Stock Market Volatility and Monetary Regime Change:

... improves on the widely used Cowles Index by using month-end closing prices rather than the average of monthly highs and lows, thereby avoiding a significant autocorrelation problem in stock returns (Schwert, 1989b; Working, 1960). An analysis of the GIP Index shows that stock volatility in September ...

... improves on the widely used Cowles Index by using month-end closing prices rather than the average of monthly highs and lows, thereby avoiding a significant autocorrelation problem in stock returns (Schwert, 1989b; Working, 1960). An analysis of the GIP Index shows that stock volatility in September ...

Goldman Sachs Absolute Return Tracker Portfolio

... This material is a financial promotion and has been issued by Goldman Sachs International, authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. Furthermore, this information should not be construed as financial rese ...

... This material is a financial promotion and has been issued by Goldman Sachs International, authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. Furthermore, this information should not be construed as financial rese ...

Fundamental of Technical Analysis and Algorithmic Trading

... Some traders use Fibonacci on different time horizons (daily, weekly, monthly,…), so in this situation, coverage of some of the sequences will be more significant. ...

... Some traders use Fibonacci on different time horizons (daily, weekly, monthly,…), so in this situation, coverage of some of the sequences will be more significant. ...

Speculation and Sovereign Debt – An Insidious Interaction

... Short term ‘directional’ and leveraged bets that are guided by noise trading According to the narrow, most common definition, speculation is the placement of a bet on the short term changes in prices of a commodity or a financial asset. The bet can be that the price will rise (taking a long positio ...

... Short term ‘directional’ and leveraged bets that are guided by noise trading According to the narrow, most common definition, speculation is the placement of a bet on the short term changes in prices of a commodity or a financial asset. The bet can be that the price will rise (taking a long positio ...

the strategic role and contribution of the risk capital market

... rebuild balance sheets to meet statutory capitalization requirements in the UK and the general on-going problem of liquidity within the international banking system are continuing to seriously constrain the availability of debt finance – even to well-established quality businesses. Under these excep ...

... rebuild balance sheets to meet statutory capitalization requirements in the UK and the general on-going problem of liquidity within the international banking system are continuing to seriously constrain the availability of debt finance – even to well-established quality businesses. Under these excep ...

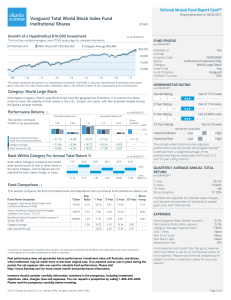

Vanguard Total World Stock Index Fund Institutional Shares

... Sector weightings for fund portfolios are determined using the Global Industry Classification Standard (GICS). GICS was developed by and is the exclusive property of Morgan Stanley Capital International Inc. and Standard & Poor's. GICS is a service mark of MSCI and S&P and has been licensed for use ...

... Sector weightings for fund portfolios are determined using the Global Industry Classification Standard (GICS). GICS was developed by and is the exclusive property of Morgan Stanley Capital International Inc. and Standard & Poor's. GICS is a service mark of MSCI and S&P and has been licensed for use ...

(T+2) Settlement Cycle Introductory Materials

... Short selling aims to gain profits in case prices of securities drop. For example, if you expect a drop in stock prices of a given company, you can borrow these stocks and sell them. If the price drops, you can buy back the stock at a lower price and make a profit on the difference between the selli ...

... Short selling aims to gain profits in case prices of securities drop. For example, if you expect a drop in stock prices of a given company, you can borrow these stocks and sell them. If the price drops, you can buy back the stock at a lower price and make a profit on the difference between the selli ...

Test Presentation Line 2

... Incorporated in England and Wales Registered number 3052894 Registered Office 9 Bonhill Street London EC2A 4PE ...

... Incorporated in England and Wales Registered number 3052894 Registered Office 9 Bonhill Street London EC2A 4PE ...

