Real estate appraisal From Wikipedia, the free encyclopedia Jump

... However, the recent trend of the business tends to be toward the use of a scientific methodology of appraisal which relies on the foundation of quantitative-data,[7] risk, and geographical based approaches.[8][9] Pagourtzi et al. have provided a review on the methods used in the industry by comparis ...

... However, the recent trend of the business tends to be toward the use of a scientific methodology of appraisal which relies on the foundation of quantitative-data,[7] risk, and geographical based approaches.[8][9] Pagourtzi et al. have provided a review on the methods used in the industry by comparis ...

The Case for a Concentrated Portfolio

... outperformance decreases. Further, a large number of different securities in a portfolio typically means the equity positions are so small (sometimes only 0.2% to 1%) that no individual stock can affect portfolio returns—negatively or positively—with any real degree of significance. The result is of ...

... outperformance decreases. Further, a large number of different securities in a portfolio typically means the equity positions are so small (sometimes only 0.2% to 1%) that no individual stock can affect portfolio returns—negatively or positively—with any real degree of significance. The result is of ...

Global Equity research

... marked the beginning of what became the steepest one year decline ever experienced on the NASDAQ and a return to value fundamentals. The technology move was based upon a number of factors including the popularisation of the internet, a revolution in communications (wireless and optical), the Y2K eff ...

... marked the beginning of what became the steepest one year decline ever experienced on the NASDAQ and a return to value fundamentals. The technology move was based upon a number of factors including the popularisation of the internet, a revolution in communications (wireless and optical), the Y2K eff ...

BRAZIL IN THE 2000`S: FINANCIAL REGULATION AND

... But rates of growth were low at first. Low growth seems to find an immediate cause in the low rates of investment that have been characteristic of the Brazilian economy for so long. While high inflation was the most obvious culprit until 1994, when price stabilization was achieved, low growth follow ...

... But rates of growth were low at first. Low growth seems to find an immediate cause in the low rates of investment that have been characteristic of the Brazilian economy for so long. While high inflation was the most obvious culprit until 1994, when price stabilization was achieved, low growth follow ...

Lectures 5 - 7

... It will also reflect the benefits of marketing and distribution arrangements with other parts of the business. It is rarely used as a stand alone valuation technique, but more usually in conjunction with earnings multiples in order to derive a median price It is particularly pertinent for long ...

... It will also reflect the benefits of marketing and distribution arrangements with other parts of the business. It is rarely used as a stand alone valuation technique, but more usually in conjunction with earnings multiples in order to derive a median price It is particularly pertinent for long ...

Far East Hospitality Trust - Singapore

... profit) arising from any use of and/or reliance upon this document and/or further communication given in relation to this document. This document is not to be construed as an offer or a solicitation of an offer to buy or sell any securities. The DBS Group, along with its affiliates and/or persons as ...

... profit) arising from any use of and/or reliance upon this document and/or further communication given in relation to this document. This document is not to be construed as an offer or a solicitation of an offer to buy or sell any securities. The DBS Group, along with its affiliates and/or persons as ...

Myth 4: Funding reduces public spending on pensions.

... personal saving by about 50 percent, and the country's capital stock by 38 percent. The connection between funding and growth is complex, however. First, savings rise only during the buildup of funded schemes; once schemes are mature, saving by workers is matched by payments to pensioners. Second, e ...

... personal saving by about 50 percent, and the country's capital stock by 38 percent. The connection between funding and growth is complex, however. First, savings rise only during the buildup of funded schemes; once schemes are mature, saving by workers is matched by payments to pensioners. Second, e ...

Chapter 6

... suppliers and distributors are providing? 2. Are there activities in our industry value chain presently being outsourced or performed independently by others that are a viable source of future profits? 3. Is there a high level of stability in the demand for the organization’s products? 4. How high i ...

... suppliers and distributors are providing? 2. Are there activities in our industry value chain presently being outsourced or performed independently by others that are a viable source of future profits? 3. Is there a high level of stability in the demand for the organization’s products? 4. How high i ...

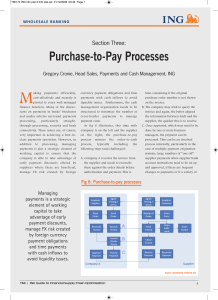

Purchase-to-Pay Processes

... They decided to focus first on their pension payments, for which they use ING. They selected a major payments system to form the centre of our payment hub. This implementation took around 6 months to complete and has been very successful, with around 225,000 payments a month now passing through the ...

