History of the Gold Standard - Capital Consulting Group NC, Inc.

... may not be a desirable byproduct at the time. Also, if one country began to hoard gold, it would require other countries to raise interest rates to keep their money. If that country happened to also be in recession, the end result would not be good. ...

... may not be a desirable byproduct at the time. Also, if one country began to hoard gold, it would require other countries to raise interest rates to keep their money. If that country happened to also be in recession, the end result would not be good. ...

Sources-of-External-Finance

... tighter monetary policy; devaluation of currency) • Paves the way for structural adjustment of the economy • But, measure can often lead to decreased real output & increased unemp. in short run – appears as pain inflicted by the developed world ...

... tighter monetary policy; devaluation of currency) • Paves the way for structural adjustment of the economy • But, measure can often lead to decreased real output & increased unemp. in short run – appears as pain inflicted by the developed world ...

PDF

... verbatim copies of this document for non-commercial purposes by any means, provided that this copyright notice appears on all such copies. ...

... verbatim copies of this document for non-commercial purposes by any means, provided that this copyright notice appears on all such copies. ...

Asian Currency Crisis 1997-1998

... resulted in too many nonperforming loans being issued (overlending) Japan: output slows down (exports from Asia fall) and consumption tax enacted Appreciation in currencies that were pegged to dollar caused decreased price competitiveness for these countries’ exports! Drop in real estate and stock m ...

... resulted in too many nonperforming loans being issued (overlending) Japan: output slows down (exports from Asia fall) and consumption tax enacted Appreciation in currencies that were pegged to dollar caused decreased price competitiveness for these countries’ exports! Drop in real estate and stock m ...

chapter 2 international monetary system

... When the euro was introduced in January 1999, the United Kingdom was conspicuously absent from the list of European countries adopting the common currency. Although the current Labor government led by Prime Minister Tony Blair appears to be in favor of joining the euro club, it is not clear at the m ...

... When the euro was introduced in January 1999, the United Kingdom was conspicuously absent from the list of European countries adopting the common currency. Although the current Labor government led by Prime Minister Tony Blair appears to be in favor of joining the euro club, it is not clear at the m ...

019-025-Scognamiglio-Pasini ing 41-42-43

... will need to reflect on their future. Supranational-level institutions have already been heavily downgraded. The World Bank is not geared to dealing with any crisis involving developed countries. The In- ...

... will need to reflect on their future. Supranational-level institutions have already been heavily downgraded. The World Bank is not geared to dealing with any crisis involving developed countries. The In- ...

13-3

... REASONS BEHIND THE MONETARY COOPERATION • To enhance the Europe’s role in the world monetary system. • To turn the European Union into a truly unified market. ...

... REASONS BEHIND THE MONETARY COOPERATION • To enhance the Europe’s role in the world monetary system. • To turn the European Union into a truly unified market. ...

The Dollar : Medium and Long Term Prospects - Inter

... the emergence of a macroeconomically important group of countries with currencies managed vis a vis the dollar to support exportdriven growth; ...

... the emergence of a macroeconomically important group of countries with currencies managed vis a vis the dollar to support exportdriven growth; ...

Industrial countries other than the United States

... The Relationship Between Money and Growth • Money is needed to facilitate economic transactions. • MV=PY →The equation of exchange. • Assuming velocity (V) is relatively stable, the quantity of money (M) determines the level of spending (PY) in the economy. • If sufficient money is not available, s ...

... The Relationship Between Money and Growth • Money is needed to facilitate economic transactions. • MV=PY →The equation of exchange. • Assuming velocity (V) is relatively stable, the quantity of money (M) determines the level of spending (PY) in the economy. • If sufficient money is not available, s ...

Bilateral Local Currency Swap Agreement with the Monetary

... The Bank of Japan has signed a bilateral local currency swap agreement with the Monetary Authority of Singapore, effective as of November 30, 2016. This agreement is designed to enhance the financial stability of the two countries, allowing for the exchange of local currencies between the two centra ...

... The Bank of Japan has signed a bilateral local currency swap agreement with the Monetary Authority of Singapore, effective as of November 30, 2016. This agreement is designed to enhance the financial stability of the two countries, allowing for the exchange of local currencies between the two centra ...

PDF Download

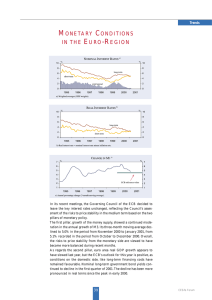

... The first pillar, growth of the money supply, showed a continued moderation in the annual growth of M3. Its three-month moving average declined to 5.0% in the period from November 2000 to January 2001, from 5.1% recorded in the period from October to December 2000. Overall, the risks to price stabil ...

... The first pillar, growth of the money supply, showed a continued moderation in the annual growth of M3. Its three-month moving average declined to 5.0% in the period from November 2000 to January 2001, from 5.1% recorded in the period from October to December 2000. Overall, the risks to price stabil ...

Peter Bernholz INSTITUTIONAL REQUIREMENTS FOR STABLE MONEY INTEGRATED WORLD ECONOMY

... example, even if all countries introduced monetary constitutions requiring the central banks to follow monetary growth rules, then these rules might be different concerning the definition of the monetary aggregate to be used, the growth rate, or the relevant base from which to start. Or if the cons ...

