Secular Stagnation, Rational Bubbles, and Fiscal

... is temporarily low due to an investment slump. Then, the young do not want to invest all their savings in capital. Instead, they buy the bubbly asset. This raises the price of this asset. Hence, the elderly, who hold these assets, receive a windfall pro…t, which they spend on extra consumption. A re ...

... is temporarily low due to an investment slump. Then, the young do not want to invest all their savings in capital. Instead, they buy the bubbly asset. This raises the price of this asset. Hence, the elderly, who hold these assets, receive a windfall pro…t, which they spend on extra consumption. A re ...

Measures of financial stability - a review

... financial fragility or stress. Composite quantitative measures of financial system stability that could signal these conditions are intuitively attractive as they could enable policy makers and financial system participants to: (a) better monitor the degree of financial stability of the system, (b) ...

... financial fragility or stress. Composite quantitative measures of financial system stability that could signal these conditions are intuitively attractive as they could enable policy makers and financial system participants to: (a) better monitor the degree of financial stability of the system, (b) ...

A framework for dealing with domestic systemically important banks

... Principle 10: National authorities should ensure that the application of the G-SIB and D-SIB frameworks is compatible within their jurisdictions. Home authorities should impose HLA requirements that they calibrate at the parent and/or consolidated level, and host authorities should impose HLA requir ...

... Principle 10: National authorities should ensure that the application of the G-SIB and D-SIB frameworks is compatible within their jurisdictions. Home authorities should impose HLA requirements that they calibrate at the parent and/or consolidated level, and host authorities should impose HLA requir ...

Understanding Financial Crises: A Developing Country

... that other people have paid for, will result in too little private production and sale of information. To understand the free rider problem recognize that if some investors acquire information that tells them which securities are undervalued and therefore buy their securities, other investors who ha ...

... that other people have paid for, will result in too little private production and sale of information. To understand the free rider problem recognize that if some investors acquire information that tells them which securities are undervalued and therefore buy their securities, other investors who ha ...

Determinants Of Cross-Border Financial Capital Flows In East Asia

... safe assets, appears to have a positive effect on the foreign bond investment. Fourth, the socalled China factor, usually meaning a negative spill-over effect on the Korean economy, appears in the case of the foreign equity investment after the 1997 crisis. On the other hand, the fast growth of Chin ...

... safe assets, appears to have a positive effect on the foreign bond investment. Fourth, the socalled China factor, usually meaning a negative spill-over effect on the Korean economy, appears in the case of the foreign equity investment after the 1997 crisis. On the other hand, the fast growth of Chin ...

CCA Impact Investing 0217 - Community Council for Australia

... 2. Measurement of impact and outcomes Measurement of impact and outcomes are a critical aspect of most impact investments. What is being bought or invested in and what are the returns beyond the economic benefit to investors? Given the significant role of measurement in all impact investing, CCA bel ...

... 2. Measurement of impact and outcomes Measurement of impact and outcomes are a critical aspect of most impact investments. What is being bought or invested in and what are the returns beyond the economic benefit to investors? Given the significant role of measurement in all impact investing, CCA bel ...

Financial Stability Report 2014

... advanced economies in 2014, as growth momentum in key emerging markets appeared to wane. In comparison, growth among advanced economies exhibited some improvement, though with growth and monetary policy divergence between the US and other major economies. Despite improved conditions, however, soft i ...

... advanced economies in 2014, as growth momentum in key emerging markets appeared to wane. In comparison, growth among advanced economies exhibited some improvement, though with growth and monetary policy divergence between the US and other major economies. Despite improved conditions, however, soft i ...

Trends and Determinants of US Farmland Values Since 1910

... such as rate of return on farm assets, is now inching down, but is also higher than the 1980s levels. It is likely that with the current stagnation of commodity prices and continued decline in farm income, the debt service ratio will continue to rise and the profitability ratio remain flat or even f ...

... such as rate of return on farm assets, is now inching down, but is also higher than the 1980s levels. It is likely that with the current stagnation of commodity prices and continued decline in farm income, the debt service ratio will continue to rise and the profitability ratio remain flat or even f ...

structured products: are you aware of what is in your back book?

... intermediaries, that have previously recommended these products as part of a client portfolio. Critics suggest that structured investment products are risky investments that are highly complex and are unlikely to be understood in any depth by the average adviser, let alone the unsophisticated invest ...

... intermediaries, that have previously recommended these products as part of a client portfolio. Critics suggest that structured investment products are risky investments that are highly complex and are unlikely to be understood in any depth by the average adviser, let alone the unsophisticated invest ...

1 Trends and developments in the Spanish

... In regard to investment in financial assets related to economic variables this document may cover. readers should be aware that under no circumstances should they base their investment decisions in the information contained in this document. Those persons or entities offering investment products to ...

... In regard to investment in financial assets related to economic variables this document may cover. readers should be aware that under no circumstances should they base their investment decisions in the information contained in this document. Those persons or entities offering investment products to ...

fundamental analysis in security investment and its

... business activities, and both international and national economic indicators, especially, microeconomics and macroeconomics. After having studied these, analysts have a duty to make feasible predictions about core elements, such as, earnings momentum, book and tangible book value of shares, as well ...

... business activities, and both international and national economic indicators, especially, microeconomics and macroeconomics. After having studied these, analysts have a duty to make feasible predictions about core elements, such as, earnings momentum, book and tangible book value of shares, as well ...

drivers of the global real estate financial markets

... How can the real estate industry cope with lower availability of capital (especially in debt), lower return on investments and more regulations for the market? Are risk sharing and safe but lower return instruments like Pfandbrief the answer? • Dimension 2: Finding the right balance in new sources ...

