exporters use local rather than imported input ...

... the rising local currency price of exports relative to the local currency price of inputs. All imports used in production increase in price (in local currency) by the amount of devaluation. Therefore, exporting becomes more profitable to the extent that exporters use local rather than imported input ...

Assessment Schedule – 2012

... target the female / sporty sectors of society and increase demand from those sectors. However, campaigns tend to be neutralised by high prices. Consumer preference for lamb as a popular barbeque meat remains, because it is quick and safe to cook (unlike pork and chicken which must be cooked fully). ...

... target the female / sporty sectors of society and increase demand from those sectors. However, campaigns tend to be neutralised by high prices. Consumer preference for lamb as a popular barbeque meat remains, because it is quick and safe to cook (unlike pork and chicken which must be cooked fully). ...

Beggar-Thy-Neighbor Interest Rate Policies

... vociferously—that foreigners often “cheat” to keep their currencies undervalued to run trade surpluses with the U.S. Whence the paradox that the international dollar standard is unloved by both foreigners and Americans. But in today’s world where capital flows freely, these complaints lack analytica ...

... vociferously—that foreigners often “cheat” to keep their currencies undervalued to run trade surpluses with the U.S. Whence the paradox that the international dollar standard is unloved by both foreigners and Americans. But in today’s world where capital flows freely, these complaints lack analytica ...

Bringing it all together: where does this leave John McDermott

... spending and the available national savings than is typical abroad. As in the simple thought experiment we started with, the underlying cause of the long term problem is the savinginvestment imbalance. While many people have worried about the lack of savings relative to other advanced countries, th ...

... spending and the available national savings than is typical abroad. As in the simple thought experiment we started with, the underlying cause of the long term problem is the savinginvestment imbalance. While many people have worried about the lack of savings relative to other advanced countries, th ...

Purchasing power parity

_per_capita_by_countries.png?width=300)

Purchasing power parity (PPP) is a component of some economic theories and is a technique used to determine the relative value of different currencies.Theories that invoke purchasing power parity assume that in some circumstances (for example, as a long-run tendency) it would cost exactly the same number of, say, US dollars to buy euros and then to use the proceeds to buy a market basket of goods as it would cost to use those dollars directly in purchasing the market basket of goods.The concept of purchasing power parity allows one to estimate what the exchange rate between two currencies would have to be in order for the exchange to be at par with the purchasing power of the two countries' currencies. Using that PPP rate for hypothetical currency conversions, a given amount of one currency thus has the same purchasing power whether used directly to purchase a market basket of goods or used to convert at the PPP rate to the other currency and then purchase the market basket using that currency. Observed deviations of the exchange rate from purchasing power parity are measured by deviations of the real exchange rate from its PPP value of 1.PPP exchange rates help to minimize misleading international comparisons that can arise with the use of market exchange rates. For example, suppose that two countries produce the same physical amounts of goods as each other in each of two different years. Since market exchange rates fluctuate substantially, when the GDP of one country measured in its own currency is converted to the other country's currency using market exchange rates, one country might be inferred to have higher real GDP than the other country in one year but lower in the other; both of these inferences would fail to reflect the reality of their relative levels of production. But if one country's GDP is converted into the other country's currency using PPP exchange rates instead of observed market exchange rates, the false inference will not occur.