Investing

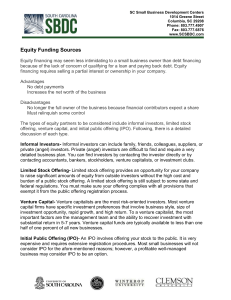

... sums of cash is to sell stock in the company…if you own a share of stock, you own a piece of the company When a company sells stock for the 1st time: “Initial Public Offering” (an “IPO”) • Selling stock means giving up a degree of ownership ...

... sums of cash is to sell stock in the company…if you own a share of stock, you own a piece of the company When a company sells stock for the 1st time: “Initial Public Offering” (an “IPO”) • Selling stock means giving up a degree of ownership ...

Chapter 9 Behavioral Finance and Technical Analysis

... ideas in investments comes from one _______________ specific time ___________________. period, the late 1990s Behavioralism has less to say about ____________ informational efficiency and more to do with allocational efficiency _________ __________________ ...

... ideas in investments comes from one _______________ specific time ___________________. period, the late 1990s Behavioralism has less to say about ____________ informational efficiency and more to do with allocational efficiency _________ __________________ ...

September 2010 - Capital Markets Board of Turkey

... CMB decision dated July 23, 2010 (the “Decision”) was classifying the stocks traded on the ISE into 3 groups (A, B or C). Some trading rules were differentiated based on this classification. For example, Group B and Group C stocks cannot be subject to margin trading and short sale. The Decision was ...

... CMB decision dated July 23, 2010 (the “Decision”) was classifying the stocks traded on the ISE into 3 groups (A, B or C). Some trading rules were differentiated based on this classification. For example, Group B and Group C stocks cannot be subject to margin trading and short sale. The Decision was ...

Law for Business

... Companies can issue stocks to raise funds for startups, expansion projects or other uses Rather than borrowing funds, companies can sell slices of ownership of the company “Shares” entitle owners to a slice of future profits and, generally, some slice of the decision-making ...

... Companies can issue stocks to raise funds for startups, expansion projects or other uses Rather than borrowing funds, companies can sell slices of ownership of the company “Shares” entitle owners to a slice of future profits and, generally, some slice of the decision-making ...

Slide 1 - Economics Arkansas

... countries located in different time zones, so markets in Europe and Asia are open and in operation while U.S. citizens are sound asleep in their beds. ...

... countries located in different time zones, so markets in Europe and Asia are open and in operation while U.S. citizens are sound asleep in their beds. ...

Stock Market Quiz - Economics Arkansas

... countries located in different time zones, so markets in Europe and Asia are open and in operation while U.S. citizens are sound asleep in their beds. ...

... countries located in different time zones, so markets in Europe and Asia are open and in operation while U.S. citizens are sound asleep in their beds. ...

Chapter 11

... Evaluate the benefits and risks of buying stock by comparing them to those of investing in bonds Identify the different systems and markets that allows the trading of stocks to occur Create an investment portfolio Describe the events leading up to the Great Depression ...

... Evaluate the benefits and risks of buying stock by comparing them to those of investing in bonds Identify the different systems and markets that allows the trading of stocks to occur Create an investment portfolio Describe the events leading up to the Great Depression ...

Research and Evaluation

... controlled by one firm. The larger the market share, the less likely the company’s profits will be squeezed by competition. 3. Insider Holdings – Knowing if company insiders are buying or selling their company’s stock has proven helpful to investors in decision making. The Securities and Exchange Co ...

... controlled by one firm. The larger the market share, the less likely the company’s profits will be squeezed by competition. 3. Insider Holdings – Knowing if company insiders are buying or selling their company’s stock has proven helpful to investors in decision making. The Securities and Exchange Co ...

PDF - BTR Capital Management

... future growth, such as energy, infrastructure, agriculture, and the continuing emergence of China and the Asian tigers. ...

... future growth, such as energy, infrastructure, agriculture, and the continuing emergence of China and the Asian tigers. ...

March 2015 - Warnke/Nichols Ltd.

... NASDAQ hit intraday lows of 6440, 666, and 1265, respectively. The market has been on a tear ever since, with the S&P 500 (now at 2067) producing returns of over 17% annually in the ensuing 6 years. Such returns are usually only possible following significant declines, which yield above-average retu ...

... NASDAQ hit intraday lows of 6440, 666, and 1265, respectively. The market has been on a tear ever since, with the S&P 500 (now at 2067) producing returns of over 17% annually in the ensuing 6 years. Such returns are usually only possible following significant declines, which yield above-average retu ...

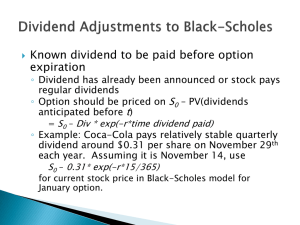

Option Price and Portfolio Simulation

... covariance, compute the associated probability for the VaR ◦ Use sorted time series data to identify the percentile value associated with the desired VaR ◦ Specify probability distributions & correlations for relevant market risk factors and build a simulation model that describes the relationship b ...

... covariance, compute the associated probability for the VaR ◦ Use sorted time series data to identify the percentile value associated with the desired VaR ◦ Specify probability distributions & correlations for relevant market risk factors and build a simulation model that describes the relationship b ...

Stock Market Game Workshop

... 5. Any stock that goes up in price must eventually come back down. 6. Bears, Bulls, and Pigs are found in the stock market. 7. Stock prices are set by the Securities and Exchange Commission, a regulatory agency of the U.S. government. 8. Stock markets are open on business days around the clock, arou ...

