International investment position

... The Committee provides a well-placed forum for addressing the policy challenges facing OECD and non-OECD countries as they seek to attract investment and maximise its benefits to host societies. The Committee represents the community of policy makers, including treaty negotiators and National Contac ...

... The Committee provides a well-placed forum for addressing the policy challenges facing OECD and non-OECD countries as they seek to attract investment and maximise its benefits to host societies. The Committee represents the community of policy makers, including treaty negotiators and National Contac ...

Borrowing costs

... This standard interprets how borrowing costs should be treated in the organisation’s financial statements. Though the standard generally requires borrowing costs to be charged as an expense to the P&L, standard also allows capitalising borrowing costs as an allowed alternative. It moves on to state ...

... This standard interprets how borrowing costs should be treated in the organisation’s financial statements. Though the standard generally requires borrowing costs to be charged as an expense to the P&L, standard also allows capitalising borrowing costs as an allowed alternative. It moves on to state ...

NBER WORKING PAPER SERIES TAX POLICY AND INTERNATIONAL CAPiTAL FLOWS Martin Feldstein

... across national boundaries, the owners and managers of the capital do not want to move it as much as would be necessary to make the level of investment in each country and the rate of ...

... across national boundaries, the owners and managers of the capital do not want to move it as much as would be necessary to make the level of investment in each country and the rate of ...

EDHEC and EuroPerformance publish the Alpha League Table 2008 for Italy and Spain

... Bancaja Fondos. A fall in average alpha is entirely responsible for this slide. As in France, Germany, and the Netherlands, asset management in Italy and Spain suffered from significant withdrawals of investors in 2007, according to the European Fund and Asset Management Association (EFAMA). One of ...

... Bancaja Fondos. A fall in average alpha is entirely responsible for this slide. As in France, Germany, and the Netherlands, asset management in Italy and Spain suffered from significant withdrawals of investors in 2007, according to the European Fund and Asset Management Association (EFAMA). One of ...

cm advisors small cap value fund cm advisors fixed income fund

... and its business. This information can include, without limitation, historical analysis, acquisition analysis, discounted free cash flow models and leveraged buyout models. The Advisor also monitors acquisition prices for companies in various industries, and may communicate with companies, their sup ...

... and its business. This information can include, without limitation, historical analysis, acquisition analysis, discounted free cash flow models and leveraged buyout models. The Advisor also monitors acquisition prices for companies in various industries, and may communicate with companies, their sup ...

Should `Minority Discounts` Diminish Share Value Under Judicial

... Net asset value (total assets less any intangible assets, less total liabilities, divided by the number of shares outstanding) is the standard for evaluating closely held manufacturing corporations or real estate and investment holding companies. Murphy, 2008 WL 2401230, at *12. Methods of Calculati ...

... Net asset value (total assets less any intangible assets, less total liabilities, divided by the number of shares outstanding) is the standard for evaluating closely held manufacturing corporations or real estate and investment holding companies. Murphy, 2008 WL 2401230, at *12. Methods of Calculati ...

27 Illustration 26.2: Valuing the Equity Stake in a building The

... Real estate businesses vary widely in terms of how they generate income and how you approach valuation will vary as well. In particular, we could categorize real estate firms into four businesses. Service Income: Some firms generate income from providing just management services or support services ...

... Real estate businesses vary widely in terms of how they generate income and how you approach valuation will vary as well. In particular, we could categorize real estate firms into four businesses. Service Income: Some firms generate income from providing just management services or support services ...

Report of the Comptroller, Year ended April 30, 2016

... The Consolidated Statement of Financial Position reports the assets owned and controlled by the University; the Liabilities owed by UNB and the Net Assets of the University as at the end of the fiscal year – April 30, 2016 (with comparative amounts from the prior year). Assets and liabilities are ca ...

... The Consolidated Statement of Financial Position reports the assets owned and controlled by the University; the Liabilities owed by UNB and the Net Assets of the University as at the end of the fiscal year – April 30, 2016 (with comparative amounts from the prior year). Assets and liabilities are ca ...

