Article Boy or girl: gender preferences from a Darwinian point of view

... and valuable contributions to discussions of issues such as preconception gender selection. In its broadest formulation, the Trivers–Willard hypothesis is that natural selection should favour parents who bias their investment in favour of the sex of offspring with the best reproductive prospects. In ...

... and valuable contributions to discussions of issues such as preconception gender selection. In its broadest formulation, the Trivers–Willard hypothesis is that natural selection should favour parents who bias their investment in favour of the sex of offspring with the best reproductive prospects. In ...

Developing a strong risk appetite program

... Source: Developing a strong risk appetite program: Challenges and solutions, KPMG International, 2013 ...

... Source: Developing a strong risk appetite program: Challenges and solutions, KPMG International, 2013 ...

2010 - GuocoLand Limited

... Mark Platinum Award, is almost fully sold. Strong sales of about 92% have also been achieved todate for Elliot at the East Coast. This project won the BCA Green Mark Gold Award in December 2009. Both prestigious awards underline the quality of our developments. In March 2010, the Group soft launched ...

... Mark Platinum Award, is almost fully sold. Strong sales of about 92% have also been achieved todate for Elliot at the East Coast. This project won the BCA Green Mark Gold Award in December 2009. Both prestigious awards underline the quality of our developments. In March 2010, the Group soft launched ...

Who are the Value and Growth Investors?

... to financial and demographic characteristics. Value investors are substantially older, tend to have higher financial wealth, higher real estate wealth, lower leverage, lower income risk, lower human capital, and are also more likely to be female, than the average growth investor. By contrast, males, ...

... to financial and demographic characteristics. Value investors are substantially older, tend to have higher financial wealth, higher real estate wealth, lower leverage, lower income risk, lower human capital, and are also more likely to be female, than the average growth investor. By contrast, males, ...

Managing A Stock Portfolio Using Schwab Equity

... reduced by holding a diversified portfolio; market risk cannot. Indeed, increasing expected portfolio returns requires taking higher market risk—a strategy best achieved not by picking riskier stocks, but by allocating more of your portfolio to stocks versus bonds or cash. To illustrate these two ki ...

... reduced by holding a diversified portfolio; market risk cannot. Indeed, increasing expected portfolio returns requires taking higher market risk—a strategy best achieved not by picking riskier stocks, but by allocating more of your portfolio to stocks versus bonds or cash. To illustrate these two ki ...

BASIC CONCEPTS OF FINANCIAL ACCOUNTING

... months' worth of rent, and if two months have gone by, then the business has incurred $2,400 of expense—$1,200 per month for two months. – The same is true for other items paid in ...

... months' worth of rent, and if two months have gone by, then the business has incurred $2,400 of expense—$1,200 per month for two months. – The same is true for other items paid in ...

Earnings per share - The Wise Investor Group

... number they use when filling out documents for the SEC, will be completely different from the one they use when reporting to shareholders. The two main types follow. Reported Earnings Companies have to report their earnings to the SEC in a standardized format following standardized rules. These earn ...

... number they use when filling out documents for the SEC, will be completely different from the one they use when reporting to shareholders. The two main types follow. Reported Earnings Companies have to report their earnings to the SEC in a standardized format following standardized rules. These earn ...

Download attachment

... functions of interest rate swaps and derivatives in managing the risks of Sukuk. The research aims to bridge an important gap in these emerging markets: namely, the analysis of risk management mechanisms in Sukuk structures. Indeed, due to the very novelty of Sukuks themselves there is a relative de ...

... functions of interest rate swaps and derivatives in managing the risks of Sukuk. The research aims to bridge an important gap in these emerging markets: namely, the analysis of risk management mechanisms in Sukuk structures. Indeed, due to the very novelty of Sukuks themselves there is a relative de ...

Barry P. Bosworth* Ralph C. Bryant Gary Burtless

... important demographic changes from the perspective of financial market fluctuations may be those occurring at the global rather than the national level. Our paper reviews the existing economic literature on the macroeconomic and asset market effects of population aging. We emphasize the open-econom ...