... example, even if all countries introduced monetary constitutions requiring the central banks to follow monetary growth rules, then these rules might be different concerning the definition of the monetary aggregate to be used, the growth rate, or the relevant base from which to start. Or if the cons ...

Ben S Bernanke: Monetary policy and the global economy

... I’m very pleased to participate in this conference honoring my good friend Mervyn King. As Mervyn noted in a recent speech in New York, we had adjoining offices at MIT as young academics and never imagined that 30 years later we still would be colleagues – as central bankers.1 Now, as then, I value ...

... I’m very pleased to participate in this conference honoring my good friend Mervyn King. As Mervyn noted in a recent speech in New York, we had adjoining offices at MIT as young academics and never imagined that 30 years later we still would be colleagues – as central bankers.1 Now, as then, I value ...

January 18, 2012

... worry as much as others about dealing with a structural deficit, since its currency is needed for international transactions. • A key currency country can “export its inflation” to other countries by keeping domestic demand high during a period of structural deficits. ...

... worry as much as others about dealing with a structural deficit, since its currency is needed for international transactions. • A key currency country can “export its inflation” to other countries by keeping domestic demand high during a period of structural deficits. ...

Global Governance and The Bretton Woods System

... rather, of the overwhelming economic dominance of the USA and the dollar. The USA contained, in 1950, some 60 per cent of all the capital stock across the industrialized world and was responsible for about 60 per cent of all industrial output. What thus made the Golden Age unusual was the USA’s capa ...

... rather, of the overwhelming economic dominance of the USA and the dollar. The USA contained, in 1950, some 60 per cent of all the capital stock across the industrialized world and was responsible for about 60 per cent of all industrial output. What thus made the Golden Age unusual was the USA’s capa ...

Chapter 3 The International Monetary System

... The financial system – distress in one emerging market causes investors to exit other countries with similar risk profiles. ...

... The financial system – distress in one emerging market causes investors to exit other countries with similar risk profiles. ...

A G-Zero World - World Policy Institute

... wave through the international system than anything that followed the collapse of the Soviet bloc. In September 2008, fears that the global economy stood on the brink of catastrophe hastened the inevitable transition to the G-20, an organization that includes the world's largest and most important e ...

... wave through the international system than anything that followed the collapse of the Soviet bloc. In September 2008, fears that the global economy stood on the brink of catastrophe hastened the inevitable transition to the G-20, an organization that includes the world's largest and most important e ...

The International Monetary System

... Rate System Collapse? Bretton Woods worked well until the late 1960s It collapsed when huge increases in welfare programs and the Vietnam War were financed by increasing the money supply and causing significant inflation other countries increased the value of their currencies relative to the U ...

... Rate System Collapse? Bretton Woods worked well until the late 1960s It collapsed when huge increases in welfare programs and the Vietnam War were financed by increasing the money supply and causing significant inflation other countries increased the value of their currencies relative to the U ...

Vocabulary Review SS 10-1 RI 3

... A provision of the Bretton Woods Agreement that all printed money, such as a paper dollar, would be convertible to gold and could be cashed in at any time for that gold ...

... A provision of the Bretton Woods Agreement that all printed money, such as a paper dollar, would be convertible to gold and could be cashed in at any time for that gold ...

Peter Kenen - Princeton University

... earned his BA at Columbia and his PhD at Harvard, where his dissertation won the David A. Wells Prize. He taught at Columbia from 1957 to 1971, where he served as Chairman of the Economics Department and, 1969-70, as Provost of the University. Provost. He was Director of the International Finance Se ...

... earned his BA at Columbia and his PhD at Harvard, where his dissertation won the David A. Wells Prize. He taught at Columbia from 1957 to 1971, where he served as Chairman of the Economics Department and, 1969-70, as Provost of the University. Provost. He was Director of the International Finance Se ...

6. The post-war reconstruction

... • Temporary imbalances were to be financed from domestic forex reserves (difference from pure gold standard, where those reserves were just monetary gold), in case of more substantial deficits, Fund was prepared to lend to individual countries – Each country contributes to the Fund a certain quota a ...

... • Temporary imbalances were to be financed from domestic forex reserves (difference from pure gold standard, where those reserves were just monetary gold), in case of more substantial deficits, Fund was prepared to lend to individual countries – Each country contributes to the Fund a certain quota a ...

Deutsche Bank’s View of the US Economy and the Fed

... BUT ER model implies the need for these controls will fade over time. ...

... BUT ER model implies the need for these controls will fade over time. ...

International monetary systems

International monetary systems are sets of internationally agreed rules, conventions and supporting institutions, that facilitate international trade, cross border investment and generally the reallocation of capital between nation states. They provide means of payment acceptable between buyers and sellers of different nationality, including deferred payment. To operate successfully, they need to inspire confidence, to provide sufficient liquidity for fluctuating levels of trade and to provide means by which global imbalances can be corrected. The systems can grow organically as the collective result of numerous individual agreements between international economic factors spread over several decades. Alternatively, they can arise from a single architectural vision as happened at Bretton Woods in 1944.