Efficient Risk Reducing Strategies by International Diversification

... Fluctuating exchange rates represent a crucial factor for investors who want to diversify their investment portfolio internationally. So, it is important to study whether hedging the exchange rate risk is worthwhile. A standard approach is to hedge the exchange rate risk completely through the use ...

... Fluctuating exchange rates represent a crucial factor for investors who want to diversify their investment portfolio internationally. So, it is important to study whether hedging the exchange rate risk is worthwhile. A standard approach is to hedge the exchange rate risk completely through the use ...

Direct Investing in Private Equity

... The performance of the direct deals deteriorates in settings where information problems make either deal selection or monitoring more difficult, for example VC investments and those that are geographically distant from the investor, consistent with the theoretical arguments in Leland and Pyle (1977) ...

... The performance of the direct deals deteriorates in settings where information problems make either deal selection or monitoring more difficult, for example VC investments and those that are geographically distant from the investor, consistent with the theoretical arguments in Leland and Pyle (1977) ...

CAPITAL GAINS REPORTING TOOL

... Capital gains – report for previous tax year (eg 2010/11) Notional disposal – report showing tax position for part or full disposal mid tax year Transaction history – for capital gains report for previous tax year What if – disposal planning report to maximise tax opportunities ...

... Capital gains – report for previous tax year (eg 2010/11) Notional disposal – report showing tax position for part or full disposal mid tax year Transaction history – for capital gains report for previous tax year What if – disposal planning report to maximise tax opportunities ...

Download attachment

... transpired that LTCM were using some 75 counterparties1 (or financial institutions) to source their credit. The list of lenders reads like the Who’s Who of banking. The fund had borrowed 50 times its capital leaving the financial system dangerously exposed when it crashed. Billions of dollars worth of ...

... transpired that LTCM were using some 75 counterparties1 (or financial institutions) to source their credit. The list of lenders reads like the Who’s Who of banking. The fund had borrowed 50 times its capital leaving the financial system dangerously exposed when it crashed. Billions of dollars worth of ...

Republic of Croatia - Grad Beli Manastir

... TOWN OF BELI MANASTIR - more than 10.000 inhabitants - area of 55 km² - railway, road and river traffic available - near the towns of Osijek, Vukovar, Zagreb, Mohacs, Belgrade and Sarajevo -near the University of Osijek: Faculty of Economics, Faculty of Law, Faculty of Medicine, Faculty of Electrica ...

... TOWN OF BELI MANASTIR - more than 10.000 inhabitants - area of 55 km² - railway, road and river traffic available - near the towns of Osijek, Vukovar, Zagreb, Mohacs, Belgrade and Sarajevo -near the University of Osijek: Faculty of Economics, Faculty of Law, Faculty of Medicine, Faculty of Electrica ...

Practice Problems on Current Account

... that cause absorption to exceed output for a time. In the 1970s both factors contributed to heavy borrowing by LDCs. Many were borrowing to try to increase growth by increasing their capital stock, because they believed the future marginal product of capital was high. Because the LDCs were poor and ...

... that cause absorption to exceed output for a time. In the 1970s both factors contributed to heavy borrowing by LDCs. Many were borrowing to try to increase growth by increasing their capital stock, because they believed the future marginal product of capital was high. Because the LDCs were poor and ...

Alternative Financing Sources for Sustainable Transport

... for sustainable transport, including the use of institutional investors and public-private partnerships (PPPs). PPPs are one potential strategy for scaling up sustainable low carbon transport infrastructure and services, which allow the public sector to engage the private sector in sharing efficienc ...

... for sustainable transport, including the use of institutional investors and public-private partnerships (PPPs). PPPs are one potential strategy for scaling up sustainable low carbon transport infrastructure and services, which allow the public sector to engage the private sector in sharing efficienc ...

Presentation - Federal Reserve Bank of Atlanta

... Brokers screen traders and guarantee the performance of trades they are allowed to book on the exchange; 2. The exchange monitors and disciplines brokers and sets trading rules; clearing members jointly and severally guarantee performance to back ...

... Brokers screen traders and guarantee the performance of trades they are allowed to book on the exchange; 2. The exchange monitors and disciplines brokers and sets trading rules; clearing members jointly and severally guarantee performance to back ...

