The effect of rising interest rates on bonds, stocks and real

... increases will be less dramatic than in the past. The Fed has indicated rate hikes will be modest and will occur at a measured pace. However, the pace of rate increases is expected to accelerate in 2017 and 2018 as the economy continues to strengthen and inflation rises. Moreover, rate normalization ...

... increases will be less dramatic than in the past. The Fed has indicated rate hikes will be modest and will occur at a measured pace. However, the pace of rate increases is expected to accelerate in 2017 and 2018 as the economy continues to strengthen and inflation rises. Moreover, rate normalization ...

Credit Rationing by Loan Size in Commercial Loan Markets

... utility function U(O)indicates the satisfaction that the owner gets from various combinations of consumption in the two time periods. We assume that the owner’s utility function is twice differentiable, strictly increasing and strictly concave. These mathematical properties imply that the owner pref ...

... utility function U(O)indicates the satisfaction that the owner gets from various combinations of consumption in the two time periods. We assume that the owner’s utility function is twice differentiable, strictly increasing and strictly concave. These mathematical properties imply that the owner pref ...

Key

... lend, borrowers will have to compete for the more limited amount of funds. Banks can charge higher interest rates on their loans because the competition for these limited funds is so keen. Market interest rates will rise in this situation. What is the required reserve ratio? For a tight money policy ...

... lend, borrowers will have to compete for the more limited amount of funds. Banks can charge higher interest rates on their loans because the competition for these limited funds is so keen. Market interest rates will rise in this situation. What is the required reserve ratio? For a tight money policy ...

The State of the Low Income Housing Tax Credit Market – National

... yield which has caused more interest in the credit as the markets continue to change. **Regardless of the type of lender or investor there is still a very large emphasis placed on the sponsor, the development team, deal location and proposed target populations. ...

... yield which has caused more interest in the credit as the markets continue to change. **Regardless of the type of lender or investor there is still a very large emphasis placed on the sponsor, the development team, deal location and proposed target populations. ...

Interest rate

... investor expectations about future inflation rates LIQUIDITY PREFERENCE THEORY: Investors are willing to accept lower interest rates on short-term debt securities which provide greater liquidity and less interest rate risk ...

... investor expectations about future inflation rates LIQUIDITY PREFERENCE THEORY: Investors are willing to accept lower interest rates on short-term debt securities which provide greater liquidity and less interest rate risk ...

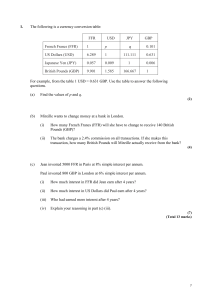

14.02 Principles of Macroeconomics Problem Set 4 Fall 2005

... 2) Imagine that in the market there is one trader with more information. She is a small trader which means that her trades don’t change the market price. At t=1 she gets insider information that the second stock will pay a higher dividend, namely $20.5 at t=3. At t=2 the information is released to t ...

... 2) Imagine that in the market there is one trader with more information. She is a small trader which means that her trades don’t change the market price. At t=1 she gets insider information that the second stock will pay a higher dividend, namely $20.5 at t=3. At t=2 the information is released to t ...

Economic Turmoil and Private Student Loans What it Means to Your Students

... • Private loans are those that exist outside the federal student loan system and are not guaranteed by the federal government. • Private loans may be provided by banks, non-profit agencies, or other financial institutions. • Private Loans for education were created to bridge the gap between the fund ...

... • Private loans are those that exist outside the federal student loan system and are not guaranteed by the federal government. • Private loans may be provided by banks, non-profit agencies, or other financial institutions. • Private Loans for education were created to bridge the gap between the fund ...

Trade, capital flows and credit growth in CEE

... Average for the countries with a share of foreign bank equal to 70% of total banking sector assets. ownership lower than 70% of total banking sector assets. Sources: Central banks; IMF; author’s estimates. ...

... Average for the countries with a share of foreign bank equal to 70% of total banking sector assets. ownership lower than 70% of total banking sector assets. Sources: Central banks; IMF; author’s estimates. ...

What is Credit- Teacher Guide

... • Commercial banks and savings and loans are very similar in the types of financial services they provide their customers; these include loans, savings accounts, and checking accounts. • Credit unions are not-for-profit cooperatives— enterprises owned by their members—that provide many of the same f ...

... • Commercial banks and savings and loans are very similar in the types of financial services they provide their customers; these include loans, savings accounts, and checking accounts. • Credit unions are not-for-profit cooperatives— enterprises owned by their members—that provide many of the same f ...

Economics 3334 – Intermediate Macroeconomics

... questions in it. Make sure you answer all of them. Within each problem the parts get harder as you go on, so manage your time accordingly. 1. (25 points) Consider a closed economy. Look at what happens as the population ages and changes its consumption patterns. a. (4 pts) First, draw the loanable f ...

... questions in it. Make sure you answer all of them. Within each problem the parts get harder as you go on, so manage your time accordingly. 1. (25 points) Consider a closed economy. Look at what happens as the population ages and changes its consumption patterns. a. (4 pts) First, draw the loanable f ...

Future Rate Hikes and Market Volatility

... “Our economy is always allow me to state two of the evolving and adapting, and big ones. Number one, the we as investors need to adapt market hates uncertainty. If with it.” — Roger Ford you want to create market volatility, just create a little uncertainty. That isn’t hard to do in the world we liv ...

... “Our economy is always allow me to state two of the evolving and adapting, and big ones. Number one, the we as investors need to adapt market hates uncertainty. If with it.” — Roger Ford you want to create market volatility, just create a little uncertainty. That isn’t hard to do in the world we liv ...

