PDF format

... 10. The applicant feels aggrieved that the respondent used ABSA bank’s conversion rate to fulfil the agreement. The correct rate would have been the indicative rate of the Reserve bank. This is however not the official rate of South Africa and I am not inclined to declare it as such. The reserve ba ...

... 10. The applicant feels aggrieved that the respondent used ABSA bank’s conversion rate to fulfil the agreement. The correct rate would have been the indicative rate of the Reserve bank. This is however not the official rate of South Africa and I am not inclined to declare it as such. The reserve ba ...

CAN

... currencies. But was is special in the EEC is that the region is not a coimnon currency area. Individual countries have different currencies and are also much more open than the region as a whole. Even before the creation of the customs union the share of imports in GDP was as high as 40 percent in B ...

... currencies. But was is special in the EEC is that the region is not a coimnon currency area. Individual countries have different currencies and are also much more open than the region as a whole. Even before the creation of the customs union the share of imports in GDP was as high as 40 percent in B ...

Adjustment Under Fixed Exchange Rates

... area, two conditions must be satisfied: The countries experience similar shocks; thus, can choose roughly the same monetary policy. Countries have high factor mobility, which allow countries to adjust to shocks. A common currency, such as the Euro, allows countries to lower the transaction costs ...

... area, two conditions must be satisfied: The countries experience similar shocks; thus, can choose roughly the same monetary policy. Countries have high factor mobility, which allow countries to adjust to shocks. A common currency, such as the Euro, allows countries to lower the transaction costs ...

The Flexible Model, Gold Dinar and Exchange Rate Determination

... a) Low inflation, stable exchange rates, relatively rapid economic growth and less real instability than in the interwar period (Bordo 1981, 1993). It also was an era of rapidly expanding international trade in commodities, services and factors production (Bordo, 1999). This favorable economic perfo ...

... a) Low inflation, stable exchange rates, relatively rapid economic growth and less real instability than in the interwar period (Bordo 1981, 1993). It also was an era of rapidly expanding international trade in commodities, services and factors production (Bordo, 1999). This favorable economic perfo ...

36 - CERGE-EI

... Euroland average then monetary policy will be too tight for that country’s economic conditions. • If a country’s inflation rate is above average then monetary policy will be too loose for that country’s economic conditions. Copyright © 2010 Cengage Learning ...

... Euroland average then monetary policy will be too tight for that country’s economic conditions. • If a country’s inflation rate is above average then monetary policy will be too loose for that country’s economic conditions. Copyright © 2010 Cengage Learning ...

A Melton William and

... Three aspects of interest rate behavior are considered here. These are the volatility of interest rates, the response of interest rates to weekly MI announcements, and the response of interest rates to new information about inflation, economic activity, and exchange rates. Differences in the volatil ...

... Three aspects of interest rate behavior are considered here. These are the volatility of interest rates, the response of interest rates to weekly MI announcements, and the response of interest rates to new information about inflation, economic activity, and exchange rates. Differences in the volatil ...

FRBSF E L CONOMIC ETTER

... of currency mismatches in their balance sheets: a big depreciation would result in significant capital losses for foreign banks that hold a large fraction of their reserves in dollars. For developing countries, this would be particularly problematic because they use these reserves as a buffer to pro ...

... of currency mismatches in their balance sheets: a big depreciation would result in significant capital losses for foreign banks that hold a large fraction of their reserves in dollars. For developing countries, this would be particularly problematic because they use these reserves as a buffer to pro ...

Chapter 22

... b. or competition for trade with a common third partner (ex. East Asia’s trade with Japan) 2. Integrated financial markets a. Banks are interconnected through loans (Mexican Banks were extending trade credit to Costa Rican banks prior to the 1994 crisis) b. Interconnection through bond holdings. (Ko ...

... b. or competition for trade with a common third partner (ex. East Asia’s trade with Japan) 2. Integrated financial markets a. Banks are interconnected through loans (Mexican Banks were extending trade credit to Costa Rican banks prior to the 1994 crisis) b. Interconnection through bond holdings. (Ko ...

Fundamentals, Contagion and Currency Crises

... was popularised by Eichengreen, Rose and Wyplosz (1995). Using quarterly data for members of the exchange rate mechanism (ERM ) of the European Monetary Union, and nonERM developing countries, they compare the behaviour of macroeconomic variables during periods of speculative pressure to the behavio ...

... was popularised by Eichengreen, Rose and Wyplosz (1995). Using quarterly data for members of the exchange rate mechanism (ERM ) of the European Monetary Union, and nonERM developing countries, they compare the behaviour of macroeconomic variables during periods of speculative pressure to the behavio ...

Can macroeconomic indicators predict a currency crisis? Evidence

... dollars); (15) the level of M2 to reserves and (16) the ratio of current account to GDP. All indicators except (5), (7), and (10) are defined as the percentage change in the variables. The excess real M1 balances are defined as the residuals from a regression of real M1 balances on real GDP, inflati ...

