OTE (Hellenic Telecoms)

... to any other persons. Each person that receives a copy by acceptance thereof represents and agrees that it will not distribute or provide it to any other person. This report is not an offer to buy or sell or a solicitation of an offer to buy or sell securities mentioned herein. The investments discu ...

... to any other persons. Each person that receives a copy by acceptance thereof represents and agrees that it will not distribute or provide it to any other person. This report is not an offer to buy or sell or a solicitation of an offer to buy or sell securities mentioned herein. The investments discu ...

Competitive Analysis of On-line Securities Investment

... ones, are between a pair of upper and lower bounds, no matter how erratically or unfortunately the rates vary from day to day. Xu et al.[7] further studied the same setting in a framework with commission and interest rate. Chou[8] investigated the bidirectional currency trading problem against a wea ...

... ones, are between a pair of upper and lower bounds, no matter how erratically or unfortunately the rates vary from day to day. Xu et al.[7] further studied the same setting in a framework with commission and interest rate. Chou[8] investigated the bidirectional currency trading problem against a wea ...

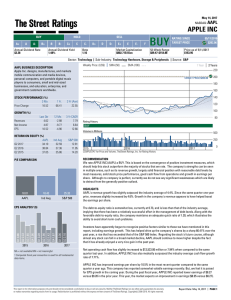

APPLE INC - TheStreet

... should help this stock outperform the majority of stocks that we rate. The company's strengths can be seen in multiple areas, such as its revenue growth, largely solid financial position with reasonable debt levels by most measures, solid stock price performance, good cash flow from operations and g ...

... should help this stock outperform the majority of stocks that we rate. The company's strengths can be seen in multiple areas, such as its revenue growth, largely solid financial position with reasonable debt levels by most measures, solid stock price performance, good cash flow from operations and g ...

2016 Capital Market Projections

... This chart articulates the asset mix and associated risk needed in order to achieve an expected 7.5% return at different points in history. ● Over time, achieving a 7.5% return has necessitated the assumption of three times the risk (standard deviation) ● Reality is that investors have had to make a ...

... This chart articulates the asset mix and associated risk needed in order to achieve an expected 7.5% return at different points in history. ● Over time, achieving a 7.5% return has necessitated the assumption of three times the risk (standard deviation) ● Reality is that investors have had to make a ...

Word - HIMIPref

... portfolios. As discussed in the publication Why Invest in Preferred Shares (available online at www.himivest.com/WhyPreferred.pdf) the after-tax return to an investor in Ontario’s highest marginal tax-bracket has historically been about 50bp higher through an investment in preferred shares vs. corpo ...

... portfolios. As discussed in the publication Why Invest in Preferred Shares (available online at www.himivest.com/WhyPreferred.pdf) the after-tax return to an investor in Ontario’s highest marginal tax-bracket has historically been about 50bp higher through an investment in preferred shares vs. corpo ...

Getting started in shares - African Securities Exchanges Association

... • “The story”- what the company does & what its outlook is (e.g. Pick ’n Pay is a supermarket chain. The outlook could be good for the economy and hence for personal spending could lead to more purchases at Pick ’n Pay hence the profits could be up and hence the share price could go up as well) • “T ...

... • “The story”- what the company does & what its outlook is (e.g. Pick ’n Pay is a supermarket chain. The outlook could be good for the economy and hence for personal spending could lead to more purchases at Pick ’n Pay hence the profits could be up and hence the share price could go up as well) • “T ...

Facing Pressure to Cut Costs, Fifth Third CEO Plays the Long Game

... The company plans to spend roughly $60 million this year to digitize its branches, upgrade its loan origination system and invest in new frauddetection software. It also plans to invest $75 million on compliance systems and personnel. Carmichael could not comment for this article because Fifth Thir ...

... The company plans to spend roughly $60 million this year to digitize its branches, upgrade its loan origination system and invest in new frauddetection software. It also plans to invest $75 million on compliance systems and personnel. Carmichael could not comment for this article because Fifth Thir ...

REVISED March 24.09 Presentation

... Why are institutional investors moving to Private Equity? Moving away from inconsistent public markets. Pro-actively diversifying by looking for consistent return. Institutional Allocations to Private Equity (as a % of total portfolio) ...

... Why are institutional investors moving to Private Equity? Moving away from inconsistent public markets. Pro-actively diversifying by looking for consistent return. Institutional Allocations to Private Equity (as a % of total portfolio) ...

CHAPTER 1: INTRODUCTION

... Later, however, options were increasingly used by speculators who found that call options were an effective vehicle for obtaining maximum possible gains on investment. As long as tulip prices continued to skyrocket, a call buyer would realize returns far in excess of those that could be obtained b ...

... Later, however, options were increasingly used by speculators who found that call options were an effective vehicle for obtaining maximum possible gains on investment. As long as tulip prices continued to skyrocket, a call buyer would realize returns far in excess of those that could be obtained b ...

treasurer- manager responsible for financing, cash management

... Borrowing and Lending. Financial institutions allow individuals to transfer expenditures across time. If you have more money now than you need and you wish to save for a rainy day, you can (for example) put the money on deposit in a bank. If you wish to anticipate some of your future income to buy ...

... Borrowing and Lending. Financial institutions allow individuals to transfer expenditures across time. If you have more money now than you need and you wish to save for a rainy day, you can (for example) put the money on deposit in a bank. If you wish to anticipate some of your future income to buy ...

Ethics of the Financial Professional

... 2.2.1. Example: A portfolio manager must give the same consideration to the portfolio of family members as the portfolio of small, individual investors. 3. Why are Ethics Important? 3.1. They act as a _____________________________________________________________ . 3.2. Ethical business practices giv ...

