Realize Higher Returns from Income-Producing Credit

... “Although profitability for the large credit card banks has risen and fallen over the years, credit card earnings have been almost always higher than returns on all commercial bank activities.Earning patterns for 2013 were consistent with historical experience: For all commercial banks, the average ...

... “Although profitability for the large credit card banks has risen and fallen over the years, credit card earnings have been almost always higher than returns on all commercial bank activities.Earning patterns for 2013 were consistent with historical experience: For all commercial banks, the average ...

We need to solve the mortgage problem before interest rates rise

... Dealing with the wider problem of affordability is likely to require a range of solutions, from treading easy on rate rises, to starting conversations with borrowers about planning for rising costs. For some, it will mean ultimately looking at mechanisms for leaving the housing market altogether. In ...

... Dealing with the wider problem of affordability is likely to require a range of solutions, from treading easy on rate rises, to starting conversations with borrowers about planning for rising costs. For some, it will mean ultimately looking at mechanisms for leaving the housing market altogether. In ...

Discussion by F. Smets

... The variation in the interest rate spread is minimal in response to all aggregate shocks (only a few basis points). Is this just a calibration issue and thus solvable or a more fundamental problem? In reality, the external finance premium is much more volatile. ...

... The variation in the interest rate spread is minimal in response to all aggregate shocks (only a few basis points). Is this just a calibration issue and thus solvable or a more fundamental problem? In reality, the external finance premium is much more volatile. ...

Ride The Seller220512

... was not sustained and by March, last year’s gloom had all but taken back over. That was until early May, when the RBA announced a surprise 50 basis points rate cut. Although the banks withhold between 10 and 18 basis points, what was passed on was enough to reignite that confidence which had pushed ...

... was not sustained and by March, last year’s gloom had all but taken back over. That was until early May, when the RBA announced a surprise 50 basis points rate cut. Although the banks withhold between 10 and 18 basis points, what was passed on was enough to reignite that confidence which had pushed ...

as file - Meetings, agendas, and minutes

... borrowings by hedge funds may represent their being leveraged 6 or even 7 times (i.e. borrowings representing around 85% of assets invested). Market movements, especially in extremely volatile conditions, can result in demands for substantially more collateral, which require the sale of more liquid ...

... borrowings by hedge funds may represent their being leveraged 6 or even 7 times (i.e. borrowings representing around 85% of assets invested). Market movements, especially in extremely volatile conditions, can result in demands for substantially more collateral, which require the sale of more liquid ...

Housing Key Issues, Problems and Solutions

... • These are long-run scenarios. So does the current slowdown make any difference? ...

... • These are long-run scenarios. So does the current slowdown make any difference? ...

The UK Housing Market: Measured Decline or Total Collapse?"

... • These are long-run scenarios. So does the current slowdown make any difference? ...

... • These are long-run scenarios. So does the current slowdown make any difference? ...

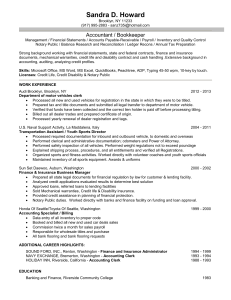

chap008-- - MCST-CS

... “To reduce the risk of an investment by making an offsetting investment. There are a large number of hedging strategies that one can use. To give an example, one may take a long position on a security and then sell short the same or a similar security. This means that one will profit (or at least av ...

... “To reduce the risk of an investment by making an offsetting investment. There are a large number of hedging strategies that one can use. To give an example, one may take a long position on a security and then sell short the same or a similar security. This means that one will profit (or at least av ...

Gearing Capital Funding

... SARB requires banks to allocate some of their equity or capital for each lending transactions. Basle II requires banks to calculate the capital it has to hold one each deal. Lending transactions are analysed according to transaction specific credit (and other) risk. More capital must be allocated to ...

... SARB requires banks to allocate some of their equity or capital for each lending transactions. Basle II requires banks to calculate the capital it has to hold one each deal. Lending transactions are analysed according to transaction specific credit (and other) risk. More capital must be allocated to ...

Chapter 8: Wages, Rent, Profit, and Interest

... Partial ownership of a corporation, which entitles the shareholder to dividends and, hopefully, a profit once the share is sold; also called a stock ...

... Partial ownership of a corporation, which entitles the shareholder to dividends and, hopefully, a profit once the share is sold; also called a stock ...

Tom Traficanti`s Lending Presentation

... projected NOI, further decline cap rates and strong investor demand for multifamily in northern Nevada. Increase in households consolidating into existing housing units, due to affordability. Availability of loans for apartments will continue to improve Short term interest rates will increase sli ...

... projected NOI, further decline cap rates and strong investor demand for multifamily in northern Nevada. Increase in households consolidating into existing housing units, due to affordability. Availability of loans for apartments will continue to improve Short term interest rates will increase sli ...

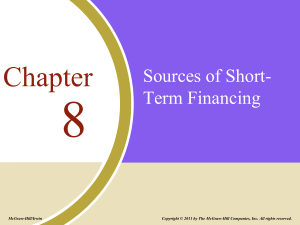

Graeme Oram Presentation[1]

... Five Lamps recognised a massive gap in the financial services marketplace …… and our capacity to integrate key elements of the service One of our first borrowers – still a customer Still in the low pay, no pay cycle Small savings Comes to us regularly with issues He can still see the joins in local ...

