Angola update – the case of dollar supply

... authorities have been acting very firmly to hasten the reduction of the US currency use internally for payment purposes (for instance, through legislation to mandate oil companies to use local banks and to make most of their operations in kwanzas). However, there are some high value items such as re ...

... authorities have been acting very firmly to hasten the reduction of the US currency use internally for payment purposes (for instance, through legislation to mandate oil companies to use local banks and to make most of their operations in kwanzas). However, there are some high value items such as re ...

global meltdown and india_VINEET

... The extent of the problems had been so severe that some of the world’s largest financial institutions had collapsed. Others were bought out by their competition at low prices and in other cases, the governments of the wealthiest nations in the world resorted to extensive bailout and rescue packages ...

... The extent of the problems had been so severe that some of the world’s largest financial institutions had collapsed. Others were bought out by their competition at low prices and in other cases, the governments of the wealthiest nations in the world resorted to extensive bailout and rescue packages ...

Slide 1

... Independent banks established by governments to finance or insure the export sales of a country’s products. Reduces risk for importers If exporter loses sales due to political actions, bank will reimburse ...

... Independent banks established by governments to finance or insure the export sales of a country’s products. Reduces risk for importers If exporter loses sales due to political actions, bank will reimburse ...

Distortions in Macroeconomic Framework and Exit Strategies

... 2.Distortions of Macroeconomic Framework after the Lehman’s Collapse 7.Major international reserve currencies including dollar and the euro have shown a large scale decline in external values. - Large fluctuation of major reserve currencies took place against the background of the tectonic shift of ...

... 2.Distortions of Macroeconomic Framework after the Lehman’s Collapse 7.Major international reserve currencies including dollar and the euro have shown a large scale decline in external values. - Large fluctuation of major reserve currencies took place against the background of the tectonic shift of ...

The Asian Crisis, the IMF and Dr Mahathir

... capital controls can go hand in hand with such measures. Indeed, Malaysia has taken steps to restructure the financial sector, forced by circumstances.8 The question then arises as to which approach works better, the IMF approach or Malaysia's. Put differently: do (temporary) capital controls work a ...

... capital controls can go hand in hand with such measures. Indeed, Malaysia has taken steps to restructure the financial sector, forced by circumstances.8 The question then arises as to which approach works better, the IMF approach or Malaysia's. Put differently: do (temporary) capital controls work a ...

What does interconnectedness imply for macroeconomic and

... for example, of the host country to provide lender-of–last- resort liquidity to foreign firms operating in their jurisdiction? At what stage, if any, does that responsibility shift to home country? Should these responsibilities change depending on the degree of information exchange or the degree or ...

... for example, of the host country to provide lender-of–last- resort liquidity to foreign firms operating in their jurisdiction? At what stage, if any, does that responsibility shift to home country? Should these responsibilities change depending on the degree of information exchange or the degree or ...

PREFACE

... another stark reminder of the region’s vulnerability to natural disasters. These challenges pose significant downside risks to an otherwise robust growth outlook as the region emerges as the growth pole of the global economy. The key immediate challenge is to address rising food prices that are thre ...

... another stark reminder of the region’s vulnerability to natural disasters. These challenges pose significant downside risks to an otherwise robust growth outlook as the region emerges as the growth pole of the global economy. The key immediate challenge is to address rising food prices that are thre ...

The value of the Iraqi currency and structural economic imbalances

... the 2008 saw an improvement in the security situation and then in the rate of inflation and the exchange rate. However, the economic environment is still repulsive acts do not encourage project planning medium or long-term. Which led to limited activities on some business and commercial projects yie ...

... the 2008 saw an improvement in the security situation and then in the rate of inflation and the exchange rate. However, the economic environment is still repulsive acts do not encourage project planning medium or long-term. Which led to limited activities on some business and commercial projects yie ...

International Political Economy

... Continue and World Bank • Structural Adjustments – Due to the US raising interest rates (protectionism) on developing nations loans, which caused the counties to defaulting » Counties need to take immediate measures to receive new loans • reduce inflation, cut social welfare, trade liberalization, ...

... Continue and World Bank • Structural Adjustments – Due to the US raising interest rates (protectionism) on developing nations loans, which caused the counties to defaulting » Counties need to take immediate measures to receive new loans • reduce inflation, cut social welfare, trade liberalization, ...

Lecture15-ForeignExchangeMarketB

... Exchange rate regimes • Exchange rate regimes in the international financial system are of two basic types: • Fixed and floating • In a fixed exchange rate regime, the value of currency are kept pegged relative to one currency called the anchor currency so that exchange rates are fixed • In a float ...

... Exchange rate regimes • Exchange rate regimes in the international financial system are of two basic types: • Fixed and floating • In a fixed exchange rate regime, the value of currency are kept pegged relative to one currency called the anchor currency so that exchange rates are fixed • In a float ...

Key Concepts: Graphs and Formulas to KNOW: *Production

... commitment to exchange domestic currency for a specified foreign currency at a fixed rate. 15) fixed exchange rate system: System in which the exchange rate between two currencies is set by government policy. 16) free-floating exchange rate system: System in which governments and central banks do no ...

... commitment to exchange domestic currency for a specified foreign currency at a fixed rate. 15) fixed exchange rate system: System in which the exchange rate between two currencies is set by government policy. 16) free-floating exchange rate system: System in which governments and central banks do no ...

Exchange Rate Regimes

... Realignments are adjustments of parities between currencies. The September 1992 EMS (European Monetary System) Crisis was caused by the belief that several countries were soon going to devalue. Some countries defended themselves by increasing the overnight interest rate up to 500%. In the end, some ...

