The real effects of debt - Bank for International Settlements

... government debt are treated separately; and externalities, since there are times when financial actors do not bear (or are able to avoid) the full costs of their actions. As modern macroeconomics developed over the last half-century, most people either ignored or finessed the issue of debt. With few ...

... government debt are treated separately; and externalities, since there are times when financial actors do not bear (or are able to avoid) the full costs of their actions. As modern macroeconomics developed over the last half-century, most people either ignored or finessed the issue of debt. With few ...

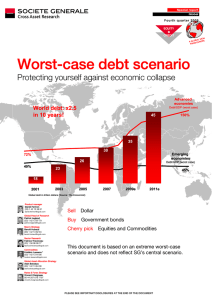

Worst-case debt scenario

... Debt explosion in 2009 The current economic crisis displays compelling similarities with Japan in the 1990s End of market rally for equities? Look at Japan! Worried about inflation? Japan suggests deflation more of a risk Stress-testing performance by asset class under a bear scenario How to invest ...

... Debt explosion in 2009 The current economic crisis displays compelling similarities with Japan in the 1990s End of market rally for equities? Look at Japan! Worried about inflation? Japan suggests deflation more of a risk Stress-testing performance by asset class under a bear scenario How to invest ...

NBER WORKING PAPER SERIES DEBT MATURITY: IS LONG-TERM DEBT OPTIMAL? Laura Alfaro

... Universidade de Sao Paulo Brazil. [email protected] ...

... Universidade de Sao Paulo Brazil. [email protected] ...

Currency Wars

... The devaluation means higher unemployment in developing economies as their exports become more expensive for Americans. The resulting inflation also means higher prices for inputs needed in developing economies like copper, corn, oil and wheat. Foreign countries have begun to fight back against U.S. ...

... The devaluation means higher unemployment in developing economies as their exports become more expensive for Americans. The resulting inflation also means higher prices for inputs needed in developing economies like copper, corn, oil and wheat. Foreign countries have begun to fight back against U.S. ...

gentherm incorporated - corporate

... regulations of the Securities and Exchange Commission. Certain information and note disclosures normally included in the audited annual consolidated financial statements prepared in accordance with generally accepted accounting principles in the United States of America have been condensed or omitte ...

... regulations of the Securities and Exchange Commission. Certain information and note disclosures normally included in the audited annual consolidated financial statements prepared in accordance with generally accepted accounting principles in the United States of America have been condensed or omitte ...

RMB as an Anchor Currency in ASEAN, China, Japan

... ($467 billion), and accounted for 8.4 percent of total trade settlement, a rise from 6.6 and 2.2 percent in 2011 and 2010 respectively. RMB settlement in direct investment reached RMB 284 billion ($45 billion), more than doubled that of 2011. By the end of 2012 a total of 206 countries and regions ...

... ($467 billion), and accounted for 8.4 percent of total trade settlement, a rise from 6.6 and 2.2 percent in 2011 and 2010 respectively. RMB settlement in direct investment reached RMB 284 billion ($45 billion), more than doubled that of 2011. By the end of 2012 a total of 206 countries and regions ...

This PDF is a selection from an out-of-print volume from... of Economic Research

... within a very few years. Even if one could be sure that the tax-inflation distortions would be eliminated by changes in the tax system 10 years from now, the present value gain from price stability until then would probably exceed the cost of the inflation reduction. There are also some countervaili ...

... within a very few years. Even if one could be sure that the tax-inflation distortions would be eliminated by changes in the tax system 10 years from now, the present value gain from price stability until then would probably exceed the cost of the inflation reduction. There are also some countervaili ...

Sovereign Debt Restructurings: Delays in Renegotiations and Risk

... distress than for external default—both in terms of an output decline and escalation of inflation. With a focus on Latin America from 1820 to the Great Depression, Kaminsky and Vega-Garcia (2016) find that almost 60 percent of sovereign defaults are of a systemic nature, different from those with an ...

... distress than for external default—both in terms of an output decline and escalation of inflation. With a focus on Latin America from 1820 to the Great Depression, Kaminsky and Vega-Garcia (2016) find that almost 60 percent of sovereign defaults are of a systemic nature, different from those with an ...

Determination of Optimal Foreign Exchange Reserves in Nigeria

... Prabheesh (2013) empirically determined the optimal level of international reserves for India by explicitly incorporating the country’s sovereign risk associated with default of external debt due to financial crisis. The empirical result shows that the volatility of foreign institutional investment, ...

