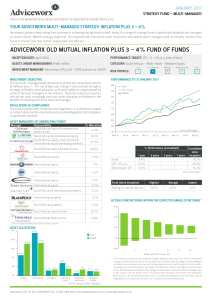

adviceworx old mutual inflation plus 3

... • You should ideally see unit trusts as a medium- to long-term investment. The fluctuations of particular investment strategies affect how a fund performs. Your fund value may go up or down. Therefore, we cannot guarantee the investment capital or return of your investment. How a fund has performed ...

... • You should ideally see unit trusts as a medium- to long-term investment. The fluctuations of particular investment strategies affect how a fund performs. Your fund value may go up or down. Therefore, we cannot guarantee the investment capital or return of your investment. How a fund has performed ...

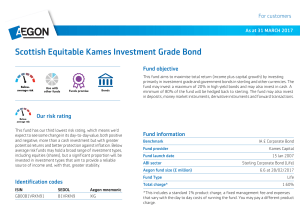

Scottish Equitable Kames Investment Grade Bond

... of investment, one region or country or one type of company, for example, technology. This increases the risk to you if this is your only investment. That's why it's best used in combination with other funds or types of investment so you're not entirely reliant on the success of one region or type o ...

... of investment, one region or country or one type of company, for example, technology. This increases the risk to you if this is your only investment. That's why it's best used in combination with other funds or types of investment so you're not entirely reliant on the success of one region or type o ...

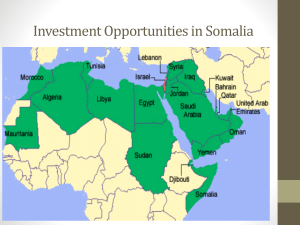

Investment Opportunities in Somalia

... (3,300km), this could be a major hub between Africa and the Middle East. Gulf Arab states have started to make strategic investments in the country, with Saudi Arabia building livestock export infrastructure and the United Arab Emirates purchasing large tracts of farmland for commercial agriculture. ...

... (3,300km), this could be a major hub between Africa and the Middle East. Gulf Arab states have started to make strategic investments in the country, with Saudi Arabia building livestock export infrastructure and the United Arab Emirates purchasing large tracts of farmland for commercial agriculture. ...

THE EXTRAORDINARY DIVIDEND

... downloads page or from our registered office. If you have a financial adviser, you should seek their advice before investing. Woodford Investment Management Ltd is not authorised to provide investment advice. ...

... downloads page or from our registered office. If you have a financial adviser, you should seek their advice before investing. Woodford Investment Management Ltd is not authorised to provide investment advice. ...

Exchange Fund Results for 2003

... The reported investment return of 10.2% is computed in US dollar terms in accordance with AIMR Global Investment Performance Standards. The difference between investment return as reported and simple return is attributable primarily to the difference between gross assets at year-end and average inve ...

... The reported investment return of 10.2% is computed in US dollar terms in accordance with AIMR Global Investment Performance Standards. The difference between investment return as reported and simple return is attributable primarily to the difference between gross assets at year-end and average inve ...

smarterinsightTM - Donald Wealth Management

... the exit and sell out of equities and hold cash. Every decision to move out of the market is coupled to a decision to get back in again. Evidence shows that investors are very unskilled at making these timing decisions - private and institutional investors alike. Stick with your portfolio strategy. ...

... the exit and sell out of equities and hold cash. Every decision to move out of the market is coupled to a decision to get back in again. Evidence shows that investors are very unskilled at making these timing decisions - private and institutional investors alike. Stick with your portfolio strategy. ...

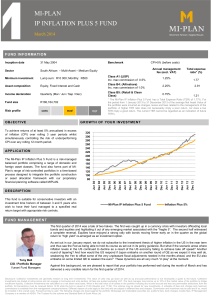

mi-plan ip inflation plus 5 fund

... render unbiased, fair advice in the best interests of you, the client, remains with your advisor. Your advisor’s obligation is to compare this financial offering against all others and ensure it commissions is available from the management company/scheme. Different classes of units apply to this fun ...

... render unbiased, fair advice in the best interests of you, the client, remains with your advisor. Your advisor’s obligation is to compare this financial offering against all others and ensure it commissions is available from the management company/scheme. Different classes of units apply to this fun ...

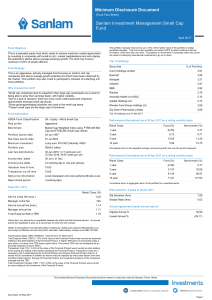

Sanlam Investment Management Small Cap Fund

... The Sanlam Group is a full member of the Association for Savings and Investment SA. Collective investment schemes are generally medium- to long-term investments. Please note that past performances are not necessarily a guide to future performances, and that the value of investments / units / unit tr ...

... The Sanlam Group is a full member of the Association for Savings and Investment SA. Collective investment schemes are generally medium- to long-term investments. Please note that past performances are not necessarily a guide to future performances, and that the value of investments / units / unit tr ...

Charity Finance Directors’ Group

... Organisations governing documents Charity SORP CC14 Investment of Charitable Funds Charities Act 2011 ...

... Organisations governing documents Charity SORP CC14 Investment of Charitable Funds Charities Act 2011 ...

the document - Lyxor Asset Management

... to a final offering memorandum. No advisory relationship is created by the receipt of this material. This material should not be construed as legal, business or tax advice. A more robust discussion of the risks and tax considerations involving in investing in a fund is available from the more comple ...

