the evaluation of active manager returns in a non

... of a symmetrical distribution and where almost all observations fall within 4 standard deviations of the mean. However where active return distributions of investment managers contain extreme observations (observations exceeding 4 standard deviations from the mean), the measures of skewness and kurt ...

... of a symmetrical distribution and where almost all observations fall within 4 standard deviations of the mean. However where active return distributions of investment managers contain extreme observations (observations exceeding 4 standard deviations from the mean), the measures of skewness and kurt ...

Ground rents: an opportunity for institutional investors to

... For newly developed properties, the developer can sell the leasehold interest of the property. The developer receives a lump sum in return for granting the leasehold interest where this lump sum is typically the vacant possession valuation of the property. In addition, the leaseholder pays a regular ...

... For newly developed properties, the developer can sell the leasehold interest of the property. The developer receives a lump sum in return for granting the leasehold interest where this lump sum is typically the vacant possession valuation of the property. In addition, the leaseholder pays a regular ...

Bank Stress Tests and Financial Stability

... and amplification effects into the modeling of the financial sector (so that even a moderate shock can produce real-economy effects similar to those observed during a severe banking crisis). Such criticisms of earlier stress tests are hardly academic for emerging Asia. The Bank for International Se ...

... and amplification effects into the modeling of the financial sector (so that even a moderate shock can produce real-economy effects similar to those observed during a severe banking crisis). Such criticisms of earlier stress tests are hardly academic for emerging Asia. The Bank for International Se ...

The German current account — Actionism is inappropiate

... The key details in brief Criticism of the German current account surplus Germany has recorded a high current account surplus by historical and international comparison for more than ten years. It is consequently subject to increasing criticism from other countries. For example, the European Commissi ...

... The key details in brief Criticism of the German current account surplus Germany has recorded a high current account surplus by historical and international comparison for more than ten years. It is consequently subject to increasing criticism from other countries. For example, the European Commissi ...

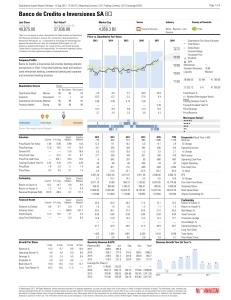

Banco de Credito e Inversiones SA BCI

... Morningstar, Inc. (“Morningstar”, “we”, “our”) calculates Quantitative Ratings for companies whether or not it already provides analyst ratings and qualitative coverage. In some cases, the Quantitative Ratings may differ from the analyst ratings because a company’s analyst-driven ratings can signifi ...

... Morningstar, Inc. (“Morningstar”, “we”, “our”) calculates Quantitative Ratings for companies whether or not it already provides analyst ratings and qualitative coverage. In some cases, the Quantitative Ratings may differ from the analyst ratings because a company’s analyst-driven ratings can signifi ...

Using the Bank Anti-Tying Provision to Curb Financial Risk

... applies antitrustprinciples to bank sales and lending practices. Under antitrust law, a seller cannot condition the availability of one item (the desired product) on the consumer's purchase of another item (the tied product). Similarly, the Anti-Tying Provision limits when banks can condition the av ...

... applies antitrustprinciples to bank sales and lending practices. Under antitrust law, a seller cannot condition the availability of one item (the desired product) on the consumer's purchase of another item (the tied product). Similarly, the Anti-Tying Provision limits when banks can condition the av ...

Workshop Summary

... A final set of insights pertained to communication, which panelists saw as key to successfully managing divestment requests. Engagement with divestment proponents, the broader campus community, and other key stakeholders was seen as a valuable part of establishing parameters for the discussion, ensu ...

... A final set of insights pertained to communication, which panelists saw as key to successfully managing divestment requests. Engagement with divestment proponents, the broader campus community, and other key stakeholders was seen as a valuable part of establishing parameters for the discussion, ensu ...

Credit Creation Social Optimality Southampton Uni

... stepping through, as Richard does, the stages by which goldsmiths became bankers.4 ...

... stepping through, as Richard does, the stages by which goldsmiths became bankers.4 ...

Why did high productivity growth of banks precede the financial crisis?

... that an important part of this productivity growth in the pre-crisis years is explained by business decisions that, ex-post, have been identified as drivers of the crisis (expansion of the housing market, securitization, short-term finance and increasing leverage). When removing these and other oper ...

... that an important part of this productivity growth in the pre-crisis years is explained by business decisions that, ex-post, have been identified as drivers of the crisis (expansion of the housing market, securitization, short-term finance and increasing leverage). When removing these and other oper ...

NHA Mortgage-Backed Securities

... residents, as well as the process for doing so. As a result, some of the securities discussed in this report may not be available to every interested investor. Accordingly, this report is provided for informational purposes only, and does not constitute an offer or solicitation to buy or sell any se ...

... residents, as well as the process for doing so. As a result, some of the securities discussed in this report may not be available to every interested investor. Accordingly, this report is provided for informational purposes only, and does not constitute an offer or solicitation to buy or sell any se ...

Benefits of Private Equity for the European Economy

... through a management buyout, but usually cannot finance a buyout with their own means. And even if they could, they would likely still lack the know-how to professionalize the business on their own. In all these cases, a management buyout that is supported by a private equity fund provides a good so ...

... through a management buyout, but usually cannot finance a buyout with their own means. And even if they could, they would likely still lack the know-how to professionalize the business on their own. In all these cases, a management buyout that is supported by a private equity fund provides a good so ...

