10 THE EXCHANGE RATE AND THE BALANCE OF PAYMENTS**

... Net exports equals the private sector balance (−£19 billion) plus the government sector balance (−£13 billion), or −£32 billion. The U.K. had a net export deficit of £32 billion. The government sector balance plus the private sector balance equals net exports. If the government sector balance change ...

... Net exports equals the private sector balance (−£19 billion) plus the government sector balance (−£13 billion), or −£32 billion. The U.K. had a net export deficit of £32 billion. The government sector balance plus the private sector balance equals net exports. If the government sector balance change ...

Brazil responses to the international financial crisis: a well succeed

... By way of example, at times of widespread lack of confidence among economic agents, monetary policy can contribute little to balancing the economic cycle, as seen in the illustration represented by the familiar liquidity trap. For this reason, Keynes (1980a: 350) argues that [i]t is not quite correc ...

... By way of example, at times of widespread lack of confidence among economic agents, monetary policy can contribute little to balancing the economic cycle, as seen in the illustration represented by the familiar liquidity trap. For this reason, Keynes (1980a: 350) argues that [i]t is not quite correc ...

Monetary policy

... investors through Fannie Mae and Freddie Mac to banks and, ultimately, to individuals and families borrowing money to buy houses. • Major commercial and investment banks borrowed heavily to buy these mortgages (and other loans), bundled them into Collateralized Debt Obligations (CDOs, one flavor of ...

... investors through Fannie Mae and Freddie Mac to banks and, ultimately, to individuals and families borrowing money to buy houses. • Major commercial and investment banks borrowed heavily to buy these mortgages (and other loans), bundled them into Collateralized Debt Obligations (CDOs, one flavor of ...

Ultra-low or negative interest rates

... are weak, they are unlikely to transmit monetary impulses effectively via increased lending. This suggests that the best way to lift an economy out of a balance sheet recession is to repair balance sheets quickly, together with structural reform. Monetary accommodation can buy time to implement this ...

... are weak, they are unlikely to transmit monetary impulses effectively via increased lending. This suggests that the best way to lift an economy out of a balance sheet recession is to repair balance sheets quickly, together with structural reform. Monetary accommodation can buy time to implement this ...

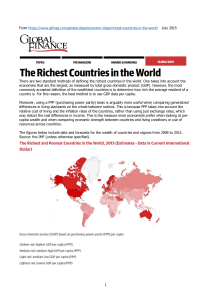

Richest Countries

... differences in the costs of goods and services persist. Exchange rates can be used to convert values in one currency to another, but since they do not fully reflect differences in price levels, they cannot measure the real volume of output. Exchange rates are determined by the demand for and supply ...

... differences in the costs of goods and services persist. Exchange rates can be used to convert values in one currency to another, but since they do not fully reflect differences in price levels, they cannot measure the real volume of output. Exchange rates are determined by the demand for and supply ...

The Fundamental Principle of Conservation of Physical Money: Its

... back up the deposits their clients have made into their accounts. Instead, the banks are required only to keep a small fraction of such deposits on hand. The world Today’s reserves wealth of Gold, Silver and Copper is estimated by 8.63 Trillion US$ compared to 4.3 Trillion US$ in Currencies. Moreove ...

... back up the deposits their clients have made into their accounts. Instead, the banks are required only to keep a small fraction of such deposits on hand. The world Today’s reserves wealth of Gold, Silver and Copper is estimated by 8.63 Trillion US$ compared to 4.3 Trillion US$ in Currencies. Moreove ...

Lecture 2: International Capital Flows

... OECD countries, legacy of controls from 1930s and from World War II took long to disappear In France, it took until late 1980s to abolish capital controls, and in the UK, capital controls were abandoned only in early 1980s It took long in part because of fear that any change in the system would ...

... OECD countries, legacy of controls from 1930s and from World War II took long to disappear In France, it took until late 1980s to abolish capital controls, and in the UK, capital controls were abandoned only in early 1980s It took long in part because of fear that any change in the system would ...

