Personal Finance

... your retirement. Because of the compounding effect, the earlier you plan, the better off you are. The best time to prepare for your retirement is NOW. Money do not grow on trees – you need to save your money FIRST before they can grow and multiply for you. You can get started by putting aside a few ...

... your retirement. Because of the compounding effect, the earlier you plan, the better off you are. The best time to prepare for your retirement is NOW. Money do not grow on trees – you need to save your money FIRST before they can grow and multiply for you. You can get started by putting aside a few ...

Conference Call

... 3.7 million with pre-approved credit, and 65.5% of these indeed using it. The pulverization of credit, combined with the approval models, has insured a good liquidity to the portfolios. •Outstanding Personal / Overdraft / Vehicles Loans: R$ 2.5 billion Credit Cards 110.2% increase over 1998; •70% of ...

... 3.7 million with pre-approved credit, and 65.5% of these indeed using it. The pulverization of credit, combined with the approval models, has insured a good liquidity to the portfolios. •Outstanding Personal / Overdraft / Vehicles Loans: R$ 2.5 billion Credit Cards 110.2% increase over 1998; •70% of ...

News Release Nomura Asset Management Nomura`s NEXT FUNDS

... the Nikkei High Dividend Yield 50. The ETF shall be managed under the responsibilities of the relevant investment trust management companies and other participants. Nikkei Inc. shall not be liable for management of the ETF or any other transactions of the ETF. Nikkei Inc. shall not be obligated to c ...

... the Nikkei High Dividend Yield 50. The ETF shall be managed under the responsibilities of the relevant investment trust management companies and other participants. Nikkei Inc. shall not be liable for management of the ETF or any other transactions of the ETF. Nikkei Inc. shall not be obligated to c ...

US Equities

... or its affiliates. Fidelity does not assume any duty to update any of the information. Past performance, dividend rates, and share buybacks are historical and do not guarantee future results. Investment decisions should be based on an individual’s own goals, time horizon, and tolerance for risk. Inv ...

... or its affiliates. Fidelity does not assume any duty to update any of the information. Past performance, dividend rates, and share buybacks are historical and do not guarantee future results. Investment decisions should be based on an individual’s own goals, time horizon, and tolerance for risk. Inv ...

FAQs - Motswedi Securities

... Like any other investment, there are risks associated with buying shares. For example the value of the shares can fall after buying them. However it is important to understand what could have caused the share price to fall, before engaging in 'panic selling' which might cause the share price to fall ...

... Like any other investment, there are risks associated with buying shares. For example the value of the shares can fall after buying them. However it is important to understand what could have caused the share price to fall, before engaging in 'panic selling' which might cause the share price to fall ...

ppt - AAII

... Use tax-deferred accounts as much as possible, and put assets that would generate the most short-term tax liability in them ...

... Use tax-deferred accounts as much as possible, and put assets that would generate the most short-term tax liability in them ...

Laura Piatti - CeRP - Collegio Carlo Alberto

... The Italian annuity market (from the paper, confirming other research): • Is at present quite underdeveloped • Has been not particularly pushed or pulled as the public pension system has been based mainly on a PAYGO scheme and has crowed-out the private market • Can be in the future much more devel ...

... The Italian annuity market (from the paper, confirming other research): • Is at present quite underdeveloped • Has been not particularly pushed or pulled as the public pension system has been based mainly on a PAYGO scheme and has crowed-out the private market • Can be in the future much more devel ...

PRINCIPLES OF INVESTMENT MAY 2012

... financial institutions and large corporations. These instruments are very liquid and considered extraordinarily safe. Because they are extremely conservative, money market securities offer significantly lower returns than most other securities. One of the main differences between the money market an ...

... financial institutions and large corporations. These instruments are very liquid and considered extraordinarily safe. Because they are extremely conservative, money market securities offer significantly lower returns than most other securities. One of the main differences between the money market an ...

2014-09-Navigator Report.indd - Clark Capital Management Group

... But we have to be careful what we wish for. Too strong a dollar will not be good for all. Companies in the S&P 500 get almost one-third of their revenues abroad and these revenues are worth less when the dollar is strong. A strong dollar makes our exports more expensive and could cause U.S. manufact ...

... But we have to be careful what we wish for. Too strong a dollar will not be good for all. Companies in the S&P 500 get almost one-third of their revenues abroad and these revenues are worth less when the dollar is strong. A strong dollar makes our exports more expensive and could cause U.S. manufact ...

