... conditions of international capital mobility. A first part looks at the traditional view of inflation and payments problems as a reflection of fiscal problems and deficit finance. From there the analysis proceeds to the macro—dynamics of inflation stabilization under alternative polciy regimes. Infl ...

Understanding Spanish Financial crises, 1850-2000

... more likely when the capital account is liberalised or a country receives large capital inflows. Bordo, Meissner, and Stuckler (2010) and Bordo and Meissner (2011), using a set of 19 countries for the first wave of globalisation (1880-1913) and 49 countries for the second wave (1973-2003), obtained ...

... more likely when the capital account is liberalised or a country receives large capital inflows. Bordo, Meissner, and Stuckler (2010) and Bordo and Meissner (2011), using a set of 19 countries for the first wave of globalisation (1880-1913) and 49 countries for the second wave (1973-2003), obtained ...

DRAFT September 8, 2010

... Flows of workers’ remittances appear to have been increasing sharply in magnitude during recent years. While related impressionistic evidence suggests that most of this increase is real, it is not possible to assess its magnitude conclusively, because part of the increase in recorded flows may simpl ...

... Flows of workers’ remittances appear to have been increasing sharply in magnitude during recent years. While related impressionistic evidence suggests that most of this increase is real, it is not possible to assess its magnitude conclusively, because part of the increase in recorded flows may simpl ...

Modelling the rand and commodity prices: A Granger causality and

... commodity prices. Using the Engle-Granger cointegration methodology, he finds that the variables exhibit dual causality and negative correlation (-0.8952), with the significantly stronger causality running from commodity prices to the exchange rate, findings consistent with Chen and Rogoff (2003). A ...

... commodity prices. Using the Engle-Granger cointegration methodology, he finds that the variables exhibit dual causality and negative correlation (-0.8952), with the significantly stronger causality running from commodity prices to the exchange rate, findings consistent with Chen and Rogoff (2003). A ...

Economic Outlook Presentation to Workers’ Compensation Trust

... banknotes, bury them at suitable depths in disused coal mines … It would, indeed, be more sensible to build houses and the like; but if there are political and practical difficulties in the way of this, the above would be better than nothing.” (Keynes, General Theory, 1937) Tuesday, May 23, 2017 ...

... banknotes, bury them at suitable depths in disused coal mines … It would, indeed, be more sensible to build houses and the like; but if there are political and practical difficulties in the way of this, the above would be better than nothing.” (Keynes, General Theory, 1937) Tuesday, May 23, 2017 ...

Shocked by the world! Introducing the three block open economy FAVAR ∗

... Reserve Bank of New Zealand. Email: [email protected] ...

... Reserve Bank of New Zealand. Email: [email protected] ...

Real exchange rates and international co-movement: news

... We develop a two-country, complete-market model with non-tradables that is able to reconcile these facts in a theoretical economy driven by sectoral productivity shocks. The main contribution of our work is to propose an alternative explanation to the Backus-Smith puzzle based on two main channels: ...

... We develop a two-country, complete-market model with non-tradables that is able to reconcile these facts in a theoretical economy driven by sectoral productivity shocks. The main contribution of our work is to propose an alternative explanation to the Backus-Smith puzzle based on two main channels: ...

Optimal Monetary and Fiscal Policy at the Zero Lower Bound in a

... outcomes. This is the case for a negative preference shock, as we described above. This finding is striking as one might expect the central bank to promise an even higher home inflation, compared to current levels, when current outcomes are worse. This result highlights a new dynamic open economy ch ...

... outcomes. This is the case for a negative preference shock, as we described above. This finding is striking as one might expect the central bank to promise an even higher home inflation, compared to current levels, when current outcomes are worse. This result highlights a new dynamic open economy ch ...

On the trade impact of nominal exchange rate volatility

... Fourth, there is significant measurement error in official statistics on nominal exchange rates, and hence in the corresponding measures of variability.8 In this paper, I argue that partial corrections of the different biases can lead to misleading answers, and that all biases should be tackled simu ...

... Fourth, there is significant measurement error in official statistics on nominal exchange rates, and hence in the corresponding measures of variability.8 In this paper, I argue that partial corrections of the different biases can lead to misleading answers, and that all biases should be tackled simu ...

