Educating Your Investment Committee on Behavioral Economics

... An investment in alternative investments can be highly illiquid, is speculative and not suitable for all investors. Investing in alternative investments is only intended for experienced and sophisticated investors who are willing to bear the high economic risks associated with such an investment. In ...

... An investment in alternative investments can be highly illiquid, is speculative and not suitable for all investors. Investing in alternative investments is only intended for experienced and sophisticated investors who are willing to bear the high economic risks associated with such an investment. In ...

Policies and Procedures

... find funding. Because banks usually loan based on assets, a startup business’s initial capital is often produced through individual equity investment or angel networks. By building the 49SAF, the Municipality of Anchorage (MOA) is helping to ensure the availability of critical capital for qualified ...

... find funding. Because banks usually loan based on assets, a startup business’s initial capital is often produced through individual equity investment or angel networks. By building the 49SAF, the Municipality of Anchorage (MOA) is helping to ensure the availability of critical capital for qualified ...

Vietnam Today: GAS leads market higher to break four-day

... Copyright 2013 Viet Capital Securities Company “VCSC”. All rights reserved. This report has been prepared on the basis of information believed to be reliable at the time of publication. VCSC makes no representation or warranty regarding the completeness and accuracy of such information. Opinions, es ...

... Copyright 2013 Viet Capital Securities Company “VCSC”. All rights reserved. This report has been prepared on the basis of information believed to be reliable at the time of publication. VCSC makes no representation or warranty regarding the completeness and accuracy of such information. Opinions, es ...

Slide set 1

... • Requires efficiency ensured also by means of regulation • Another regulatory objective: investor protection ...

... • Requires efficiency ensured also by means of regulation • Another regulatory objective: investor protection ...

See Mind the Bytes` press release here.

... Park and the Copenhagen Bio Science Park, has passed into the realm of overfunding with 234% of the initial investment objective thanks to over one hundred investors The funds are intended to boost the international marketing of its SaaS platform, which reduces the time and cost of developing new dr ...

... Park and the Copenhagen Bio Science Park, has passed into the realm of overfunding with 234% of the initial investment objective thanks to over one hundred investors The funds are intended to boost the international marketing of its SaaS platform, which reduces the time and cost of developing new dr ...

2012-05-18 OPEB Trust Minutes

... about the type of insurance needed and their quote was within $100 of the Martha’s Vineyard Insurance Co. quote. Mort said that the officers could make the decision as which company to use. Kathy will send Laurie Garcia at Rockland a pdf file of the unit balances. Mort, Noreen and Kathy will have a ...

... about the type of insurance needed and their quote was within $100 of the Martha’s Vineyard Insurance Co. quote. Mort said that the officers could make the decision as which company to use. Kathy will send Laurie Garcia at Rockland a pdf file of the unit balances. Mort, Noreen and Kathy will have a ...

Download attachment

... Secondly, Shariah compliant funds commonly use purication techniques aimed at morally neutralizing an investment that appear to be non-Shariah compliant, typically after an audit has been conducted on the morality of the assets. Such purication is effected by distributing part of the funds income ...

... Secondly, Shariah compliant funds commonly use purication techniques aimed at morally neutralizing an investment that appear to be non-Shariah compliant, typically after an audit has been conducted on the morality of the assets. Such purication is effected by distributing part of the funds income ...

The Nasdaq Composite Index rose to a fresh 15

... 500 and the Dow’s 1.1% gain. But the better performance has lasted longer than that. Over the past year, the Nasdaq has gained 15.3% versus the 14.1% gain in the S&P 500. For the Nasdaq, which is heavily weighted toward technology stocks, it is a far cry from the era of ill-fated Internet blowups li ...

... 500 and the Dow’s 1.1% gain. But the better performance has lasted longer than that. Over the past year, the Nasdaq has gained 15.3% versus the 14.1% gain in the S&P 500. For the Nasdaq, which is heavily weighted toward technology stocks, it is a far cry from the era of ill-fated Internet blowups li ...

Measures of Total Debt Financing for Developing Countries

... Gap Left By International Institutions ...

... Gap Left By International Institutions ...

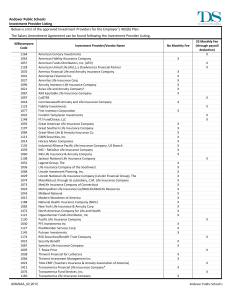

SALARY REDUCTION AGREEMENT (SRA) 403(b)

... the annuity and/or custodial account; it’s terms; the selection of Investment Provider; the solvency of, operation of, or benefits provided by said Investment Provider; or his/her selection and purchase of annuity contracts and/or shares of regulated investments from an Investment Provider. It is un ...

... the annuity and/or custodial account; it’s terms; the selection of Investment Provider; the solvency of, operation of, or benefits provided by said Investment Provider; or his/her selection and purchase of annuity contracts and/or shares of regulated investments from an Investment Provider. It is un ...

2015 Fall – David Stowell

... Weekly presentations on market developments and the M&A case will be completed by groups. These and other group activities must adhere to principals of Academic Integrity in every respect, including each group member having a full understanding of any written material that includes a student’s name. ...

... Weekly presentations on market developments and the M&A case will be completed by groups. These and other group activities must adhere to principals of Academic Integrity in every respect, including each group member having a full understanding of any written material that includes a student’s name. ...