... dollars); (15) the level of M2 to reserves and (16) the ratio of current account to GDP. All indicators except (5), (7), and (10) are defined as the percentage change in the variables. The excess real M1 balances are defined as the residuals from a regression of real M1 balances on real GDP, inflati ...

Chapter 19

... be an increase in the demand for dollars. Foreigners will be more interested in purchasing U.S. assets (and less interested in purchasing their own assets) and therefore, at any given exchange rate, they will be more interested in purchasing dollars. The demand curve for dollars will shift to the ri ...

... be an increase in the demand for dollars. Foreigners will be more interested in purchasing U.S. assets (and less interested in purchasing their own assets) and therefore, at any given exchange rate, they will be more interested in purchasing dollars. The demand curve for dollars will shift to the ri ...

Global Economic Prospects and Principles for Policy Exit

... monetary and fiscal policies could undermine the nascent rebound, as the policyinduced rebound could be mistaken for a strong and durable recovery. Financial strains could also reemerge if the recovery falters and efforts to restore health to bank balance sheets are not forcefully implemented. Hence ...

... monetary and fiscal policies could undermine the nascent rebound, as the policyinduced rebound could be mistaken for a strong and durable recovery. Financial strains could also reemerge if the recovery falters and efforts to restore health to bank balance sheets are not forcefully implemented. Hence ...

the determination of exchange rates

... determinants of currency supplies and demands are first discussed with the aid of a twocurrency model featuring the U.S. dollar and the euro, the official currency of the twelve countries that participate in the European Monetary Union (EMU). The members of EMU are often known collectively as Eurola ...

... determinants of currency supplies and demands are first discussed with the aid of a twocurrency model featuring the U.S. dollar and the euro, the official currency of the twelve countries that participate in the European Monetary Union (EMU). The members of EMU are often known collectively as Eurola ...

The 1980s financial liberalization in the Nordic

... interest rates low. Investments by companies and households were also supported by generous tax benefits. For example, interest payments on loans were largely or fully tax-deductible. Investment was supported in order to achieve rapid growth. Economic thinking that ascribed a minimal role to the int ...

... interest rates low. Investments by companies and households were also supported by generous tax benefits. For example, interest payments on loans were largely or fully tax-deductible. Investment was supported in order to achieve rapid growth. Economic thinking that ascribed a minimal role to the int ...

One Country, One Currency? Dollarization and the Case for

... merged into a single EU market that could rival the United States, individual currencies came to be seen as an obstacle to completion of the process. Although unemployment remained high in some European countries, few policy makers any longer believed that monetary expansion could effect a longer-te ...

... merged into a single EU market that could rival the United States, individual currencies came to be seen as an obstacle to completion of the process. Although unemployment remained high in some European countries, few policy makers any longer believed that monetary expansion could effect a longer-te ...

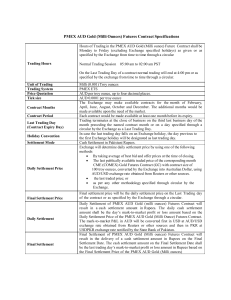

PMEX AUD Gold Futures Contract

... 200,000,000 contracts per Broker (including proprietary and all its clients) 10,000,000 contracts per Client of Broker. All Margins will be collected in Pakistani Rupees. Margins will be based on VaR methodology at 99% Confidence Interval over a 1-day Time Horizon, rounded up to the nearest 0.25% or ...

... 200,000,000 contracts per Broker (including proprietary and all its clients) 10,000,000 contracts per Client of Broker. All Margins will be collected in Pakistani Rupees. Margins will be based on VaR methodology at 99% Confidence Interval over a 1-day Time Horizon, rounded up to the nearest 0.25% or ...

Exchange Control Liberalization, Measures and Their Economic

... Foreign exchange generally means foreign currency. Foreign currency may also be defined to include assets denominated in foreign currencies. Foreign assets that can be used to serve the functions of a foreign money, i.e., a medium of international payments/exchange, medium of deferred payments for i ...

... Foreign exchange generally means foreign currency. Foreign currency may also be defined to include assets denominated in foreign currencies. Foreign assets that can be used to serve the functions of a foreign money, i.e., a medium of international payments/exchange, medium of deferred payments for i ...

NBER WORKING PAPER SERIES THE TRANSMISSION MECHANISM AND THE Frederic S. Mishkin

... exchange rate fluctuations are a major concern in so many countries raises the danger that monetary policy may put too much focus on limiting exchange rate movements. This indeed was a problem for Israel in the early stages of its inflation targeting regime. As part of this regime, Israel had an int ...

... exchange rate fluctuations are a major concern in so many countries raises the danger that monetary policy may put too much focus on limiting exchange rate movements. This indeed was a problem for Israel in the early stages of its inflation targeting regime. As part of this regime, Israel had an int ...

Foreign-exchange reserves

Foreign-exchange reserves (also called forex reserves or FX reserves) are assets held by a central bank or other monetary authority, usually in various reserve currencies, mostly the United States dollar, and to a lesser extent the euro, the pound sterling, and the Japanese yen, and used to back its liabilities—e.g., the local currency issued, and the various bank reserves deposited with the central bank by the government or by financial institutions.