The Investment Efficiency Of Private And Public

... based on evidence from public firms, because the accounting data of private firms is not easily available to the public. In this paper, we examine whether private firms invest more efficiently than publicly traded firms using a large dataset Korean firms. Therefore, we hypothesize that the investmen ...

... based on evidence from public firms, because the accounting data of private firms is not easily available to the public. In this paper, we examine whether private firms invest more efficiently than publicly traded firms using a large dataset Korean firms. Therefore, we hypothesize that the investmen ...

PDF | Notice accrued interest on the notes ISIN

... as to the contents of this announcement or the Tender Offer Memorandum or the action you should take, you are recommended to seek your own financial and legal advice, including in respect of any tax consequences. Any individual or company whose Existing Notes are held on its behalf by a broker, deal ...

... as to the contents of this announcement or the Tender Offer Memorandum or the action you should take, you are recommended to seek your own financial and legal advice, including in respect of any tax consequences. Any individual or company whose Existing Notes are held on its behalf by a broker, deal ...

The influence of macroeconomic developments on Austrian banks

... payments (due to rising interest rates and/or growing debt ratios) reduces the borrowers’ scope to service their debt. ...

... payments (due to rising interest rates and/or growing debt ratios) reduces the borrowers’ scope to service their debt. ...

The Hexagon System

... Manhattan were already providing corporate customers with mainframe computer terminals, through which they could access within-country transactions and balance data about their accounts. This was a strategic threat to the HongkongBank because these products focused on business customers engaged in i ...

... Manhattan were already providing corporate customers with mainframe computer terminals, through which they could access within-country transactions and balance data about their accounts. This was a strategic threat to the HongkongBank because these products focused on business customers engaged in i ...

Disgorge the Cash - Roosevelt Institute

... These results have important implications for macroeconomic policy. The shareholder revolution – and its implications for corporate financing decisions – may help explain why higher corporate profits in recent business cycles have generally failed to lead to high levels of investment. And under this ...

... These results have important implications for macroeconomic policy. The shareholder revolution – and its implications for corporate financing decisions – may help explain why higher corporate profits in recent business cycles have generally failed to lead to high levels of investment. And under this ...

Ethical Investment and Portfolio Theory

... Index, and found the expected performance of these impact investments to be comparable if not better”. One ethical fund, the Amity International Fund (Ecclesiastical), is consistently in the top 25% of IMA Global Growth Sector Funds, and in the decade up to August 2011 outperformed the global growth ...

... Index, and found the expected performance of these impact investments to be comparable if not better”. One ethical fund, the Amity International Fund (Ecclesiastical), is consistently in the top 25% of IMA Global Growth Sector Funds, and in the decade up to August 2011 outperformed the global growth ...

What Makes a Good ʽBad Bankʼ? The Irish, Spanish and German

... documentation and a solid valuation process, a strong legal framework, efficient asset servicing and skilled staff. The financial backing of Irish, German and Spanish authorities has been crucial to these AMCsʼ progress, though it has come at a fiscal cost. The new Bank Recovery and Resolution Direc ...

... documentation and a solid valuation process, a strong legal framework, efficient asset servicing and skilled staff. The financial backing of Irish, German and Spanish authorities has been crucial to these AMCsʼ progress, though it has come at a fiscal cost. The new Bank Recovery and Resolution Direc ...

The Effects of Foreign Direct Investments for Host Country`s

... subcontracting systems between a foreign firm and local subcontractors who supply spare parts, components or semi-finished goods to the foreign firm, extra jobs are created ultimately and further economic activity encouraged. The employment effects of FDI are of considerable interest to host develop ...

... subcontracting systems between a foreign firm and local subcontractors who supply spare parts, components or semi-finished goods to the foreign firm, extra jobs are created ultimately and further economic activity encouraged. The employment effects of FDI are of considerable interest to host develop ...

Leaving home and housing prices. The Experience of Italian

... In the recent years house prices more than doubled in the largest Italian cities (Panetta et al. 2009); similar developments were recorded in other European countries with the exception of Germany. Developments in residential property prices are an important factor underlying monetary policy decisio ...

... In the recent years house prices more than doubled in the largest Italian cities (Panetta et al. 2009); similar developments were recorded in other European countries with the exception of Germany. Developments in residential property prices are an important factor underlying monetary policy decisio ...

Unconstrained Investing: Unleash Your Bonds

... At Western Asset we have broken down unconstrained strategies into three groupings: Unconstrained with Bond-Like Risk and Return The simplest approach to unconstrained is an investment-grade portfolio that seeks to provide bond-like risk and return over the long term, but does not have a benchmark. ...

... At Western Asset we have broken down unconstrained strategies into three groupings: Unconstrained with Bond-Like Risk and Return The simplest approach to unconstrained is an investment-grade portfolio that seeks to provide bond-like risk and return over the long term, but does not have a benchmark. ...

The buck stops here: Vanguard money market funds Factor

... It’s important to note, however, that not all factor exposures are expected to earn a return premium over the long term. That is, factor exposures can be compensated or uncompensated, a critical distinction in any factor-based investing framework. The market factor, for example, has historically ear ...

... It’s important to note, however, that not all factor exposures are expected to earn a return premium over the long term. That is, factor exposures can be compensated or uncompensated, a critical distinction in any factor-based investing framework. The market factor, for example, has historically ear ...

Land banking

Land banking is the practice of aggregating parcels of land for future sale or development.While in many countries land banking may refer to various private real-estate investment schemes, in the United States it refers to the establishment of quasi-governmental county or municipal authorities purposed with managing an inventory of surplus land.