International Financial Stability - International Center for Monetary

... Research Task Force where he chairs a working group on risk management. His policy work has also been discussed in the ECOFIN Council, the ECB Governing Council, European Commission fora, the Bank of England Central Bank Governors' Symposium and published in many policy reports. In 2002 Philipp Hart ...

... Research Task Force where he chairs a working group on risk management. His policy work has also been discussed in the ECOFIN Council, the ECB Governing Council, European Commission fora, the Bank of England Central Bank Governors' Symposium and published in many policy reports. In 2002 Philipp Hart ...

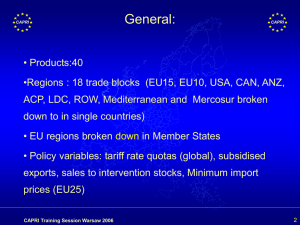

Kein Folientitel

... • In many cases, TRQ relate to specific tariff lines which are more dis-aggregated as the model’s product aggregated product is mix of TRQ and tariff only regime • Depending on quota administration, the observed fill rate may not be an indicator for the regime • Quota may be allocated to single co ...

... • In many cases, TRQ relate to specific tariff lines which are more dis-aggregated as the model’s product aggregated product is mix of TRQ and tariff only regime • Depending on quota administration, the observed fill rate may not be an indicator for the regime • Quota may be allocated to single co ...

Strategic Housing Market Assessment for the East Kent Sub

... reaching its recommendations, through discussions with developers, housing associations and local authority planning staff, our analysis of housing markets and in particular analysis of the changes in prices that have been experienced since the beginning of the ‘credit crunch’. Recommendation eight: ...

... reaching its recommendations, through discussions with developers, housing associations and local authority planning staff, our analysis of housing markets and in particular analysis of the changes in prices that have been experienced since the beginning of the ‘credit crunch’. Recommendation eight: ...

Leverage and Disagreement ∗ François Geerolf UCLA

... choose loans which are fully secured according to their beliefs. The leverage ratios of these loans are higher when they are relatively more optimistic. Those higher leverage loans would be attractive to all borrowers if implicit returns on loan contracts were the same, because borrowers would ideal ...

... choose loans which are fully secured according to their beliefs. The leverage ratios of these loans are higher when they are relatively more optimistic. Those higher leverage loans would be attractive to all borrowers if implicit returns on loan contracts were the same, because borrowers would ideal ...

Spot Market Power and Futures Market Trading

... optimal quantity of hedging; a risk-neutral monopolist will not want to hedge risk in the …nancial markets, while a risk-averse one will hedge less than he would if he had no market power. We will show that as the degree of risk-aversion increases, the optimal amount of hedging will increase. Relati ...

... optimal quantity of hedging; a risk-neutral monopolist will not want to hedge risk in the …nancial markets, while a risk-averse one will hedge less than he would if he had no market power. We will show that as the degree of risk-aversion increases, the optimal amount of hedging will increase. Relati ...

What caused the collapse of Lehman Brothers?

... Notwithstanding the billions of dollars worth of CDOs that Lehman originated from 2006 to 2007, Lehman accounted for only 3% of the total value of new CDO issuances; and their CDO portfolio was subjected to the disruptions in the credit markets and deteriorating value of mortgages and mortgage‐linke ...

... Notwithstanding the billions of dollars worth of CDOs that Lehman originated from 2006 to 2007, Lehman accounted for only 3% of the total value of new CDO issuances; and their CDO portfolio was subjected to the disruptions in the credit markets and deteriorating value of mortgages and mortgage‐linke ...

FSB Securities Lending and Repos: Market Overview and Financial

... interchangeably to refer to the degree of over-collateralisation in securities financing transactions. ...

... interchangeably to refer to the degree of over-collateralisation in securities financing transactions. ...

Overconfidence and Firm Decision Making: Evidence from

... value their own investments. Real estate also provides a far more precise measurement of over- or underpricing than takeovers. Even we can observe how much a firm spends on an acquisition, we have less information on the comparable tranactions in a merger or takeover than in a property transaction, ...

... value their own investments. Real estate also provides a far more precise measurement of over- or underpricing than takeovers. Even we can observe how much a firm spends on an acquisition, we have less information on the comparable tranactions in a merger or takeover than in a property transaction, ...