NBER WORKING PAPER SERIES AND THE REAL EXCHANGE RATE

... that follows an increase in public consumption. Within this framework, an increase in government purchases produces an expansion in aggregate demand that drives interest rates up. In turn, the elevated level of interest rates attracts foreign capital inflows, which increase the demand for domestic c ...

... that follows an increase in public consumption. Within this framework, an increase in government purchases produces an expansion in aggregate demand that drives interest rates up. In turn, the elevated level of interest rates attracts foreign capital inflows, which increase the demand for domestic c ...

Monetary Policy Frameworks in the SAARC

... monetary policy among all countries. Almost all of them have indirect instruments of monetary policy, such as the open market operations, cash reserve requirement and standing facilities, in their use. However, the devil is in the details. Many of the countries are still targeting reserve money, whi ...

... monetary policy among all countries. Almost all of them have indirect instruments of monetary policy, such as the open market operations, cash reserve requirement and standing facilities, in their use. However, the devil is in the details. Many of the countries are still targeting reserve money, whi ...

Basic Exchange Rate Theories

... curve QM is drawn downward sloping in Figure 1.2, which implicitly assumes that the value effect of a rise in Q , which given the import level ( M say) raises the term QM , is more than compensated by the volume effect of the fall in imports M caused by the increase in the real exchange rate. In gen ...

... curve QM is drawn downward sloping in Figure 1.2, which implicitly assumes that the value effect of a rise in Q , which given the import level ( M say) raises the term QM , is more than compensated by the volume effect of the fall in imports M caused by the increase in the real exchange rate. In gen ...

This PDF is a selection from an out-of-print volume from... of Economic Research Volume Title: Currency Crises

... given to GDP-weighted leaver and stayer aggregates. However, these aggregates disguise diversity; just as Nickell’s (1997) analysis of structural unemployment in Europe remarks on the diversity of experience within Europe, so our analysis uncovers a wide range of experience among the leavers, and to ...

... given to GDP-weighted leaver and stayer aggregates. However, these aggregates disguise diversity; just as Nickell’s (1997) analysis of structural unemployment in Europe remarks on the diversity of experience within Europe, so our analysis uncovers a wide range of experience among the leavers, and to ...

NBER WORKING PAPER SERIES SHARING THE BURDEN: David Cook

... the home economy. Overall, it is best for both countries to have higher interest rates in the trading partner, when the source country shock requires zero home interest rates. Our results in fact show that the response of policy interest rates in a global liquidity trap are piecewise functions of t ...

... the home economy. Overall, it is best for both countries to have higher interest rates in the trading partner, when the source country shock requires zero home interest rates. Our results in fact show that the response of policy interest rates in a global liquidity trap are piecewise functions of t ...

Expanding the Central Bank mandate in the “Soy Republic”

... Figure 2.3: Provincial map and agro-ecological map of Argentina. .................. 17 Figure 2.4: Evolution of the area planted with soybeans, 1970/1971-2011/2012, and rates of expansion pre- and post-1996/1997 .................................... 23 Figure 2.5: Comparison of soy production by ...

... Figure 2.3: Provincial map and agro-ecological map of Argentina. .................. 17 Figure 2.4: Evolution of the area planted with soybeans, 1970/1971-2011/2012, and rates of expansion pre- and post-1996/1997 .................................... 23 Figure 2.5: Comparison of soy production by ...

Competitiveness and its leverage in a currency union

... members also trade with countries outside the currency union, their “apparent” competitiveness is also important in determining their trade balance vis-a-vis their trading partners outside the currency union. In the case of a currency union, unlike the previous case of freely floating exchange rates ...

... members also trade with countries outside the currency union, their “apparent” competitiveness is also important in determining their trade balance vis-a-vis their trading partners outside the currency union. In the case of a currency union, unlike the previous case of freely floating exchange rates ...

Effects of monetary policy on the $ / £ exchange rate. Is there a

... the US (indicated by ∗ ): the inflation differential πtd = πt − πt∗ , the output gap differential, ytd = yt − yt∗ , the 3-month interest rate spread idt = it − i∗t , the 10-year government bond yield spread rtd = rt − rt∗ , and the nominal exchange rate, et , itself. Of particular interest to this p ...