... important demographic changes from the perspective of financial market fluctuations may be those occurring at the global rather than the national level. Our paper reviews the existing economic literature on the macroeconomic and asset market effects of population aging. We emphasize the open-econom ...

Balance of Payments Manual

... Because of the important relationship between external and domestic economic developments, timely, reliable, and comprehensive balance of payments statistics based on an appropriate and analytically oriented methodology are an indispensable tool for economic analysis and policy making. Indeed, with ...

... Because of the important relationship between external and domestic economic developments, timely, reliable, and comprehensive balance of payments statistics based on an appropriate and analytically oriented methodology are an indispensable tool for economic analysis and policy making. Indeed, with ...

Employer Securities in Qualified Plans

... Loyalty: An ERISA fiduciary is required to act “solely in the interest” of the plan’s participants and beneficiaries and for the “exclusive purpose” of providing benefits to participants and beneficiaries and defraying reasonable administrative costs of the plan. (ERISA § 404(a)(1)(A)). a. ...

... Loyalty: An ERISA fiduciary is required to act “solely in the interest” of the plan’s participants and beneficiaries and for the “exclusive purpose” of providing benefits to participants and beneficiaries and defraying reasonable administrative costs of the plan. (ERISA § 404(a)(1)(A)). a. ...

View Determination - Pensions Ombudsman

... the Employers the Trustees may determine as they consider just all questions and matters of doubt arising under the Scheme and any such determination whether made upon a question actually raised or implied in the acts or proceedings of the Trustees shall so far as the law permits be conclusive and n ...

... the Employers the Trustees may determine as they consider just all questions and matters of doubt arising under the Scheme and any such determination whether made upon a question actually raised or implied in the acts or proceedings of the Trustees shall so far as the law permits be conclusive and n ...

ASPEN INSURANCE HOLDINGS LTD (Form: 8-K

... Some of the statements in Exhibit 99.3 include forward-looking statements which reflect Aspen’s current views with respect to future events and financial performance. Such statements may include forward-looking statements both with respect to Aspen in general and the insurance and reinsurance sector ...

... Some of the statements in Exhibit 99.3 include forward-looking statements which reflect Aspen’s current views with respect to future events and financial performance. Such statements may include forward-looking statements both with respect to Aspen in general and the insurance and reinsurance sector ...

Oxera (2011) “Discount rates for low

... participants supplemented by findings from a literature review. Oxera has also made use of market evidence on key parameters relevant to assessing the costs of debt and equity in order to develop discount rate estimates that are consistent with current capital market conditions and market expectatio ...

... participants supplemented by findings from a literature review. Oxera has also made use of market evidence on key parameters relevant to assessing the costs of debt and equity in order to develop discount rate estimates that are consistent with current capital market conditions and market expectatio ...

ACCA F9 Workbook Questions 1

... B. An offering of new shares to all investors in the market to enable them to purchase them if they wish. C. Offering shares to current shareholders in the same proportion as they currently own them. D. An issue to current shareholders of shares instead of dividends. ...

... B. An offering of new shares to all investors in the market to enable them to purchase them if they wish. C. Offering shares to current shareholders in the same proportion as they currently own them. D. An issue to current shareholders of shares instead of dividends. ...

Commercial Risk Europe

... or a market crash, more often than not human error and the wrong organisational culture are the root cause. For many, problems in the subprime market that five years ago caused the biggest financial crisis since the 1930s were clear to see, but bankers simply turned a blind eye while regulators and ...

... or a market crash, more often than not human error and the wrong organisational culture are the root cause. For many, problems in the subprime market that five years ago caused the biggest financial crisis since the 1930s were clear to see, but bankers simply turned a blind eye while regulators and ...