... Prabheesh (2013) empirically determined the optimal level of international reserves for India by explicitly incorporating the country’s sovereign risk associated with default of external debt due to financial crisis. The empirical result shows that the volatility of foreign institutional investment, ...

Sovereign Risk, Currency Risk, and Corporate Balance Sheets.

... market sovereigns went from having around 85% of their external debt in FC to having more than half of their external sovereign debt in their own currency. By contrast, even as governments were dramatically changing the way they finance themselves, the private sector continued to borrow from foreign ...

... market sovereigns went from having around 85% of their external debt in FC to having more than half of their external sovereign debt in their own currency. By contrast, even as governments were dramatically changing the way they finance themselves, the private sector continued to borrow from foreign ...

mmi13 Watzka 19074706 en

... with the subprime crisis. Low interest rates and rising house prices, together with an unregulated subprime mortgage market, encouraged an increasing number of Americans to fulfill their lifelong dreams of buying their own apartments or houses or moving into larger and fancier homes. In 2006-2007, t ...

... with the subprime crisis. Low interest rates and rising house prices, together with an unregulated subprime mortgage market, encouraged an increasing number of Americans to fulfill their lifelong dreams of buying their own apartments or houses or moving into larger and fancier homes. In 2006-2007, t ...

Italy: 2016 Article IV Consultation

... environment, structural rigidities, strained bank balance sheets, and high public debt. They, therefore, urged the authorities to fully implement and deepen the reforms to strengthen near-term growth, further build up buffers, enhance resilience, and bolster economic performance over the medium term ...

... environment, structural rigidities, strained bank balance sheets, and high public debt. They, therefore, urged the authorities to fully implement and deepen the reforms to strengthen near-term growth, further build up buffers, enhance resilience, and bolster economic performance over the medium term ...

PDF Download

... the firm than outside (Hart and Moore, 1994). Diamond (1991) stresses that debt maturity is the result of a trade-off between liquidity risk and borrowers’ preference for ST debt due to private information about the future credit rating.2 Moreover, ST debt may serve as disciplining device to reduce ...

... the firm than outside (Hart and Moore, 1994). Diamond (1991) stresses that debt maturity is the result of a trade-off between liquidity risk and borrowers’ preference for ST debt due to private information about the future credit rating.2 Moreover, ST debt may serve as disciplining device to reduce ...

The “Mystery of the Printing Press” Monetary Policy and Self

... the government in all circumstances, at the cost of high in‡ation. The gist of our argument is most easily understood referring to a situation in which the relevant (risk-free) nominal interest rate is at its lower bound. In this case, the central bank would be able to issue …at money at will to buy ...

... the government in all circumstances, at the cost of high in‡ation. The gist of our argument is most easily understood referring to a situation in which the relevant (risk-free) nominal interest rate is at its lower bound. In this case, the central bank would be able to issue …at money at will to buy ...

Nicaragua: 2015 Article IV

... policies. Over the last three years, real GDP growth has averaged 4.8 percent, one of the highest in the region, while inflation has remained anchored by the exchange rate regime. The external current account deficit has declined, reflecting a smaller oil bill due to both lower oil prices and increa ...

... policies. Over the last three years, real GDP growth has averaged 4.8 percent, one of the highest in the region, while inflation has remained anchored by the exchange rate regime. The external current account deficit has declined, reflecting a smaller oil bill due to both lower oil prices and increa ...

USING THE BALANCE SHEET APPROACH IN FINANCIAL

... but also looks at activities within the economy; the focus is on the heterogeneity of the sectors regarding their levels of exposure to various financial risks and their financial strengths, and on the relationships between the sectors, which could intensify shocks and cause financial crises. In add ...

... but also looks at activities within the economy; the focus is on the heterogeneity of the sectors regarding their levels of exposure to various financial risks and their financial strengths, and on the relationships between the sectors, which could intensify shocks and cause financial crises. In add ...

Analyzing and Forecasting the Canadian

... where forecasts of the levels of many variables are required. For instance, the cointegrating relationships implied by ToTEM are often counterfactual, leading us to detrend the data and deal with long-term trends separately. This implies that trend movements have no cyclical implications in ToTEM. I ...