Business/Market Due Diligence

... costs. In other cases, it may not be so obvious. For instance, a company may not have long-term contracts, but it is very painful, difficult and/or costly for their customers to switch. Assessing the extent to which these are recurring or quasi-recurring revenues will be critical to understanding t ...

... costs. In other cases, it may not be so obvious. For instance, a company may not have long-term contracts, but it is very painful, difficult and/or costly for their customers to switch. Assessing the extent to which these are recurring or quasi-recurring revenues will be critical to understanding t ...

Portfolio Compass

... Real Estate/REITs may result in potential illiquidity and there is no assurance the objectives of the program will be attained. The fast price swings of commodities will result in significant volatility in an investor's holdings. International and emerging markets involve special risks such as curre ...

... Real Estate/REITs may result in potential illiquidity and there is no assurance the objectives of the program will be attained. The fast price swings of commodities will result in significant volatility in an investor's holdings. International and emerging markets involve special risks such as curre ...

PRESS RELEASE Announcement of scrip issue price for final

... shares, or a combination of the two. Shareholders electing for a dividend in shares, which will be paid out of the share premium reserve and therefore not subject to dividend withholding tax, will receive 1 (one) new ordinary share for every 29 (twenty nine) ordinary shares held. This equates to a p ...

... shares, or a combination of the two. Shareholders electing for a dividend in shares, which will be paid out of the share premium reserve and therefore not subject to dividend withholding tax, will receive 1 (one) new ordinary share for every 29 (twenty nine) ordinary shares held. This equates to a p ...

Document

... • FROM CHAPTER 7 – assumed return on a risky asset was related to the return on a market index ...

... • FROM CHAPTER 7 – assumed return on a risky asset was related to the return on a market index ...

10-CAPM

... • FROM CHAPTER 8 – assumed return on a risky asset was related to the return on a market index ...

... • FROM CHAPTER 8 – assumed return on a risky asset was related to the return on a market index ...

Current Conditions Index - Legacy Financial Planning

... The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual. To determine which investments may be appropriate for you, consult your financial advisor prior to inve ...

... The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual. To determine which investments may be appropriate for you, consult your financial advisor prior to inve ...

ECONOMIC OPPORTUNITY COST OF CAPITAL (a)

... the investment over the life of the project should be discounted by the economic cost of capital. • If the NPV of these economic benefits and costs is equal to or greater than zero, then the project is feasible from an economic point of view. • If the NPV is less than zero, the project should be rej ...

... the investment over the life of the project should be discounted by the economic cost of capital. • If the NPV of these economic benefits and costs is equal to or greater than zero, then the project is feasible from an economic point of view. • If the NPV is less than zero, the project should be rej ...

Regional Council releases broadband guide

... work with telecommunication providers to get better broadband services to their businesses, schools and communities. Councils in the region have been advocating for better broadband in the Bay of Plenty for some time. Four years ago they developed a strategy aimed at developing more capacity and bet ...

... work with telecommunication providers to get better broadband services to their businesses, schools and communities. Councils in the region have been advocating for better broadband in the Bay of Plenty for some time. Four years ago they developed a strategy aimed at developing more capacity and bet ...

The future of Turkey`s capital markets

... savings, intermediaries and market infrastructure players need to educate investors and borrowers on emerging asset classes such as corporate bonds, derivatives or asset management products. The growth of capital markets will bring about a set of challenges to the industry. There are three major are ...

... savings, intermediaries and market infrastructure players need to educate investors and borrowers on emerging asset classes such as corporate bonds, derivatives or asset management products. The growth of capital markets will bring about a set of challenges to the industry. There are three major are ...

Chapter 1

... operations. Those who register with the SEC and are accepted are called Registered Investment Advisors (RIAs) As a restriction on compensation, the advisor cannot share in the profits of the client unless the client has assets of over $1 million or is a registered investment company. The advisor can ...

... operations. Those who register with the SEC and are accepted are called Registered Investment Advisors (RIAs) As a restriction on compensation, the advisor cannot share in the profits of the client unless the client has assets of over $1 million or is a registered investment company. The advisor can ...

Mufti Najeeb - Presentation Islamic fund

... Net Liquid Assets vs. Share Price: The net liquid assets per share should be less than the market price of the share. ...

... Net Liquid Assets vs. Share Price: The net liquid assets per share should be less than the market price of the share. ...

Investment fund

An investment fund is a way of investing money alongside other investors in order to benefit from the inherent advantages of working as part of a group. These advantages include an ability to: hire professional investment managers, which may potentially be able to offer better returns and more adequate risk management; benefit from economies of scale, i.e., lower transaction costs; increase the asset diversification to reduce some unsystemic risk.Terminology varies with country but investment funds are often referred to as investment pools, collective investment vehicles, collective investment schemes, managed funds, or simply funds. An investment fund may be held by the public, such as a mutual fund, exchange-traded fund, or closed-end fund, or it may be sold only in a private placement, such as a hedge fund or private equity fund. The term also includes specialized vehicles such as collective and common trust funds, which are unique bank-managed funds structured primarily to commingle assets from qualifying pension plans or trusts.Investment funds are promoted with a wide range of investment aims either targeting specific geographic regions (e.g., emerging markets or Europe) or specified industry sectors (e.g., technology). Depending on the country there is normally a bias towards the domestic market due to familiarity, and the lack of currency risk. Funds are often selected on the basis of these specified investment aims, their past investment performance, and other factors such as fees.