Financial globalization and exchange rates

... an exchange rate depreciation will depend on gross foreign asset and liability holdings (in addition to the net position); the currency composition of both sides of the international balance sheet; and the nature of the co-movement between exchange rate changes and other financial returns.2 These fa ...

... an exchange rate depreciation will depend on gross foreign asset and liability holdings (in addition to the net position); the currency composition of both sides of the international balance sheet; and the nature of the co-movement between exchange rate changes and other financial returns.2 These fa ...

This PDF is a selection from an out-of-print volume from... of Economic Research

... one of the most uneven in Latin America, and other welfare indicators, such as life expectancy and infant mortality, are among the worst in the region (see table 9.1). More than half of Peru’s poorest 30 percent live in the Andean highlands and are self-employed peasants. Agriculture and mining have ...

... one of the most uneven in Latin America, and other welfare indicators, such as life expectancy and infant mortality, are among the worst in the region (see table 9.1). More than half of Peru’s poorest 30 percent live in the Andean highlands and are self-employed peasants. Agriculture and mining have ...

A MONETARY CONDITIONS INDEX FOR ALBANIA

... aggregate supply, the price equation usually includes non-tradable goods prices adjusted with inflation expectations, the output gap (or unemployment gap), tradable goods prices determined by world prices and the exchange rate. According to the theory, a change in monetary policy changes the real in ...

... aggregate supply, the price equation usually includes non-tradable goods prices adjusted with inflation expectations, the output gap (or unemployment gap), tradable goods prices determined by world prices and the exchange rate. According to the theory, a change in monetary policy changes the real in ...

NBER WORKING PAPER SERIES DEBT DELEVERAGING AND THE EXCHANGE RATE Pierpaolo Benigno

... omy requires short-run depreciation and long-run appreciation of the deleverager’s real exchange rate and a sharper short-term fall in its real interest rate than in the rest of the world. Constraints or policies that impede these mechanisms can only prolong the contraction. For instance, the zero- ...

... omy requires short-run depreciation and long-run appreciation of the deleverager’s real exchange rate and a sharper short-term fall in its real interest rate than in the rest of the world. Constraints or policies that impede these mechanisms can only prolong the contraction. For instance, the zero- ...

© 21st Century Math Projects

... A.) Student will complete “Money Changers” which will practice the type of problems and develop the thinking necessary to complete the project. B.) Students will complete “World Traveler” where they develop functions and inverse to convert currency. Students will track spending and remaining conscio ...

... A.) Student will complete “Money Changers” which will practice the type of problems and develop the thinking necessary to complete the project. B.) Students will complete “World Traveler” where they develop functions and inverse to convert currency. Students will track spending and remaining conscio ...

Index numbers

... Index numbers measure the magnitude of economic changes over time. They express these changes as percentages of a predetermined period (usually a particular year, known as the base year). The Index of Retail Prices, which attempts to measure the change in price of the goods and services we buy, is o ...

... Index numbers measure the magnitude of economic changes over time. They express these changes as percentages of a predetermined period (usually a particular year, known as the base year). The Index of Retail Prices, which attempts to measure the change in price of the goods and services we buy, is o ...

Targeting Inflation in Dollarized Economies(2)

... patterns typical of any other standard (i.e., nondollarized) economies. The policy rate was changed from time to time based on the forward-looking inflation outlook and these changes were implemented in a gradual, serially correlated, manner. Having said that, it is remarkable how small the degree o ...

... patterns typical of any other standard (i.e., nondollarized) economies. The policy rate was changed from time to time based on the forward-looking inflation outlook and these changes were implemented in a gradual, serially correlated, manner. Having said that, it is remarkable how small the degree o ...

Currency Crises and Collapses

... of the damagecould have been avoided. The protractedlack of growth, other than for election year spending, was the prime evidence of unsustainableovervaluation.2 To virtually any observer, the sheer vehemence of the collapse and the extent of disruptionin capitalmarketsremaina surprise.3This paper r ...

... of the damagecould have been avoided. The protractedlack of growth, other than for election year spending, was the prime evidence of unsustainableovervaluation.2 To virtually any observer, the sheer vehemence of the collapse and the extent of disruptionin capitalmarketsremaina surprise.3This paper r ...

Day-of-the-week Anomaly: An illusion or a Reality? Evidence from

... allow for fatter tails than in a standard normal distribution was used. This is because, the student’s t-distribution peak more than the normal distribution and as such, takes into consideration the leptokurtic distribution for the error, than the normal distribution. Just like the stock returns, th ...

... allow for fatter tails than in a standard normal distribution was used. This is because, the student’s t-distribution peak more than the normal distribution and as such, takes into consideration the leptokurtic distribution for the error, than the normal distribution. Just like the stock returns, th ...

Does the Exchange Rate Regime Matter for Inflation? Ilker Domaç

... developments in Argentina. More precisely, the debate over fixed and flexible exchange regimes has once again taken center stage. Some claimed that the first round of this debate was won by those advocating flexible regimes: all crisis episodes took place in countries which had adopted a variety of ...

... developments in Argentina. More precisely, the debate over fixed and flexible exchange regimes has once again taken center stage. Some claimed that the first round of this debate was won by those advocating flexible regimes: all crisis episodes took place in countries which had adopted a variety of ...

