2010 - About KLP

... The total costs of the fire damage for KLP Skadeforsikring amount to almost NOK 300 million. In comparison, the average for the last five years has been NOK 20 million! It is expected that these figures will vary substantially, but this is a dramatic deviation for one single accounting year. Looking ...

... The total costs of the fire damage for KLP Skadeforsikring amount to almost NOK 300 million. In comparison, the average for the last five years has been NOK 20 million! It is expected that these figures will vary substantially, but this is a dramatic deviation for one single accounting year. Looking ...

sample - Test Bank College

... secondary markets for many types of debt securities. Explain how such a lack of liquidity would affect the prices of the debt securities in the secondary markets. ANSWER: Investors were less willing to invest in many debt securities because they were concerned that these securities might default. As ...

... secondary markets for many types of debt securities. Explain how such a lack of liquidity would affect the prices of the debt securities in the secondary markets. ANSWER: Investors were less willing to invest in many debt securities because they were concerned that these securities might default. As ...

Principles Underlying Asset Liability Management

... influence the lapse/withdrawal rate, which in turn may require unexpected liquidation or reinvestment of assets. The mutual dependence principle implies that assets and liabilities must be managed concurrently in order to optimize achievement of economic and financial objectives. C. ...

... influence the lapse/withdrawal rate, which in turn may require unexpected liquidation or reinvestment of assets. The mutual dependence principle implies that assets and liabilities must be managed concurrently in order to optimize achievement of economic and financial objectives. C. ...

Premium Factors and the Risk-Return Trade

... Their specification incorporates conditional skewness. The extended form of the CAPM is preferred as the conditional skewness captures asymmetry in risk, in particular downside risk which has recently become considerably important in measuring value at risk. They however reported that conditional sk ...

... Their specification incorporates conditional skewness. The extended form of the CAPM is preferred as the conditional skewness captures asymmetry in risk, in particular downside risk which has recently become considerably important in measuring value at risk. They however reported that conditional sk ...

Morgan Stanley Reports Fourth Quarter and Full Year Results

... CIC’s ownership in Morgan Stanley's common shares, including the conversion of these Equity Units, will be 9.9 percent or less of Morgan Stanley's total shares outstanding. CIC will be a passive financial investor. CIC will have no special rights of ownership and no role in the management of Morgan ...

... CIC’s ownership in Morgan Stanley's common shares, including the conversion of these Equity Units, will be 9.9 percent or less of Morgan Stanley's total shares outstanding. CIC will be a passive financial investor. CIC will have no special rights of ownership and no role in the management of Morgan ...

Tick Size and Institutional Trading Costs: Evidence from Mutual Funds

... Small, retail orders that can be executed at quoted prices unambiguously benefit from the tighter spreads that follow reductions in tick size without suffering from any contemporaneous reduction in market depth. For the large orders from pension funds, mutual funds, and hedge funds, tighter bid-ask ...

... Small, retail orders that can be executed at quoted prices unambiguously benefit from the tighter spreads that follow reductions in tick size without suffering from any contemporaneous reduction in market depth. For the large orders from pension funds, mutual funds, and hedge funds, tighter bid-ask ...

Togo - Green Climate Fund

... 3. Draft a country programme (see activity 2 below); 4. Liaise with other ministries, departments and relevant agencies including consultations on the development of a country programme; and 5. Conduct robust awareness campaigns in order to get greater commitment from key stakeholders, starting with ...

... 3. Draft a country programme (see activity 2 below); 4. Liaise with other ministries, departments and relevant agencies including consultations on the development of a country programme; and 5. Conduct robust awareness campaigns in order to get greater commitment from key stakeholders, starting with ...

securities trading policy

... No short-term trading in the Company’s securities Key Management Personnel should never engage in short-term trading of the Company’s securities except for the exercise of options where the shares will be sold shortly thereafter. ...

... No short-term trading in the Company’s securities Key Management Personnel should never engage in short-term trading of the Company’s securities except for the exercise of options where the shares will be sold shortly thereafter. ...

Equilibrium Analysis of Expected Shortfall

... agent needs to commit himself to comply with the constraint in all future dates. This is due to the static nature of ES. There are papers, e.g., Yiu (2004); Cuoco and Liu (2006); Leippold et al. (2006); Cuoco et al. (2008), that apply VaR dynamically. We do not attempt this approach in the current p ...

