Monetary policy in the euro area`s neighbouring countries

... Before the onset of the global financial crisis, the euro area was regarded by financial markets as a more or less homogeneous unit. Hardly any distinction was made between country risk within the euro area. This was reflected in the fact that the government bond interest rates of most member countr ...

... Before the onset of the global financial crisis, the euro area was regarded by financial markets as a more or less homogeneous unit. Hardly any distinction was made between country risk within the euro area. This was reflected in the fact that the government bond interest rates of most member countr ...

Percent of GDP (right axis)

... for half of net private flows Net FDI inflows to developing countries $ billion ...

... for half of net private flows Net FDI inflows to developing countries $ billion ...

Macroeconomic Crises and the Social Order

... the short-sighted, time-inconsistent meddling of politicians who tax too much and spend even more cause problems. Presumably, the development of scientific knowledge has led to this clarification – if such it is – of the nature of the world we live in. What, then, were these scientific developments? ...

... the short-sighted, time-inconsistent meddling of politicians who tax too much and spend even more cause problems. Presumably, the development of scientific knowledge has led to this clarification – if such it is – of the nature of the world we live in. What, then, were these scientific developments? ...

Private Wealth Adviser United Capital Secures $38 Million in Growth

... Capital co-founder and CEO, Joe Duran. “We see substantial opportunities to continue to grow our adviser and customer base through acquisitions, adviser recruitment, and organic growth initiatives, and it was important that any new equity partner would share our vision.” “We talked to many different ...

... Capital co-founder and CEO, Joe Duran. “We see substantial opportunities to continue to grow our adviser and customer base through acquisitions, adviser recruitment, and organic growth initiatives, and it was important that any new equity partner would share our vision.” “We talked to many different ...

International Aspects of U.S. Monetary and Fiscal Policy Paul Krugman* Introduction

... Since 1980 U.S. rr~acroeconomic policy has diverged from that of other major industrial countries. While most countries responded to the inflationary impact of the 1979 oil shock by tightening their fiscal policies, the influence of supply-side doctrine has led the United States into a dramatic fisc ...

... Since 1980 U.S. rr~acroeconomic policy has diverged from that of other major industrial countries. While most countries responded to the inflationary impact of the 1979 oil shock by tightening their fiscal policies, the influence of supply-side doctrine has led the United States into a dramatic fisc ...

DEVELOPING COUNTRIES AND THE DOLLAR C. P. Chandrasekhar and Jayati Ghosh

... governments. This is important not only because it suggests that Ricardian equivalence does not hold. (Indeed, estimates by IMF staff suggest that a 1 per cent increase in public saving increases the national savings rates by 0.85 per cent, as higher public saving is only partially offset by adjustm ...

... governments. This is important not only because it suggests that Ricardian equivalence does not hold. (Indeed, estimates by IMF staff suggest that a 1 per cent increase in public saving increases the national savings rates by 0.85 per cent, as higher public saving is only partially offset by adjustm ...

Document

... treasure bills nominated in bolivianos (the local currency) and nominated in foreign currency (dollars). So we need three data series. For each one, follow the following procedure: Select the country (Bolivia, US) and the data concept (“treasure bill rate” for US and Bolivia and “treasure bill rate ...

... treasure bills nominated in bolivianos (the local currency) and nominated in foreign currency (dollars). So we need three data series. For each one, follow the following procedure: Select the country (Bolivia, US) and the data concept (“treasure bill rate” for US and Bolivia and “treasure bill rate ...

Policy Brief Will Pinning the Blame on China Help Correct Global Imbalances?

... particularly those with substantial resource endowments. Between 1999 and 2007, in contrast, China had run surpluses on its capital and financial account, powered mostly by continuous inflows of net direct investment that amounted to 2-4% of GDP. China’s recent shift to capital exports could represe ...

... particularly those with substantial resource endowments. Between 1999 and 2007, in contrast, China had run surpluses on its capital and financial account, powered mostly by continuous inflows of net direct investment that amounted to 2-4% of GDP. China’s recent shift to capital exports could represe ...

China`s Currency Policy - Duke

... growth, are major factors in the Chinese government’s currency policy. A slowing Chinese economy has meant less inflows of “hot money” from abroad into China and more outflows of capital out of China to other countries by those seeking safety or higher investment returns. China’s merchandise export ...

... growth, are major factors in the Chinese government’s currency policy. A slowing Chinese economy has meant less inflows of “hot money” from abroad into China and more outflows of capital out of China to other countries by those seeking safety or higher investment returns. China’s merchandise export ...

