Banking and Currency Crises: How Common Are Twins?

... is also well recognized. Miller (1996), for example, shows that a speculative attack on a currency can lead to a bank crisis if deposit money is used to speculate in the foreign exchange market and banks are “loaned up.” Rojas-Suarez and Weisbrod (1995) and Obstfeld (1994) argue that a currency cris ...

... is also well recognized. Miller (1996), for example, shows that a speculative attack on a currency can lead to a bank crisis if deposit money is used to speculate in the foreign exchange market and banks are “loaned up.” Rojas-Suarez and Weisbrod (1995) and Obstfeld (1994) argue that a currency cris ...

Argentina: From From Default to Default

... 4.4.1 Effectiveness of capital controls on inflows ................................................................................... 35 4.4.2 Effectiveness of capital controls on outflows ................................................................................. 37 4.4.3 Costs of capital co ...

... 4.4.1 Effectiveness of capital controls on inflows ................................................................................... 35 4.4.2 Effectiveness of capital controls on outflows ................................................................................. 37 4.4.3 Costs of capital co ...

Poverty Reduction Strategy Paper - Basic Facts

... A Poverty Reduction Strategy Paper (PRSP) is an assessment of poverty and describes the macroeconomic, structural, social programs and policies that countriesintend to pursue over a number of years to promote growth and reduce poverty; it includes external financing needs and guaranteed sources of f ...

... A Poverty Reduction Strategy Paper (PRSP) is an assessment of poverty and describes the macroeconomic, structural, social programs and policies that countriesintend to pursue over a number of years to promote growth and reduce poverty; it includes external financing needs and guaranteed sources of f ...

The Impact of RMB Appreciation on Shandong Foreign Trade Enterprises

... attracting foreign capital inflow and improving the capital account. In the long term, high economic growth is the deciding factors of strengthening the currency exchange rate. In recent years, China’s economic development is strong, and overall national strength is increased, according to the Natio ...

... attracting foreign capital inflow and improving the capital account. In the long term, high economic growth is the deciding factors of strengthening the currency exchange rate. In recent years, China’s economic development is strong, and overall national strength is increased, according to the Natio ...

Mr. Samson Ampofo

... framework serve to reduce exchange rate volatility? Three cases can be considered: (1) In the middle of 1998, the nominal rand exchange rate began to rapidly depreciate, in large part due to contagion from the East Asian financial crisis. The initial consequence was an increase in imported inflation ...

... framework serve to reduce exchange rate volatility? Three cases can be considered: (1) In the middle of 1998, the nominal rand exchange rate began to rapidly depreciate, in large part due to contagion from the East Asian financial crisis. The initial consequence was an increase in imported inflation ...

Saskia Sassen and the Sociology of Globalization

... Saskia Sassen and the Sociology of Globalization However, this displacement does not account for outmigration as opposed to internal migration and nor does it explain the particular direction of outmigration. Only when this disruption is coupled with other objective and cultural-ideological linkage ...

... Saskia Sassen and the Sociology of Globalization However, this displacement does not account for outmigration as opposed to internal migration and nor does it explain the particular direction of outmigration. Only when this disruption is coupled with other objective and cultural-ideological linkage ...

Global Caring: Rethinking the relationship between Self and Other

... and sometimes even overlap, in part because of a common historical development. Sometimes ‘global civil society’ and ‘global citizenship’ are presented as the same: ‘groups that campaign for a better environment can be seen as quintessential expressions of global civil society and world citizenship’ ...

... and sometimes even overlap, in part because of a common historical development. Sometimes ‘global civil society’ and ‘global citizenship’ are presented as the same: ‘groups that campaign for a better environment can be seen as quintessential expressions of global civil society and world citizenship’ ...

World Economic Situation and Prospects 2013

... 2012. A growing number of developed economies, especially in Europe, have already fallen into a double-dip recession, while those facing sovereign debt distress moved even deeper into recession. Many developed economies are caught in downward spiralling dynamics from high unemployment, weak aggregat ...

... 2012. A growing number of developed economies, especially in Europe, have already fallen into a double-dip recession, while those facing sovereign debt distress moved even deeper into recession. Many developed economies are caught in downward spiralling dynamics from high unemployment, weak aggregat ...

understanding monetary policy series no 26 causes of banking crises

... in meeting their obligations. In an update, Laeven & Valencia, June 2012 defined a systemic banking crises to occur when certain criteria are met: noteworthy indication of collapse in the banking sector (as specified by important runs, losses in the banking system, and /or bank liquidation,; and, im ...

... in meeting their obligations. In an update, Laeven & Valencia, June 2012 defined a systemic banking crises to occur when certain criteria are met: noteworthy indication of collapse in the banking sector (as specified by important runs, losses in the banking system, and /or bank liquidation,; and, im ...

