The real exchange rate

... the real exchange rate and net exports is one of the principal ways by which cycles are transmitted internationally. • A decline in US output shifts the Canadian IS curve down. • The cycle can also be transmitted through international asset markets. ...

... the real exchange rate and net exports is one of the principal ways by which cycles are transmitted internationally. • A decline in US output shifts the Canadian IS curve down. • The cycle can also be transmitted through international asset markets. ...

An electricity-backed currency proposal

... form of belief and associated behaviors. Gold is primarily a volatile scarcity-based asset contributing only marginally to social progress. Many who favor gold-backed currencies are articulating a desire for a stable independent central bank issued currency with a fixed reserve ratio. In this guise, ...

... form of belief and associated behaviors. Gold is primarily a volatile scarcity-based asset contributing only marginally to social progress. Many who favor gold-backed currencies are articulating a desire for a stable independent central bank issued currency with a fixed reserve ratio. In this guise, ...

NBER WORKING PAPER SERIES HOUSING AND THE MONETARY TRANSMISSION MECHANISM

... The housing market seems to be on everybody’s mind these days, and for good reason: Developments in the housing market have a major effect on economic activity. For example, as single-family housing starts in the United States dropped from their peak of 1.84 million units in January 2006 to the curr ...

... The housing market seems to be on everybody’s mind these days, and for good reason: Developments in the housing market have a major effect on economic activity. For example, as single-family housing starts in the United States dropped from their peak of 1.84 million units in January 2006 to the curr ...

18-20 Capital Goods and Economic Growth (cont`d)

... and identify obstacles to international investment in these nations • Identify the key functions of the World Bank and the International Monetary Fund • Explain the basis for recent criticisms of policymaking at the World Bank and the International Monetary Fund Copyright © 2012 Pearson Addison-Wesl ...

... and identify obstacles to international investment in these nations • Identify the key functions of the World Bank and the International Monetary Fund • Explain the basis for recent criticisms of policymaking at the World Bank and the International Monetary Fund Copyright © 2012 Pearson Addison-Wesl ...

Setting the Stage for a National Currency in the West

... buffet the economy. When shocks emanate from the domestic money market (e.g., an increase in money demand), the central bank intervenes to accommodate these shocks in order to maintain the stability of the exchange rate under a fixed regime. Money supply will increase as the monetary authority buys ...

... buffet the economy. When shocks emanate from the domestic money market (e.g., an increase in money demand), the central bank intervenes to accommodate these shocks in order to maintain the stability of the exchange rate under a fixed regime. Money supply will increase as the monetary authority buys ...

PPT

... on the collection and validation of national accounts statistics among member institutions ...

... on the collection and validation of national accounts statistics among member institutions ...

Foreign Exchange Market - KV Institute of Management and

... The Foreign Exchange Market (FOREX, FX, or currency market) is a global decentralized market for the trading of currencies. The main participants in this market are the larger international banks. The foreign exchange market works through financial institutions, and it operates on several levels. Th ...

... The Foreign Exchange Market (FOREX, FX, or currency market) is a global decentralized market for the trading of currencies. The main participants in this market are the larger international banks. The foreign exchange market works through financial institutions, and it operates on several levels. Th ...

The role of exchange rate dynamics in Bulgaria and

... transformation. In the first period, rather chaotic systems were applied in both of the countries. The central banks did not have the situation under control and attempted to fix/control exchange rates with consequent huge devaluations. These periods were interposed by periods of floating. The exch ...

... transformation. In the first period, rather chaotic systems were applied in both of the countries. The central banks did not have the situation under control and attempted to fix/control exchange rates with consequent huge devaluations. These periods were interposed by periods of floating. The exch ...

SP151: FCIs and Economic Activity :Some International Evidence

... A Monetary Conditions Index (MCI), a weighted average of the short-term interest rate and the exchange rate, has commonly been used as a composite measure of the stance of monetary policy. The MCI concept was pioneered by the Bank of Canada in the 1980s (Freedman, 1995, Duguay, 1994), based on empir ...