... 2.2.1. Example: A portfolio manager must give the same consideration to the portfolio of family members as the portfolio of small, individual investors. 3. Why are Ethics Important? 3.1. They act as a _____________________________________________________________ . 3.2. Ethical business practices giv ...

Helping CTAs Blossom in Today`s Competitive Environment (Oct

... We will make sure every one of the CTA accounts across any and all FCMs will receive their respective trades. We then reconcile accounts for accuracy in elements such as positions, equity, margins and fees. Most importantly, we customise position and equity reports to the specs required by the CTA. ...

... We will make sure every one of the CTA accounts across any and all FCMs will receive their respective trades. We then reconcile accounts for accuracy in elements such as positions, equity, margins and fees. Most importantly, we customise position and equity reports to the specs required by the CTA. ...

Markets Update - Salford City Council

... Place and other Council assets to them. F:ps-marketsupdate ...

... Place and other Council assets to them. F:ps-marketsupdate ...

Global Capital Markets - An Updated Profile

... the latter as a combination of international elements (usually referred to as crossborder or open border, depending on the analyst’s contra- or pro-globalization stand) and transnational elements (sometimes called transborder transactions, like transworld banking or transworld securities, where dist ...

... the latter as a combination of international elements (usually referred to as crossborder or open border, depending on the analyst’s contra- or pro-globalization stand) and transnational elements (sometimes called transborder transactions, like transworld banking or transworld securities, where dist ...

Unless otherwise defined herein, capitalised terms

... Unless otherwise defined herein, capitalised terms used in this announcement shall have the same respective meanings as those defined in the prospectus dated 29 September 2016 (the “Prospectus”) issued by IBI Group Holdings Limited (the “Company”). Hong Kong Exchanges and Clearing Limited, The Stock ...

... Unless otherwise defined herein, capitalised terms used in this announcement shall have the same respective meanings as those defined in the prospectus dated 29 September 2016 (the “Prospectus”) issued by IBI Group Holdings Limited (the “Company”). Hong Kong Exchanges and Clearing Limited, The Stock ...

2017-Wiley-CPAexcel - Wiley Efficient Learning

... Hedging Asset/Liability, Available-for-Sale, or Foreign Operations ...

... Hedging Asset/Liability, Available-for-Sale, or Foreign Operations ...

fundamental analysis as a method of share valuation in comparison

... As the stock market is highly volatile and take the forms of bullish and bearish trends, the survey shows that nearly 84 per cent of the respondents rely upon technical indicators when the market is bullish. Close to 61 per cent of the respondents take positions based on Fundamental anlysis when the ...

... As the stock market is highly volatile and take the forms of bullish and bearish trends, the survey shows that nearly 84 per cent of the respondents rely upon technical indicators when the market is bullish. Close to 61 per cent of the respondents take positions based on Fundamental anlysis when the ...

Student Response Sheet

... The family has decided to start investing money to create more savings for the twins’ college tuition. They have $1500 and are trying to decide in which stocks to invest. Using current stock market data, calculate the money they made or lost during the week. Use this information to determine in whic ...

... The family has decided to start investing money to create more savings for the twins’ college tuition. They have $1500 and are trying to decide in which stocks to invest. Using current stock market data, calculate the money they made or lost during the week. Use this information to determine in whic ...

Risk Management and Financial Institutions

... block of securities and obtains shares in the fund Shares are traded on an exchange Large institutional investors can exchange shares in the fund for the underlying assets, and vice versa This keeps the share price close to the NAV of the fund’s investments ...

... block of securities and obtains shares in the fund Shares are traded on an exchange Large institutional investors can exchange shares in the fund for the underlying assets, and vice versa This keeps the share price close to the NAV of the fund’s investments ...

Mutual Funds - Iowa State University Extension and Outreach

... However, the choices can be mind-boggling. “There are more mutual funds to choose from than there are stocks listed on the New York Stock Exchange. To narrow your search look at financial magazines and Web sites that evaluate funds. Then read the fund’s prospectus. This is a document a mutual fund c ...

... However, the choices can be mind-boggling. “There are more mutual funds to choose from than there are stocks listed on the New York Stock Exchange. To narrow your search look at financial magazines and Web sites that evaluate funds. Then read the fund’s prospectus. This is a document a mutual fund c ...

The Determinants of Stock Market Development

... alternative method of intermediation is through equity financing. This is only possible through the development of capital markets. Capital markets, which deal with securities such as stocks and bonds, are associated with financial resource mobilization on a long term basis. By raising capital direc ...

... alternative method of intermediation is through equity financing. This is only possible through the development of capital markets. Capital markets, which deal with securities such as stocks and bonds, are associated with financial resource mobilization on a long term basis. By raising capital direc ...

Stock trader

A stock trader or equity trader or share trader is a person or company involved in trading equity securities. Stock traders may be an agent, hedger, arbitrageur, speculator, stockbroker or investor. A stock investor is an individual or company who puts money to use by the purchase of equity securities, offering potential profitable returns, as interest, income, or appreciation in value (capital gains). This buy-and-hold long term strategy is passive in nature, as opposed to speculation, which is typically active in nature. Many stock speculators will trade bonds (and possibly other financial assets) as well. Stock speculation is a risky and complex occupation because the direction of the markets are generally unpredictable and lack transparency, also financial regulators are sometimes unable to adequately detect, prevent and remediate irregularities committed by malicious listed companies or other financial market participants. In addition, the financial markets are usually subjected to speculation.