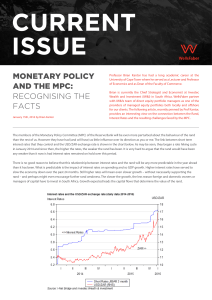

Monetary policy and the Mpc: Recognising the facts

... The sooner the members of the MPC fully recognise these facts of SA economic life, the less likely they are to damage the growth prospects of the economy. The exchange value of the rand and so the inflation rate and the expectation of inflation (that take their cue from the exchange rate, for good ...

... The sooner the members of the MPC fully recognise these facts of SA economic life, the less likely they are to damage the growth prospects of the economy. The exchange value of the rand and so the inflation rate and the expectation of inflation (that take their cue from the exchange rate, for good ...

Downlaod File

... Thereare six main factors that determine exchange rates. These factors affect the trading relationship between two countries. The first factor is Differentials in Inflation. The value of the currency is determined by the inflation rate. The lower the inflation rate is, the more value the currency ha ...

... Thereare six main factors that determine exchange rates. These factors affect the trading relationship between two countries. The first factor is Differentials in Inflation. The value of the currency is determined by the inflation rate. The lower the inflation rate is, the more value the currency ha ...

The exchange rate of the króna and the interset

... Iceland and other countries, i.e. by examining the real rather than nominal interest-rate differential. It transpires that although interest rates went up considerably in Iceland in 2000 and 2001 as a result of rises in the Central Bank’s policy rate, they did not keep pace then with the surge in in ...

... Iceland and other countries, i.e. by examining the real rather than nominal interest-rate differential. It transpires that although interest rates went up considerably in Iceland in 2000 and 2001 as a result of rises in the Central Bank’s policy rate, they did not keep pace then with the surge in in ...

Low interest rates and implications for financial stability

... for the October 2013 WEO and 2012 for the April 2016 WEO. As for the European Commission, the table shows the projections of potential output growth for the years 2020 and 2025 reported in the 2009, 2012 and 2015 Aging reports. Source: IMF World Economic Outlook and European Commission Aging Report. ...

... for the October 2013 WEO and 2012 for the April 2016 WEO. As for the European Commission, the table shows the projections of potential output growth for the years 2020 and 2025 reported in the 2009, 2012 and 2015 Aging reports. Source: IMF World Economic Outlook and European Commission Aging Report. ...

The Bank, the States, and the Market: an Austro - Hal-SHS

... rich country (Flandreau [1998]). As a result, in regions close to the border, identical or similar foreign and domestic coins circulated side by side (Willis [1901]). This could sometimes create confusion: foreign coins were in principle not legal tender and they could be turned down. There were thu ...

... rich country (Flandreau [1998]). As a result, in regions close to the border, identical or similar foreign and domestic coins circulated side by side (Willis [1901]). This could sometimes create confusion: foreign coins were in principle not legal tender and they could be turned down. There were thu ...

Making Inflation Targeting Appropriately Flexible

... • One can set an inflation goal for the LR, or 2-year range, and yet set an intermediate target (other than inflation) at the 1-year range. • The argument in favor of intermediate targets is to enhance transparency, accountability, and monitorability, giving the public confidence that the central ba ...

... • One can set an inflation goal for the LR, or 2-year range, and yet set an intermediate target (other than inflation) at the 1-year range. • The argument in favor of intermediate targets is to enhance transparency, accountability, and monitorability, giving the public confidence that the central ba ...

Eduardo Cavallo

... This scenario could trigger a liquidity crisis in quite a few countries. If a country does not have sufficient international reserves to cover the debt service, it could generate a stampede by everyone who believes that the reserves are not going to be there when needed. ...

... This scenario could trigger a liquidity crisis in quite a few countries. If a country does not have sufficient international reserves to cover the debt service, it could generate a stampede by everyone who believes that the reserves are not going to be there when needed. ...

view text of speech / press release

... domestic prices and the tighter labour market arising from the initial increase in export demand. Rising prices and wages feed on each other, and lead to an appreciation of the real exchange rate that offsets the initial gains in competitiveness. Studies by M A S suggest that the bulk of the initial ...

... domestic prices and the tighter labour market arising from the initial increase in export demand. Rising prices and wages feed on each other, and lead to an appreciation of the real exchange rate that offsets the initial gains in competitiveness. Studies by M A S suggest that the bulk of the initial ...

