Impact of Macroeconomic Factors on Share Price Index

... valuation of domestic currency or decreased exchange rate (because exchange rate is determined as price of a currency unit calculated based on price of other currency – domestic), so relation between stock price and exchange rate is in the opposite direction. Increased price of domestic assets makes ...

... valuation of domestic currency or decreased exchange rate (because exchange rate is determined as price of a currency unit calculated based on price of other currency – domestic), so relation between stock price and exchange rate is in the opposite direction. Increased price of domestic assets makes ...

LO 3 Explain the accounting for stock investments.

... Valuing and Reporting Investments Trading Securities Companies hold trading securities with the intention of selling them in a short period. Trading means frequent buying and selling. Companies report trading securities at fair value, and report changes from cost as part of net income. ...

... Valuing and Reporting Investments Trading Securities Companies hold trading securities with the intention of selling them in a short period. Trading means frequent buying and selling. Companies report trading securities at fair value, and report changes from cost as part of net income. ...

Document

... The current yield is the ratio of the coupon payment to the price of the bond. The life of a bond is the amount of time left until the ...

... The current yield is the ratio of the coupon payment to the price of the bond. The life of a bond is the amount of time left until the ...

April 14, 2014 - LeBlanc Wealth Management

... debuted in 2013 and focused on measuring the extent to which 50 countries met the non-economic needs of their citizens. The 2014 SPI gauged 54 social, health, and environmental factors across 132 countries, considering only outputs (like literacy) and not inputs (like spending on education). When th ...

... debuted in 2013 and focused on measuring the extent to which 50 countries met the non-economic needs of their citizens. The 2014 SPI gauged 54 social, health, and environmental factors across 132 countries, considering only outputs (like literacy) and not inputs (like spending on education). When th ...

Financialization in the Extreme - Political Economy Research Institute

... Asset markets, conventional theory holds, allow investors to identify and fund those investment projects with the highest risk-adjusted return. Financial markets are efficient in this task, at least in an informational sense. Under conventional theory, they will produce distorted, suboptimal outcome ...

... Asset markets, conventional theory holds, allow investors to identify and fund those investment projects with the highest risk-adjusted return. Financial markets are efficient in this task, at least in an informational sense. Under conventional theory, they will produce distorted, suboptimal outcome ...

Highlights of First Quarter 2007 Accomplishments for

... 3. Increased our small-cap exposure with a small-cap ETF. We are now neutrally weighted small-cap stocks relative to large-cap stocks. 4. Added an actively managed large core equity mutual fund. This fund has been one of the top performers over the last few years and we believe it will fit appropria ...

... 3. Increased our small-cap exposure with a small-cap ETF. We are now neutrally weighted small-cap stocks relative to large-cap stocks. 4. Added an actively managed large core equity mutual fund. This fund has been one of the top performers over the last few years and we believe it will fit appropria ...

Joint stock company

... global market, currency fluctuations, especially LVL/USD, LVL/EUR, USD/EUR and quality of precious scrap metal; and also the limiting laws and regulations in relation to precious metals in various countries. Macroeconomic risk One of the key risks is the impact of macroeconomic processes on the Comp ...

... global market, currency fluctuations, especially LVL/USD, LVL/EUR, USD/EUR and quality of precious scrap metal; and also the limiting laws and regulations in relation to precious metals in various countries. Macroeconomic risk One of the key risks is the impact of macroeconomic processes on the Comp ...

The role of hedge funds (II)

... There are good reasons to doubt the regulated counterparties' ability to impose market discipline on hedge funds, especially when hedge funds have become an important source of their revenue. Fierce competition for prime brokerage business is likely to put pressure on these institutions to compromis ...

... There are good reasons to doubt the regulated counterparties' ability to impose market discipline on hedge funds, especially when hedge funds have become an important source of their revenue. Fierce competition for prime brokerage business is likely to put pressure on these institutions to compromis ...

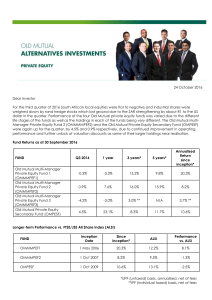

24 October 2016 Dear Investor For the third quarter of 2016 South

... for investors by outperforming inflation by 14.1% per annum since inception in May 2006. OMMMPEF1 has made four cash distribution to date. As investors have had the benefit of receiving cash proceeds from the fund, we believe it more appropriate to calculate the since-inception returns for OMMMPEF1 ...