... agent needs to commit himself to comply with the constraint in all future dates. This is due to the static nature of ES. There are papers, e.g., Yiu (2004); Cuoco and Liu (2006); Leippold et al. (2006); Cuoco et al. (2008), that apply VaR dynamically. We do not attempt this approach in the current p ...

View/Open

... contribution has been, if not negligible, far smaller in amount than the contribution made by domestic savings. Although it is rarely possible to make exact comparisons, there is little doubt 'the great bulk of the savings needed for growth and industrialization were generated inside each country'. ...

... contribution has been, if not negligible, far smaller in amount than the contribution made by domestic savings. Although it is rarely possible to make exact comparisons, there is little doubt 'the great bulk of the savings needed for growth and industrialization were generated inside each country'. ...

Exchange rate risk and internationally diversified

... will typically cause additional positive correlation of dollar denominated returns among assets of the same country. It is, therefore, logical to hypothesize that an investor would obtain the majority of all diversification benefits available in a foreign country from his/her first acquisition in th ...

... will typically cause additional positive correlation of dollar denominated returns among assets of the same country. It is, therefore, logical to hypothesize that an investor would obtain the majority of all diversification benefits available in a foreign country from his/her first acquisition in th ...

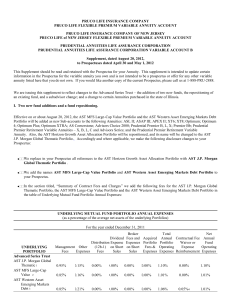

PRUCO LIFE INSURANCE COMPANY PRUCO LIFE FLEXIBLE

... (value companies). The Subadviser uses a “bottom-up” investment approach to buying and selling investments for the Portfolio. Investments are selected primarily based on fundamental analysis of individual issuers. Quantitative models that systematically evaluate issuers may also be considered. ...

... (value companies). The Subadviser uses a “bottom-up” investment approach to buying and selling investments for the Portfolio. Investments are selected primarily based on fundamental analysis of individual issuers. Quantitative models that systematically evaluate issuers may also be considered. ...

Introduction to Managerial Accounting

... The payback period is the length of time that it takes for a project to recover its initial cost out of the cash receipts that it generates. When the net annual cash inflow is the same each year, this formula can be used to compute the payback period: Payback period = ...

... The payback period is the length of time that it takes for a project to recover its initial cost out of the cash receipts that it generates. When the net annual cash inflow is the same each year, this formula can be used to compute the payback period: Payback period = ...

Commercial Real Estate: New Paradigm or Old Story?

... context is critical: Any investment needs to be judged relative to a number of factors, including the returns available from other investment alternatives, its funding costs, and the risk inherent in the opportunity. As it turns out, all three of these bases of comparison present lower hurdles for t ...

... context is critical: Any investment needs to be judged relative to a number of factors, including the returns available from other investment alternatives, its funding costs, and the risk inherent in the opportunity. As it turns out, all three of these bases of comparison present lower hurdles for t ...

What Determines Investment in the Oil Sector?

... decline rates of oil fields. Helmi-Oskoui, Narayanan, Glover and Sinha (1992) try to solve for the optimal extraction rate of petroleum resources in a model of oil fields, and show the importance of the discount rate in determining the optimal level. In studying the expenditure growth of oilexportin ...

... decline rates of oil fields. Helmi-Oskoui, Narayanan, Glover and Sinha (1992) try to solve for the optimal extraction rate of petroleum resources in a model of oil fields, and show the importance of the discount rate in determining the optimal level. In studying the expenditure growth of oilexportin ...

k = D 0 (I +g)

... believe supply and demand factors are most important. Most investment research deals with predicting future earnings. A value investor believes a security should only be purchased when the underlying fundamentals justify the purchase. They believe in a regression to the mean of security returns. ...

... believe supply and demand factors are most important. Most investment research deals with predicting future earnings. A value investor believes a security should only be purchased when the underlying fundamentals justify the purchase. They believe in a regression to the mean of security returns. ...

Momentum-Value in Options

... Conceptually, option operators are segmented into “investors”, who demand options as a way to gain beta exposure and do not engage in dynamic delta-hedging and “market-makers”, who supply options and delta-hedge that position dynamically. The volatility risk premium in equilibrium is supply/demand-b ...

... Conceptually, option operators are segmented into “investors”, who demand options as a way to gain beta exposure and do not engage in dynamic delta-hedging and “market-makers”, who supply options and delta-hedge that position dynamically. The volatility risk premium in equilibrium is supply/demand-b ...

