Foundations of Economics for International Business Selected

... (b) The increase in money demand is equivalent to a decrease in the velocity of money. Recall the quantity equation M /P = kY , where k = 1/V . For this equation to hold, an increase in real money balances for a given amount of output means that k must increase; that is, velocity falls. Because inte ...

... (b) The increase in money demand is equivalent to a decrease in the velocity of money. Recall the quantity equation M /P = kY , where k = 1/V . For this equation to hold, an increase in real money balances for a given amount of output means that k must increase; that is, velocity falls. Because inte ...

Start with government purchases of goods and services, and with

... accomplish both purposes. Thus we need a Federal Reserve--that is, a central bank--for there is no reason why the interest rate that balances supply and demand for liquid assets should be the same as the interest rate that generates the level of investment that guides the economy to full employment. ...

... accomplish both purposes. Thus we need a Federal Reserve--that is, a central bank--for there is no reason why the interest rate that balances supply and demand for liquid assets should be the same as the interest rate that generates the level of investment that guides the economy to full employment. ...

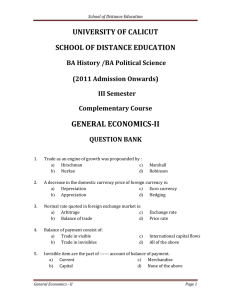

GENERAL ECONOMICSII UNIVERSITY OF CALICUT SCHOOL OF DISTANCE EDUCATION

... 15. In all balance of payment accounts, there are a fictitious head of account called: a) Invisibles c) Reserves b) Deficits d) Errors and omissions ...

... 15. In all balance of payment accounts, there are a fictitious head of account called: a) Invisibles c) Reserves b) Deficits d) Errors and omissions ...

Real GDP, Nominal GDP, Money Supply, Velocity of Money, Inflation

... relationship between money Supply and price level (Ruffin, 1938). This theory was taken up by the great American economist, Irving Fisher of Yale University (1867–1947) and by the great English economist Alfred Marshall (1842-1924) and has come to be called the Crude Quantity Theory of Money or simp ...

... relationship between money Supply and price level (Ruffin, 1938). This theory was taken up by the great American economist, Irving Fisher of Yale University (1867–1947) and by the great English economist Alfred Marshall (1842-1924) and has come to be called the Crude Quantity Theory of Money or simp ...

Document

... (a) the opportunity cost of holding real money balances. (b) the inflation rate. (c) the opportunity cost of holding bonds. (d) the growth rate of output in the long run. The fact that in addition to being a medium of exchange, money serves as a store of value means that (a) movements in the interes ...

... (a) the opportunity cost of holding real money balances. (b) the inflation rate. (c) the opportunity cost of holding bonds. (d) the growth rate of output in the long run. The fact that in addition to being a medium of exchange, money serves as a store of value means that (a) movements in the interes ...

Notes

... • In late 1998, the Bank of Japan, and the Bank of England, were removed from the direct control of the Ministry of Finance and the Chancellor and the Exchequer respectively. • In 1997 and 2003 revisions of the Bank of Korea Act, the Bank of Korea were removed from the direct and indirect control of ...

... • In late 1998, the Bank of Japan, and the Bank of England, were removed from the direct control of the Ministry of Finance and the Chancellor and the Exchequer respectively. • In 1997 and 2003 revisions of the Bank of Korea Act, the Bank of Korea were removed from the direct and indirect control of ...

The liquidity effect

... rate. If we can explain how that happens then we can explain relatively easily how interest rates then affect output. However, explaining why the nominal interest rate falls is not a trivial exercise. In a neoclassical model the standard way of viewing nominal interest rates is through the Fisher hyp ...

... rate. If we can explain how that happens then we can explain relatively easily how interest rates then affect output. However, explaining why the nominal interest rate falls is not a trivial exercise. In a neoclassical model the standard way of viewing nominal interest rates is through the Fisher hyp ...

Fiscal Policy

... 2.44 percent of GDP by 1989-90. Across the same period the centre‟s gross fiscal deficit (GFD) climbed from 5.71 percent to 7.31 percent of GDP. Minimum Alternative Tax (MAT) was introduced in 1996-97. It required a company to pay a minimum of 30 percent of book profits as tax. Further attempts to e ...

... 2.44 percent of GDP by 1989-90. Across the same period the centre‟s gross fiscal deficit (GFD) climbed from 5.71 percent to 7.31 percent of GDP. Minimum Alternative Tax (MAT) was introduced in 1996-97. It required a company to pay a minimum of 30 percent of book profits as tax. Further attempts to e ...

Arshad Zabir

... should take account of foreign monetary developments, such as variation in exchange rates and foreign interest rate (Arango and Nadiri, 1981). The link between exchange rates and money demand can also be used to define currency substitution. The currency substitution literature suggests that portfol ...