... Five Lamps recognised a massive gap in the financial services marketplace …… and our capacity to integrate key elements of the service One of our first borrowers – still a customer Still in the low pay, no pay cycle Small savings Comes to us regularly with issues He can still see the joins in local ...

UK consumer credit

... Sterling net lending by UK MFIs and other lenders to UK individuals (excluding student loans). Non seasonally adjusted. Percentage change on a year earlier of quarterly nominal disposable household income. Seasonally adjusted. Other is estimated as total consumer credit lending minus dealership car ...

... Sterling net lending by UK MFIs and other lenders to UK individuals (excluding student loans). Non seasonally adjusted. Percentage change on a year earlier of quarterly nominal disposable household income. Seasonally adjusted. Other is estimated as total consumer credit lending minus dealership car ...

BANK OF ISRAEL Office of the Spokesperson and Economic

... What about small businesses? First, the importance of small businesses in the Israeli economy is similar to that in the other OECD countries, in fact a bit larger, constituting 42% of business sector GDP—a significant part of the economy that could be a source of economic growth. The banks increased ...

... What about small businesses? First, the importance of small businesses in the Israeli economy is similar to that in the other OECD countries, in fact a bit larger, constituting 42% of business sector GDP—a significant part of the economy that could be a source of economic growth. The banks increased ...

personal finance - Gen i Revolution

... reward, when compared to bonds, certificates of deposit, and stock mutual funds. Certificates of deposit would be considered the savings alternative with the lowest risk and lowest potential reward, when compared to bonds, stock mutual funds, and individual stocks. ...

... reward, when compared to bonds, certificates of deposit, and stock mutual funds. Certificates of deposit would be considered the savings alternative with the lowest risk and lowest potential reward, when compared to bonds, stock mutual funds, and individual stocks. ...

Chap 3

... Rf,n = yield of an n-day Treasury (risk-free) security DP = default premium to compensate for credit risk ...

... Rf,n = yield of an n-day Treasury (risk-free) security DP = default premium to compensate for credit risk ...

Show Me the Money! - Fuse Financial Partners

... • Forecast Growth & Payback! – Know What “Drives” the Business – Know When You Break Even ...

... • Forecast Growth & Payback! – Know What “Drives” the Business – Know When You Break Even ...

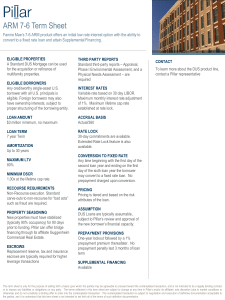

ARM 7-6 Term Sheet

... the new borrower’s financial capacity. PREPAYMENT PROVISIONS One-year lockout followed by a 1% prepayment premium thereafater. No prepayment penalty last 3 months of loan term ...

... the new borrower’s financial capacity. PREPAYMENT PROVISIONS One-year lockout followed by a 1% prepayment premium thereafater. No prepayment penalty last 3 months of loan term ...

November 2007 Testimony to Joint Economic Committee of Congress

... intensified investors' concerns about credit market developments and the implications of the downturn in the housing market for economic growth. In addition, further sharp increases in crude oil prices have put renewed upward pressure on inflation and may impose further restraint on economic activit ...

... intensified investors' concerns about credit market developments and the implications of the downturn in the housing market for economic growth. In addition, further sharp increases in crude oil prices have put renewed upward pressure on inflation and may impose further restraint on economic activit ...

MONETARY POLICY MEASURES

... • It refers to the minimum percentage of a bank’s total deposits required to be kept with the Central Bank in the form of cash reserves. • HIGH CRR – less credit availability –will reduce the money supply. • Low CRR – more credit availability will increase the money supply. ...

... • It refers to the minimum percentage of a bank’s total deposits required to be kept with the Central Bank in the form of cash reserves. • HIGH CRR – less credit availability –will reduce the money supply. • Low CRR – more credit availability will increase the money supply. ...

Understanding Debt - UConn Financial Aid

... Account balance is $100. You make a purchase for $10, now your account then has $90 remaining ...

... Account balance is $100. You make a purchase for $10, now your account then has $90 remaining ...

Credit rationing

Credit rationing refers to the situation where lenders limit the supply of additional credit to borrowers who demand funds, even if the latter are willing to pay higher interest rates. It is an example of market imperfection, or market failure, as the price mechanism fails to bring about equilibrium in the market. It should not be confused with cases where credit is simply ""too expensive"" for some borrowers, that is, situations where the interest rate is deemed too high. On the contrary, the borrower would like to acquire the funds at the current rates, and the imperfection refers to the absence of equilibrium in spite of willing borrowers. In other words, at the prevailing market interest rate, demand exceeds supply, but lenders are not willing to either loan more funds, or raise the interest rate charged, as they are already maximising profits.

![Graeme Oram Presentation[1]](http://s1.studyres.com/store/data/021314501_1-3cb04f79840be6ebc60c4382080f818a-300x300.png)