Transfer of Shares Ownership - American Century Investments

... • Use this form to transfer shares to a not-for-profit organization or other business account or to transfer shares to an IRA, 403(b) or 457(b) due to a divorce. • If you intend to transfer Prime Money Market Fund shares to a not-for-profit or other business account, you must exchange your shares in ...

... • Use this form to transfer shares to a not-for-profit organization or other business account or to transfer shares to an IRA, 403(b) or 457(b) due to a divorce. • If you intend to transfer Prime Money Market Fund shares to a not-for-profit or other business account, you must exchange your shares in ...

Chapter 11

... represents ownership in the corporation. A portion of stock is called a share. Stocks are also called equities. • Stockowners can earn a profit in two ways: 1. Dividends, which are portions of a corporation’s profits, are paid out to stockholders of many corporations. The higher the corporate profit ...

... represents ownership in the corporation. A portion of stock is called a share. Stocks are also called equities. • Stockowners can earn a profit in two ways: 1. Dividends, which are portions of a corporation’s profits, are paid out to stockholders of many corporations. The higher the corporate profit ...

Portfolio Benefits of The Currency Asset Class

... website at www.merkfunds.com or calling 866-MERK FUND. Please read the prospectus carefully before you invest. Since the Funds primarily invest in foreign currencies, changes in currency exchange rates affect the value of what the Funds own and the price of the Funds’ shares. Investing in foreign in ...

... website at www.merkfunds.com or calling 866-MERK FUND. Please read the prospectus carefully before you invest. Since the Funds primarily invest in foreign currencies, changes in currency exchange rates affect the value of what the Funds own and the price of the Funds’ shares. Investing in foreign in ...

Machinery purchasing decision support for broadacre growers

... logistics set-up in season and at seeding and harvest needs to be analysed before and after a potential investment in expansion. For instance, efficiencies of a second header may not be generated unless investment is also made in freight, storage and handling to avoid bottlenecks and delays in logis ...

... logistics set-up in season and at seeding and harvest needs to be analysed before and after a potential investment in expansion. For instance, efficiencies of a second header may not be generated unless investment is also made in freight, storage and handling to avoid bottlenecks and delays in logis ...

Document

... In making investment decisions, savers evaluate (a) the variability of the expected return as well as the size of the return. (b) the size of the expected return, but not the variability of the return. (c) the variability of the expected return, but not the size of the return. (d) neither the size n ...

... In making investment decisions, savers evaluate (a) the variability of the expected return as well as the size of the return. (b) the size of the expected return, but not the variability of the return. (c) the variability of the expected return, but not the size of the return. (d) neither the size n ...

FIN_Course_SLO

... approach to the principles of real estate to make the following decisions: 2. Recommend whether to lease, buy, or mortgage a real property acquisition; 3. Justify whether to renovate, refinance, demolish or expand real property; 4. Evaluate when and how to divest (sell, trade, or abandon) real prope ...

... approach to the principles of real estate to make the following decisions: 2. Recommend whether to lease, buy, or mortgage a real property acquisition; 3. Justify whether to renovate, refinance, demolish or expand real property; 4. Evaluate when and how to divest (sell, trade, or abandon) real prope ...

CIO Thoughts 5/09

... change at any time due to changes in market or economic conditions. This document contains general information only and does not take into account an individual’s financial circumstances. An assessment should be made as to whether the information is appropriate in individual circumstances and consid ...

... change at any time due to changes in market or economic conditions. This document contains general information only and does not take into account an individual’s financial circumstances. An assessment should be made as to whether the information is appropriate in individual circumstances and consid ...

Midyear Outlook - Keystone Financial Group

... During any presidential election, you can expect a barrage of promises from the yard sign endorsements, bumper stickers, stump speeches, and media headlines. All pledge to improve the economy, provide better education for all, and preserve the environment. This year has repeated that routine, and ce ...

... During any presidential election, you can expect a barrage of promises from the yard sign endorsements, bumper stickers, stump speeches, and media headlines. All pledge to improve the economy, provide better education for all, and preserve the environment. This year has repeated that routine, and ce ...

The Case for the Japan Hedged Equity Fund (DXJ)

... from currency fluctuation or political or economic uncertainty. The Fund focuses its investments in Japan, thereby increasing the impact of events and developments in Japan that can adversely affect performance. Investments in currency involve additional special risks, such as credit risk, interest ...

... from currency fluctuation or political or economic uncertainty. The Fund focuses its investments in Japan, thereby increasing the impact of events and developments in Japan that can adversely affect performance. Investments in currency involve additional special risks, such as credit risk, interest ...

Valuation Statement

... warehouse prime yields have moved in since the Q1 2010 but currently the short-term forecast for the yields is stable. The polarisation of the market seems also to continue. Demand for core assets remains strong as equity rich investors keep on looking for safe heavens but at the same time tightenin ...

... warehouse prime yields have moved in since the Q1 2010 but currently the short-term forecast for the yields is stable. The polarisation of the market seems also to continue. Demand for core assets remains strong as equity rich investors keep on looking for safe heavens but at the same time tightenin ...

ST Advertising PPT - IA Traing Dallas 2010

... Non-Disclosure of How Investment Performance is Calculated (Actual, Hypothetical, etc.) Non-Disclosure or Misrepresentation of the Time Frame Involved on Quoted Investment Performance Inadequate, Inappropriately Displayed, or Missing Key ...