Guaranteeing employment - Sa-Dhan

... either that a larger budget deficit results in higher inflation. So the link between budget deficit and inflation tends to be more imaginary than real, and for good reasons. A larger budget deficit by pumping more money into the economy would raise prices if goods and services do not expand proporti ...

... either that a larger budget deficit results in higher inflation. So the link between budget deficit and inflation tends to be more imaginary than real, and for good reasons. A larger budget deficit by pumping more money into the economy would raise prices if goods and services do not expand proporti ...

The Grand Duchy of Luxembourg

... LUXEMBOURG INVESTMENT FUNDS There are more than 4149 investment funds registered in Luxembourg (2012), representing approximately 32% of the market share in Europe for investment funds. As a result of the country’s flexible fund legislation, Luxembourg funds may take the form of an investment compan ...

... LUXEMBOURG INVESTMENT FUNDS There are more than 4149 investment funds registered in Luxembourg (2012), representing approximately 32% of the market share in Europe for investment funds. As a result of the country’s flexible fund legislation, Luxembourg funds may take the form of an investment compan ...

Mixed Signals

... requested amount was based on the results of two independent audits, which examined both best case and worst case scenarios before developing the bailout request.v Housing market tough for many buyers. A combination of low housing stock and wary lenders is creating problems for homebuyers in many ci ...

... requested amount was based on the results of two independent audits, which examined both best case and worst case scenarios before developing the bailout request.v Housing market tough for many buyers. A combination of low housing stock and wary lenders is creating problems for homebuyers in many ci ...

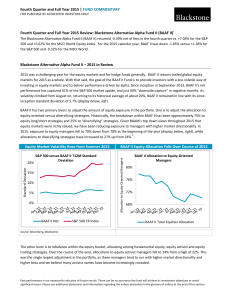

Fourth Quarter and Full Year 2015

... Performance data quoted represents past performance and is no guarantee of future results. Investment results will fluctuate so that an investor’s shares, if repurchased in a tender offer, may be worth more or less than original cost. Current performance may be higher or lower than performance data ...

... Performance data quoted represents past performance and is no guarantee of future results. Investment results will fluctuate so that an investor’s shares, if repurchased in a tender offer, may be worth more or less than original cost. Current performance may be higher or lower than performance data ...

Charting and Technical Analysis

... irrational. The market continually and automatically weighs all these factors. (A random walker would have no qualms about this assumption either. He would point out that any irrational factors are just as likely to be one side of the market as on the other.) Disregarding minor fluctuations in the m ...

... irrational. The market continually and automatically weighs all these factors. (A random walker would have no qualms about this assumption either. He would point out that any irrational factors are just as likely to be one side of the market as on the other.) Disregarding minor fluctuations in the m ...

Mini Case (p.45) A. Why is corporate finance important to all

... the company on open stock exchanges. A company continues to grow by demonstrating increasing value. Value is continued generation of cash flows and/or consistently decreasing the cost of capital. Agency problem is the plausible conflict of interest that might exist between management and stakeholder ...

... the company on open stock exchanges. A company continues to grow by demonstrating increasing value. Value is continued generation of cash flows and/or consistently decreasing the cost of capital. Agency problem is the plausible conflict of interest that might exist between management and stakeholder ...

a concluded canada-china fipa and its implications for

... with uncertainty, the Chinese market is viewed as an important hedge against any turmoil that might generated in the United States or Europe. With New Zealand having entered into a free-trade agreement (FTA) with China in 2008, and Australia close to agreement on an ...

... with uncertainty, the Chinese market is viewed as an important hedge against any turmoil that might generated in the United States or Europe. With New Zealand having entered into a free-trade agreement (FTA) with China in 2008, and Australia close to agreement on an ...

Michael Dimelow, VP Business Development, ARM

... ARM Ownership: • Undisclosed Strategic Rationale for Investment: • Establish presence in low power server chips Recent Events: • Significant customer traction for ultra low power compute • Closed $55 Million Funding Round Q4’2012 ...

... ARM Ownership: • Undisclosed Strategic Rationale for Investment: • Establish presence in low power server chips Recent Events: • Significant customer traction for ultra low power compute • Closed $55 Million Funding Round Q4’2012 ...

(IASB) Exposure Draft (ED 10), “Consolidated Financial Statements”

... private equity investments – often a majority of the outstanding voting shares of private companies – be carried at fair value. This is the method of accounting that best meets the needs of private equity investors, typically endowments, pension plans, foundations, insurance companies, and high net ...

