Smith, Thompson and Nickels have a partnership

... 2) Crawford’s loan payable to Palmer $12,000 – Palmer’s deficit capital balance 2,000 =10,000 3) Palmer and Lake share the $4,000 liquidation expense equally. 4) Other assets $157,000 – Other assets sold for 103,000 = 54,000 5) Palmer and Lake share the $54,000 loss from the sale of assets 6) Since ...

... 2) Crawford’s loan payable to Palmer $12,000 – Palmer’s deficit capital balance 2,000 =10,000 3) Palmer and Lake share the $4,000 liquidation expense equally. 4) Other assets $157,000 – Other assets sold for 103,000 = 54,000 5) Palmer and Lake share the $54,000 loss from the sale of assets 6) Since ...

Housing Finance in Emerging Markets: Policy and

... Staff/Volume Imbalance - poor planning, managing loan volume variability (cost control) ...

... Staff/Volume Imbalance - poor planning, managing loan volume variability (cost control) ...

XOM 9-13

... products (please note the reference from Exxon’s website in the previous section on its lubricant brands). ...

... products (please note the reference from Exxon’s website in the previous section on its lubricant brands). ...

Clarion Partners and Pacific Industrial Acquire Premier Orange

... BREA, CA – Clarion Partners, a leading real estate investment manager, and Pacific Industrial, a Long Beach-based industrial development firm, today announced the acquisition of 17.66 acres in Brea, CA, located at 1225 West Imperial Highway. The partners plan to redevelop the site to construct a 367 ...

... BREA, CA – Clarion Partners, a leading real estate investment manager, and Pacific Industrial, a Long Beach-based industrial development firm, today announced the acquisition of 17.66 acres in Brea, CA, located at 1225 West Imperial Highway. The partners plan to redevelop the site to construct a 367 ...

Equity Research: Fundamental and Technical Analysis

... investment decisions. These fundamental factors relate to the overall economy or a specific industry or a company. The performance of the securities that represent the company can be said to depend on the performance of the company itself. However, as companies are a part of industrial and business ...

... investment decisions. These fundamental factors relate to the overall economy or a specific industry or a company. The performance of the securities that represent the company can be said to depend on the performance of the company itself. However, as companies are a part of industrial and business ...

Mr. Muhammad Farid Alam

... 75% - 25% Split - A minimum of 25% of total offer size has to be offered to general public with remaining being offered to financial Institutions and High Net Worth Individuals (“HNWI”)-individuals with net worth of at least PkR1.0 mn The Lead Manager (“LM”) & Book Runner (“BR”), with the consen ...

... 75% - 25% Split - A minimum of 25% of total offer size has to be offered to general public with remaining being offered to financial Institutions and High Net Worth Individuals (“HNWI”)-individuals with net worth of at least PkR1.0 mn The Lead Manager (“LM”) & Book Runner (“BR”), with the consen ...

PIPEs Transaction and Regulation D

... – Significant timing flexibility (assuming no material non-public information)—particularly advantageous in volatile markets – Allows issuer to set minimum price – Minimizes disruption to stock price by dribbling into market, rather than selling large blocks – Avoids risk of announcing large offerin ...

... – Significant timing flexibility (assuming no material non-public information)—particularly advantageous in volatile markets – Allows issuer to set minimum price – Minimizes disruption to stock price by dribbling into market, rather than selling large blocks – Avoids risk of announcing large offerin ...

Systematic Withdrawals Investments and Annuitization

... Income for life, fixed in units, but variable with investment performance Wealth and liquidity needs not serviced Strategy 4. Deferred variable annuity plus guaranteed minimum withdrawal benefit rider (VA+GMWB) One-time purchase at retirement with entire account balance Underlying mutual fun ...

... Income for life, fixed in units, but variable with investment performance Wealth and liquidity needs not serviced Strategy 4. Deferred variable annuity plus guaranteed minimum withdrawal benefit rider (VA+GMWB) One-time purchase at retirement with entire account balance Underlying mutual fun ...