How important is dividend yield?

... investment. It is calculated as the common dividend per share divided by the market price per share. This is a particularly an important valuation measure for investors seeking regular income. Investors who depend on income from their investments include retired persons as well as pension and mutual ...

... investment. It is calculated as the common dividend per share divided by the market price per share. This is a particularly an important valuation measure for investors seeking regular income. Investors who depend on income from their investments include retired persons as well as pension and mutual ...

Business plan targets for production and business in 2017

... adjustment of planning and investment solutions such as Vuon Vua resort & villas, TIG Dai Mo green garden ... in line with the reality of market demand as well as many solutions. Improvements in architectural options, construction solutions, machine tools, ... as well as the solution to use native m ...

... adjustment of planning and investment solutions such as Vuon Vua resort & villas, TIG Dai Mo green garden ... in line with the reality of market demand as well as many solutions. Improvements in architectural options, construction solutions, machine tools, ... as well as the solution to use native m ...

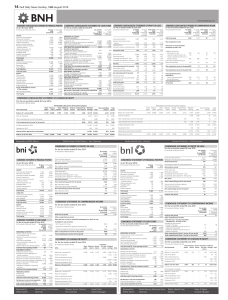

14 Gulf Daily News Sunday, 14th August 2016

... Payments to insurance and reinsurance companies Claims paid to policyholders Claims recovered from reinsurers and salvage recoveries Payment made for other operating expenses ...

... Payments to insurance and reinsurance companies Claims paid to policyholders Claims recovered from reinsurers and salvage recoveries Payment made for other operating expenses ...

Audit of Non Banking Financial Companies

... and doubtful debts; (5) Capital adequacy norm; (6) Prohibition of granting loans against its own shares; (7) Prohibition on loans and investments for failure to repay public deposits and (8) Norms for concentration of credit etc. ...

... and doubtful debts; (5) Capital adequacy norm; (6) Prohibition of granting loans against its own shares; (7) Prohibition on loans and investments for failure to repay public deposits and (8) Norms for concentration of credit etc. ...

Contracts and Contracting in the Film Industry

... finance package with a loan secured against the film's unsold territories and rights. Gap (or supergap) loans are subordinate to the senior/bank production loan, but in turn, the gap/supergap loan will be senior to equity financiers. A gap loan becomes a supergap loan when it extends beyond 10-1 ...

... finance package with a loan secured against the film's unsold territories and rights. Gap (or supergap) loans are subordinate to the senior/bank production loan, but in turn, the gap/supergap loan will be senior to equity financiers. A gap loan becomes a supergap loan when it extends beyond 10-1 ...

Multiple Choice Questions

... The stock market just crashed; the Dow Jones Industrial Average fell by 750 points. You would expect the effect on aggregate consumption to be the largest if which of the following facts was true? ...

... The stock market just crashed; the Dow Jones Industrial Average fell by 750 points. You would expect the effect on aggregate consumption to be the largest if which of the following facts was true? ...

Investment fund

An investment fund is a way of investing money alongside other investors in order to benefit from the inherent advantages of working as part of a group. These advantages include an ability to: hire professional investment managers, which may potentially be able to offer better returns and more adequate risk management; benefit from economies of scale, i.e., lower transaction costs; increase the asset diversification to reduce some unsystemic risk.Terminology varies with country but investment funds are often referred to as investment pools, collective investment vehicles, collective investment schemes, managed funds, or simply funds. An investment fund may be held by the public, such as a mutual fund, exchange-traded fund, or closed-end fund, or it may be sold only in a private placement, such as a hedge fund or private equity fund. The term also includes specialized vehicles such as collective and common trust funds, which are unique bank-managed funds structured primarily to commingle assets from qualifying pension plans or trusts.Investment funds are promoted with a wide range of investment aims either targeting specific geographic regions (e.g., emerging markets or Europe) or specified industry sectors (e.g., technology). Depending on the country there is normally a bias towards the domestic market due to familiarity, and the lack of currency risk. Funds are often selected on the basis of these specified investment aims, their past investment performance, and other factors such as fees.