The Future Value of a Dollar (FVD)

... Risk-return profiles o Low risk = low potential return but stable o High Risk – Potential very high or very low returns, unstable ...

... Risk-return profiles o Low risk = low potential return but stable o High Risk – Potential very high or very low returns, unstable ...

Transition to Management

... common stock is to assume that the dividends will be received over an infinite time horizon – an assumption that is appropriate so long as the firm is considered a “going concern”. ...

... common stock is to assume that the dividends will be received over an infinite time horizon – an assumption that is appropriate so long as the firm is considered a “going concern”. ...

How to Predict the Next Fiasco

... "After Enron, investors realize they have to question every financial statement they get," says Murray Stahl, director of research at Horizon Research, a New York investmentresearch firm. If nothing else, the Enron debacle "will make the issue of accounting very important in the future." Short selle ...

... "After Enron, investors realize they have to question every financial statement they get," says Murray Stahl, director of research at Horizon Research, a New York investmentresearch firm. If nothing else, the Enron debacle "will make the issue of accounting very important in the future." Short selle ...

What Caused the Wall Street Crash of 1929?

... enabled more money to be put into shares, increasing their value. It is said there were many ‘margin millionaire’ investors. They had made huge profits by buying on the margin and watching share prices rise. But, it left investors very exposed when prices fell. These margin millionaires got wiped ou ...

... enabled more money to be put into shares, increasing their value. It is said there were many ‘margin millionaire’ investors. They had made huge profits by buying on the margin and watching share prices rise. But, it left investors very exposed when prices fell. These margin millionaires got wiped ou ...

Main Market – key eligibility criteria

... The Main Market is the London Stock Exchange’s flagship market for large, established companies and our regulated market for listed securities. Issuers of securities admitted to trading on the Main Market are also admitted to the UK Listing Authority’s Official List. There are two listing segments – ...

... The Main Market is the London Stock Exchange’s flagship market for large, established companies and our regulated market for listed securities. Issuers of securities admitted to trading on the Main Market are also admitted to the UK Listing Authority’s Official List. There are two listing segments – ...

світовий валютний ринок forex .аналізйого функціювання

... 1.The object of my master's research is the international currency market FOREX 2. The subject of the master's study is the mechanism of functioning of the global currency market FOREX 3.The purpose of my master's research is the theoretical analysis of functioning of the global currency market FOR ...

... 1.The object of my master's research is the international currency market FOREX 2. The subject of the master's study is the mechanism of functioning of the global currency market FOREX 3.The purpose of my master's research is the theoretical analysis of functioning of the global currency market FOR ...

File - Ryan Reynolds

... Stock Market Crash of October 1929 What led to the Crash ? So much stock is bought “on margin” (on CREDIT) that the VALUE of shares are INFLATED (like a “bubble”), meaning that shares are not WORTH the prices ...

... Stock Market Crash of October 1929 What led to the Crash ? So much stock is bought “on margin” (on CREDIT) that the VALUE of shares are INFLATED (like a “bubble”), meaning that shares are not WORTH the prices ...

st. james investment company investment adviser`s letter

... studied over 66,465 online trading accounts for a period of six years, from 1991 through 1996. They found that the average traderʹs returns were about 6.5% less than the overall market—the average mutual fund manager routinely performs only 4.8% worse than the market. In general, the more a ...

... studied over 66,465 online trading accounts for a period of six years, from 1991 through 1996. They found that the average traderʹs returns were about 6.5% less than the overall market—the average mutual fund manager routinely performs only 4.8% worse than the market. In general, the more a ...

Lecture Notes-1

... THE STAGES FOR STATISTICAL THINKING ARE: 1- DEFINE THE PROBLEM 2- DETERMINE WHAT DATA IS NEEDED 3- SELECT A SAMPLE 4- COLLECT DATA 5- SUMMARIZE AND ANALYZE DATA 6- MAKE INFERENCES AND DECISIONS BASED ON INFORMATION ...

... THE STAGES FOR STATISTICAL THINKING ARE: 1- DEFINE THE PROBLEM 2- DETERMINE WHAT DATA IS NEEDED 3- SELECT A SAMPLE 4- COLLECT DATA 5- SUMMARIZE AND ANALYZE DATA 6- MAKE INFERENCES AND DECISIONS BASED ON INFORMATION ...

Zeitgeist sitting on a powder keg

... The consequence is rather simple: the United States and Europe will lose their export markets which generated growth over the last twenty years. New products and services are not in sight. As is generally known, the high hopes on the Internet burst long ago. Even though Web 2.0 represents a new tool ...

... The consequence is rather simple: the United States and Europe will lose their export markets which generated growth over the last twenty years. New products and services are not in sight. As is generally known, the high hopes on the Internet burst long ago. Even though Web 2.0 represents a new tool ...

FINA 351 – Managerial Finance, Ch. 10 (Ref 10c)

... cover his short trade, and netted a profit of $54,696. He then purchased another 3500 shares of Emulex at a price of $51.82. Later in the day when the hoax was discovered, the price rebounded to $105.75, at which time Mark sold his 3500 shares, netting a profit of $186,815. Mark then made the first ...

... cover his short trade, and netted a profit of $54,696. He then purchased another 3500 shares of Emulex at a price of $51.82. Later in the day when the hoax was discovered, the price rebounded to $105.75, at which time Mark sold his 3500 shares, netting a profit of $186,815. Mark then made the first ...

WAM 8-11-09 Be Wary of Things will be Different This Time

... the ingredients for an explosive upside move in the stock market. This time will not be any different. The six most dangerous words in the stock market are: “Things will be different this time.” Normally this phrase is associated with the tops of markets. However, we are seeing this phrase over and ...