... should take account of foreign monetary developments, such as variation in exchange rates and foreign interest rate (Arango and Nadiri, 1981). The link between exchange rates and money demand can also be used to define currency substitution. The currency substitution literature suggests that portfol ...

A stable money demand - Federal Reserve Bank of Chicago

... Before 1980, M1, consisting of currency, non-interest-bearing demand deposits, and a very small amount of interest-bearing checkable deposits (see ...

... Before 1980, M1, consisting of currency, non-interest-bearing demand deposits, and a very small amount of interest-bearing checkable deposits (see ...

Business cycles

... Keynes, the determination of wages is more complicated. First, he argued that it is not real but nominal wages that are set in negotiations between employers and workers, as opposed to a barter relationship. Second, nominal wage cuts would be difficult to put into effect because of laws and wage con ...

... Keynes, the determination of wages is more complicated. First, he argued that it is not real but nominal wages that are set in negotiations between employers and workers, as opposed to a barter relationship. Second, nominal wage cuts would be difficult to put into effect because of laws and wage con ...

The Quantity Theory of Money and Its Long Run Implications

... y = real output (of commodities) P = price level (i.e. the average price level of commodities) Y = nominal value of output (≡ nominal income) M = money supply V = velocity of circulation of money (M) against output (y) over the designated period. Equation (1) is an identity since it is derived solel ...

... y = real output (of commodities) P = price level (i.e. the average price level of commodities) Y = nominal value of output (≡ nominal income) M = money supply V = velocity of circulation of money (M) against output (y) over the designated period. Equation (1) is an identity since it is derived solel ...

Chapter 13

... checking account and deposits it into his savings account. This transaction causes M1 to: Increase by $100 and M2 to remain the same. → Decrease by $100 and M2 to remain the same. X Decrease by $100 and M2 to increase by $100. Remain the same and M2 to increase by $100. ...

... checking account and deposits it into his savings account. This transaction causes M1 to: Increase by $100 and M2 to remain the same. → Decrease by $100 and M2 to remain the same. X Decrease by $100 and M2 to increase by $100. Remain the same and M2 to increase by $100. ...

The Great Depression

... withdrawing money from their bank accounts, which meant that banks lost reserves and were unable to provide depositors with cash when they wanted to withdraw money. Bank failures resulted, leading to depositors taking money out of other banks – a domino effect ensued. The leftward shift in the money ...

... withdrawing money from their bank accounts, which meant that banks lost reserves and were unable to provide depositors with cash when they wanted to withdraw money. Bank failures resulted, leading to depositors taking money out of other banks – a domino effect ensued. The leftward shift in the money ...

Key

... Make sure that you have read the “Banking Manual” and SimEcon® Operation Instructions”. These materials may be found at the Class Web site prior to beginning the exercise. For many of the exercise’s questions, it will be necessary to refer to those instructions. For many of the exercise’s questions, ...

... Make sure that you have read the “Banking Manual” and SimEcon® Operation Instructions”. These materials may be found at the Class Web site prior to beginning the exercise. For many of the exercise’s questions, it will be necessary to refer to those instructions. For many of the exercise’s questions, ...

Lecture 7. Classical monetary theory

... From Alfred Marshall and Arthur Pigou, Keynes had inherited an alternative version of the above statement of relationship between goods, prices and money, which focused more on money demand, rather than supply: Md = k · P · Y The Cambridge economists argued that a certain portion of the money supply ...

... From Alfred Marshall and Arthur Pigou, Keynes had inherited an alternative version of the above statement of relationship between goods, prices and money, which focused more on money demand, rather than supply: Md = k · P · Y The Cambridge economists argued that a certain portion of the money supply ...

Money

Money is any item or verifiable record that is generally accepted as payment for goods and services and repayment of debts in a particular country or socio-economic context, or is easily converted to such a form. The main functions of money are distinguished as: a medium of exchange; a unit of account; a store of value; and, sometimes, a standard of deferred payment. Any item or verifiable record that fulfills these functions can be considered money.Money is historically an emergent market phenomenon establishing a commodity money, but nearly all contemporary money systems are based on fiat money. Fiat money, like any check or note of debt, is without intrinsic use value as a physical commodity. It derives its value by being declared by a government to be legal tender; that is, it must be accepted as a form of payment within the boundaries of the country, for ""all debts, public and private"". Such laws in practice cause fiat money to acquire the value of any of the goods and services that it may be traded for within the nation that issues it.The money supply of a country consists of currency (banknotes and coins) and, depending on the particular definition used, one or more types of bank money (the balances held in checking accounts, savings accounts, and other types of bank accounts). Bank money, which consists only of records (mostly computerized in modern banking), forms by far the largest part of broad money in developed countries.