... the US (indicated by ∗ ): the inflation differential πtd = πt − πt∗ , the output gap differential, ytd = yt − yt∗ , the 3-month interest rate spread idt = it − i∗t , the 10-year government bond yield spread rtd = rt − rt∗ , and the nominal exchange rate, et , itself. Of particular interest to this p ...

The Eurosystem`s bond purchases and the exchange rate of the

... The Eurosystem’s bond purchases and the exchange rate of the euro In January 2015, the Governing Council of the ECB announced an expanded asset purchase programme (APP) and thereafter twice extended its duration besides increasing the monthly volume of purchases. The aim of the programme is to bring ...

... The Eurosystem’s bond purchases and the exchange rate of the euro In January 2015, the Governing Council of the ECB announced an expanded asset purchase programme (APP) and thereafter twice extended its duration besides increasing the monthly volume of purchases. The aim of the programme is to bring ...

Monetary Conditions in the Euro Area

... considered to be important, it is tempting for the reader to conclude that economic activity will accelerate once the transmission process from a monetary impulse to the real sphere has run its course in stimulating aggregate demand. This paper takes a closer look at the leading indicator qualities ...

... considered to be important, it is tempting for the reader to conclude that economic activity will accelerate once the transmission process from a monetary impulse to the real sphere has run its course in stimulating aggregate demand. This paper takes a closer look at the leading indicator qualities ...

The Wizard Test Maker

... unemployment in the short-run and long-run respectively? (A) Increase in the short-run, decrease in the long-run. (B) Unaffected in the short-run, decrease in the long-run. (C) Increase in the short-run, increase in the long-run. (D) Increase in the short-run, unaffected in the long-run. (E) Decreas ...

... unemployment in the short-run and long-run respectively? (A) Increase in the short-run, decrease in the long-run. (B) Unaffected in the short-run, decrease in the long-run. (C) Increase in the short-run, increase in the long-run. (D) Increase in the short-run, unaffected in the long-run. (E) Decreas ...

S0900783_en.pdf

... The most damaging effects of international capital movements occur when, after a period of sustained and large capital inflows into an economy, there is a sudden reversal of such flows implying an interruption of external financing (sudden stop).3 While sudden outflows can affect all forms of foreig ...

... The most damaging effects of international capital movements occur when, after a period of sustained and large capital inflows into an economy, there is a sudden reversal of such flows implying an interruption of external financing (sudden stop).3 While sudden outflows can affect all forms of foreig ...

foreign exchange risk

... objectives can lead to possibly conflicting and costly actions on the part of employees. Although many firms do have objectives, their goals are often so vague and simplistic (e.g., “eliminate all exposure” or “minimize reported foreign exchange losses”) that they provide little realistic guidance t ...

... objectives can lead to possibly conflicting and costly actions on the part of employees. Although many firms do have objectives, their goals are often so vague and simplistic (e.g., “eliminate all exposure” or “minimize reported foreign exchange losses”) that they provide little realistic guidance t ...

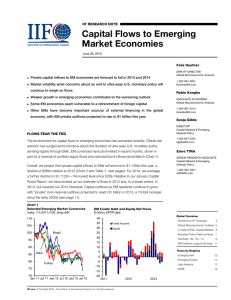

Capital Flows to Emerging Market Economies

... policy in Japan. Additionally, growth in emerging economies has lost some momentum recently, while growth prospects in mature economies have brightened somewhat, thus reducing the relative attractiveness for developed market investors to move capital abroad. Our baseline forecast for capital flows a ...

... policy in Japan. Additionally, growth in emerging economies has lost some momentum recently, while growth prospects in mature economies have brightened somewhat, thus reducing the relative attractiveness for developed market investors to move capital abroad. Our baseline forecast for capital flows a ...

Foreign-exchange reserves

Foreign-exchange reserves (also called forex reserves or FX reserves) are assets held by a central bank or other monetary authority, usually in various reserve currencies, mostly the United States dollar, and to a lesser extent the euro, the pound sterling, and the Japanese yen, and used to back its liabilities—e.g., the local currency issued, and the various bank reserves deposited with the central bank by the government or by financial institutions.