... They decided to focus first on their pension payments, for which they use ING. They selected a major payments system to form the centre of our payment hub. This implementation took around 6 months to complete and has been very successful, with around 225,000 payments a month now passing through the ...

Educating Your Investment Committee on Behavioral Economics

... An investment in alternative investments can be highly illiquid, is speculative and not suitable for all investors. Investing in alternative investments is only intended for experienced and sophisticated investors who are willing to bear the high economic risks associated with such an investment. In ...

... An investment in alternative investments can be highly illiquid, is speculative and not suitable for all investors. Investing in alternative investments is only intended for experienced and sophisticated investors who are willing to bear the high economic risks associated with such an investment. In ...

Banking Industry Country Risk Assessment

... other indicators when available. The performance of the CRE segment is at least as important for the banking sector as the residential housing segment, but the data gaps relating to prices are much wider than those for residential housing. 44. For countries where CRE prices are available, the analys ...

... other indicators when available. The performance of the CRE segment is at least as important for the banking sector as the residential housing segment, but the data gaps relating to prices are much wider than those for residential housing. 44. For countries where CRE prices are available, the analys ...

British Investment Overseas 1870-1913

... capital markets discriminated against domestic industry in favor of overseas investments.6 Ripley describes these views and responds to them eloquently: “British capital … was being used to develop foreign and colonial industries which were to prove serious competitors with the industries of Britain ...

... capital markets discriminated against domestic industry in favor of overseas investments.6 Ripley describes these views and responds to them eloquently: “British capital … was being used to develop foreign and colonial industries which were to prove serious competitors with the industries of Britain ...

Chapter 15: Intercorporate Investments

... sponsoring entity. It may be used to securitize receivables, lease assets, and so on. • In the past, sponsors were able to avoid consolidating SPEs on their financial statements because they did not have “control” (i.e., own a majority of the voting interest) of the SPE. • By avoiding consolidation, ...

... sponsoring entity. It may be used to securitize receivables, lease assets, and so on. • In the past, sponsors were able to avoid consolidating SPEs on their financial statements because they did not have “control” (i.e., own a majority of the voting interest) of the SPE. • By avoiding consolidation, ...

The Power of a Low Volatility Investing Approach

... Governments: Government bonds include all bonds covered by the J.P. Morgan Government Bond Index (GBI). The GBI is a market-cap-weighted index of all liquid government bonds across 13 markets (Australia, Belgium, Canada, Denmark, France, Germany, Italy, Japan, Netherlands, Spain, Sweden, U.K., U.S.) ...

... Governments: Government bonds include all bonds covered by the J.P. Morgan Government Bond Index (GBI). The GBI is a market-cap-weighted index of all liquid government bonds across 13 markets (Australia, Belgium, Canada, Denmark, France, Germany, Italy, Japan, Netherlands, Spain, Sweden, U.K., U.S.) ...

Hungary - CUTS International

... suppliers. An important question and point of discussion is if a slower, more gradual liberalization had been applied, would that have provided more time and some temporary protection for local firms to grow and match foreign competitors? There is empirical evidence that firms did not utilize such ...

... suppliers. An important question and point of discussion is if a slower, more gradual liberalization had been applied, would that have provided more time and some temporary protection for local firms to grow and match foreign competitors? There is empirical evidence that firms did not utilize such ...

Chromis Successfully Secures Seed Funding from Torrey Pines

... company focused on the development of novel curative treatments for chronic HBV infection, announced that it has completed $3M seed financing round, led by Torrey Pines Investment. The funding will advance Chromis’ innovative platform of antivirals including cccDNA inhibitors, entry inhibitors and c ...

... company focused on the development of novel curative treatments for chronic HBV infection, announced that it has completed $3M seed financing round, led by Torrey Pines Investment. The funding will advance Chromis’ innovative platform of antivirals including cccDNA inhibitors, entry inhibitors and c ...

The big four banks: The evolution of the financial sector, Part I

... This research looks at how the financial sector has evolved over the periods both before and after the financial crisis of 2007-8. This paper is the first in a series, examining the balance sheets of the four largest banks; it will be followed by papers on the regional banks, the smaller banks and t ...