General information - Hong Kong Institute for Monetary Research

... As the name suggests GIMF has been designed for joint monetary and fiscal policy analysis. This has involved extending the workhorse infinite-horizon (IH) model that has been developed for monetary policy analysis to allow for non-Ricardian household and firm behavior. There are two main advantages ...

... As the name suggests GIMF has been designed for joint monetary and fiscal policy analysis. This has involved extending the workhorse infinite-horizon (IH) model that has been developed for monetary policy analysis to allow for non-Ricardian household and firm behavior. There are two main advantages ...

Dollarization Versus a National Currency

... the trade balance. 13 A country such as El Salvador is not only closely tied to the United States through major trade agreements, but a large component of its GDP derives from dollar denominated remittances. Other countries that have not officially dollarized, but which have highly dollarized econom ...

... the trade balance. 13 A country such as El Salvador is not only closely tied to the United States through major trade agreements, but a large component of its GDP derives from dollar denominated remittances. Other countries that have not officially dollarized, but which have highly dollarized econom ...

Download pdf | 168 KB |

... exceeding the national average by as much as 20%. Other states, on the other hand, have been gaining competitiveness vis-à-vis the national average over the past decade. [See fan chart on dispersion of ULC in the US] In summary, these results suggest that those who are questioning the viability of t ...

... exceeding the national average by as much as 20%. Other states, on the other hand, have been gaining competitiveness vis-à-vis the national average over the past decade. [See fan chart on dispersion of ULC in the US] In summary, these results suggest that those who are questioning the viability of t ...

comparison of monetary and fiscal policies

... example, when demand is low in the economy, the government can step in and increase its spending to stimulate demand. Or it can lower taxes to increase disposable income for people as well as corporations. Definition of Monetary policy: it relates to the supply of money, which is controlled via fact ...

... example, when demand is low in the economy, the government can step in and increase its spending to stimulate demand. Or it can lower taxes to increase disposable income for people as well as corporations. Definition of Monetary policy: it relates to the supply of money, which is controlled via fact ...

[email protected]

... have investigated the effect of US monetary policy shocks on various countries. They find that 1 unit shock to US interest rates causes the interest rates of Austria, Canada and New Zeland by 0.5 to 0.6 points contamporaneously. When the period is extended to 12-24 months, the effect becomes 1.0 to ...

... have investigated the effect of US monetary policy shocks on various countries. They find that 1 unit shock to US interest rates causes the interest rates of Austria, Canada and New Zeland by 0.5 to 0.6 points contamporaneously. When the period is extended to 12-24 months, the effect becomes 1.0 to ...

Banking and the Endogenous Money Supply as viewed from a

... bank profitability may restrict credit activity along the credit cycle, without having to affect the tendency towards economic growth and credit expansion. ...

... bank profitability may restrict credit activity along the credit cycle, without having to affect the tendency towards economic growth and credit expansion. ...

Gold News, Gold Market, Mining Companies, Silver News | Kitco News

... Gold has slid so far this year, with many investors feeling more comfortable about the economy and willing to turn to Tom Winmill so-called risk assets, including the broader equity market, with the Dow Jones Industrial Average repeatedly hitting record highs in recent sessions. Further, this is a p ...

... Gold has slid so far this year, with many investors feeling more comfortable about the economy and willing to turn to Tom Winmill so-called risk assets, including the broader equity market, with the Dow Jones Industrial Average repeatedly hitting record highs in recent sessions. Further, this is a p ...

programme

... Representation with(out) taxation—A debate on tax reform: Which geese can hiss the loudest? Since the time corporate tax was introduced in the US in 1909, so too have existed means to evade paying it. Rising in popularity are corporate passthrough structures such as master list partnerships (MLP) as ...

... Representation with(out) taxation—A debate on tax reform: Which geese can hiss the loudest? Since the time corporate tax was introduced in the US in 1909, so too have existed means to evade paying it. Rising in popularity are corporate passthrough structures such as master list partnerships (MLP) as ...