US Equities: Light at the End of the Tunnel

... real bond yields are negative, P/E multiples are low, and the equity risk premium is high (see Exhibit 4, below). Similar to the results seen from 1926 to 2012, equities achieved higher subsequent fiveand 10-year returns on both an absolute and a relative basis when they started from low valuations ...

... real bond yields are negative, P/E multiples are low, and the equity risk premium is high (see Exhibit 4, below). Similar to the results seen from 1926 to 2012, equities achieved higher subsequent fiveand 10-year returns on both an absolute and a relative basis when they started from low valuations ...

Diversified thinking

... spreads exposure across a range of asset classes and the limited liability of each exposure can be an important risk management feature that protects investors from the potential collapse in any individual asset class. With inappropriate use of leverage, shocks in a particular asset may spill over t ...

... spreads exposure across a range of asset classes and the limited liability of each exposure can be an important risk management feature that protects investors from the potential collapse in any individual asset class. With inappropriate use of leverage, shocks in a particular asset may spill over t ...

Capture the Rebound Potential - CSOP Asset Management Limited

... Investors should refer to the Prospectus and the Product Key Facts Statement (“KFS”) for further details, including product features and risk factors. Investors should not base on this material alone to make investment decisions. If you are in any doubt about the contents of the Prospectus and KFS, ...

... Investors should refer to the Prospectus and the Product Key Facts Statement (“KFS”) for further details, including product features and risk factors. Investors should not base on this material alone to make investment decisions. If you are in any doubt about the contents of the Prospectus and KFS, ...

Lida furniture factory

... Increased production and sales of new products Business plan is elaborated, list of the equipment is prepared Reconstruction of production premises and acquisition of the equipment Large-sized products of the liquid glass (headlight diffusors, washers’ windows, isolators) ...

... Increased production and sales of new products Business plan is elaborated, list of the equipment is prepared Reconstruction of production premises and acquisition of the equipment Large-sized products of the liquid glass (headlight diffusors, washers’ windows, isolators) ...

Hedging Inflation

... redemption value at maturity, and the semiannual interest payments increase as the fixed interest rate is applied to a growing principal value. But if interest rates in the marketplace rise, investors may begin to demand higher yields on new TIPS. And as with other bonds, those higher yields would d ...

... redemption value at maturity, and the semiannual interest payments increase as the fixed interest rate is applied to a growing principal value. But if interest rates in the marketplace rise, investors may begin to demand higher yields on new TIPS. And as with other bonds, those higher yields would d ...

Mahoney (1992)

... VC from industrial organization and strategy To analyze the contingent relationship between VFO and VC If transaction costs and agency costs are assumed away, VFO=VC Otherwise, simple distinction between VFO and VC is inadequate ...

... VC from industrial organization and strategy To analyze the contingent relationship between VFO and VC If transaction costs and agency costs are assumed away, VFO=VC Otherwise, simple distinction between VFO and VC is inadequate ...

OnePath Wholesale High Growth Trust

... Warning: You should consider the likely investment return, the risk and your investment timeframe when choosing to invest in the Trust (including if you are an indirect investor investing through a master trust or wrap service). OnePath Wholesale High Growth Trust – Fund information Description The ...

... Warning: You should consider the likely investment return, the risk and your investment timeframe when choosing to invest in the Trust (including if you are an indirect investor investing through a master trust or wrap service). OnePath Wholesale High Growth Trust – Fund information Description The ...

Investment fund

An investment fund is a way of investing money alongside other investors in order to benefit from the inherent advantages of working as part of a group. These advantages include an ability to: hire professional investment managers, which may potentially be able to offer better returns and more adequate risk management; benefit from economies of scale, i.e., lower transaction costs; increase the asset diversification to reduce some unsystemic risk.Terminology varies with country but investment funds are often referred to as investment pools, collective investment vehicles, collective investment schemes, managed funds, or simply funds. An investment fund may be held by the public, such as a mutual fund, exchange-traded fund, or closed-end fund, or it may be sold only in a private placement, such as a hedge fund or private equity fund. The term also includes specialized vehicles such as collective and common trust funds, which are unique bank-managed funds structured primarily to commingle assets from qualifying pension plans or trusts.Investment funds are promoted with a wide range of investment aims either targeting specific geographic regions (e.g., emerging markets or Europe) or specified industry sectors (e.g., technology). Depending on the country there is normally a bias towards the domestic market due to familiarity, and the lack of currency risk. Funds are often selected on the basis of these specified investment aims, their past investment performance, and other factors such as fees.