... the ingredients for an explosive upside move in the stock market. This time will not be any different. The six most dangerous words in the stock market are: “Things will be different this time.” Normally this phrase is associated with the tops of markets. However, we are seeing this phrase over and ...

Chapter03 - U of L Class Index

... established, publicly owned companies The primary market - additional shares sold by established, publicly owned companies IPO market - new public offerings by privately ...

... established, publicly owned companies The primary market - additional shares sold by established, publicly owned companies IPO market - new public offerings by privately ...

About - Nasdaq

... biotechnology industries. NASDAQ’s competitive market structure, combined with an extensive portfolio of products and services, attracts today’s largest and fastest growing companies. In fact, more companies now list on NASDAQ than all other major U.S. stock markets. NASDAQ is the fastest growing ma ...

... biotechnology industries. NASDAQ’s competitive market structure, combined with an extensive portfolio of products and services, attracts today’s largest and fastest growing companies. In fact, more companies now list on NASDAQ than all other major U.S. stock markets. NASDAQ is the fastest growing ma ...

Press Release

... platform and a leading Social Trading platform. Social Trading allows retail investors to automatically copy the trades of Top Traders. In recent years, ayondo has won several accolades, including Europe’s leading Financial Technology providers (“FinTech 50”). Other honours include the International ...

... platform and a leading Social Trading platform. Social Trading allows retail investors to automatically copy the trades of Top Traders. In recent years, ayondo has won several accolades, including Europe’s leading Financial Technology providers (“FinTech 50”). Other honours include the International ...

MARE - Stock Market- Exit at Your Own Risk Case for Staying

... negative (redemptions exceeded sales) during the 12-month period to February 28, 2003. However, from that point on throughout the next year, the S&P 500 rallied 35%. In other words, most investors were selling out of equity funds prior to a significant rebound and at exactly the time when they would ...

... negative (redemptions exceeded sales) during the 12-month period to February 28, 2003. However, from that point on throughout the next year, the S&P 500 rallied 35%. In other words, most investors were selling out of equity funds prior to a significant rebound and at exactly the time when they would ...

1 January 2016 Commentary Most major US stock market

... For the fourth quarter of 2015, D.F. Dent portfolios generally picked up after a weak third quarter. Your portfolio’s 4Q15 performance was hurt by stock-specific weakness in the Financials and Consumer Discretionary sectors, offset by strong stock selection within the Information Technology and Indu ...

... For the fourth quarter of 2015, D.F. Dent portfolios generally picked up after a weak third quarter. Your portfolio’s 4Q15 performance was hurt by stock-specific weakness in the Financials and Consumer Discretionary sectors, offset by strong stock selection within the Information Technology and Indu ...

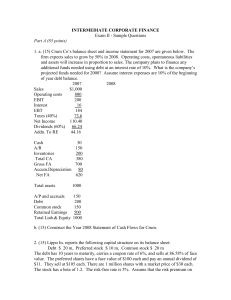

A corporate bond maturing in 5 years carries a 10% coupon rate and

... b. What is the weighted average cost of capital for the firm, if the current capital structure based on market values is the optimal capital structure? 3. (5) Roland & Company has a new management team that has developed an operating plan to improve upon last year's ROE. The new plan would place the ...

... b. What is the weighted average cost of capital for the firm, if the current capital structure based on market values is the optimal capital structure? 3. (5) Roland & Company has a new management team that has developed an operating plan to improve upon last year's ROE. The new plan would place the ...

Chapter 2 Economic Systems and Decision Making Section 1 p. 33

... EC: Bonds are cheap! • Bonds tend to have much lower returns (interest rates) than stocks. • Why would anyone buy bonds at such low interest rates? (4) – Most investors sell their bonds to other investors long before the term is up = quick profit – Other investors are looking for safer (slower) way ...

... EC: Bonds are cheap! • Bonds tend to have much lower returns (interest rates) than stocks. • Why would anyone buy bonds at such low interest rates? (4) – Most investors sell their bonds to other investors long before the term is up = quick profit – Other investors are looking for safer (slower) way ...

Downlaod File

... Fundamental analysis determines the intrinsic value of a stock by focusing and analyzing the company’s published financial statements, business environment, industry, competitors and other economic factors that can influence the supply and demand of the stock. ...

... Fundamental analysis determines the intrinsic value of a stock by focusing and analyzing the company’s published financial statements, business environment, industry, competitors and other economic factors that can influence the supply and demand of the stock. ...

“Games are won by players who focus on the playing field — not by

... grow without investing additional capital in the business. That frees up their capital to pay dividends, buy back stock, or pursue an acquisition while still growing organically. However, most businesses cannot grow without reinvesting capital in new plants, stores, warehouses, trucks or other areas ...

... grow without investing additional capital in the business. That frees up their capital to pay dividends, buy back stock, or pursue an acquisition while still growing organically. However, most businesses cannot grow without reinvesting capital in new plants, stores, warehouses, trucks or other areas ...

Stock trader

A stock trader or equity trader or share trader is a person or company involved in trading equity securities. Stock traders may be an agent, hedger, arbitrageur, speculator, stockbroker or investor. A stock investor is an individual or company who puts money to use by the purchase of equity securities, offering potential profitable returns, as interest, income, or appreciation in value (capital gains). This buy-and-hold long term strategy is passive in nature, as opposed to speculation, which is typically active in nature. Many stock speculators will trade bonds (and possibly other financial assets) as well. Stock speculation is a risky and complex occupation because the direction of the markets are generally unpredictable and lack transparency, also financial regulators are sometimes unable to adequately detect, prevent and remediate irregularities committed by malicious listed companies or other financial market participants. In addition, the financial markets are usually subjected to speculation.