... where forecasts of the levels of many variables are required. For instance, the cointegrating relationships implied by ToTEM are often counterfactual, leading us to detrend the data and deal with long-term trends separately. This implies that trend movements have no cyclical implications in ToTEM. I ...

Debt committee report March 2001

... outstanding debt to the annual level of key economic aggregates and (b) flow measures, which relate the value of annual debt service payments to the same economic aggregates. Stock measures of the external debt burdens are generally expressed in terms of ratios to GDP and ratio to annual foreign exc ...

... outstanding debt to the annual level of key economic aggregates and (b) flow measures, which relate the value of annual debt service payments to the same economic aggregates. Stock measures of the external debt burdens are generally expressed in terms of ratios to GDP and ratio to annual foreign exc ...

A New Structure for US Federal Debt

... It is a riskless store of value, an asset with immediate liquidity. Interest-‐paying electronic money has been the ideal of monetary economics for decades. When money does not pay interest, people ...

... It is a riskless store of value, an asset with immediate liquidity. Interest-‐paying electronic money has been the ideal of monetary economics for decades. When money does not pay interest, people ...

A Small Open Economy Model with Sovereign

... associated with these episodes. Net exports and sovereign spreads are countercyclical because in the model the risk of default increases when the economy is either more indebted or transiting through periods where productivity is low. As a consequence, in bad times, not only is the economy unable to ...

... associated with these episodes. Net exports and sovereign spreads are countercyclical because in the model the risk of default increases when the economy is either more indebted or transiting through periods where productivity is low. As a consequence, in bad times, not only is the economy unable to ...

Voluntary Sovereign Debt Exchanges

... (see, for instance, Panizza et al., 2009 and Hatchondo and Martinez, 2011). In many countries (including the U.S.), there are legal procedures that creditors may follow once individuals or corporations renege on their debt. Creditors rely on the enforcement of domestic courts to get—partially—repaid ...

... (see, for instance, Panizza et al., 2009 and Hatchondo and Martinez, 2011). In many countries (including the U.S.), there are legal procedures that creditors may follow once individuals or corporations renege on their debt. Creditors rely on the enforcement of domestic courts to get—partially—repaid ...

CURRENCY IMPACT IN BRAZILIAN PE/VC DEALS

... writeoffs with missing exit data information, and assumed conservatively that they had total losses, and therefore a PME of zero. As we have information of gross MoM, we multiplied our figures by 0.8 in order to estimate net PME, assuming that fixed and performance fees accounts for 20% of proceeds. ...

... writeoffs with missing exit data information, and assumed conservatively that they had total losses, and therefore a PME of zero. As we have information of gross MoM, we multiplied our figures by 0.8 in order to estimate net PME, assuming that fixed and performance fees accounts for 20% of proceeds. ...

Research and Monetary Policy Department Working Paper No:06/04

... country interest rates and new-issue bond spreads. Eichengreen and Mody (1998) emphasized the fact that, for launch spreads, it is important to distinguish supply and demand effects of changes in international interest rates. They analyzed more than 1500 new-issue bond spreads between 1991 and 1996 ...

... country interest rates and new-issue bond spreads. Eichengreen and Mody (1998) emphasized the fact that, for launch spreads, it is important to distinguish supply and demand effects of changes in international interest rates. They analyzed more than 1500 new-issue bond spreads between 1991 and 1996 ...

NBER WORKING PAPER SERIES Michael D. Bordo

... countries. However, they also suggest capital inflows deliver rapid growth in non-crisis periods which is likely to offset the negative effects of crises. Countries with high capital inflows grow faster on average than countries with low capital inflows. Other evidence suggests, to the contrary, tha ...

... countries. However, they also suggest capital inflows deliver rapid growth in non-crisis periods which is likely to offset the negative effects of crises. Countries with high capital inflows grow faster on average than countries with low capital inflows. Other evidence suggests, to the contrary, tha ...

Free Full text

... rebound. Unemployment declined to 4.4 percent in Q4 2016 and wage increases have picked up. Nonetheless, inflation remained below the 1–3 percent target range of the Bank of Israel (BOI), reflecting external factors and government measures to reduce the cost of living. The BOI has held the policy ra ...

... rebound. Unemployment declined to 4.4 percent in Q4 2016 and wage increases have picked up. Nonetheless, inflation remained below the 1–3 percent target range of the Bank of Israel (BOI), reflecting external factors and government measures to reduce the cost of living. The BOI has held the policy ra ...