Key Investor Information db x-trackers Equity Value Factor UCITS ETF

... DY shows how much a company pays out in dividends each year relative to its current share price. The underlying constituents are listed in multiple currencies. The Index is calculated on a total return net basis, all dividends and distributions by the companies are reinvested in the shares after tax ...

... DY shows how much a company pays out in dividends each year relative to its current share price. The underlying constituents are listed in multiple currencies. The Index is calculated on a total return net basis, all dividends and distributions by the companies are reinvested in the shares after tax ...

Market Know-How - Covenant Asset Management, LLC

... rate hikes (maximum available data). Bottom Section Notes: Top chart analyzes data from 2005 Q1–2015 Q2. GDP is calculated by the sum of expenditures, namely consumption, gross capital formation, and net exports. Bottom chart as of 2005 Q3–2015 Q3. The chart shows that return on equity (ROE) is near ...

... rate hikes (maximum available data). Bottom Section Notes: Top chart analyzes data from 2005 Q1–2015 Q2. GDP is calculated by the sum of expenditures, namely consumption, gross capital formation, and net exports. Bottom chart as of 2005 Q3–2015 Q3. The chart shows that return on equity (ROE) is near ...

Key Investor Information Document

... This document provides you with key investor information about this fund (the “Fund”). It is not marketing material. The information is required by law to help you understand the nature and the risks of investing in this fund. You are advised to read it so you can make an informed decision about whe ...

... This document provides you with key investor information about this fund (the “Fund”). It is not marketing material. The information is required by law to help you understand the nature and the risks of investing in this fund. You are advised to read it so you can make an informed decision about whe ...

Goodbody Global Leaders Fund

... Sustainable structural cost advantages versus its competitors. The best of these companies, with a proven track record of leadership within their industry, set themselves apart by using the extra profits generated by this position to fund innovation. This is often driven by an innovative culture and ...

... Sustainable structural cost advantages versus its competitors. The best of these companies, with a proven track record of leadership within their industry, set themselves apart by using the extra profits generated by this position to fund innovation. This is often driven by an innovative culture and ...

Emerging Markets – Income Opportunities

... It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Changes in exchange rates may have an adverse effect on the value, price or income of the prod ...

... It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Changes in exchange rates may have an adverse effect on the value, price or income of the prod ...

Earnings and Cash Flow Analysis

... REVIEW: As we discussed, dividends became taboo during the 1990’s. Since the 2000-2002 bear market, investors have changed their minds about dividends. Dividends can be discussed in polite company again! ...

... REVIEW: As we discussed, dividends became taboo during the 1990’s. Since the 2000-2002 bear market, investors have changed their minds about dividends. Dividends can be discussed in polite company again! ...

Shining a light

... US Securities and Exchange Commission (SEC) is finally showing interest in enhanced environmental, social and governance (ESG) disclosure. At its very first meeting in July, the SEC Investor Advisory Committee agreed that its agenda would include assessing whether current disclosure practices actual ...

... US Securities and Exchange Commission (SEC) is finally showing interest in enhanced environmental, social and governance (ESG) disclosure. At its very first meeting in July, the SEC Investor Advisory Committee agreed that its agenda would include assessing whether current disclosure practices actual ...

Standard Life Investments event PDF

... sustained and pronounced rises in household net worth - defined here as total wealth (including financial assets, such as equities, and nonfinancial assets, like property) less debt. Indeed, between 1998 and 2007 household total net worth grew from 658% of gross disposable income to 772% (see Chart ...

... sustained and pronounced rises in household net worth - defined here as total wealth (including financial assets, such as equities, and nonfinancial assets, like property) less debt. Indeed, between 1998 and 2007 household total net worth grew from 658% of gross disposable income to 772% (see Chart ...

The market has seen leveraged and inverse exchange

... contrast to traditional mutual funds, which declined 18.7% between the end of 2003 and September this year to NT$2.17 trillion ($68.7 billion). The reasons for this are fairly simple: ETF management and trading fees are far cheaper than actively managed funds and offer an easy means to build asset d ...

