Maradona theory of interest rates

... The source of monetary policy’s influence over output and employment lies in frictions, which mean that prices and wages do not adjust instantaneously to clear markets whenever demand and supply are out of balance. Firms change prices only irregularly in response to changes in demand; wages adjust o ...

... The source of monetary policy’s influence over output and employment lies in frictions, which mean that prices and wages do not adjust instantaneously to clear markets whenever demand and supply are out of balance. Firms change prices only irregularly in response to changes in demand; wages adjust o ...

Speech - Bank of England

... His work underscores the value of empirics – informational broadening – to help make the interpersonal comparisons necessary to understand, and act upon, the force of public concerns about poverty, inequality, even tyranny. And his insights have been applied to the most pressing economic and ethical ...

... His work underscores the value of empirics – informational broadening – to help make the interpersonal comparisons necessary to understand, and act upon, the force of public concerns about poverty, inequality, even tyranny. And his insights have been applied to the most pressing economic and ethical ...

Chapter 9

... • The equality of money demanded and money supplied – Equilibrium in the asset market requires that the real money supply equal the real quantity of money demanded – Real money supply is determined by the central bank and isn’t affected by the real interest rate – Real money demand falls as the real ...

... • The equality of money demanded and money supplied – Equilibrium in the asset market requires that the real money supply equal the real quantity of money demanded – Real money supply is determined by the central bank and isn’t affected by the real interest rate – Real money demand falls as the real ...

INFLATION

... and saving supply in the global capital market. The real interest rate adjusts to make the quantity of investment equal the quantity of saving. National rates vary because of differences in risk. The nominal interest rate is determined by the demand for money and the supply of money in each nation’s ...

... and saving supply in the global capital market. The real interest rate adjusts to make the quantity of investment equal the quantity of saving. National rates vary because of differences in risk. The nominal interest rate is determined by the demand for money and the supply of money in each nation’s ...

CH 9 PDF

... • The equality of money demanded and money supplied – Equilibrium in the asset market requires that the real money supply equal the real quantity of money demanded – Real money supply is determined by the central bank and isn’t affected by the real interest rate – Real money demand falls as the real ...

... • The equality of money demanded and money supplied – Equilibrium in the asset market requires that the real money supply equal the real quantity of money demanded – Real money supply is determined by the central bank and isn’t affected by the real interest rate – Real money demand falls as the real ...

Inflation Targeting in South Africa: A VAR Analysis

... distinction is illustrated in the figures on the next page. These figures depict a simple textbook, ISLM version (e.g., Mankiw (1997)) of the Mundell Fleming model of a small open economy. The LM curve has a vertical slope because the demand for money is assumed to depend only on the price of domest ...

... distinction is illustrated in the figures on the next page. These figures depict a simple textbook, ISLM version (e.g., Mankiw (1997)) of the Mundell Fleming model of a small open economy. The LM curve has a vertical slope because the demand for money is assumed to depend only on the price of domest ...

Business Economics – II (MB1B4): January 2009

... (a) Decline as firms reduces production to stop the buildup of inventories (b) Increase as firms cut their prices to try to stop depletion of inventories (c) Decline as firms increase their prices to stop the buildup o f inventories (d) Increase as firms increase production to try to stop depletion ...

... (a) Decline as firms reduces production to stop the buildup of inventories (b) Increase as firms cut their prices to try to stop depletion of inventories (c) Decline as firms increase their prices to stop the buildup o f inventories (d) Increase as firms increase production to try to stop depletion ...

The 3-Equation New Keynesian Model — a Graphical

... to the problem faced by the central bank in minimizing the costs of achieving its objectives given the constraints it faces from the private sector. To derive the monetary rule graphically, we need to consider how the central bank behaves. In Fig.2, we assume that the economy is initially at point B ...

... to the problem faced by the central bank in minimizing the costs of achieving its objectives given the constraints it faces from the private sector. To derive the monetary rule graphically, we need to consider how the central bank behaves. In Fig.2, we assume that the economy is initially at point B ...

Economics Explorer Series No. 3 - Inflation

... tend to buy less of an item whose price has risen and more of a cheaper substitute. This would lead to what is known as substitution bias. DOS attempts to alleviate this problem by updating the CPI basket every five years. Another measurement problem arises with the emergence of new retail chains, d ...

