The Money Market Notes

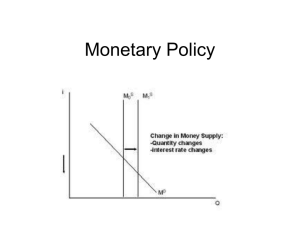

... The Money Market • The market where the Fed and the users of money interact thus determining the nominal interest rate (i%). • Money Demand (MD) comes from households, firms, government and the foreign sector. • The Money Supply (MS) is determined only by the Federal Reserve. ...

... The Money Market • The market where the Fed and the users of money interact thus determining the nominal interest rate (i%). • Money Demand (MD) comes from households, firms, government and the foreign sector. • The Money Supply (MS) is determined only by the Federal Reserve. ...

HW 5.1 AP Macro – Modules 31 and 32 Directions: After reading

... passes a law requiring the central bank to use monetary policy to lower the unemployment rate to 3% and keep it there. How could the central bank achieve this goal in the short run? What would happen in the long run? Illustrate with a diagram 11. The effectiveness of monetary policy depends on how e ...

... passes a law requiring the central bank to use monetary policy to lower the unemployment rate to 3% and keep it there. How could the central bank achieve this goal in the short run? What would happen in the long run? Illustrate with a diagram 11. The effectiveness of monetary policy depends on how e ...

7.1 rise in investment demand when saving depends on interest rate

... money supply (monetary inflation) which causes increases in the price level. Inflation can also be described as a decline in the real value of money i-e a loss of purchasing power in the medium of exchange which is also the monetary unit of account. When the general price level rises, each unit of c ...

... money supply (monetary inflation) which causes increases in the price level. Inflation can also be described as a decline in the real value of money i-e a loss of purchasing power in the medium of exchange which is also the monetary unit of account. When the general price level rises, each unit of c ...

Chapter 27 - Money and Banking

... Money is as an asset that can be used to transport purchasing power from one time period to another. Money is easily portable across time and space. ...

... Money is as an asset that can be used to transport purchasing power from one time period to another. Money is easily portable across time and space. ...

Eco 200 – Principles of Macroeconomics

... 12 District Banks – 9 person board (6 elected by members banks in the district, 3 appointed by Board of Governors) Federal Open Market Committee – 12 members (Board of Governors + 5 District Bank Presidents selected on a rotating basis, but always including President of NY Fed) ...

... 12 District Banks – 9 person board (6 elected by members banks in the district, 3 appointed by Board of Governors) Federal Open Market Committee – 12 members (Board of Governors + 5 District Bank Presidents selected on a rotating basis, but always including President of NY Fed) ...

fiscal policy - Doral Academy Preparatory

... 1. If the reserve requirement is 25 percent and banks hold no excess reserves, an open market sale of $400,000 of government securities by the Federal Reserve will (A) increase the money supply by up to $1.6 million (B) decrease the money supply by up to $1.6 million (C) increase the money supply b ...

... 1. If the reserve requirement is 25 percent and banks hold no excess reserves, an open market sale of $400,000 of government securities by the Federal Reserve will (A) increase the money supply by up to $1.6 million (B) decrease the money supply by up to $1.6 million (C) increase the money supply b ...

Chapter 17 International Finance Name

... 8. A change in the supply or demand changes the money’s ( ) ( ). 9. After the Lord of the Rings, if there was a sudden demand by Americans for travel to New Zealand, the equilibrium price of the NZ dollar would ( ). The US dollar becomes worth ( ) in terms of the NZ dollar, and the NZ dollar become ...

... 8. A change in the supply or demand changes the money’s ( ) ( ). 9. After the Lord of the Rings, if there was a sudden demand by Americans for travel to New Zealand, the equilibrium price of the NZ dollar would ( ). The US dollar becomes worth ( ) in terms of the NZ dollar, and the NZ dollar become ...

Monetary Policy

... • Fed buys bonds, lowers reserve requirements, or lowers discount rate • Real interest rates decrease • Stimulates AD (investment and consumption) • Lower interest rates lead to capital outflow, so dollar depreciates, and exports stimulated (higher AD) • Asset prices increase (housing) ...

... • Fed buys bonds, lowers reserve requirements, or lowers discount rate • Real interest rates decrease • Stimulates AD (investment and consumption) • Lower interest rates lead to capital outflow, so dollar depreciates, and exports stimulated (higher AD) • Asset prices increase (housing) ...

The Uses of Money - McGraw Hill Higher Education

... Barter is the direct exchange of one good for another, without the use of money. ...

... Barter is the direct exchange of one good for another, without the use of money. ...

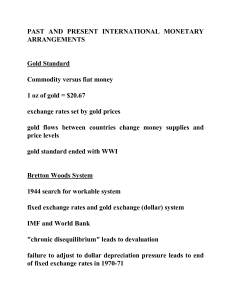

past and present international monetary

... (thereby changing relative prices) If resources are immobile, then flexible exchange rates help to adjust relative prices when the monetary authorities try to limit price changes ...

... (thereby changing relative prices) If resources are immobile, then flexible exchange rates help to adjust relative prices when the monetary authorities try to limit price changes ...

SUGGESTED ANSWE RS NOV 2012 PAP ER INTRODUCTION TO

... (c) Diagram to be done manually, but a student should be able to state/explain the following: (1) label the key players in the flow of income diagram (households, firms, govt and producers); (2) state the injections and withdrawals 32. (a) An Indifference curve is a curve that shows points/set of c ...

... (c) Diagram to be done manually, but a student should be able to state/explain the following: (1) label the key players in the flow of income diagram (households, firms, govt and producers); (2) state the injections and withdrawals 32. (a) An Indifference curve is a curve that shows points/set of c ...

Money

Money is any item or verifiable record that is generally accepted as payment for goods and services and repayment of debts in a particular country or socio-economic context, or is easily converted to such a form. The main functions of money are distinguished as: a medium of exchange; a unit of account; a store of value; and, sometimes, a standard of deferred payment. Any item or verifiable record that fulfills these functions can be considered money.Money is historically an emergent market phenomenon establishing a commodity money, but nearly all contemporary money systems are based on fiat money. Fiat money, like any check or note of debt, is without intrinsic use value as a physical commodity. It derives its value by being declared by a government to be legal tender; that is, it must be accepted as a form of payment within the boundaries of the country, for ""all debts, public and private"". Such laws in practice cause fiat money to acquire the value of any of the goods and services that it may be traded for within the nation that issues it.The money supply of a country consists of currency (banknotes and coins) and, depending on the particular definition used, one or more types of bank money (the balances held in checking accounts, savings accounts, and other types of bank accounts). Bank money, which consists only of records (mostly computerized in modern banking), forms by far the largest part of broad money in developed countries.