Outlook for 2017: Paradigm Shift

... Inspired by the aforementioned catalysts, we have entered into what my KKR colleague Ken Mehlman describes as a “political bull market.” From 2008-2015, this “political bull market” took the form of more regulation, higher taxes, and heightened industry scrutiny. Many governments also promoted fisca ...

... Inspired by the aforementioned catalysts, we have entered into what my KKR colleague Ken Mehlman describes as a “political bull market.” From 2008-2015, this “political bull market” took the form of more regulation, higher taxes, and heightened industry scrutiny. Many governments also promoted fisca ...

What Determines Institutional Arrangements for Macroprudential

... stability committee6 in a great number of countries. Second, in some countries the ministry of finance (MOF) representing the government chairs the committee, implying that it tends to play an important role in macroprudential policy7 as the chairperson or a coordinator of the committee. Based on th ...

... stability committee6 in a great number of countries. Second, in some countries the ministry of finance (MOF) representing the government chairs the committee, implying that it tends to play an important role in macroprudential policy7 as the chairperson or a coordinator of the committee. Based on th ...

NBER WORKING PAPER SERIES EXPENDITURE SWITCHING VS. REAL EXCHANGE RATE

... objective of achieving terms of trade adjustment. Moreover, when the production functions are not identical (e.g., exhibiting home bias in the use of traded inputs), or when non-traded inputs are used in production, the optimal real exchange rate is not constant. It is nonetheless true that the opti ...

... objective of achieving terms of trade adjustment. Moreover, when the production functions are not identical (e.g., exhibiting home bias in the use of traded inputs), or when non-traded inputs are used in production, the optimal real exchange rate is not constant. It is nonetheless true that the opti ...

Time-Varying Risk, Interest Rates, and Exchange Rates

... across countries. One of these implications is that if inflation is permanently higher in one country, then asset market participation is too. With higher asset market participation, markets are less segmented; thus, the volatility of the risk premia should be smaller. The model thus predicts that c ...

... across countries. One of these implications is that if inflation is permanently higher in one country, then asset market participation is too. With higher asset market participation, markets are less segmented; thus, the volatility of the risk premia should be smaller. The model thus predicts that c ...

NBER WORKING PAPER SERIES FORTUNE OR VIRTUE:

... heteroscedastic structural shocks. Perhaps the most in‡uential work in this tradition is Sims and Zha (2006). Relying on a structural vector autoregression (SVAR) with regime switching, Sims and Zha …nd that the model that best …ts the data only has changes over time in the variances of structural d ...

... heteroscedastic structural shocks. Perhaps the most in‡uential work in this tradition is Sims and Zha (2006). Relying on a structural vector autoregression (SVAR) with regime switching, Sims and Zha …nd that the model that best …ts the data only has changes over time in the variances of structural d ...

What Does Measured FDI Actually Measure?

... vestors, it is not obvious why domestic investors would want to invest more abroad, especially within the same quarter. The second is an increase in quarterly FDI inflows to emerging-market countries in response to decreases in the US monetary policy rate. Again, a reasonable prior would be that FDI ...

... vestors, it is not obvious why domestic investors would want to invest more abroad, especially within the same quarter. The second is an increase in quarterly FDI inflows to emerging-market countries in response to decreases in the US monetary policy rate. Again, a reasonable prior would be that FDI ...

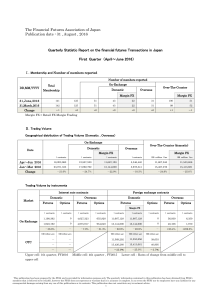

The Financial Futures Association of Japan Publication date : 31

... yen converted value of quarterly trading volume (in units) multiplied by the number of contracts. ・FFAJ converts the amounts of trading volume and open positions denominated in a foreign currency into JPY based on the value of each currency against the yen spot rate published by the Bank of Japan on ...

... yen converted value of quarterly trading volume (in units) multiplied by the number of contracts. ・FFAJ converts the amounts of trading volume and open positions denominated in a foreign currency into JPY based on the value of each currency against the yen spot rate published by the Bank of Japan on ...

Exchange Rate Regime: Does it Matter for Inflation?

... deficits and a loss of international reserves. Insofar as the exchange rate cannot be used to restore the external disequilibrium, the country will ultimately have to discipline itself through other contractionary policies such as aggregate demand policies, commercial policy, or exchange control [se ...

... deficits and a loss of international reserves. Insofar as the exchange rate cannot be used to restore the external disequilibrium, the country will ultimately have to discipline itself through other contractionary policies such as aggregate demand policies, commercial policy, or exchange control [se ...

