Debt crisis hits Europe`s retail credit markets

... The extent of deleveraging in separate countries is significantly correlated with the country’s credit expansion prior to the financial crisis, but is only weakly linked to current household debt levels. This suggests/means? that the trend in deleveraging is mainly caused by the pre-crisis credit ex ...

... The extent of deleveraging in separate countries is significantly correlated with the country’s credit expansion prior to the financial crisis, but is only weakly linked to current household debt levels. This suggests/means? that the trend in deleveraging is mainly caused by the pre-crisis credit ex ...

Lecture 2

... • The GFC has had a major impact on the economies of developed and developing countries in late 2008 and 2009. • European countries and the US have been severely impact, but Australia has not been as badly affected. • Let’s see what the impact was, and then let’s try to understand what caused the cr ...

... • The GFC has had a major impact on the economies of developed and developing countries in late 2008 and 2009. • European countries and the US have been severely impact, but Australia has not been as badly affected. • Let’s see what the impact was, and then let’s try to understand what caused the cr ...

FRS 102 for leaders – in plain English Financial Reporting Standard

... Housing associations which have not already done so, may need at some point to reformat budgets and management accounts for consistency with the FRS 102 audited accounts as well, in time, regulatory financial returns should housing regulators remodel them for consistency with FRS 102. ...

... Housing associations which have not already done so, may need at some point to reformat budgets and management accounts for consistency with the FRS 102 audited accounts as well, in time, regulatory financial returns should housing regulators remodel them for consistency with FRS 102. ...

Lecture / Chapter 3

... Increase in Equity Through Mortgage Reduction Tax Shelter High Rate of Return Equity Leverage Estate Building Inflation Hedging Psychological Factors ...

... Increase in Equity Through Mortgage Reduction Tax Shelter High Rate of Return Equity Leverage Estate Building Inflation Hedging Psychological Factors ...

Demystifying the Federal Home Loan Banks:

... These programs were begun to help community lenders retain more of the value of their mortgage originations. Lenders, particularly smaller lenders who know their customers better than any GSE can, have traditionally originated very high-quality fixed-rate mortgages. However, they often were not able ...

... These programs were begun to help community lenders retain more of the value of their mortgage originations. Lenders, particularly smaller lenders who know their customers better than any GSE can, have traditionally originated very high-quality fixed-rate mortgages. However, they often were not able ...

Understanding the Global Economic Crisis

... positions could increase transparency • Micro-prudential regulation has to be complemented by macro-prudential regulation • Need of an international dimension to financial regulation and institution to take into account systemic risk ...

... positions could increase transparency • Micro-prudential regulation has to be complemented by macro-prudential regulation • Need of an international dimension to financial regulation and institution to take into account systemic risk ...

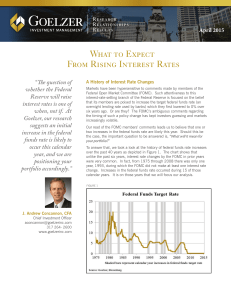

What to Expect From Rising Interest Rates

... example, the price of the current 3-year U.S. Treasury note would fall by 2% if the yield a year from now were one percentage point higher. By contrast, the current 10-year U.S. Treasury bond would experience a nearly 8% price decline under the same scenario. Thus, by investing in shorter maturities ...

... example, the price of the current 3-year U.S. Treasury note would fall by 2% if the yield a year from now were one percentage point higher. By contrast, the current 10-year U.S. Treasury bond would experience a nearly 8% price decline under the same scenario. Thus, by investing in shorter maturities ...

Why Has Good Economic News Hurt Financial Markets?

... of room to maintain its support if economic conditions don't continue to improve in the coming months; in 2010, it halted bond purchases because the economy was growing, only to renew them a couple of months later. Fed Chairman Ben Bernanke has said that when the Fed does begin to reverse course, it ...

... of room to maintain its support if economic conditions don't continue to improve in the coming months; in 2010, it halted bond purchases because the economy was growing, only to renew them a couple of months later. Fed Chairman Ben Bernanke has said that when the Fed does begin to reverse course, it ...