... to a final offering memorandum. No advisory relationship is created by the receipt of this material. This material should not be construed as legal, business or tax advice. A more robust discussion of the risks and tax considerations involving in investing in a fund is available from the more comple ...

FCA bans the promotion of UCIS and close substitutes to ordinary

... The Financial Conduct Authority (“FCA”) has published final rules to ban the promotion of Unregulated Collective Investment Schemes (“UCIS”) and certain other “non-mainstream pooled investments” (“NMPIs”) to the vast majority of retail investors in the UK. The new rules follow an FSA consultation la ...

... The Financial Conduct Authority (“FCA”) has published final rules to ban the promotion of Unregulated Collective Investment Schemes (“UCIS”) and certain other “non-mainstream pooled investments” (“NMPIs”) to the vast majority of retail investors in the UK. The new rules follow an FSA consultation la ...

FridayMarch28thMeeting - Sites at Lafayette

... • In Feb online bill payment grows to more than 50,000 ...

... • In Feb online bill payment grows to more than 50,000 ...

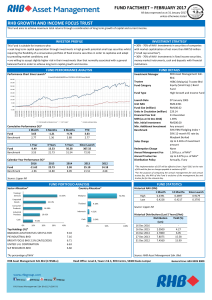

RHB Growth And Income Focus Trust

... call 1-800-88-3175 for a copy of the PHS and the Master Prospectus or collect one from any of our branches or authorised distributors. The Manager wishes to highlight the specific risks for the Fund are liquidity of underlying investments, interest rate risk, credit / default risk, inflation / purch ...

... call 1-800-88-3175 for a copy of the PHS and the Master Prospectus or collect one from any of our branches or authorised distributors. The Manager wishes to highlight the specific risks for the Fund are liquidity of underlying investments, interest rate risk, credit / default risk, inflation / purch ...

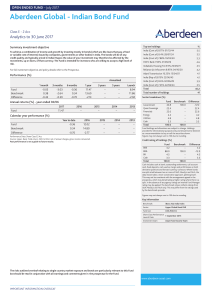

Aberdeen Global - Indian Bond Fund

... Variable (a “SICAV”). The information contained in this marketing document is intended to be of general interest only and should not be considered as an offer, or solicitation, to deal in the shares of any securities or financial instruments. Aberdeen Global has been authorized for public sale in ce ...

... Variable (a “SICAV”). The information contained in this marketing document is intended to be of general interest only and should not be considered as an offer, or solicitation, to deal in the shares of any securities or financial instruments. Aberdeen Global has been authorized for public sale in ce ...

The role of insurance risk transfer in encouraging climate investment in developing countries

... Any investment faces risk. Underwriting some of these in exchange for a premium payment can reduce investors’ uncertainty and make some investments more attractive. This article explores if and how this insurance mechanism can be applied to harness investment in environmental protection in developin ...

... Any investment faces risk. Underwriting some of these in exchange for a premium payment can reduce investors’ uncertainty and make some investments more attractive. This article explores if and how this insurance mechanism can be applied to harness investment in environmental protection in developin ...

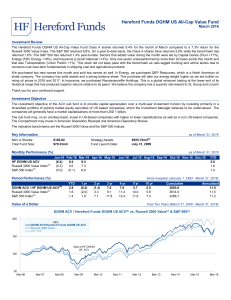

Click to download DGHM ACV March 2016

... for any errors, mistakes or omission or for future returns. This document is intended for the use of the addressee or recipient only and may not be reproduced, redistributed, passed on or published, in whole or in part, for any purpose, without the prior written consent of HEREFORD FUNDS. Neither th ...

... for any errors, mistakes or omission or for future returns. This document is intended for the use of the addressee or recipient only and may not be reproduced, redistributed, passed on or published, in whole or in part, for any purpose, without the prior written consent of HEREFORD FUNDS. Neither th ...

Slide 1

... * Source: Lipper Hindsight at 31.08.07 since launch (28.12.01), performance based on financial peer group comprising financial funds held within the IMA Specialist Sector. ** Source: Citywire at 31.08.07 Fund Manager ratings are based on assessing individual fund managers outperformance against appr ...

... * Source: Lipper Hindsight at 31.08.07 since launch (28.12.01), performance based on financial peer group comprising financial funds held within the IMA Specialist Sector. ** Source: Citywire at 31.08.07 Fund Manager ratings are based on assessing individual fund managers outperformance against appr ...

Investment fund

An investment fund is a way of investing money alongside other investors in order to benefit from the inherent advantages of working as part of a group. These advantages include an ability to: hire professional investment managers, which may potentially be able to offer better returns and more adequate risk management; benefit from economies of scale, i.e., lower transaction costs; increase the asset diversification to reduce some unsystemic risk.Terminology varies with country but investment funds are often referred to as investment pools, collective investment vehicles, collective investment schemes, managed funds, or simply funds. An investment fund may be held by the public, such as a mutual fund, exchange-traded fund, or closed-end fund, or it may be sold only in a private placement, such as a hedge fund or private equity fund. The term also includes specialized vehicles such as collective and common trust funds, which are unique bank-managed funds structured primarily to commingle assets from qualifying pension plans or trusts.Investment funds are promoted with a wide range of investment aims either targeting specific geographic regions (e.g., emerging markets or Europe) or specified industry sectors (e.g., technology). Depending on the country there is normally a bias towards the domestic market due to familiarity, and the lack of currency risk. Funds are often selected on the basis of these specified investment aims, their past investment performance, and other factors such as fees.