... 5. Any stock that goes up in price must eventually come back down. 6. Bears, Bulls, and Pigs are found in the stock market. 7. Stock prices are set by the Securities and Exchange Commission, a regulatory agency of the U.S. government. 8. Stock markets are open on business days around the clock, arou ...

File

... Most investors will purchase stock of a company when they perceive their value is likely to increase. Investors who want to purchase stock, usually use a stockbroker. They are sometimes called brokers For a commission they will buy or sell ...

... Most investors will purchase stock of a company when they perceive their value is likely to increase. Investors who want to purchase stock, usually use a stockbroker. They are sometimes called brokers For a commission they will buy or sell ...

WWI and Over-Production - Mr. Longacre`s US History Website

... fall of stock prices led to a massive selloff that caused them to plummet in value. In a little over two months, the stock market had lost over $40 billion dollars in value (more than the total cost of World War I to the United States). ...

... fall of stock prices led to a massive selloff that caused them to plummet in value. In a little over two months, the stock market had lost over $40 billion dollars in value (more than the total cost of World War I to the United States). ...

Word Version

... “The market had a significant rally post-election, and what it was pricing in was the best-case scenario for all of these pro-growth policies occurring,” Spika said. “To the extent that they don’t and they don’t occur as timely as the market would expect, there’s likely to be some volatility. Our be ...

... “The market had a significant rally post-election, and what it was pricing in was the best-case scenario for all of these pro-growth policies occurring,” Spika said. “To the extent that they don’t and they don’t occur as timely as the market would expect, there’s likely to be some volatility. Our be ...

PPT - Sabrient Systems

... Great for indexing, portfolio weighting, hedging, pairs trading, or absolute return long/short strategies ...

... Great for indexing, portfolio weighting, hedging, pairs trading, or absolute return long/short strategies ...

Curriculum at a Glance Personal Finance 2: Investing and the Stock

... Identify factors that affect personal financial decisions. Explain the opportunity costs associated with personal financial decisions. Understand the time value of money. Identify eight strategies for achieving financial goals at different stages of life. ...

... Identify factors that affect personal financial decisions. Explain the opportunity costs associated with personal financial decisions. Understand the time value of money. Identify eight strategies for achieving financial goals at different stages of life. ...

Portfolio Management

... 1. Technical analysis is simple and straightforward, with tools available to everyone from the seasoned hedge fund manager, to the novice retail trader. In addition, technical tools are easier to interpret than fundamental indicators, the understanding of which usually requires a period of diligent ...

... 1. Technical analysis is simple and straightforward, with tools available to everyone from the seasoned hedge fund manager, to the novice retail trader. In addition, technical tools are easier to interpret than fundamental indicators, the understanding of which usually requires a period of diligent ...

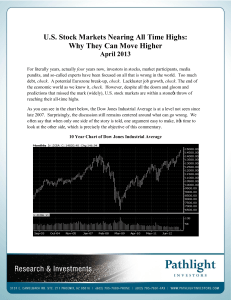

U.S. Stock Markets Nearing All Time Highs: Why They Can Move

... This newsletter is limited to the dissemination of general information pertaining to Pathlight Investors, LLC’s (“Pathlight Investors”) investment advisory services and general economic market conditions. The information contained herein should not be construed as personalized investment advice and ...

... This newsletter is limited to the dissemination of general information pertaining to Pathlight Investors, LLC’s (“Pathlight Investors”) investment advisory services and general economic market conditions. The information contained herein should not be construed as personalized investment advice and ...

Second Half Outlook 2014

... disconnected from earnings growth. Multiple expansion (investors paying a higher price for the same level of earnings) drove gains in all major markets last year with the exception of Japan. This factor has been behind gains in emerging markets, the Eurozone and the U.K. this year, even as earnings ...

... disconnected from earnings growth. Multiple expansion (investors paying a higher price for the same level of earnings) drove gains in all major markets last year with the exception of Japan. This factor has been behind gains in emerging markets, the Eurozone and the U.K. this year, even as earnings ...

Another Year, Another Stock Market Increase

... 1. The results portrayed are model results for the period 4/1/07 to present. Results prior to this date are hypothetical. Piedmont was not managing money prior to 2003. There are limitations inherent in model results, particularly the fact that such results do not represent actual and hypothetical ...

... 1. The results portrayed are model results for the period 4/1/07 to present. Results prior to this date are hypothetical. Piedmont was not managing money prior to 2003. There are limitations inherent in model results, particularly the fact that such results do not represent actual and hypothetical ...

Stock trader

A stock trader or equity trader or share trader is a person or company involved in trading equity securities. Stock traders may be an agent, hedger, arbitrageur, speculator, stockbroker or investor. A stock investor is an individual or company who puts money to use by the purchase of equity securities, offering potential profitable returns, as interest, income, or appreciation in value (capital gains). This buy-and-hold long term strategy is passive in nature, as opposed to speculation, which is typically active in nature. Many stock speculators will trade bonds (and possibly other financial assets) as well. Stock speculation is a risky and complex occupation because the direction of the markets are generally unpredictable and lack transparency, also financial regulators are sometimes unable to adequately detect, prevent and remediate irregularities committed by malicious listed companies or other financial market participants. In addition, the financial markets are usually subjected to speculation.