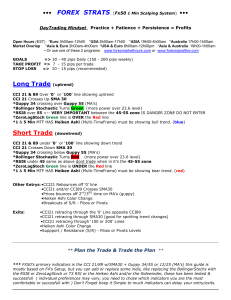

Long Trade (uptrend) Short Trade (downtrend)

... and 100. When Wilder introduced the Relative Strength Index, he recommended using a 14-day RSI. A popular method of analyzing the RSI is to look for a divergence in which the security is making a new high, but the RSI is failing to surpass its previous high. This divergence is an indication of an im ...

... and 100. When Wilder introduced the Relative Strength Index, he recommended using a 14-day RSI. A popular method of analyzing the RSI is to look for a divergence in which the security is making a new high, but the RSI is failing to surpass its previous high. This divergence is an indication of an im ...

Snímek 1

... • If e < 1, then foreign price level relatively lower than domestic one, domestic goods relatively more expensive, so less competitive • if e > 1, then foreign price level relatively higher than domestic one, domestic goods relatively cheaper, so ...

... • If e < 1, then foreign price level relatively lower than domestic one, domestic goods relatively more expensive, so less competitive • if e > 1, then foreign price level relatively higher than domestic one, domestic goods relatively cheaper, so ...

Library of Parliament

... certain historic indicators have pointed to a stronger (or weaker) dollar, when in fact the reverse occurred over that period. A. Domestic and Comparative Factors 1. Relative Economic Growth Perhaps the most significant domestic influence on the Canadian dollar is the relative health of the Canadian ...

... certain historic indicators have pointed to a stronger (or weaker) dollar, when in fact the reverse occurred over that period. A. Domestic and Comparative Factors 1. Relative Economic Growth Perhaps the most significant domestic influence on the Canadian dollar is the relative health of the Canadian ...

This PDF is a selection from an out-of-print volume from... of Economic Research

... its effect on exports. Some members whose currencies were grossly overvalued did not communicate par values in 1946. The par values of the currencies of a few countries that the Fund approved were expected to last only a year or so, as the staff noted. Actually, the initial par values that the Fund ...

... its effect on exports. Some members whose currencies were grossly overvalued did not communicate par values in 1946. The par values of the currencies of a few countries that the Fund approved were expected to last only a year or so, as the staff noted. Actually, the initial par values that the Fund ...

NBER WORKING PAPER SERIES INTERNATIONAL TRADE AND MACROECONOMIC DYNAMICS WITH HETEROGENEOUS FIRMS

... goods and their terms of trade. As previously mentioned, these changes occur within sectors and generate persistent deviations in sector-level prices. Although we do not explicitly model multiple sectors, our framework nevertheless highlights the micro-level characteristics of sectors (the level of ...

... goods and their terms of trade. As previously mentioned, these changes occur within sectors and generate persistent deviations in sector-level prices. Although we do not explicitly model multiple sectors, our framework nevertheless highlights the micro-level characteristics of sectors (the level of ...

SP151: FCIs and Economic Activity :Some International Evidence

... for the four largest economic areas of the world, the US, the euro area, Japan and the UK, using quarterly data over the period 1982-1997. The indices are derived based on coefficient estimates from reduced form aggregate demand equations. The results suggest that that the real interest rate and rea ...

... for the four largest economic areas of the world, the US, the euro area, Japan and the UK, using quarterly data over the period 1982-1997. The indices are derived based on coefficient estimates from reduced form aggregate demand equations. The results suggest that that the real interest rate and rea ...

π t - Seðlabanki Íslands

... – “… inflation stabilization is more challenging in Iceland than in other industrial countries primarily because of the relative magnitudes of the economic shocks” – “... Inflation-output variability trade-off faced by the monetary authorities in Iceland is much less favorable than those faced by th ...

... – “… inflation stabilization is more challenging in Iceland than in other industrial countries primarily because of the relative magnitudes of the economic shocks” – “... Inflation-output variability trade-off faced by the monetary authorities in Iceland is much less favorable than those faced by th ...

Purchasing power parity

_per_capita_by_countries.png?width=300)

Purchasing power parity (PPP) is a component of some economic theories and is a technique used to determine the relative value of different currencies.Theories that invoke purchasing power parity assume that in some circumstances (for example, as a long-run tendency) it would cost exactly the same number of, say, US dollars to buy euros and then to use the proceeds to buy a market basket of goods as it would cost to use those dollars directly in purchasing the market basket of goods.The concept of purchasing power parity allows one to estimate what the exchange rate between two currencies would have to be in order for the exchange to be at par with the purchasing power of the two countries' currencies. Using that PPP rate for hypothetical currency conversions, a given amount of one currency thus has the same purchasing power whether used directly to purchase a market basket of goods or used to convert at the PPP rate to the other currency and then purchase the market basket using that currency. Observed deviations of the exchange rate from purchasing power parity are measured by deviations of the real exchange rate from its PPP value of 1.PPP exchange rates help to minimize misleading international comparisons that can arise with the use of market exchange rates. For example, suppose that two countries produce the same physical amounts of goods as each other in each of two different years. Since market exchange rates fluctuate substantially, when the GDP of one country measured in its own currency is converted to the other country's currency using market exchange rates, one country might be inferred to have higher real GDP than the other country in one year but lower in the other; both of these inferences would fail to reflect the reality of their relative levels of production. But if one country's GDP is converted into the other country's currency using PPP exchange rates instead of observed market exchange rates, the false inference will not occur.