Derivative Markets By Robert Goodwin

... better rating on all of them as a whole. Mortgages with terrible ratings were being bunched together with mortgages with great ratings in order to get one rating for all of the mortgages. These are called CMO’s or Collateralized Mortgage Obligations. People began to see this happening more frequent ...

... better rating on all of them as a whole. Mortgages with terrible ratings were being bunched together with mortgages with great ratings in order to get one rating for all of the mortgages. These are called CMO’s or Collateralized Mortgage Obligations. People began to see this happening more frequent ...

Christophe Andre: Housing Markets, Business Cycles and

... In the vast majority of OECD countries, house prices have risen sharply from the mid-90s to 2006-07 and housing wealth has increased considerably during that period. At the same time, household debt has reached record levels in many countries, largely as a result of the decrease in real and nominal ...

... In the vast majority of OECD countries, house prices have risen sharply from the mid-90s to 2006-07 and housing wealth has increased considerably during that period. At the same time, household debt has reached record levels in many countries, largely as a result of the decrease in real and nominal ...

The characteristics of the capital market

... • Stable, conservative and concentrated • Tight supervision, and stability-related limitations • International standards––risk management, control, corporate governance, capital (Basel 2) ...

... • Stable, conservative and concentrated • Tight supervision, and stability-related limitations • International standards––risk management, control, corporate governance, capital (Basel 2) ...

Identifying Opportunity. Navigating Risk.

... The price of oil firmed quickly and started rising more than expected causing anxiety even as it turned lower again by quarter end. Lower oil prices have reduced capital spending by the major oil companies which is a negative for the economy. However, with over two-thirds of the U.S. economy driven ...

... The price of oil firmed quickly and started rising more than expected causing anxiety even as it turned lower again by quarter end. Lower oil prices have reduced capital spending by the major oil companies which is a negative for the economy. However, with over two-thirds of the U.S. economy driven ...

Document

... surrounding it and by the quality and desirability of the neighborhood. When most prospective buyers start looking for a home they will target certain neighborhoods. They choose these neighborhoods for a variety of reasons including housing costs, schools, shopping, employment, parks, safety, and a ...

... surrounding it and by the quality and desirability of the neighborhood. When most prospective buyers start looking for a home they will target certain neighborhoods. They choose these neighborhoods for a variety of reasons including housing costs, schools, shopping, employment, parks, safety, and a ...

United States housing bubble

The United States housing bubble was an economic bubble affecting many parts of the United States housing market in over half of American states. Housing prices peaked in early 2006, started to decline in 2006 and 2007, and reached new lows in 2012. On December 30, 2008, the Case-Shiller home price index reported its largest price drop in its history. The credit crisis resulting from the bursting of the housing bubble is—according to general consensus—the primary cause of the 2007–2009 recession in the United States.Increased foreclosure rates in 2006–2007 among U.S. homeowners led to a crisis in August 2008 for the subprime, Alt-A, collateralized debt obligation (CDO), mortgage, credit, hedge fund, and foreign bank markets. In October 2007, the U.S. Secretary of the Treasury called the bursting housing bubble ""the most significant risk to our economy.""Any collapse of the U.S. housing bubble has a direct impact not only on home valuations, but the nation's mortgage markets, home builders, real estate, home supply retail outlets, Wall Street hedge funds held by large institutional investors, and foreign banks, increasing the risk of a nationwide recession. Concerns about the impact of the collapsing housing and credit markets on the larger U.S. economy caused President George W. Bush and the Chairman of the Federal Reserve Ben Bernanke to announce a limited bailout of the U.S. housing market for homeowners who were unable to pay their mortgage debts.In 2008 alone, the United States government allocated over $900 billion to special loans and rescues related to the U.S. housing bubble, with over half going to Fannie Mae and Freddie Mac (both of which are government-sponsored enterprises) as well as the Federal Housing Administration. On December 24, 2009, the Treasury Department made an unprecedented announcement that it would be providing Fannie Mae and Freddie Mac unlimited financial support for the next three years despite acknowledging losses in excess of $400 billion so far. The Treasury has been criticized for encroaching on spending powers that are enumerated for Congress alone by the United States Constitution, and for violating limits imposed by the Housing and Economic Recovery Act of 2008.