Concentrated Ownership and Bailout Guarantees (November 2005)

... entrepreneurs. We show that, in such economies, lending booms fuelled by guarantees can occur, but tend to naturally end in a soft landing. In our model, entrepreneurs hold large stakes in their firms, because contracts cannot be enforced perfectly. Bailout guarantees encourage overinvestment and ri ...

... entrepreneurs. We show that, in such economies, lending booms fuelled by guarantees can occur, but tend to naturally end in a soft landing. In our model, entrepreneurs hold large stakes in their firms, because contracts cannot be enforced perfectly. Bailout guarantees encourage overinvestment and ri ...

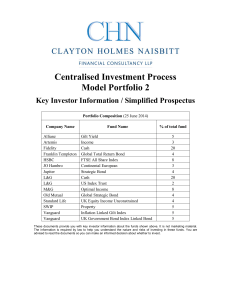

Key Investor Information - Clayton Holmes Naisbitt

... For more information, please consult the Prospectus and latest Reports and Accounts which can be obtained free of charge in English and other main languages from the Fund Manager, the distributors or online at any time. The Net Asset Values per unit are available at the registered office of the Fund ...

... For more information, please consult the Prospectus and latest Reports and Accounts which can be obtained free of charge in English and other main languages from the Fund Manager, the distributors or online at any time. The Net Asset Values per unit are available at the registered office of the Fund ...

Our Portfolio Management Portfolios

... The views expressed herein are those of the author and do not necessarily reflect the views of Morgan Stanley Wealth Management or its affiliates. All opinions are subject to change without notice. Neither the information provided nor any opinion expressed constitutes a solicitation for the purchase ...

... The views expressed herein are those of the author and do not necessarily reflect the views of Morgan Stanley Wealth Management or its affiliates. All opinions are subject to change without notice. Neither the information provided nor any opinion expressed constitutes a solicitation for the purchase ...

Chapter 5 The Financial Environment: Markets, Institutions, and

... h. Organized security exchanges, such as the New York Stock Exchange, facilitate communication between buyers and sellers of securities. Each organized exchange is a physical entity and is governed by an elected board of governors. The over-the-counter market consists of all the facilities that prov ...

... h. Organized security exchanges, such as the New York Stock Exchange, facilitate communication between buyers and sellers of securities. Each organized exchange is a physical entity and is governed by an elected board of governors. The over-the-counter market consists of all the facilities that prov ...

Stifel to Acquire Ziegler Lotsoff Capital Management

... ST. LOUIS, October 16, 2013 – Stifel Financial Corp. (NYSE: SF) today announced that it has entered into an agreement to acquire Ziegler Lotsoff Capital Management, LLC (“ZLCM”) a Chicago and Milwaukee-based asset management business. The acquisition will bring new asset management strategies and ca ...

... ST. LOUIS, October 16, 2013 – Stifel Financial Corp. (NYSE: SF) today announced that it has entered into an agreement to acquire Ziegler Lotsoff Capital Management, LLC (“ZLCM”) a Chicago and Milwaukee-based asset management business. The acquisition will bring new asset management strategies and ca ...

SM_C14_Reilly1ce

... It is most likely that a single position in an index futures market would be the best hedge. There are several reasons for this. The most important is cost. Since there are no exchange traded futures for individual stocks, entering 50 different positions would have to be done through an over-the-cou ...

... It is most likely that a single position in an index futures market would be the best hedge. There are several reasons for this. The most important is cost. Since there are no exchange traded futures for individual stocks, entering 50 different positions would have to be done through an over-the-cou ...

98.02 - Study Center Gerzensee

... with a liberalized …nancial sector. The primary objective of this essay is to substantiate this claim. To this end, it develops a simple model of a small open economy with a tradeable good produced using a non-tradeable input (which may be thought of as real estate or skilled labor). To this it adds ...

... with a liberalized …nancial sector. The primary objective of this essay is to substantiate this claim. To this end, it develops a simple model of a small open economy with a tradeable good produced using a non-tradeable input (which may be thought of as real estate or skilled labor). To this it adds ...

Form ADV 2A - The Asset Advisory Group

... custodians, Fidelity and Schwab charge transaction fees on purchases and sales of mutual funds and stocks, which generally range between $7.95 and $25 per trade, but may be higher. TAAG does not receive any portion of these transaction charges. Mutual funds charge a management fee for their services ...