Slide 1

... The adverse effect on the global economy will be cushioned however by the strength of the two Asian Giants, China and India which together account for over 25% of world GDP growth, and over one-half of the GDP growth of the low and middle-income countries. Russia and Brazil too, both with oil resour ...

... The adverse effect on the global economy will be cushioned however by the strength of the two Asian Giants, China and India which together account for over 25% of world GDP growth, and over one-half of the GDP growth of the low and middle-income countries. Russia and Brazil too, both with oil resour ...

I.Why RMB exchange rate issue

... ●Average GDP per person in China just reached 1000 US Dollar in 2003,while it is almost 30,000 in the US. ● Even if 95% families in the big and medium sized cities use all their monthly income to buy hamburgers(10 Yuan/one),they can just get 200 or so. While Americans who are blue collars can affor ...

... ●Average GDP per person in China just reached 1000 US Dollar in 2003,while it is almost 30,000 in the US. ● Even if 95% families in the big and medium sized cities use all their monthly income to buy hamburgers(10 Yuan/one),they can just get 200 or so. While Americans who are blue collars can affor ...

... denominated in the national monetary unit. Because all modern governments issue currency denominated in their own monetary units, monetary economics has blurred the distinction between the monetary unit as an abstract unit like the yard, and the store of value, analogous to the yardstick. History pr ...

Chapter 13. Uses of Balance of Payments

... The use of BOP statistics in explaining changes in the money supply, an important indicator for the determination of monetary policy. The possibility that BOP/IIP could be used as a supplementary data source for monetary statistics under certain circumstances will be described (in particular, they c ...

... The use of BOP statistics in explaining changes in the money supply, an important indicator for the determination of monetary policy. The possibility that BOP/IIP could be used as a supplementary data source for monetary statistics under certain circumstances will be described (in particular, they c ...

THE IMF Lecture 6 LIUC 2010 1

... The need for an institution like the IMF became apparent during the Great Depression of the 1930s. The restrictions on imports and capital flows and sharp devaluations of currencies produced a collapse of world trade, which only worsened the problems in the world economy. Two economists, White ...

... The need for an institution like the IMF became apparent during the Great Depression of the 1930s. The restrictions on imports and capital flows and sharp devaluations of currencies produced a collapse of world trade, which only worsened the problems in the world economy. Two economists, White ...

Globalization and the MNC

... - These represented 31% of their stores. - International operations accounted for about 20% of Starbucks 2008 earnings (compared to 16% in 2005). Major markets included Japan, U.K. and Canada ...

... - These represented 31% of their stores. - International operations accounted for about 20% of Starbucks 2008 earnings (compared to 16% in 2005). Major markets included Japan, U.K. and Canada ...

Document

... of the pillars upon which the Bretton Woods fixed exchange rate regime had been constructed were now wobbling. Economic forces were already pushing the United States towards a major ...

... of the pillars upon which the Bretton Woods fixed exchange rate regime had been constructed were now wobbling. Economic forces were already pushing the United States towards a major ...

Y BRIEFS MPDD POLIC t Division

... of partially processed materials. For hydrocarbons concealing capital flows takes the form of misreporting of the quality of the oil or gas. This monitoring requires considerable technical expertise. If the public sector lacks sufficient expertise in the post conflict period, it can seek external h ...

... of partially processed materials. For hydrocarbons concealing capital flows takes the form of misreporting of the quality of the oil or gas. This monitoring requires considerable technical expertise. If the public sector lacks sufficient expertise in the post conflict period, it can seek external h ...

International monetary systems

International monetary systems are sets of internationally agreed rules, conventions and supporting institutions, that facilitate international trade, cross border investment and generally the reallocation of capital between nation states. They provide means of payment acceptable between buyers and sellers of different nationality, including deferred payment. To operate successfully, they need to inspire confidence, to provide sufficient liquidity for fluctuating levels of trade and to provide means by which global imbalances can be corrected. The systems can grow organically as the collective result of numerous individual agreements between international economic factors spread over several decades. Alternatively, they can arise from a single architectural vision as happened at Bretton Woods in 1944.