World Economic Outlook: Housing and the Business Cycle

... A number of assumptions have been adopted for the projections presented in the World Economic Outlook. It has been assumed (1) that real effective exchange rates will remain constant at their average levels during January 30–February 27, 2008, except for the currencies participating in the European ...

... A number of assumptions have been adopted for the projections presented in the World Economic Outlook. It has been assumed (1) that real effective exchange rates will remain constant at their average levels during January 30–February 27, 2008, except for the currencies participating in the European ...

Mercantilism and China`s hunger for international reserves

... second and more important one is to minimize the danger of underestimating the mercantilist motive as a determinant of China’s reserve build-up by selecting too generous a threshold of precautionary reserve needs. The analysis focuses on the period after the Asian Financial Crisis using quarterly da ...

... second and more important one is to minimize the danger of underestimating the mercantilist motive as a determinant of China’s reserve build-up by selecting too generous a threshold of precautionary reserve needs. The analysis focuses on the period after the Asian Financial Crisis using quarterly da ...

Why Did Asian Countries Fare Better during the Global Financial

... stability—that is, the advanced economies—have increasingly become the sources of global instability since the crisis. The advanced economies are large enough to systematically matter, and they affect Asia and the rest of the world. Notwithstanding its substantial adverse implications for Asia’s med ...

... stability—that is, the advanced economies—have increasingly become the sources of global instability since the crisis. The advanced economies are large enough to systematically matter, and they affect Asia and the rest of the world. Notwithstanding its substantial adverse implications for Asia’s med ...

Free Full text

... Dissemination System (e-GDDS) as a part of its data standards initiatives aimed at promoting data transparency globally.3 The financial crisis of recent years that affected both advanced and emerging/low-income economies revealed the complexity and integration of the world economy, especially its fi ...

... Dissemination System (e-GDDS) as a part of its data standards initiatives aimed at promoting data transparency globally.3 The financial crisis of recent years that affected both advanced and emerging/low-income economies revealed the complexity and integration of the world economy, especially its fi ...

NBER WORKING PAPER SERIES VARIETIES OF CURRENCY CRISES Graciela L. Kaminsky

... onset of crises and therefore to predict balance of payment problems, it has failed to identify the changing nature of crises and to predict those crises that do not fit a particular mold. This paper contributes to this literature by assessing whether the crises of the last thirty years are of diffe ...

... onset of crises and therefore to predict balance of payment problems, it has failed to identify the changing nature of crises and to predict those crises that do not fit a particular mold. This paper contributes to this literature by assessing whether the crises of the last thirty years are of diffe ...

Output Response to Government Spending: Evidence from New International Military Spending Data

... employment of a magnitude unseen since the early 1930s’ Great Depression. During this episode, policymakers found themselves in an environment that required an immediate, bold response and that was poorly explained by the dominant economic theories of the time. Fiscal policy, among other measures, w ...

... employment of a magnitude unseen since the early 1930s’ Great Depression. During this episode, policymakers found themselves in an environment that required an immediate, bold response and that was poorly explained by the dominant economic theories of the time. Fiscal policy, among other measures, w ...

G97/4 Current account and exchange rate behaviour economy

... deviation of the forecast of foreign inflation - in practice, averaged over the next three years - and the midpoint of the inflation target band. The second term represents the fact that the RBNZ is not indifferent to forecast values of domestic inflation in different parts of the band. Thus, the no ...

... deviation of the forecast of foreign inflation - in practice, averaged over the next three years - and the midpoint of the inflation target band. The second term represents the fact that the RBNZ is not indifferent to forecast values of domestic inflation in different parts of the band. Thus, the no ...

NBER WORKING PAPER SERIES TERMS OF TRADE SHOCKS AND FISCAL CYCLES

... example, Tornell and Lane (1999) develop a model in which competition for a common pool of funds among different units (ministries, provinces) leads to the so-called ‘voracity effect,’ whereby expenditure could actually exceed a given windfall. Taking as given such a political distortion, Talvi and ...

... example, Tornell and Lane (1999) develop a model in which competition for a common pool of funds among different units (ministries, provinces) leads to the so-called ‘voracity effect,’ whereby expenditure could actually exceed a given windfall. Taking as given such a political distortion, Talvi and ...

International monetary systems

International monetary systems are sets of internationally agreed rules, conventions and supporting institutions, that facilitate international trade, cross border investment and generally the reallocation of capital between nation states. They provide means of payment acceptable between buyers and sellers of different nationality, including deferred payment. To operate successfully, they need to inspire confidence, to provide sufficient liquidity for fluctuating levels of trade and to provide means by which global imbalances can be corrected. The systems can grow organically as the collective result of numerous individual agreements between international economic factors spread over several decades. Alternatively, they can arise from a single architectural vision as happened at Bretton Woods in 1944.