... private equity investments – often a majority of the outstanding voting shares of private companies – be carried at fair value. This is the method of accounting that best meets the needs of private equity investors, typically endowments, pension plans, foundations, insurance companies, and high net ...

Goodbody Global Leaders Fund

... price or income of such securities. Goodbody Stockbrokers and its associated companies and/or its officers may from time to time perform banking or Corporate Finance services including underwriting, managing or advising on a public offering for, or solicit business from any company recommended in th ...

... price or income of such securities. Goodbody Stockbrokers and its associated companies and/or its officers may from time to time perform banking or Corporate Finance services including underwriting, managing or advising on a public offering for, or solicit business from any company recommended in th ...

Risk Analysis - Purdue Agriculture

... • Potential for revenue to be lower and expenditures to be higher than “expected” when investment was made. • Measured by variation in these factors • Causes – Physical risk – physical loss of growing stock due to acts of God or uncontrollable acts of man – Market risk – changes in markets that caus ...

... • Potential for revenue to be lower and expenditures to be higher than “expected” when investment was made. • Measured by variation in these factors • Causes – Physical risk – physical loss of growing stock due to acts of God or uncontrollable acts of man – Market risk – changes in markets that caus ...

Madrid, a 19 de abril de 2

... With regard to the distribution and payment of dividends to the shareholders of Promotora de Informaciones, S.A., we are attaching the text of the announcement that will be published tomorrow, March 23, in EL PAIS and CINCO DIAS. ...

... With regard to the distribution and payment of dividends to the shareholders of Promotora de Informaciones, S.A., we are attaching the text of the announcement that will be published tomorrow, March 23, in EL PAIS and CINCO DIAS. ...

Document

... Manage for tax efficiency: ETFs, traditional index funds, taxmanaged funds, individual stocks. Check to see if munis offer better after-tax return than comparable taxable bond funds. (Favorite firm for munis: Fidelity.) Use taxequivalent yield function of Morningstar’s Bond Calculator. Don’t go craz ...

... Manage for tax efficiency: ETFs, traditional index funds, taxmanaged funds, individual stocks. Check to see if munis offer better after-tax return than comparable taxable bond funds. (Favorite firm for munis: Fidelity.) Use taxequivalent yield function of Morningstar’s Bond Calculator. Don’t go craz ...

INVESTMENT POLICY STATEMENT APPROVED JANUARY 30

... b. Provide the Foundation, its investment managers and consultant special reports as reasonably requested; and c. Communicate immediately any concerns regarding portfolio ...

... b. Provide the Foundation, its investment managers and consultant special reports as reasonably requested; and c. Communicate immediately any concerns regarding portfolio ...

fixed income strategies for a rising interest rate environment

... insurance agent for final recommendations and before changing or implementing any financial, tax, or estate planning strategy. Sector and asset allocation recommendations should be considered in the context of an individual investor’s goals, time horizon and risk tolerance. Not all recommendations w ...

... insurance agent for final recommendations and before changing or implementing any financial, tax, or estate planning strategy. Sector and asset allocation recommendations should be considered in the context of an individual investor’s goals, time horizon and risk tolerance. Not all recommendations w ...

Investment fund

An investment fund is a way of investing money alongside other investors in order to benefit from the inherent advantages of working as part of a group. These advantages include an ability to: hire professional investment managers, which may potentially be able to offer better returns and more adequate risk management; benefit from economies of scale, i.e., lower transaction costs; increase the asset diversification to reduce some unsystemic risk.Terminology varies with country but investment funds are often referred to as investment pools, collective investment vehicles, collective investment schemes, managed funds, or simply funds. An investment fund may be held by the public, such as a mutual fund, exchange-traded fund, or closed-end fund, or it may be sold only in a private placement, such as a hedge fund or private equity fund. The term also includes specialized vehicles such as collective and common trust funds, which are unique bank-managed funds structured primarily to commingle assets from qualifying pension plans or trusts.Investment funds are promoted with a wide range of investment aims either targeting specific geographic regions (e.g., emerging markets or Europe) or specified industry sectors (e.g., technology). Depending on the country there is normally a bias towards the domestic market due to familiarity, and the lack of currency risk. Funds are often selected on the basis of these specified investment aims, their past investment performance, and other factors such as fees.