... Non-Disclosure of How Investment Performance is Calculated (Actual, Hypothetical, etc.) Non-Disclosure or Misrepresentation of the Time Frame Involved on Quoted Investment Performance Inadequate, Inappropriately Displayed, or Missing Key ...

LO 3 Explain the accounting for stock investments.

... c. a change in the name of the firm issuing the debt securities. d. sale of the debt investment. Chapter ...

... c. a change in the name of the firm issuing the debt securities. d. sale of the debt investment. Chapter ...

How to assess a manager recovery skill - ORBi

... Focusing on the correlation of our measure of risk, we can first notice that it does not show negative correlation with any of the other measures of risk. Since we selected these measures of risk as being the most traditional and commonly used measure of risk by both practitioners and academics, we ...

... Focusing on the correlation of our measure of risk, we can first notice that it does not show negative correlation with any of the other measures of risk. Since we selected these measures of risk as being the most traditional and commonly used measure of risk by both practitioners and academics, we ...

annual report

... guidance included slightly higher credit losses than previously foreunderperformed its benchmark, the Russell 1000® Growth Index, casted. Liberty Global shares declined following the Brexit vote. and the broad-market S&P 500® Index. The following discussion of With close to 40% of revenues from the ...

... guidance included slightly higher credit losses than previously foreunderperformed its benchmark, the Russell 1000® Growth Index, casted. Liberty Global shares declined following the Brexit vote. and the broad-market S&P 500® Index. The following discussion of With close to 40% of revenues from the ...

Alternative ways of state property utilisation: some new proposals

... Within a period of maximum 12-18 months, we derive two independent valuations for all assets in the portfolio (one evaluator is appointed by the Greek government, the other from the Company) – final appraised value of each asset will be the average. Note that we should expect much higher appraised v ...

... Within a period of maximum 12-18 months, we derive two independent valuations for all assets in the portfolio (one evaluator is appointed by the Greek government, the other from the Company) – final appraised value of each asset will be the average. Note that we should expect much higher appraised v ...

Client Investing Guide

... Affordability (capacity for loss) Part of conducting a suitability assessment involves assessing the degree to which you are financially able to bear investment risk, consistent with your objectives. In other words, assessing the extent to which a decline in the value of your portfolio would have a ...

... Affordability (capacity for loss) Part of conducting a suitability assessment involves assessing the degree to which you are financially able to bear investment risk, consistent with your objectives. In other words, assessing the extent to which a decline in the value of your portfolio would have a ...

structured products: are you aware of what is in your back book?

... and objectives and recommended products that did not match ATR. There have clearly, in the past, been issues with advisers misunderstanding or underestimating a structured investment product’s risk, leading to unsuitability. Firms should ensure that they have a clear view of a structured investment’ ...

... and objectives and recommended products that did not match ATR. There have clearly, in the past, been issues with advisers misunderstanding or underestimating a structured investment product’s risk, leading to unsuitability. Firms should ensure that they have a clear view of a structured investment’ ...

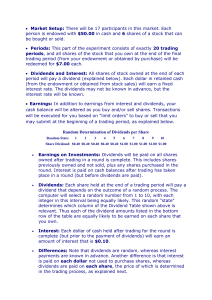

Experimental Instructions

... those who wish to purchase shares will indicate the number of shares desired and the maximum or "limit" price that they are willing to pay. Similarly, those who wish to sell shares will indicate the number of shares offered and the minimum "limit" price that they are willing to accept. Buy and Sel ...

... those who wish to purchase shares will indicate the number of shares desired and the maximum or "limit" price that they are willing to pay. Similarly, those who wish to sell shares will indicate the number of shares offered and the minimum "limit" price that they are willing to accept. Buy and Sel ...

Downlaod File

... The WACC help to make long term capital investment decisions such as, capital budgeting. However, the types of capital include the WACC are used to pay for long term assets which is typically long term debt, common stock and preferred stock if it already used. The sources in the short term consist b ...

... The WACC help to make long term capital investment decisions such as, capital budgeting. However, the types of capital include the WACC are used to pay for long term assets which is typically long term debt, common stock and preferred stock if it already used. The sources in the short term consist b ...

Investment fund

An investment fund is a way of investing money alongside other investors in order to benefit from the inherent advantages of working as part of a group. These advantages include an ability to: hire professional investment managers, which may potentially be able to offer better returns and more adequate risk management; benefit from economies of scale, i.e., lower transaction costs; increase the asset diversification to reduce some unsystemic risk.Terminology varies with country but investment funds are often referred to as investment pools, collective investment vehicles, collective investment schemes, managed funds, or simply funds. An investment fund may be held by the public, such as a mutual fund, exchange-traded fund, or closed-end fund, or it may be sold only in a private placement, such as a hedge fund or private equity fund. The term also includes specialized vehicles such as collective and common trust funds, which are unique bank-managed funds structured primarily to commingle assets from qualifying pension plans or trusts.Investment funds are promoted with a wide range of investment aims either targeting specific geographic regions (e.g., emerging markets or Europe) or specified industry sectors (e.g., technology). Depending on the country there is normally a bias towards the domestic market due to familiarity, and the lack of currency risk. Funds are often selected on the basis of these specified investment aims, their past investment performance, and other factors such as fees.