... Realignments are adjustments of parities between currencies. The September 1992 EMS (European Monetary System) Crisis was caused by the belief that several countries were soon going to devalue. Some countries defended themselves by increasing the overnight interest rate up to 500%. In the end, some ...

Socio-Economic Impact, Political Economy of Response

... Tax carbon, not employment or value added ...

... Tax carbon, not employment or value added ...

Slide 1

... country’s currency becomes more expensive to buy. Depreciation in currency means there is a decreasing in exchange rates. The foreign country finds that other country’s currency becomes cheaper to buy. Trade- weighted exchange rates is the way to evaluate the significant of the effects resulting fro ...

... country’s currency becomes more expensive to buy. Depreciation in currency means there is a decreasing in exchange rates. The foreign country finds that other country’s currency becomes cheaper to buy. Trade- weighted exchange rates is the way to evaluate the significant of the effects resulting fro ...

Good societies

... • U.S. = lighter tax burden than other rich democracies; smaller public sector • Sweden = state revenues and spending amount to more than half of GDP ...

... • U.S. = lighter tax burden than other rich democracies; smaller public sector • Sweden = state revenues and spending amount to more than half of GDP ...

Chapter 28 - Weber State University

... 7. Which of the following historical events is often cited as an example of the successful implementation of Keynesian theory? a. the Kennedy-Johnson tax cut of 1964 b. the price controls of the Nixon administration c. the anti-inflation policies of the Carter administration d. the series of tax cut ...

... 7. Which of the following historical events is often cited as an example of the successful implementation of Keynesian theory? a. the Kennedy-Johnson tax cut of 1964 b. the price controls of the Nixon administration c. the anti-inflation policies of the Carter administration d. the series of tax cut ...

USI Library News Information Service Pioneer 11-07

... To increase the effectiveness of the current format, the organisation should increase coordination in all areas. The summit declarations reflect common concerns and stance on global issues. But plan of action regarding some of these issues is lacking or tardy. On the positive side, there is progress ...

... To increase the effectiveness of the current format, the organisation should increase coordination in all areas. The summit declarations reflect common concerns and stance on global issues. But plan of action regarding some of these issues is lacking or tardy. On the positive side, there is progress ...

Topic: reference currency basket of the renminbi

... the market and may take a relatively longer-term view in their investments are unlikely to benefit from such volatility. Chances are they will be made worse off, particularly if they are highly leveraged. ...

... the market and may take a relatively longer-term view in their investments are unlikely to benefit from such volatility. Chances are they will be made worse off, particularly if they are highly leveraged. ...

The Global Economic and Financial Crisis

... Even the principle that spending provides more stimulus than tax cuts has returned; not just from Larry Summers, e.g., but also from Martin Feldstein. ...

... Even the principle that spending provides more stimulus than tax cuts has returned; not just from Larry Summers, e.g., but also from Martin Feldstein. ...

Chapter 3: THE WORLD MARKETPLACE

... good than other nations, using the same amount of resources. ...

... good than other nations, using the same amount of resources. ...

Euro and Macroeconomic Stability

... • Recent cases in Hungary, the Baltic countries, Iceland or some members of the Euro zone (e.g. Belgium, Austria etc.) have shown that the point is to have reasonable and stable economic policy and prudential approach of domestic regulation • Without it you cannot have stable economic environment di ...

... • Recent cases in Hungary, the Baltic countries, Iceland or some members of the Euro zone (e.g. Belgium, Austria etc.) have shown that the point is to have reasonable and stable economic policy and prudential approach of domestic regulation • Without it you cannot have stable economic environment di ...

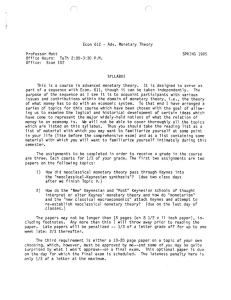

ECON 612-001 Monetary Theory

... Econ 612 - Adv. Monetary Theory Professor Mott Office Hours: TuTh 2:00-3:30 P.M. Office : Econ 102 ...

... Econ 612 - Adv. Monetary Theory Professor Mott Office Hours: TuTh 2:00-3:30 P.M. Office : Econ 102 ...

International Economics II: International Monetary & Finance Economics

... ** The instructor reserves the right to alter the course outline and course requirements at any time. Grading Policy: Grades are based on two mid-term exams (25% each), a final exam (25% and cumulative), and homework exercises (25%). Attendance Expectations: You are acquired to attend every class a ...

... ** The instructor reserves the right to alter the course outline and course requirements at any time. Grading Policy: Grades are based on two mid-term exams (25% each), a final exam (25% and cumulative), and homework exercises (25%). Attendance Expectations: You are acquired to attend every class a ...

5th Edition - Indiana University

... keep the exchange rates among their currencies fixed for long periods. • From the 19th century until the 1930s, countries’ currencies were redeemable for fixed amounts of gold—a system known as the gold standard. The amount of gold each for which currency was redeemable determined the exchange rates ...

... keep the exchange rates among their currencies fixed for long periods. • From the 19th century until the 1930s, countries’ currencies were redeemable for fixed amounts of gold—a system known as the gold standard. The amount of gold each for which currency was redeemable determined the exchange rates ...

International monetary systems

International monetary systems are sets of internationally agreed rules, conventions and supporting institutions, that facilitate international trade, cross border investment and generally the reallocation of capital between nation states. They provide means of payment acceptable between buyers and sellers of different nationality, including deferred payment. To operate successfully, they need to inspire confidence, to provide sufficient liquidity for fluctuating levels of trade and to provide means by which global imbalances can be corrected. The systems can grow organically as the collective result of numerous individual agreements between international economic factors spread over several decades. Alternatively, they can arise from a single architectural vision as happened at Bretton Woods in 1944.