What Do Financial Market Indicators Tell Us?

... An interest rate is simply the price of borrowing money for a fixed period. In the United States, the federal funds rate, which is importantly influenced by Federal Reserve monetary policy decisions, is one of the most important interest rates. It is the interest rate at which banks borrow money fro ...

... An interest rate is simply the price of borrowing money for a fixed period. In the United States, the federal funds rate, which is importantly influenced by Federal Reserve monetary policy decisions, is one of the most important interest rates. It is the interest rate at which banks borrow money fro ...

Central Bank of Egypt Credit Risk

... higher the risk of negative credit event (default, etc), the higher the interest rate investors will demand for assuming that risk. • •Private rating agencies (Moody’s and Standard & Poor’s) provide guidance for investors to the credit quality of various issues. ...

... higher the risk of negative credit event (default, etc), the higher the interest rate investors will demand for assuming that risk. • •Private rating agencies (Moody’s and Standard & Poor’s) provide guidance for investors to the credit quality of various issues. ...

Chapter 9

... investor expectations about future inflation rates LIQUIDITY PREFERENCE THEORY: Investors are willing to accept lower interest rates on short-term debt securities which provide greater liquidity and less interest rate risk ...

... investor expectations about future inflation rates LIQUIDITY PREFERENCE THEORY: Investors are willing to accept lower interest rates on short-term debt securities which provide greater liquidity and less interest rate risk ...

Lecture / Chapter 3

... 3. Lender obtains credit reports of borrower from three sources 4. Borrower provides to the lender W-2 tax information, income statements, verification of employment and history, proof of assets (bank ...

... 3. Lender obtains credit reports of borrower from three sources 4. Borrower provides to the lender W-2 tax information, income statements, verification of employment and history, proof of assets (bank ...

personal statement - Bath Savings Institution

... Name(s):__________________________________________________________________________ Address:__________________________________________________________________________ ___________________________________________________________________________ ...

... Name(s):__________________________________________________________________________ Address:__________________________________________________________________________ ___________________________________________________________________________ ...

Products, services, customers, geography

... Using credit cards to establish a good credit history is a sound business decision; Although credit card offers and solicitations are perfectly legal, if a consumer does not use credit cards wisely, they can get into serious financial trouble. Thus, credit cards can end up being a legal form of pred ...

... Using credit cards to establish a good credit history is a sound business decision; Although credit card offers and solicitations are perfectly legal, if a consumer does not use credit cards wisely, they can get into serious financial trouble. Thus, credit cards can end up being a legal form of pred ...

The Origins of the U.S. Financial and Economic Crises

... only a great investment, but it was also widely perceived as a very safe investment," the study said. The prices eventually moved "out of line with fundamentals like household income," creating the so-called bubble, the study said. There were two trends developing at that time that contributed to th ...

... only a great investment, but it was also widely perceived as a very safe investment," the study said. The prices eventually moved "out of line with fundamentals like household income," creating the so-called bubble, the study said. There were two trends developing at that time that contributed to th ...

Morgan Stanley Newsletter

... International investing entails greater risk, as well as greater potential rewards compared to U.S. investing. These risks include political and economic uncertainties of foreign countries as well as the risk of currency fluctuations. These risks are magnified in countries with emerging markets, sin ...

... International investing entails greater risk, as well as greater potential rewards compared to U.S. investing. These risks include political and economic uncertainties of foreign countries as well as the risk of currency fluctuations. These risks are magnified in countries with emerging markets, sin ...

Real Money Rob Rikoon Good news for retirees: low

... when interest rates go up 1%. Investors who own short-term bonds face a paper decline of only 2% for every 1% rise in interest rates. Interest rates will rise because that is the only direction they can go. It has become clear to most economists that one of the unexpected costs for continuing to art ...

... when interest rates go up 1%. Investors who own short-term bonds face a paper decline of only 2% for every 1% rise in interest rates. Interest rates will rise because that is the only direction they can go. It has become clear to most economists that one of the unexpected costs for continuing to art ...

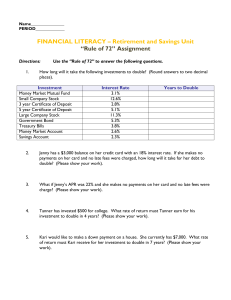

Lesson Two Exponential and Logarithmic Word

... 3.5% every year. If the forest currently has 3,350 trees in it, how many trees were in the forest 4 years and 3 months ago? ...

... 3.5% every year. If the forest currently has 3,350 trees in it, how many trees were in the forest 4 years and 3 months ago? ...

Slides

... • Convince them that you are their highest and safest ROI option • The riskier your startup, the higher the potential payoff has to be • 50% chance you’ll succeed – You need to double their investment for them to break even – Even more once PV is computed ...

... • Convince them that you are their highest and safest ROI option • The riskier your startup, the higher the potential payoff has to be • 50% chance you’ll succeed – You need to double their investment for them to break even – Even more once PV is computed ...

Credit rationing

Credit rationing refers to the situation where lenders limit the supply of additional credit to borrowers who demand funds, even if the latter are willing to pay higher interest rates. It is an example of market imperfection, or market failure, as the price mechanism fails to bring about equilibrium in the market. It should not be confused with cases where credit is simply ""too expensive"" for some borrowers, that is, situations where the interest rate is deemed too high. On the contrary, the borrower would like to acquire the funds at the current rates, and the imperfection refers to the absence of equilibrium in spite of willing borrowers. In other words, at the prevailing market interest rate, demand exceeds supply, but lenders are not willing to either loan more funds, or raise the interest rate charged, as they are already maximising profits.