Value and Prices of Intangible Assets

... on the balance sheet (sometimes with a premium added to tangible assets for a normal profit). The separability issue aside, that calculation values hazy intangible assets from speculative market valuations of those assets. Anchoring Value in the Financial Statements Fundamental analysis recognizes t ...

... on the balance sheet (sometimes with a premium added to tangible assets for a normal profit). The separability issue aside, that calculation values hazy intangible assets from speculative market valuations of those assets. Anchoring Value in the Financial Statements Fundamental analysis recognizes t ...

NBER WORKING PAPER SERIES INTERNATIONAL CAPITAL FLOWS AND HOUSE PRICES: Jack Favilukis

... At the same time, the capital in‡ow stimulates residential investment and an expected increase in the housing stock. So while low interest rates in isolation tend to raise home prices, these general equilibrium consequences tend to reduce them, thereby limiting the scope for a capital in‡ow to incre ...

... At the same time, the capital in‡ow stimulates residential investment and an expected increase in the housing stock. So while low interest rates in isolation tend to raise home prices, these general equilibrium consequences tend to reduce them, thereby limiting the scope for a capital in‡ow to incre ...

Volatility: Implications for Value and Glamour Stocks

... wave” of volatility until comfortable values replace extreme episodes. Volatility is a fact of life in financial markets. Investors who keep this in mind may be well positioned for potential long-term success. Based on results revealed in this study, high volatility regimes are not necessarily threa ...

... wave” of volatility until comfortable values replace extreme episodes. Volatility is a fact of life in financial markets. Investors who keep this in mind may be well positioned for potential long-term success. Based on results revealed in this study, high volatility regimes are not necessarily threa ...

Delia Fernandez, MBA, CFP

... Past performance is no guarantee of future results. Risk and return are measured by standard deviation and compound annual return, respectively. They are based on annual data over the period 1970–2013. This is for illustrative purposes only and not indicative of any investment. An investment cannot ...

... Past performance is no guarantee of future results. Risk and return are measured by standard deviation and compound annual return, respectively. They are based on annual data over the period 1970–2013. This is for illustrative purposes only and not indicative of any investment. An investment cannot ...

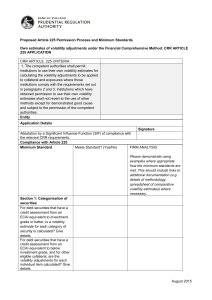

Proposed Article 225 Permission Process and

... out in Article 225(2)(b), using the square root of time formula set out in Article 225(2)(c). Provide detail on which categories of securities the volatility adjustments are calculated for in this manner. The liquidity of lower quality assets is taken into account. The liquidation period is adjusted ...

... out in Article 225(2)(b), using the square root of time formula set out in Article 225(2)(c). Provide detail on which categories of securities the volatility adjustments are calculated for in this manner. The liquidity of lower quality assets is taken into account. The liquidation period is adjusted ...

Investment fund

An investment fund is a way of investing money alongside other investors in order to benefit from the inherent advantages of working as part of a group. These advantages include an ability to: hire professional investment managers, which may potentially be able to offer better returns and more adequate risk management; benefit from economies of scale, i.e., lower transaction costs; increase the asset diversification to reduce some unsystemic risk.Terminology varies with country but investment funds are often referred to as investment pools, collective investment vehicles, collective investment schemes, managed funds, or simply funds. An investment fund may be held by the public, such as a mutual fund, exchange-traded fund, or closed-end fund, or it may be sold only in a private placement, such as a hedge fund or private equity fund. The term also includes specialized vehicles such as collective and common trust funds, which are unique bank-managed funds structured primarily to commingle assets from qualifying pension plans or trusts.Investment funds are promoted with a wide range of investment aims either targeting specific geographic regions (e.g., emerging markets or Europe) or specified industry sectors (e.g., technology). Depending on the country there is normally a bias towards the domestic market due to familiarity, and the lack of currency risk. Funds are often selected on the basis of these specified investment aims, their past investment performance, and other factors such as fees.