... for investors by outperforming inflation by 14.1% per annum since inception in May 2006. OMMMPEF1 has made four cash distribution to date. As investors have had the benefit of receiving cash proceeds from the fund, we believe it more appropriate to calculate the since-inception returns for OMMMPEF1 ...

A ten-minute stock game for 1 to 10 players by Ben

... and not use its special power. Using the special power would require you to discard the chip, and you may prefer to score it instead. The exception is in the solitaire (single-player version) game, where you must use all special actions, and as soon as possible for each you draw. Q. Do I ever move t ...

... and not use its special power. Using the special power would require you to discard the chip, and you may prefer to score it instead. The exception is in the solitaire (single-player version) game, where you must use all special actions, and as soon as possible for each you draw. Q. Do I ever move t ...

Active Management: Andrew Slimmon Shares His

... industry, makes these observations about “active share” in an Active Share: What It Is and Isn’t: (a) Timeliness and availability of data may be limited. (b) single point-in-time data make it difficult to discern trends (c) benchmark specification should be appropriate (d) ideally the active share c ...

... industry, makes these observations about “active share” in an Active Share: What It Is and Isn’t: (a) Timeliness and availability of data may be limited. (b) single point-in-time data make it difficult to discern trends (c) benchmark specification should be appropriate (d) ideally the active share c ...

RBGD23 Insert 7_10_17_Fact Sheet

... companies is subject to additional risks, as the share prices of small-cap companies and certain mid-cap companies are often more volatile than those of larger companies due to several factors, including limited trading volumes, products, financial resources, management inexperience and less publicl ...

... companies is subject to additional risks, as the share prices of small-cap companies and certain mid-cap companies are often more volatile than those of larger companies due to several factors, including limited trading volumes, products, financial resources, management inexperience and less publicl ...

Portfolio Risk and return

... money is held. Therefore, bonds with identical risk, liquidity, and tax characteristics may have different interest rates because the time remaining to maturity is different. The interest rates can be graphically illustrated on a yield curve. The Yield curve is a plot of the yields on bonds with dif ...

... money is held. Therefore, bonds with identical risk, liquidity, and tax characteristics may have different interest rates because the time remaining to maturity is different. The interest rates can be graphically illustrated on a yield curve. The Yield curve is a plot of the yields on bonds with dif ...

AB-ICI: Some Recovery in Sentiment - Alfa-Bank

... The contents of this document have been prepared by Open Joint Stock Company Alfa Bank ("Alfa Bank"), as Investment Research within the meaning of Article 24 of Commission Directive 2006/73/EC implementing the Markets in Financial Instruments Directive 2004/39/EC ("MiFID"). Alfa Capital Markets ("AC ...

... The contents of this document have been prepared by Open Joint Stock Company Alfa Bank ("Alfa Bank"), as Investment Research within the meaning of Article 24 of Commission Directive 2006/73/EC implementing the Markets in Financial Instruments Directive 2004/39/EC ("MiFID"). Alfa Capital Markets ("AC ...

banking sector consolidation and stock market performance

... Nigeria was discussed, some literatures were reviewed ,past challenges in the capital market, consolidation exercise between 2004 and 2009 were looked into. The secondary source of data was used to analyze if there was any significant relationship between the banking sector consolidation and stock m ...

... Nigeria was discussed, some literatures were reviewed ,past challenges in the capital market, consolidation exercise between 2004 and 2009 were looked into. The secondary source of data was used to analyze if there was any significant relationship between the banking sector consolidation and stock m ...

Financial Literacy Notes

... government regulations and global economic and environmental conditions, etc. 16. Using key investing principles one can achieve the goal of increasing net worth. 17. Investment strategies must take several factors into consideration including the time horizon of the investment, the degree of divers ...

... government regulations and global economic and environmental conditions, etc. 16. Using key investing principles one can achieve the goal of increasing net worth. 17. Investment strategies must take several factors into consideration including the time horizon of the investment, the degree of divers ...

SEC amends Rule 2a-7 to eliminate dependency on NRSRO ratings

... Under amended Rule 2a-7, the SEC revised the definition of Eligible Security to eliminate the reliance on NRSRO ratings to establish eligibility and, consequently, eliminated NRSRO-dependent categorization of Eligible Securities as First Tier or Second Tier securities. Rather than rely on NRSRO rati ...