... custodians, Fidelity and Schwab charge transaction fees on purchases and sales of mutual funds and stocks, which generally range between $7.95 and $25 per trade, but may be higher. TAAG does not receive any portion of these transaction charges. Mutual funds charge a management fee for their services ...

Compost Mrkt Dev.-Noble - Association of Compost Producers

... This will entail fully understanding the private contracting methods and how these can be reworked to create higher value feedstocks. Curbside Residential Delivery: Kellogg Garden Products looking to team with compost blowers and their customer stores (e.g. Home Depot) and go beyond the “five bag li ...

... This will entail fully understanding the private contracting methods and how these can be reworked to create higher value feedstocks. Curbside Residential Delivery: Kellogg Garden Products looking to team with compost blowers and their customer stores (e.g. Home Depot) and go beyond the “five bag li ...

Your 401k Is Riskier Than you Think

... good “investment.” Ask someone who can’t sell insurance and get a commission whether the insurance is needed before purchasing. Never ask an insurance agent (who can get a huge commission). Since most “financial advisors” have life insurance licenses you need to be very careful. The larger the fund ...

... good “investment.” Ask someone who can’t sell insurance and get a commission whether the insurance is needed before purchasing. Never ask an insurance agent (who can get a huge commission). Since most “financial advisors” have life insurance licenses you need to be very careful. The larger the fund ...

tax equity investments overview

... When is the ITC available to an owner or investor? The ITC is available to the legal owner (or partners/members in an owner organized as a partnership or LLC) of a PV system on the date the PV system is “placed in service.” The ITC is claimed on the federal income tax return for the year in which th ...

... When is the ITC available to an owner or investor? The ITC is available to the legal owner (or partners/members in an owner organized as a partnership or LLC) of a PV system on the date the PV system is “placed in service.” The ITC is claimed on the federal income tax return for the year in which th ...

Not-for-profit organizations

... Types of Funds : Capital Asset Fund • A capital asset fund is another type of restricted fund. • This is a fund that must be used for the acquisition and maintenance of capital assets. • The above are types of funds that any given notfor-profit organization may select. The not-for-profit organizati ...

... Types of Funds : Capital Asset Fund • A capital asset fund is another type of restricted fund. • This is a fund that must be used for the acquisition and maintenance of capital assets. • The above are types of funds that any given notfor-profit organization may select. The not-for-profit organizati ...

Paper-14: Advanced Financial Management

... Revisionary Test Paper_Final_Syllabus 2012_June 2014 (c) Difference between the primary market and the secondary market In the primary market, securities are offered to public for subscription for the purpose of raising capital or fund. Secondary market is an equity trading avenue in which already ...

... Revisionary Test Paper_Final_Syllabus 2012_June 2014 (c) Difference between the primary market and the secondary market In the primary market, securities are offered to public for subscription for the purpose of raising capital or fund. Secondary market is an equity trading avenue in which already ...

Investment fund

An investment fund is a way of investing money alongside other investors in order to benefit from the inherent advantages of working as part of a group. These advantages include an ability to: hire professional investment managers, which may potentially be able to offer better returns and more adequate risk management; benefit from economies of scale, i.e., lower transaction costs; increase the asset diversification to reduce some unsystemic risk.Terminology varies with country but investment funds are often referred to as investment pools, collective investment vehicles, collective investment schemes, managed funds, or simply funds. An investment fund may be held by the public, such as a mutual fund, exchange-traded fund, or closed-end fund, or it may be sold only in a private placement, such as a hedge fund or private equity fund. The term also includes specialized vehicles such as collective and common trust funds, which are unique bank-managed funds structured primarily to commingle assets from qualifying pension plans or trusts.Investment funds are promoted with a wide range of investment aims either targeting specific geographic regions (e.g., emerging markets or Europe) or specified industry sectors (e.g., technology). Depending on the country there is normally a bias towards the domestic market due to familiarity, and the lack of currency risk. Funds are often selected on the basis of these specified investment aims, their past investment performance, and other factors such as fees.