... tend to buy less of an item whose price has risen and more of a cheaper substitute. This would lead to what is known as substitution bias. DOS attempts to alleviate this problem by updating the CPI basket every five years. Another measurement problem arises with the emergence of new retail chains, d ...

NATIONAL

... and the many stabilization programs (for example, the papers in Bruno et al. 1988] and Bruno et al. [1991)). This literature addresses a dizzying array of phenomena: budget deficits, supply shocks, external debt, exchange rate crises, the effects of inflation on tax revenue, incomes policies, the ch ...

... and the many stabilization programs (for example, the papers in Bruno et al. 1988] and Bruno et al. [1991)). This literature addresses a dizzying array of phenomena: budget deficits, supply shocks, external debt, exchange rate crises, the effects of inflation on tax revenue, incomes policies, the ch ...

Keun H. Lee, Northern State University, Farid Sadrieh, Quinnipiac University,

... controversial issue of expectation formation, because long-term interest rates are often viewed as reflecting the future growth of the economy, this analysis takes them as the proxy variable for future growth prospects. While FDI is normally long-term in kind, FPI can either be long-term or short-te ...

... controversial issue of expectation formation, because long-term interest rates are often viewed as reflecting the future growth of the economy, this analysis takes them as the proxy variable for future growth prospects. While FDI is normally long-term in kind, FPI can either be long-term or short-te ...

Integration of Real and Monetary Sectors with Labor Market – SD

... where a is a fraction of income for transactional demand for money, and b is an interest sensitivity of demand for money. P is a price level and was treated as a sticky exogenous parameter. This definition of demand for money may be no longer appropriate. The integrated model intends to be a complet ...

... where a is a fraction of income for transactional demand for money, and b is an interest sensitivity of demand for money. P is a price level and was treated as a sticky exogenous parameter. This definition of demand for money may be no longer appropriate. The integrated model intends to be a complet ...

AP 宏觀經濟學講義

... This section introduces the aggregate supply and aggregate demand model to explain the determination of equilibrium national output and the general price level, as well as to analyze and evaluate the effects of public policy. It is important to discuss the aggregate demand and aggregate supply conce ...

... This section introduces the aggregate supply and aggregate demand model to explain the determination of equilibrium national output and the general price level, as well as to analyze and evaluate the effects of public policy. It is important to discuss the aggregate demand and aggregate supply conce ...

ANALYSIS OF THE ZIMBABWEAN HYPERINFLATION CRISIS: A

... rates that did not account for ever-rising prices. Banks too were susceptible to the incorrect expectations that produced government revenue. The key to creating revenue is that the increase in price created by the growth of the money supply must be larger than the expected change in the price ...

... rates that did not account for ever-rising prices. Banks too were susceptible to the incorrect expectations that produced government revenue. The key to creating revenue is that the increase in price created by the growth of the money supply must be larger than the expected change in the price ...

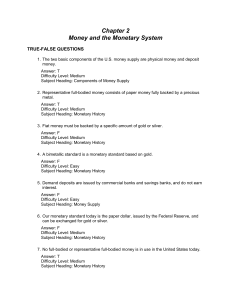

FREE Sample Here

... 18. One reason the Fed defines so many measures of money is that economists have different opinions as to which measure is most consistently related to spending and other economic activity. Answer: T Difficulty Level: Medium Subject Heading: Money Supply 19. Even though credit card balances and limi ...

... 18. One reason the Fed defines so many measures of money is that economists have different opinions as to which measure is most consistently related to spending and other economic activity. Answer: T Difficulty Level: Medium Subject Heading: Money Supply 19. Even though credit card balances and limi ...

PDF Download

... Effects of the US dollar depreciation on the US current account deficit VAR models and data Ogawa and Kudo (2007) investigated how the US dollar depreciation would affect the US current account deficit. In this context we simulated how much depreciation of the US dollar was needed for current accoun ...

... Effects of the US dollar depreciation on the US current account deficit VAR models and data Ogawa and Kudo (2007) investigated how the US dollar depreciation would affect the US current account deficit. In this context we simulated how much depreciation of the US dollar was needed for current accoun ...