Financial Instruments

... On the other hand, as they are joint owners, shareholders have the following rights: Rights attached to shares - dividend right: if the company has made a profit and the general meeting resolves to allocate such profit, either wholly or in part (and not to reinvest it or to appropriate it to reserve ...

... On the other hand, as they are joint owners, shareholders have the following rights: Rights attached to shares - dividend right: if the company has made a profit and the general meeting resolves to allocate such profit, either wholly or in part (and not to reinvest it or to appropriate it to reserve ...

The Certified Financial Planner™, CFP® and federally registered

... The CFP® certification is a voluntary certification; no federal or state law or regulation requires financial planners to hold CFP® certification. It is recognized in the United States and a number of other countries for its (1) high standard of professional education; (2) stringent code of conduct ...

... The CFP® certification is a voluntary certification; no federal or state law or regulation requires financial planners to hold CFP® certification. It is recognized in the United States and a number of other countries for its (1) high standard of professional education; (2) stringent code of conduct ...

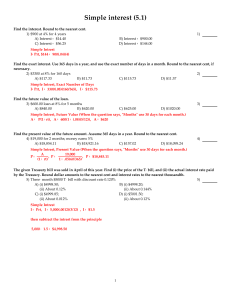

Simple interest (5.1)

... Present Value of Annuity (The ammount required to be deposited as a lump sum to equal what the future value of a simular annunity with said payments and intrest. The terms Payments and Present value let you know it is a Present value annunity question.) P=R ...

... Present Value of Annuity (The ammount required to be deposited as a lump sum to equal what the future value of a simular annunity with said payments and intrest. The terms Payments and Present value let you know it is a Present value annunity question.) P=R ...

Stock Market Speculation and Managerial Myopia

... narrow or does it lead their decision-making astray? The answer depends on how much the stock-market knows about corporate decisions: a well-informed stock market can provide accurate incentives that lead to profit-maximizing decisions, but an ill-informed one distorts incentives away from profit-ma ...

... narrow or does it lead their decision-making astray? The answer depends on how much the stock-market knows about corporate decisions: a well-informed stock market can provide accurate incentives that lead to profit-maximizing decisions, but an ill-informed one distorts incentives away from profit-ma ...

Fault Lines in CRM: New E-Commerce Business Models

... Engines at the time of transaction, thus stealing potential revenue from Intentions Networks. In fact, Bargain Finding Engines and Product Configurators can pick off these customers by trying to replicate the offers that were created with so much effort by Intentions Networks. The implication of thi ...

... Engines at the time of transaction, thus stealing potential revenue from Intentions Networks. In fact, Bargain Finding Engines and Product Configurators can pick off these customers by trying to replicate the offers that were created with so much effort by Intentions Networks. The implication of thi ...

- Franklin Templeton Investments

... higher, and the notion that higher rates typically lead to improving lending profitability underpinned the sector’s gains. Speculation about the prospect of lower taxes and lighter bank regulations under the Trump administration also boosted the stocks of large global banks. Finally, a notable contr ...

... higher, and the notion that higher rates typically lead to improving lending profitability underpinned the sector’s gains. Speculation about the prospect of lower taxes and lighter bank regulations under the Trump administration also boosted the stocks of large global banks. Finally, a notable contr ...

Tricon Capital Group Announces Q2 2016 Results AUM Surpasses

... the syndication of this investment and Queen Creek in Phoenix to a third-party investor on an 80/20 basis (with Tricon retaining 20% of the investment). Similar to its existing managed investment vehicles, Tricon expects to earn asset management fees and potentially performance fees as well as Inves ...

... the syndication of this investment and Queen Creek in Phoenix to a third-party investor on an 80/20 basis (with Tricon retaining 20% of the investment). Similar to its existing managed investment vehicles, Tricon expects to earn asset management fees and potentially performance fees as well as Inves ...

does the budget deficit crowd-out private credit from the banking

... bank claims from 30% in June 2008 to 49% in June 2011; the share of claims in local currency is even more significant, reaching 60% by June 2011. This increase is driven mostly by investment in government securities and T-bills growing by 28% between December 2010 and 2011. On the other hand, the pr ...