... This research looks at how the financial sector has evolved over the periods both before and after the financial crisis of 2007-8. This paper is the first in a series, examining the balance sheets of the four largest banks; it will be followed by papers on the regional banks, the smaller banks and t ...

Capital Budgeting in Projects

... • Example: a case predicts net cash flow of $20 M if marketing program implemented • Depends on assumptions that cannot be managed or controlled. • Will overall results be close to predicted value? • Sensitivity and risk analysis produce information about uncertainties. • Sensitivity analysis - whic ...

... • Example: a case predicts net cash flow of $20 M if marketing program implemented • Depends on assumptions that cannot be managed or controlled. • Will overall results be close to predicted value? • Sensitivity and risk analysis produce information about uncertainties. • Sensitivity analysis - whic ...

Chapter 8 - McGraw Hill Higher Education

... • Tell us how much total wealth has gone up or down. • Provide benchmarks for performance of money ...

... • Tell us how much total wealth has gone up or down. • Provide benchmarks for performance of money ...

Making more out of less

... a generalised boom in house prices, but there is considerable variation between locations. For example, the recent construction surge in Melbourne and other parts of Victoria (now coming to an end), has left supply and demand in better balance, while Sydney has been slower to ramp up construction in ...

... a generalised boom in house prices, but there is considerable variation between locations. For example, the recent construction surge in Melbourne and other parts of Victoria (now coming to an end), has left supply and demand in better balance, while Sydney has been slower to ramp up construction in ...

Why do companies go public?

... Evidence is inconsistent with high growth opportunity hypothesis. Firms do not go public to finance future investment and growth. Independent firms go public to rebalance their balance sheet accounts and capital structure after high growth and investment. Carve-outs choose best listing time to maxim ...

... Evidence is inconsistent with high growth opportunity hypothesis. Firms do not go public to finance future investment and growth. Independent firms go public to rebalance their balance sheet accounts and capital structure after high growth and investment. Carve-outs choose best listing time to maxim ...

Practice Problems on Current Account

... growth, higher TFP growth leads to a rise in expected MPK that raises the incentive to invest. As the TFP growth is higher for HPAE economies it also follows that Investment will be higher in HPAE economies. 13- Suppose the U.S government raised its expenditures and did not change tax rates. How wil ...

... growth, higher TFP growth leads to a rise in expected MPK that raises the incentive to invest. As the TFP growth is higher for HPAE economies it also follows that Investment will be higher in HPAE economies. 13- Suppose the U.S government raised its expenditures and did not change tax rates. How wil ...

HSBC World Selection Personal Pension

... All investments carry some risk and there is a chance that your pension investment could lose some or all of its value. Each HSBC pension fund, or portfolio, has been given one of four risk ratings which are described below. These risk ratings provide an indicator of the balance between the risk of ...

... All investments carry some risk and there is a chance that your pension investment could lose some or all of its value. Each HSBC pension fund, or portfolio, has been given one of four risk ratings which are described below. These risk ratings provide an indicator of the balance between the risk of ...

UN PRI and private equity returns. Empirical evidence from the US

... both return on assets and market-to-book value measures in the US stock market, supporting the theory that corporate social performance is beneficial for corporate financial performance. Manescu (2011) finds that certain ESG indicators, such as community relations, protection of human rights and saf ...

... both return on assets and market-to-book value measures in the US stock market, supporting the theory that corporate social performance is beneficial for corporate financial performance. Manescu (2011) finds that certain ESG indicators, such as community relations, protection of human rights and saf ...

Disclaimer

... offer to sell or a solicitation of an offer to buy the securities referred to herein. Investors should note that values of such securities, if any, may fluctuate and that each security’s price or value may rise or fall. Opinions or recommendations contained herein are in form of technical ratings an ...

... offer to sell or a solicitation of an offer to buy the securities referred to herein. Investors should note that values of such securities, if any, may fluctuate and that each security’s price or value may rise or fall. Opinions or recommendations contained herein are in form of technical ratings an ...

Land banking

Land banking is the practice of aggregating parcels of land for future sale or development.While in many countries land banking may refer to various private real-estate investment schemes, in the United States it refers to the establishment of quasi-governmental county or municipal authorities purposed with managing an inventory of surplus land.