... A Monetary Conditions Index (MCI), a weighted average of the short-term interest rate and the exchange rate, has commonly been used as a composite measure of the stance of monetary policy. The MCI concept was pioneered by the Bank of Canada in the 1980s (Freedman, 1995, Duguay, 1994), based on empir ...

Some hypotheses related to the mexican 1994

... international financial community which complemented with its funds the country's domestic savings. Then everything collapsed. The rundown of international reserves brought about by political unease forced a devaluation in December 1994 that triggered the suspension of access to external savings. Un ...

... international financial community which complemented with its funds the country's domestic savings. Then everything collapsed. The rundown of international reserves brought about by political unease forced a devaluation in December 1994 that triggered the suspension of access to external savings. Un ...

DOLLARISATION AND THE UNDERGROUND ECONOMY

... Norway Germany Portugal Spain Sweden Switzerland UK USA Euro zone ...

... Norway Germany Portugal Spain Sweden Switzerland UK USA Euro zone ...

Volume 68 No. 4, December 2005 Contents

... exchange rates. If they are adjusted for differences in purchasing power across countries, New Zealand’s relative oil intensity falls relative to that of Japan and Europe – expenditure on oil there is high, but other domestic production inputs can also command a higher value than in New Zealand. ...

... exchange rates. If they are adjusted for differences in purchasing power across countries, New Zealand’s relative oil intensity falls relative to that of Japan and Europe – expenditure on oil there is high, but other domestic production inputs can also command a higher value than in New Zealand. ...

NBER WORKING PAPER SERIES CURRENT ACCOUNT DYNAMICS AND MONETARY POLICY Andrea Ferrero

... expected productivity growth as well as differences in saving propensities, the two main factors typically cited as underlying the recent situation.1 We initialize the model to approximately match the recent U.S. current account deficit, which is roughly five percent of GDP. The expected depreciation ...

... expected productivity growth as well as differences in saving propensities, the two main factors typically cited as underlying the recent situation.1 We initialize the model to approximately match the recent U.S. current account deficit, which is roughly five percent of GDP. The expected depreciation ...

NBER WORKING PAPER SERIES CURRENT ACCOUNT DYNAMICS AND MONETARY POLICY Andrea Ferrero

... expected productivity growth as well as differences in saving propensities, the two main factors typically cited as underlying the recent situation.1 We initialize the model to approximately match the recent U.S. current account deficit, which is roughly five percent of GDP. The expected depreciation ...

... expected productivity growth as well as differences in saving propensities, the two main factors typically cited as underlying the recent situation.1 We initialize the model to approximately match the recent U.S. current account deficit, which is roughly five percent of GDP. The expected depreciation ...

Inflation Targeting and the Global Financial Crisis: Successes and Challenges

... a singular focus on price stability suffices, and some have argued that monetary policy should be directed at minimizing risks to financial stability as well. In this regard, it is important to recall that the near single-mindedness regarding the nominal anchor was originally seen as a virtue, not a ...

... a singular focus on price stability suffices, and some have argued that monetary policy should be directed at minimizing risks to financial stability as well. In this regard, it is important to recall that the near single-mindedness regarding the nominal anchor was originally seen as a virtue, not a ...

The Demand for International Reserves and Monetary

... fluctuations in external payment imbalances, to neutralize speculative attacks on currencies, for boosting international confidence on domestic economy, for prestige and as collateral for international borrowing (see Bahmani-Oskooee and Brown, 2002).3 Alternatively, reserve accumulation can also be ...

... fluctuations in external payment imbalances, to neutralize speculative attacks on currencies, for boosting international confidence on domestic economy, for prestige and as collateral for international borrowing (see Bahmani-Oskooee and Brown, 2002).3 Alternatively, reserve accumulation can also be ...

Factor income shares and the current account of the New... balance of payments

... The economic implications of an increased overseas-owned profit flow (and hence of the recorded current account deficit) depend on the behaviour of the overseas owners to whom the profits accrue. So far as economic growth goes, to the extent that these profits are retained in New Zealand and reinves ...

... The economic implications of an increased overseas-owned profit flow (and hence of the recorded current account deficit) depend on the behaviour of the overseas owners to whom the profits accrue. So far as economic growth goes, to the extent that these profits are retained in New Zealand and reinves ...