... bank claims from 30% in June 2008 to 49% in June 2011; the share of claims in local currency is even more significant, reaching 60% by June 2011. This increase is driven mostly by investment in government securities and T-bills growing by 28% between December 2010 and 2011. On the other hand, the pr ...

Balance Sheet Capacity and Endogenous Risk

... our model are also consistent with accmulating empirical evidence that the balance sheet capacity of banks and other financial intermediaries predict returns on various risky assets (we discuss the literature shortly). Faster asset growth today is associated with lower future risky asset returns, co ...

... our model are also consistent with accmulating empirical evidence that the balance sheet capacity of banks and other financial intermediaries predict returns on various risky assets (we discuss the literature shortly). Faster asset growth today is associated with lower future risky asset returns, co ...

MPDD W P

... In the discussion on means to development in underdeveloped countries in the period immediately after World War II, the focus was on the appropriate macroeconomic policies needed to raise investment, accelerate productivity growth and raise per capita incomes. It was in the 1970s that the influence ...

... In the discussion on means to development in underdeveloped countries in the period immediately after World War II, the focus was on the appropriate macroeconomic policies needed to raise investment, accelerate productivity growth and raise per capita incomes. It was in the 1970s that the influence ...

Innovation and performance of European banks adopting Internet

... online, as transactions can be easily automated. But internet banking is not just a process innovation that allows existing banks to centralise back office operations and increase their efficiency. The existence of virtual and branch offices has important effects on the interaction between clients ...

... online, as transactions can be easily automated. But internet banking is not just a process innovation that allows existing banks to centralise back office operations and increase their efficiency. The existence of virtual and branch offices has important effects on the interaction between clients ...

foreign direct investment theory and strategy

... Q: Compared to domestic firms in what ways are MNE’s better able to exploit competitive advantages? A: Economies of scale Managerial and technological expertise Product differentiation Financial strength ...

... Q: Compared to domestic firms in what ways are MNE’s better able to exploit competitive advantages? A: Economies of scale Managerial and technological expertise Product differentiation Financial strength ...

a study on buyer satisfaction on residential flat promoter services in

... improvement, the commercial real estate industry is emerging from a transitional phase in 2010 to a recovery stage in 2011. Institutional-quality real estate assets in primary markets have begun to stabilize and appear to be poised for recovery. The future of real estate is full of challenges. In th ...

... improvement, the commercial real estate industry is emerging from a transitional phase in 2010 to a recovery stage in 2011. Institutional-quality real estate assets in primary markets have begun to stabilize and appear to be poised for recovery. The future of real estate is full of challenges. In th ...

monetary transmission mechanism and behaviour of asset

... and the possibility of financial difficulties is smaller, the psychological effects of abstaining from a desired purchase decrease and so does their interest in savings for the rainy day. At the same time, expenses for different goods and services increase as well as interest in the purchase of dura ...

... and the possibility of financial difficulties is smaller, the psychological effects of abstaining from a desired purchase decrease and so does their interest in savings for the rainy day. At the same time, expenses for different goods and services increase as well as interest in the purchase of dura ...

Supply of loanable funds

... Savers make a sacrifice of current consumption, that is their opportunity cost. Interest earned on their saving is the reward for sacrificing current consumption; that is they get greater future consumption. So we would expect that the higher the interest rate the more households would be willing to ...

... Savers make a sacrifice of current consumption, that is their opportunity cost. Interest earned on their saving is the reward for sacrificing current consumption; that is they get greater future consumption. So we would expect that the higher the interest rate the more households would be willing to ...

PDF

... sectional analysis, a time-series approach, and panel data methods (a combination of both techniques). Each of these approaches has made useful contributions to the investigation of the relationship between finance and growth. However, Schmidt emphasized [Schmidt et al 2006] that all approaches suff ...

... sectional analysis, a time-series approach, and panel data methods (a combination of both techniques). Each of these approaches has made useful contributions to the investigation of the relationship between finance and growth. However, Schmidt emphasized [Schmidt et al 2006] that all approaches suff ...

Influence of foreign bank presence on the level of crediting in Ukraine

... All these effects stimulate reduction in costs. Still, timing of such cost reduction is not easy to define. Usually these effects come into force only in long run perspective, since banks first should invest in innovations and only then receive cost reduction. Proceeding with positive effects of for ...