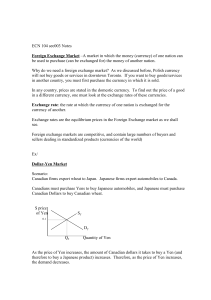

ECN 104 sec003 Notes Foreign Exchange Market –A market in

... Foreign Exchange Market –A market in which the money (currency) of one nation can be used to purchase (can be exchanged for) the money of another nation. Why do we need a foreign exchange market? As we discussed before, Polish currency will not buy goods or services in downtown Toronto. If you want ...

... Foreign Exchange Market –A market in which the money (currency) of one nation can be used to purchase (can be exchanged for) the money of another nation. Why do we need a foreign exchange market? As we discussed before, Polish currency will not buy goods or services in downtown Toronto. If you want ...

Fixed versus floating exchange rates and the role of central bank

... Currency crises • Often just seen as a large devaluation • Speculative attack with sudden loss of confidence in the central bank promise to keep the exchange rate fixed: run on the central bank foreign reserves : to defend the fixed exchange rate the central bank sells its reserves • But not all at ...

... Currency crises • Often just seen as a large devaluation • Speculative attack with sudden loss of confidence in the central bank promise to keep the exchange rate fixed: run on the central bank foreign reserves : to defend the fixed exchange rate the central bank sells its reserves • But not all at ...

economic and monetary union

... Eliminate the possibility of devaluations/revaluations: with free flows of financial capital, capital flight and speculation could occur in an EMS with separate currencies, but would be more difficult with a single currency. ...

... Eliminate the possibility of devaluations/revaluations: with free flows of financial capital, capital flight and speculation could occur in an EMS with separate currencies, but would be more difficult with a single currency. ...

Monetary Policy Statement - National Reserve Bank of Tonga

... investment is still weak, unemployment rates high at 11.1%, and inflation and Gross Domestic Product (GDP) barely above zero. Challenges were further exacerbated by the declining global oil price which saw the IMF revise GDP growth downwards for both 2015 and 2016 as the Eurozone is a major exporter ...

... investment is still weak, unemployment rates high at 11.1%, and inflation and Gross Domestic Product (GDP) barely above zero. Challenges were further exacerbated by the declining global oil price which saw the IMF revise GDP growth downwards for both 2015 and 2016 as the Eurozone is a major exporter ...

Chapter 20

... Eliminate the possibility of devaluations/revaluations: with free flows of financial capital, capital flight and speculation could occur in an EMS with separate currencies, but would be more difficult with a single currency. ...

... Eliminate the possibility of devaluations/revaluations: with free flows of financial capital, capital flight and speculation could occur in an EMS with separate currencies, but would be more difficult with a single currency. ...

Krugman-Chapter 20

... Eliminate the possibility of devaluations/revaluations: with free flows of financial capital, capital flight and speculation could occur in an EMS with separate currencies, but would be more difficult with a single currency. ...

... Eliminate the possibility of devaluations/revaluations: with free flows of financial capital, capital flight and speculation could occur in an EMS with separate currencies, but would be more difficult with a single currency. ...

Dubravko Radosevic PEAC Final version Brussels

... because fixed exchange rate was the nominal anchor in disinflation process) and interest rates at international capital markets on external loans, enabled „carry trade“ to foreign banks, and led to rising external debt. 1.3. European monetary union and debt crisis In a nutshell, both countries (Cro ...

... because fixed exchange rate was the nominal anchor in disinflation process) and interest rates at international capital markets on external loans, enabled „carry trade“ to foreign banks, and led to rising external debt. 1.3. European monetary union and debt crisis In a nutshell, both countries (Cro ...

Origins: Financial Innovation

... US, however, had already come about with the repeal of the 1933 Glass-Steagall Act in 1999; Although it should be said that relaxing the 1933 Act began in 1987 (when the Fed allowed 5% of bank deposits to be used for investment banking, and further promoted in 1996 when 25% of deposits were allowe ...

... US, however, had already come about with the repeal of the 1933 Glass-Steagall Act in 1999; Although it should be said that relaxing the 1933 Act began in 1987 (when the Fed allowed 5% of bank deposits to be used for investment banking, and further promoted in 1996 when 25% of deposits were allowe ...

International monetary systems

International monetary systems are sets of internationally agreed rules, conventions and supporting institutions, that facilitate international trade, cross border investment and generally the reallocation of capital between nation states. They provide means of payment acceptable between buyers and sellers of different nationality, including deferred payment. To operate successfully, they need to inspire confidence, to provide sufficient liquidity for fluctuating levels of trade and to provide means by which global imbalances can be corrected. The systems can grow organically as the collective result of numerous individual agreements between international economic factors spread over several decades. Alternatively, they can arise from a single architectural vision as happened at Bretton Woods in 1944.