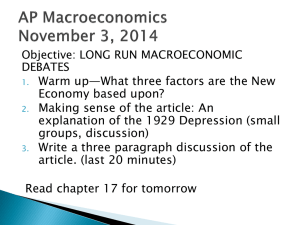

November 2014 agendas

... 4. How banks create money reviewed. Homework: p420-421 Recalling facts and ideas 1-10, Thinking critically 1-3 ...

... 4. How banks create money reviewed. Homework: p420-421 Recalling facts and ideas 1-10, Thinking critically 1-3 ...

S05154_en.pdf

... rate of return of capital will export capital, all this for given levels of domestic and foreign incomes. Countries can have different configurations in labor markets and the savings-investment balance. A country can be either a net importer of labor (i.e. a net immigration country) or a net exporte ...

... rate of return of capital will export capital, all this for given levels of domestic and foreign incomes. Countries can have different configurations in labor markets and the savings-investment balance. A country can be either a net importer of labor (i.e. a net immigration country) or a net exporte ...

Is there a monetary growth imperative?

... Note the critical conceptual framing here: neoclassical economics sees interest and growth as independent of money. Both concepts are explained by certain characteristics of the capital stock (positive but diminishing returns on accumulation), individual preferences (saving vs. consuming) and techn ...

... Note the critical conceptual framing here: neoclassical economics sees interest and growth as independent of money. Both concepts are explained by certain characteristics of the capital stock (positive but diminishing returns on accumulation), individual preferences (saving vs. consuming) and techn ...

This PDF is a selection from an out-of-print volume from... of Economic Research

... focuses on a few central themes that are echoed in the content of several of the conference papers; it is deliberately not a full-fledged survey of business-cycle theory, that task having be(~n admirably accomplished very recently by Victor Zarnowitz (1985). 'The treatment of continuity and change i ...

... focuses on a few central themes that are echoed in the content of several of the conference papers; it is deliberately not a full-fledged survey of business-cycle theory, that task having be(~n admirably accomplished very recently by Victor Zarnowitz (1985). 'The treatment of continuity and change i ...

Capital controls: a normative analysis preliminary and incomplete

... policy in open economies (Corsetti et al. (2010) and references there in). But apart from traditional monetary policy, capital controls can be (and often are) used as tool to manage exchange rate ‡uctuations (see survey by Edwards (1999), or more recently, Schmitt-Grohe and Uribe (2012)). The aim of ...

... policy in open economies (Corsetti et al. (2010) and references there in). But apart from traditional monetary policy, capital controls can be (and often are) used as tool to manage exchange rate ‡uctuations (see survey by Edwards (1999), or more recently, Schmitt-Grohe and Uribe (2012)). The aim of ...

Financial Systems and Economic Performance: A cross country analysis:

... 1990–1998. More specifically, we investigate whether financial structure and financial development are significantly correlated with the measures of economic performance such as capital accumulation, profit rate of capital and total factor productivity growth. This investigation provides empirical e ...

... 1990–1998. More specifically, we investigate whether financial structure and financial development are significantly correlated with the measures of economic performance such as capital accumulation, profit rate of capital and total factor productivity growth. This investigation provides empirical e ...

the paper in PDF format

... resurgence of interest on the impact of financial market integration on both emerging and developing economies. While there might be some short-run side effects, it has been argued that in the long-run financial integration by encouraging financial development can provide a boost to the economy.1 Fi ...

... resurgence of interest on the impact of financial market integration on both emerging and developing economies. While there might be some short-run side effects, it has been argued that in the long-run financial integration by encouraging financial development can provide a boost to the economy.1 Fi ...

International monetary systems

International monetary systems are sets of internationally agreed rules, conventions and supporting institutions, that facilitate international trade, cross border investment and generally the reallocation of capital between nation states. They provide means of payment acceptable between buyers and sellers of different nationality, including deferred payment. To operate successfully, they need to inspire confidence, to provide sufficient liquidity for fluctuating levels of trade and to provide means by which global imbalances can be corrected. The systems can grow organically as the collective result of numerous individual agreements between international economic factors spread over several decades. Alternatively, they can arise from a single architectural vision as happened at Bretton Woods in 1944.