Economics 302

... increase in the economy. This is a result of investors searching for the greatest return. This will occur until the real interest rate domestically is equal to that of the real world interest rate. Once again, this argument is valid for the proposed policies but not in general. It is possible that d ...

... increase in the economy. This is a result of investors searching for the greatest return. This will occur until the real interest rate domestically is equal to that of the real world interest rate. Once again, this argument is valid for the proposed policies but not in general. It is possible that d ...

Internet Assignment

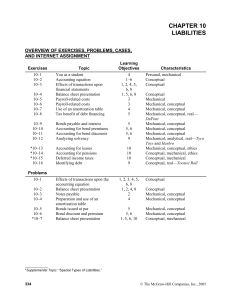

... Less: Annual tax savings ($500,000 30%) ...................................................................... Annual after-tax cost of borrowing..................................................................................... ...

... Less: Annual tax savings ($500,000 30%) ...................................................................... Annual after-tax cost of borrowing..................................................................................... ...

ProposedRuleAttach2015-00056

... Any interested person may participate in the rule making through submission of written data, views and arguments to the Division of Real Estate. Persons are requested to submit data, views and arguments to the Division of Real Estate in writing no less than ten (10) days prior to the hearing date an ...

... Any interested person may participate in the rule making through submission of written data, views and arguments to the Division of Real Estate. Persons are requested to submit data, views and arguments to the Division of Real Estate in writing no less than ten (10) days prior to the hearing date an ...

Movement of the United States Dollars against selected major

... of many researchers. The Brandes Institute in 2007 conducted an analysis spanning a period of thirty four years currency data and its potential implications for investor currency hedging programs. They examined the behaviour of currencies over an extended period and issues facing investors who decid ...

... of many researchers. The Brandes Institute in 2007 conducted an analysis spanning a period of thirty four years currency data and its potential implications for investor currency hedging programs. They examined the behaviour of currencies over an extended period and issues facing investors who decid ...

Equity Risk, Credit Risk, Default Correlation, and Corporate Sustainability

... For firm’s with no debt or negative book value, we simply assume that non-survival will be coincident with stock price to zero, since a firm with a positive stock price should be able to sell shares to raise cash to pay debt If you have a stock with 40% a year volatility you need a 2.5 standard ...

... For firm’s with no debt or negative book value, we simply assume that non-survival will be coincident with stock price to zero, since a firm with a positive stock price should be able to sell shares to raise cash to pay debt If you have a stock with 40% a year volatility you need a 2.5 standard ...

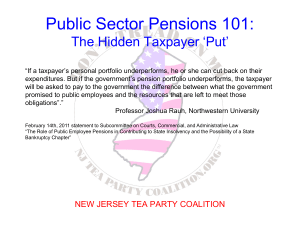

The Spectre of Mortgage Fraud: A PRIMER

... If I have saved enough to support my lifestyle in retirement, then I have a funded retirement. If my neighbor who teaches in public school wants to support a similar lifestyle based on her pension, then she has a retirement that is somewhat unfunded. That is, as of now, her pension plan has only abo ...

... If I have saved enough to support my lifestyle in retirement, then I have a funded retirement. If my neighbor who teaches in public school wants to support a similar lifestyle based on her pension, then she has a retirement that is somewhat unfunded. That is, as of now, her pension plan has only abo ...

Bonds[1] bernadette 2-15-11

... What is Interest? • Interest is money being paid or charged for money being taken out/borrowed from the use of money • It can also be defined as the percentage of money borrowed that was borrowed and will be paid back with in a given time span, most likely a year. http://dictionary.reference.com/ ...

... What is Interest? • Interest is money being paid or charged for money being taken out/borrowed from the use of money • It can also be defined as the percentage of money borrowed that was borrowed and will be paid back with in a given time span, most likely a year. http://dictionary.reference.com/ ...

Thoughts on Rising Interest Rates

... U.S. monetary policy stance remains relatively accommodative. In fact, the real policy rate — the nominal fed funds rate minus the U.S. core inflation rate — remains firmly negative. The Fed also continues to maintain an inflated balance sheet of nearly $4.5 trillion, acting to depress longer-term i ...

... U.S. monetary policy stance remains relatively accommodative. In fact, the real policy rate — the nominal fed funds rate minus the U.S. core inflation rate — remains firmly negative. The Fed also continues to maintain an inflated balance sheet of nearly $4.5 trillion, acting to depress longer-term i ...

CAPSTEAD MORTGAGE CORP (Form: 8-K, Received: 01

... Company’s borrowings, however, are not reflected at fair value on the balance sheet. Fair value is impacted by market conditions, including changes in interest rates, and the availability of financing at reasonable rates and leverage levels, among other factors. Page 3 of 12 ...

... Company’s borrowings, however, are not reflected at fair value on the balance sheet. Fair value is impacted by market conditions, including changes in interest rates, and the availability of financing at reasonable rates and leverage levels, among other factors. Page 3 of 12 ...

file

... – Loan details and interest rate – Some borrower personal characteristics – Details on property which loan is secured against ...

... – Loan details and interest rate – Some borrower personal characteristics – Details on property which loan is secured against ...

notes 2nd midterm

... Banks often have deposits at other larger banks for check clearing and exchanging foreign currency. Securities. Banks hold securities as a source of income (and profit). Bank's security holding are only debt securities as they are not allowed to hold stock. Banks hold a large amount of U.S. governme ...

... Banks often have deposits at other larger banks for check clearing and exchanging foreign currency. Securities. Banks hold securities as a source of income (and profit). Bank's security holding are only debt securities as they are not allowed to hold stock. Banks hold a large amount of U.S. governme ...

CHAPTER 1

... On the other hand, renting an apartment accumulates no equity and, thus, no wealth while the student attends school. Addtionally, if the student is in school for four years or more, the holding period of the asset may not be considered “short” and it may be logical to purchase a house. The cost of r ...

... On the other hand, renting an apartment accumulates no equity and, thus, no wealth while the student attends school. Addtionally, if the student is in school for four years or more, the holding period of the asset may not be considered “short” and it may be logical to purchase a house. The cost of r ...

![Bonds[1] bernadette 2-15-11](http://s1.studyres.com/store/data/008221501_1-fa7b1ba3bcf572926a18d3dd6c220c1d-300x300.png)