... contrast to traditional mutual funds, which declined 18.7% between the end of 2003 and September this year to NT$2.17 trillion ($68.7 billion). The reasons for this are fairly simple: ETF management and trading fees are far cheaper than actively managed funds and offer an easy means to build asset d ...

$doc.title

... wonders what this means for the stock market outlook. It seems reasonable to suspect that prices are not likely ever to drift too far from their normal levels relative to indicators of fundamental value, such as dividends or earnings. Thus it seems natural to give at least some weight to the simple ...

... wonders what this means for the stock market outlook. It seems reasonable to suspect that prices are not likely ever to drift too far from their normal levels relative to indicators of fundamental value, such as dividends or earnings. Thus it seems natural to give at least some weight to the simple ...

Click to download DSM US LCG NOVEMBER 2010

... Growth index and a 0.1% appreciation for the S&P 500. At the end of November, the Fund was invested primarily in the technology, health care, consumer discretionary, and business services sectors, with smaller weights in the industrials and materials sectors. During the month the Fund trailed its be ...

... Growth index and a 0.1% appreciation for the S&P 500. At the end of November, the Fund was invested primarily in the technology, health care, consumer discretionary, and business services sectors, with smaller weights in the industrials and materials sectors. During the month the Fund trailed its be ...

Convertible bonds

... Of the 19 analysts that cover the company, according to Bloomberg data, 16 have a "buy" or "overweight“ recommendation. ...

... Of the 19 analysts that cover the company, according to Bloomberg data, 16 have a "buy" or "overweight“ recommendation. ...

RBC Microcap Value Fund - RBC Global Asset Management

... mutual fund. It is the belief of the RBC Mid Cap Value portfolio management team that there is a correlation between earnings growth rates and stock performance. Long-Term Debt/Total Capitalization - a ratio used to show a company’s financial leverage by comparing its long-term debt to its available ...

... mutual fund. It is the belief of the RBC Mid Cap Value portfolio management team that there is a correlation between earnings growth rates and stock performance. Long-Term Debt/Total Capitalization - a ratio used to show a company’s financial leverage by comparing its long-term debt to its available ...

Financial ratio analysis in practice

... operating statistics. This can lead to a more effective and efficient audit. Management use financial analysis to measure and manage a company’s performance more effectively. It is common for graphs to be used in annual reports to present financial information. Graphs give a clear presentation of im ...

... operating statistics. This can lead to a more effective and efficient audit. Management use financial analysis to measure and manage a company’s performance more effectively. It is common for graphs to be used in annual reports to present financial information. Graphs give a clear presentation of im ...

Kahan - NYU School of Law

... Many states (including Del) have accepted this argument against appraisal rights. See DGCL§262(b). D. Valuation - Dissenter usually gets the “value immediately before the effectuation of the corporate action...excluding any ...

... Many states (including Del) have accepted this argument against appraisal rights. See DGCL§262(b). D. Valuation - Dissenter usually gets the “value immediately before the effectuation of the corporate action...excluding any ...

Stock trader

A stock trader or equity trader or share trader is a person or company involved in trading equity securities. Stock traders may be an agent, hedger, arbitrageur, speculator, stockbroker or investor. A stock investor is an individual or company who puts money to use by the purchase of equity securities, offering potential profitable returns, as interest, income, or appreciation in value (capital gains). This buy-and-hold long term strategy is passive in nature, as opposed to speculation, which is typically active in nature. Many stock speculators will trade bonds (and possibly other financial assets) as well. Stock speculation is a risky and complex occupation because the direction of the markets are generally unpredictable and lack transparency, also financial regulators are sometimes unable to adequately detect, prevent and remediate irregularities committed by malicious listed companies or other financial market participants. In addition, the financial markets are usually subjected to speculation.