... How can the real estate industry cope with lower availability of capital (especially in debt), lower return on investments and more regulations for the market? Are risk sharing and safe but lower return instruments like Pfandbrief the answer? • Dimension 2: Finding the right balance in new sources ...

Leadership: Nurturing Opportunity and Vision

... leadership roles since joining RubinBrown, including serving as a career development coordinator and mentor and as a key developer of RubinBrown University. The program now includes more than 150 continuing education courses offered to all team members. ...

... leadership roles since joining RubinBrown, including serving as a career development coordinator and mentor and as a key developer of RubinBrown University. The program now includes more than 150 continuing education courses offered to all team members. ...

Banking structures report, October 2014

... from 2008 to 20131 on the basis of a range of selected indicators. This time period includes the beginning of the financial crisis and the time when some euro area countries entered financial assistance programmes. Special attention is paid to the changes that occurred after the publication of the p ...

... from 2008 to 20131 on the basis of a range of selected indicators. This time period includes the beginning of the financial crisis and the time when some euro area countries entered financial assistance programmes. Special attention is paid to the changes that occurred after the publication of the p ...

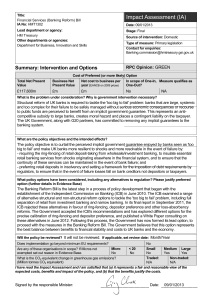

Impact Assessment

... 1. The financial crisis of 2007-09 revealed the urgent need to reform the UK banking system to improve the resilience of both individual banks and the system as a whole. In response to the crisis, as well as embarking on the radical reform of the UK regulatory architecture through the Financial Serv ...

... 1. The financial crisis of 2007-09 revealed the urgent need to reform the UK banking system to improve the resilience of both individual banks and the system as a whole. In response to the crisis, as well as embarking on the radical reform of the UK regulatory architecture through the Financial Serv ...

Investment and saving Ch24 Economics Ch09 Macroeconomics

... A) an increase of the real interest rate B) the economy experiences a recession C) technology that increases productivity is introduced D) an economy experiences a rapid increase in population 33) Technological change increases investment demand because it A) lowers the interest rate. B) can create ...

... A) an increase of the real interest rate B) the economy experiences a recession C) technology that increases productivity is introduced D) an economy experiences a rapid increase in population 33) Technological change increases investment demand because it A) lowers the interest rate. B) can create ...

Equity Research: Fundamental and Technical Analysis

... investment decisions. These fundamental factors relate to the overall economy or a specific industry or a company. The performance of the securities that represent the company can be said to depend on the performance of the company itself. However, as companies are a part of industrial and business ...

... investment decisions. These fundamental factors relate to the overall economy or a specific industry or a company. The performance of the securities that represent the company can be said to depend on the performance of the company itself. However, as companies are a part of industrial and business ...

The Icelandic banking crisis and what to do about it:

... Unfortunately, Iceland has a problem. Its banking sector, following aggressive expansion during the past decade, has assets and liabilities that dwarf its GDP. While the banking sector’s assets are believed to be of good quality, they are – in the manner of bank assets – of long maturity and illiqui ...

... Unfortunately, Iceland has a problem. Its banking sector, following aggressive expansion during the past decade, has assets and liabilities that dwarf its GDP. While the banking sector’s assets are believed to be of good quality, they are – in the manner of bank assets – of long maturity and illiqui ...

EN EN Foreword The Commission`s priority – Europe`s priority – is

... between investors and those who need funding are identified and broken down, whether they be within a Member State or cross border. Building a Capital Markets Union is a key initiative in the work programme of the Commission. It would ensure greater diversification in the funding of the economy and ...

... between investors and those who need funding are identified and broken down, whether they be within a Member State or cross border. Building a Capital Markets Union is a key initiative in the work programme of the Commission. It would ensure greater diversification in the funding of the economy and ...

T-Accounts - Knowledge

... The Yen in the US bank initially corresponded to a US Short Term Claim on Japanese economy and were recorded at that time with a minus sign (it was originally an increase in foreign assets). They now return to Japan and cancel the initial claim by being recorded as credit in the Short Term Claim ac ...

... The Yen in the US bank initially corresponded to a US Short Term Claim on Japanese economy and were recorded at that time with a minus sign (it was originally an increase in foreign assets). They now return to Japan and cancel the initial claim by being recorded as credit in the Short Term Claim ac ...

The American University in Cairo School of Business A Thesis Submitted to

... a debtor". However in the beginning of the 20th century, the dominant theory was in support of neutral or even negative effect of finance on growth (as cited in Fry, 1995). Robinson (1952) argues that finance responds to changes in the real sector. Moreover, Lucas (1988) believes that finance is not ...

... a debtor". However in the beginning of the 20th century, the dominant theory was in support of neutral or even negative effect of finance on growth (as cited in Fry, 1995). Robinson (1952) argues that finance responds to changes in the real sector. Moreover, Lucas (1988) believes that finance is not ...

Understanding and responding to housing market change

... in behaviour. The attitudes of investors offer equally telling reasons for the market growth of this sector. In their study of rising markets in Yorkshire and Humber, Hickman et al. (2007) consider the impact of ‘investor markets’ on the housing system. They suggest that decisions about investment a ...

... in behaviour. The attitudes of investors offer equally telling reasons for the market growth of this sector. In their study of rising markets in Yorkshire and Humber, Hickman et al. (2007) consider the impact of ‘investor markets’ on the housing system. They suggest that decisions about investment a ...

Land banking

Land banking is the practice of aggregating parcels of land for future sale or development.While in many countries land banking may refer to various private real-estate investment schemes, in the United States it refers to the establishment of quasi-governmental county or municipal authorities purposed with managing an inventory of surplus land.