The Term Structure of Money Market Spreads

... Each participating bank is asked to base its quoted rate on the following question: "At what rate could you borrow funds, were you to do so by asking for and then accepting interbank offers in a reasonable market size just prior to 11 a.m. London time?" An important distinction is that this is an of ...

... Each participating bank is asked to base its quoted rate on the following question: "At what rate could you borrow funds, were you to do so by asking for and then accepting interbank offers in a reasonable market size just prior to 11 a.m. London time?" An important distinction is that this is an of ...

Home credit remedies evaluation

... Home credit lenders find new customers by a combination of word of mouth recommendation, direct marketing and canvassing using vouchers or goods on credit. 17 Home credit is governed by consumer credit law, which is primarily concerned with the protection of the individual who is granted credit. The ...

... Home credit lenders find new customers by a combination of word of mouth recommendation, direct marketing and canvassing using vouchers or goods on credit. 17 Home credit is governed by consumer credit law, which is primarily concerned with the protection of the individual who is granted credit. The ...

discrimination in the small-business credit market

... Although not much previous research has examined discrimination in small-business credit markets, there has been an active debate on the question of whether banks discriminate against minority applicants for mortgages. In an in uential study in that area, researchers at the Federal Reserve Bank of ...

... Although not much previous research has examined discrimination in small-business credit markets, there has been an active debate on the question of whether banks discriminate against minority applicants for mortgages. In an in uential study in that area, researchers at the Federal Reserve Bank of ...

THE OUTSOURCING OF FINANCIAL REGULATION TO RISK

... in the subprime mortgage market, and this outsourcing of regulation exacerbated the crisis. To understand the crisis, the failure of risk models, and the dangers of regulatory outsourcing, it is helpful to sketch out the system by which mortgages are connected to asset-backed securities, derivatives ...

... in the subprime mortgage market, and this outsourcing of regulation exacerbated the crisis. To understand the crisis, the failure of risk models, and the dangers of regulatory outsourcing, it is helpful to sketch out the system by which mortgages are connected to asset-backed securities, derivatives ...

Review of the Differentiated Nature and Scope of Financial Regulation

... securities sectors. These differences are warranted in some cases due to specific attributes of each financial sector, but, in others, these differences may contribute to gaps in the regulation of the financial system as a whole. One way to understand the differences and identify the gaps is to comp ...

... securities sectors. These differences are warranted in some cases due to specific attributes of each financial sector, but, in others, these differences may contribute to gaps in the regulation of the financial system as a whole. One way to understand the differences and identify the gaps is to comp ...

Annual Equity-Based Insurance Guarantees Conference

... Dr. K. (Ravi) Ravindran currently spends much of his time lecturing, selectively consulting on VArelated issues and running a private equity fund. In addition to this, he holds a visiting professor appointment in Haskolinn Reykjavik (Iceland) and is the author of the recently published book titled T ...

... Dr. K. (Ravi) Ravindran currently spends much of his time lecturing, selectively consulting on VArelated issues and running a private equity fund. In addition to this, he holds a visiting professor appointment in Haskolinn Reykjavik (Iceland) and is the author of the recently published book titled T ...

Liquidity Flooding, Asset Prices and the Real EconomyWe are

... as the same sort of problem the Japanese faced, but in the completely opposite direction. That is, the massive liquidity injections and credit expansion in China created overheating in some sectors (e.g., the real estate sector) which led to the effective demand for credit shooting up, in turn caus ...

... as the same sort of problem the Japanese faced, but in the completely opposite direction. That is, the massive liquidity injections and credit expansion in China created overheating in some sectors (e.g., the real estate sector) which led to the effective demand for credit shooting up, in turn caus ...

NBER WORKING PAPER SERIES THE ASYMMETRIC EFFECTS OF FINANCIAL FRICTIONS

... signals about conditions are generated, and the learning that fuels recoveries is slower. The larger rise in lending rates combined with their slower recovery means greater asymmetry in the movements of lending rates and economic activity in economies with frictions. I reach these conclusions by ex ...