... All these effects stimulate reduction in costs. Still, timing of such cost reduction is not easy to define. Usually these effects come into force only in long run perspective, since banks first should invest in innovations and only then receive cost reduction. Proceeding with positive effects of for ...

ALLAN GRAY BALANCED FUND

... Act. Exposures in excess of the limits will be corrected immediately, except where due to a change in the fair value or characteristic of an asset, e.g. market value fluctuations, in which case they will be corrected within a reasonable time period. The Management Company does not monitor compliance ...

... Act. Exposures in excess of the limits will be corrected immediately, except where due to a change in the fair value or characteristic of an asset, e.g. market value fluctuations, in which case they will be corrected within a reasonable time period. The Management Company does not monitor compliance ...

Glossary of Foreign Direct Investment Terms and

... economic control of a single government. Economic territory has the dimensions of physical location as well as legal jurisdiction. With regard to its composition, an economic territory (or economy) consists of all the institutional units that are resident in that territory. The concepts of economic ...

... economic control of a single government. Economic territory has the dimensions of physical location as well as legal jurisdiction. With regard to its composition, an economic territory (or economy) consists of all the institutional units that are resident in that territory. The concepts of economic ...

ETF Trends - Davis ETFs

... Portfolio Holdings Disclosure policy that governs the release of non-public portfolio holding infor mation. This policy is described in the prospectus. Holding percentages are subject to change. Visit davisetfs.com or call 800-279-0279 for the most current public portfolio holdings information. Pas ...

... Portfolio Holdings Disclosure policy that governs the release of non-public portfolio holding infor mation. This policy is described in the prospectus. Holding percentages are subject to change. Visit davisetfs.com or call 800-279-0279 for the most current public portfolio holdings information. Pas ...

File - The Institute of International Finance

... investor base in the secondary market. Individuals depend on these markets as investors, as pension beneficiaries, and as employees and customers of dynamic companies that raise capital in equity markets to grow. Because of these dependencies, an overly conservative regulatory regime that unnecessar ...

... investor base in the secondary market. Individuals depend on these markets as investors, as pension beneficiaries, and as employees and customers of dynamic companies that raise capital in equity markets to grow. Because of these dependencies, an overly conservative regulatory regime that unnecessar ...

Lower Middle Market Direct Lending

... auctioned private equity deal flow. These lenders quickly create a crowd in a narrow segment of the market and commoditize themselves and their products. It doesn’t take our friends in private equity long to chip away at terms and effectively gut the rights and remedies of a lender. When lending get ...

... auctioned private equity deal flow. These lenders quickly create a crowd in a narrow segment of the market and commoditize themselves and their products. It doesn’t take our friends in private equity long to chip away at terms and effectively gut the rights and remedies of a lender. When lending get ...

What explains developments in business investment?

... between investment and cash flow in Germany and the UK over the period 1993-99. However, problems associated with asymmetric information, and thus the effect of firms’ balance sheets, may be less pronounced in countries such as Norway and Germany, where investment is largely financed by banks. Banks ...

... between investment and cash flow in Germany and the UK over the period 1993-99. However, problems associated with asymmetric information, and thus the effect of firms’ balance sheets, may be less pronounced in countries such as Norway and Germany, where investment is largely financed by banks. Banks ...

Contagion Risk in Banking

... Jagannathan, 1988; Gorton, 1985) introduces investment risk in addition to consumption risk. Asymmetric information between the bank and its depositors on the true value of loans is a key element of these models. In the Chari-Jagannathan model, only a fraction of depositors receives information on t ...

... Jagannathan, 1988; Gorton, 1985) introduces investment risk in addition to consumption risk. Asymmetric information between the bank and its depositors on the true value of loans is a key element of these models. In the Chari-Jagannathan model, only a fraction of depositors receives information on t ...

Land banking

Land banking is the practice of aggregating parcels of land for future sale or development.While in many countries land banking may refer to various private real-estate investment schemes, in the United States it refers to the establishment of quasi-governmental county or municipal authorities purposed with managing an inventory of surplus land.