Who Benefits from Fair Value Accounting? An Equilibrium Analysis

... assets and liabilities are marked to market at each reporting date rather than ...

... assets and liabilities are marked to market at each reporting date rather than ...

q. are you the same charles e. olson whose direct testimony

... either. Additionally, it is apparent that regulatory bodies do not believe share ...

... either. Additionally, it is apparent that regulatory bodies do not believe share ...

REAL ESTATE SETTLEMENT PROCEDURES ACT (RESPA) T E

... financial institution from which it is to be purchased by Freddie Mac; or ...

... financial institution from which it is to be purchased by Freddie Mac; or ...

A4.8 - Treasurers Handbook

... cash received book. (3) Other credits appearing on the bank statement (e.g. interest received etc) should now be added to the income in the cash received book. (4) Tick each cheque payment appearing on the bank statement which agrees with the payments detailed in the cash payments book. (5) Other de ...

... cash received book. (3) Other credits appearing on the bank statement (e.g. interest received etc) should now be added to the income in the cash received book. (4) Tick each cheque payment appearing on the bank statement which agrees with the payments detailed in the cash payments book. (5) Other de ...

Sundiro Holding Co., Ltd. The Third Quarter of 2012

... Cash received from primary insurance premium Net cash received from reinsurance business Net increase in policyholders' deposits and investments Net increase in disposal of trading financial assets Cash interest, fees and charged commissions Net increased of capital borrowed Net capital increase of ...

... Cash received from primary insurance premium Net cash received from reinsurance business Net increase in policyholders' deposits and investments Net increase in disposal of trading financial assets Cash interest, fees and charged commissions Net increased of capital borrowed Net capital increase of ...

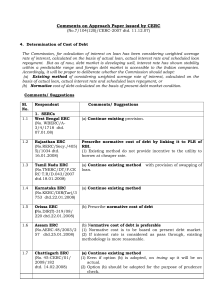

Comments on approach paper 04 - Central Electricity Regulatory

... (1) Issue is whether debt should become an instrument for ...

... (1) Issue is whether debt should become an instrument for ...

risks associated with financial instruments (glossary)

... Also, high inflation typically causes the real returns of investments to decrease. The real return of a financial instrument can be approximated as its actual (or nominal) return less inflation. While inflation risk impacts most asset classes, it is particularly acute for fixed-rate products. As a s ...

... Also, high inflation typically causes the real returns of investments to decrease. The real return of a financial instrument can be approximated as its actual (or nominal) return less inflation. While inflation risk impacts most asset classes, it is particularly acute for fixed-rate products. As a s ...

Preference Actions?

... frequently requires the use of experts and industry source materials. Accordingly, defendants who are sued frequently for preference should now give greater consideration to the industry standard which is often ignored in the earlier stages of negotiations with plaintiff’s counsel. Those creditors s ...

... frequently requires the use of experts and industry source materials. Accordingly, defendants who are sued frequently for preference should now give greater consideration to the industry standard which is often ignored in the earlier stages of negotiations with plaintiff’s counsel. Those creditors s ...

True/False Questions

... 5. Cash flows of $500 in one month, $500 in 3 months and $500 in 6 months comprise an annuity. Answer: False Page: 28 Level: Easy ...

... 5. Cash flows of $500 in one month, $500 in 3 months and $500 in 6 months comprise an annuity. Answer: False Page: 28 Level: Easy ...

77 Illustration 1 : Cost of Irredeemable Debtntures : Borrower Ltd

... Decision : If ROI 11%, Project is acceptable only if (a) Project Ivestment is less than Rs. 5 Lakhs. (b) Fractional Investment is possible on a divisible project — Investment is less than Rs. 5 Lakhs. Illustration 14 : Financing Decision and EPS Maximisation A Company requires Rs. 15 Lakhs for the i ...

... Decision : If ROI 11%, Project is acceptable only if (a) Project Ivestment is less than Rs. 5 Lakhs. (b) Fractional Investment is possible on a divisible project — Investment is less than Rs. 5 Lakhs. Illustration 14 : Financing Decision and EPS Maximisation A Company requires Rs. 15 Lakhs for the i ...

7. Which of the following statements regarding money

... return tradeoff from the investors’ viewpoint: common stock, corporate bonds, U. S. Treasury bonds, options, preferred stock.. ...

... return tradeoff from the investors’ viewpoint: common stock, corporate bonds, U. S. Treasury bonds, options, preferred stock.. ...

FORM 10-Q - corporate

... only of normal recurring adjustments, necessary for a fair statement of (a) the consolidated profit for the three and six months ended June 30, 2016 and 2015, (b) the consolidated comprehensive income for the three and six months ended June 30, 2016 and 2015, (c) the consolidated financial position ...

... only of normal recurring adjustments, necessary for a fair statement of (a) the consolidated profit for the three and six months ended June 30, 2016 and 2015, (b) the consolidated comprehensive income for the three and six months ended June 30, 2016 and 2015, (c) the consolidated financial position ...