... signals about conditions are generated, and the learning that fuels recoveries is slower. The larger rise in lending rates combined with their slower recovery means greater asymmetry in the movements of lending rates and economic activity in economies with frictions. I reach these conclusions by ex ...

Rural East Anglia Partnership Strategic Housing Market Assessment SubRegional Report

... to describe the work conducted here. Key terms are defined in Chapter 2. As with SHMAs generally, this report is part of a process involving stakeholders. It is therefore important to point out that the report is only one stage in what is intended to be a continuing process. The report is structu ...

... to describe the work conducted here. Key terms are defined in Chapter 2. As with SHMAs generally, this report is part of a process involving stakeholders. It is therefore important to point out that the report is only one stage in what is intended to be a continuing process. The report is structu ...

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

... Madison County Bank is a federally chartered savings bank headquartered in Madison, Nebraska, which is the county seat of Madison County, and is located in northeastern Nebraska approximately 120 miles northwest of Omaha and approximately 100 miles southwest of Sioux City, Iowa. Madison County Bank ...

... Madison County Bank is a federally chartered savings bank headquartered in Madison, Nebraska, which is the county seat of Madison County, and is located in northeastern Nebraska approximately 120 miles northwest of Omaha and approximately 100 miles southwest of Sioux City, Iowa. Madison County Bank ...

Reservation bid and ask prices for options and covered

... the covered warrants. This allows us to show specifically that both reservation bid and ask prices for covered warrants are strictly greater than the BlackScholes value and to draw other specific implications for covered warrant and structured product prices. Finally, we compare the implications of ...

... the covered warrants. This allows us to show specifically that both reservation bid and ask prices for covered warrants are strictly greater than the BlackScholes value and to draw other specific implications for covered warrant and structured product prices. Finally, we compare the implications of ...

Gentrification, Displacement and the Role of Public Investment: A

... like Houston or Dallas are much more likely to segregate themselves than those in denser older regions like Boston or Philadelphia or even Chicago (Fry and Taylor 2012). This suggests that segregation is related to metropolitan structure and suburbanization. The concentric zone model is particularly ...

... like Houston or Dallas are much more likely to segregate themselves than those in denser older regions like Boston or Philadelphia or even Chicago (Fry and Taylor 2012). This suggests that segregation is related to metropolitan structure and suburbanization. The concentric zone model is particularly ...

United States housing bubble

The United States housing bubble was an economic bubble affecting many parts of the United States housing market in over half of American states. Housing prices peaked in early 2006, started to decline in 2006 and 2007, and reached new lows in 2012. On December 30, 2008, the Case-Shiller home price index reported its largest price drop in its history. The credit crisis resulting from the bursting of the housing bubble is—according to general consensus—the primary cause of the 2007–2009 recession in the United States.Increased foreclosure rates in 2006–2007 among U.S. homeowners led to a crisis in August 2008 for the subprime, Alt-A, collateralized debt obligation (CDO), mortgage, credit, hedge fund, and foreign bank markets. In October 2007, the U.S. Secretary of the Treasury called the bursting housing bubble ""the most significant risk to our economy.""Any collapse of the U.S. housing bubble has a direct impact not only on home valuations, but the nation's mortgage markets, home builders, real estate, home supply retail outlets, Wall Street hedge funds held by large institutional investors, and foreign banks, increasing the risk of a nationwide recession. Concerns about the impact of the collapsing housing and credit markets on the larger U.S. economy caused President George W. Bush and the Chairman of the Federal Reserve Ben Bernanke to announce a limited bailout of the U.S. housing market for homeowners who were unable to pay their mortgage debts.In 2008 alone, the United States government allocated over $900 billion to special loans and rescues related to the U.S. housing bubble, with over half going to Fannie Mae and Freddie Mac (both of which are government-sponsored enterprises) as well as the Federal Housing Administration. On December 24, 2009, the Treasury Department made an unprecedented announcement that it would be providing Fannie Mae and Freddie Mac unlimited financial support for the next three years despite acknowledging losses in excess of $400 billion so far. The Treasury has been criticized for encroaching on spending powers that are enumerated for Congress alone by the United States Constitution, and for violating limits imposed by the Housing and Economic Recovery Act of 2008.