... Under amended Rule 2a-7, the SEC revised the definition of Eligible Security to eliminate the reliance on NRSRO ratings to establish eligibility and, consequently, eliminated NRSRO-dependent categorization of Eligible Securities as First Tier or Second Tier securities. Rather than rely on NRSRO rati ...

Document

... Used k-means cluster to create virtual clusters 11 clusters for 300/500 stock universe and 10 clusters for 100 stock universe Input: β, Market Cap (Liquidity), P/E (Price/Earning) ...

... Used k-means cluster to create virtual clusters 11 clusters for 300/500 stock universe and 10 clusters for 100 stock universe Input: β, Market Cap (Liquidity), P/E (Price/Earning) ...

stock market transactions

... placed an order to sell 100 shares of Vizer stock. Since he did not have shares of Vizer to sell, this transaction was a short sale. Vizer stock does not pay dividends, so Ed did not have to cover dividend payments for the stock that his brokerage firm borrowed and sold for him. The sale of the stoc ...

... placed an order to sell 100 shares of Vizer stock. Since he did not have shares of Vizer to sell, this transaction was a short sale. Vizer stock does not pay dividends, so Ed did not have to cover dividend payments for the stock that his brokerage firm borrowed and sold for him. The sale of the stoc ...

Land Market - Property News

... Nowadays the investments are planned short-term – they are expected to begin and end within 5 years due to less stable situation on the market. If there are any problems with the site that can be solved in a relatively short time, a conditioned preliminary sales agreement is concluded. ...

... Nowadays the investments are planned short-term – they are expected to begin and end within 5 years due to less stable situation on the market. If there are any problems with the site that can be solved in a relatively short time, a conditioned preliminary sales agreement is concluded. ...

Overview Real Versus Financial Assets

... – Limited liability – In case of default, last in line ...

... – Limited liability – In case of default, last in line ...

Equity Linked Debentures

... So what are ELD’s? • An ELD is a form of a fixed income product. • It differs from standard fixed-income product as the final payout is also based on the return of the underlying equity, which can be a set of stocks, basket of stocks or an equity index (all predefined) ...

... So what are ELD’s? • An ELD is a form of a fixed income product. • It differs from standard fixed-income product as the final payout is also based on the return of the underlying equity, which can be a set of stocks, basket of stocks or an equity index (all predefined) ...

Shift Happens

... equilibrium-based models with caution. Linear models may have important simpl ifying assumptions that do not jibe well with how the world actually works. Theory Laid Out Capital market theory, largely developed over the past 50 years, rests on a few key points. These include efficient markets, rando ...

... equilibrium-based models with caution. Linear models may have important simpl ifying assumptions that do not jibe well with how the world actually works. Theory Laid Out Capital market theory, largely developed over the past 50 years, rests on a few key points. These include efficient markets, rando ...

The Quantitative, Data-Based, Risk

... the more the fund company made, no matter how well (or poorly) the fund performed. As hedge funds evolved, Jones's essential structure stuck. Hedge-fund managers made sure their investors were both wealthy and few in number; these days, the rules allow them to have up to 500 ''qualified'' investors ...

... the more the fund company made, no matter how well (or poorly) the fund performed. As hedge funds evolved, Jones's essential structure stuck. Hedge-fund managers made sure their investors were both wealthy and few in number; these days, the rules allow them to have up to 500 ''qualified'' investors ...

Future of Cooperatives: A Corporate Perspective

... group with common interests will have a much easier time to reach a good decision than a group with highly divergent interests. The latter may not reach any decision at all, or reach poor compromises that waste a lot of social surplus. Consequently, while voice might be of value, because exit option ...

... group with common interests will have a much easier time to reach a good decision than a group with highly divergent interests. The latter may not reach any decision at all, or reach poor compromises that waste a lot of social surplus. Consequently, while voice might be of value, because exit option ...

Stock trader

A stock trader or equity trader or share trader is a person or company involved in trading equity securities. Stock traders may be an agent, hedger, arbitrageur, speculator, stockbroker or investor. A stock investor is an individual or company who puts money to use by the purchase of equity securities, offering potential profitable returns, as interest, income, or appreciation in value (capital gains). This buy-and-hold long term strategy is passive in nature, as opposed to speculation, which is typically active in nature. Many stock speculators will trade bonds (and possibly other financial assets) as well. Stock speculation is a risky and complex occupation because the direction of the markets are generally unpredictable and lack transparency, also financial regulators are sometimes unable to adequately detect, prevent and remediate irregularities committed by malicious listed companies or other financial market participants. In addition, the financial markets are usually subjected to speculation.