unaudited but reviewed

... Company with a discount of approximately Baht 0.4 million and the Company’s future interest obligations also reduced by Baht 0.3 million. The Company recorded the totaled Baht 2.8 million of such reduction in indebtedness as a gain from debt restructuring, presenting it as an extraordinary item in t ...

... Company with a discount of approximately Baht 0.4 million and the Company’s future interest obligations also reduced by Baht 0.3 million. The Company recorded the totaled Baht 2.8 million of such reduction in indebtedness as a gain from debt restructuring, presenting it as an extraordinary item in t ...

1 Complaint for Violation of the Federal Securities Laws 05/19/2015

... manipulated sales, receivables, profit and other asset accounts; and (2) Vipshop's financial statements have been contradicted by management's own disclosures in several instances. The Mithra report stated, in part: Depending upon the nature of its sales transactions, VIPS acts as either a principal ...

... manipulated sales, receivables, profit and other asset accounts; and (2) Vipshop's financial statements have been contradicted by management's own disclosures in several instances. The Mithra report stated, in part: Depending upon the nature of its sales transactions, VIPS acts as either a principal ...

Combining active and passive managements in a portfolio

... Nicolas Gaussel: It may seem paradoxical that the demand for alternative asset management structures, such as hedge funds, has been increasing in the midst of this boom for indexing and passive solutions—yet investor inflows into alternatives have been very strong. Another study, conducted by Cliffw ...

... Nicolas Gaussel: It may seem paradoxical that the demand for alternative asset management structures, such as hedge funds, has been increasing in the midst of this boom for indexing and passive solutions—yet investor inflows into alternatives have been very strong. Another study, conducted by Cliffw ...

Fund Categories and Basis of Accounting

... A fund is defined as: “a fiscal and accounting entity with a self-balancing set of accounts recording cash and other financial resources, together with all related liabilities and residual equities or balances, and changes therein, which are segregated for the purpose of carrying on specific activit ...

... A fund is defined as: “a fiscal and accounting entity with a self-balancing set of accounts recording cash and other financial resources, together with all related liabilities and residual equities or balances, and changes therein, which are segregated for the purpose of carrying on specific activit ...

Managing The Leverage Cycle

... Observe that the Down Payment axis has been reversed, because lower down payment requirements are correlated with higher home prices. Note: For every AltA or Subprime first loan originated from Q1 2000 to Q1 2008, down payment percentage was calculated as appraised value (or sale price if available) ...

... Observe that the Down Payment axis has been reversed, because lower down payment requirements are correlated with higher home prices. Note: For every AltA or Subprime first loan originated from Q1 2000 to Q1 2008, down payment percentage was calculated as appraised value (or sale price if available) ...

Halal Stock Designation And Impact On Price and Trading Volume

... stock’s returns and trading volume. While there appears to be evidence of an impact on both these variables, much of the debate has been on whether the impact is temporary or permanent and on the reasons for the impact. Alternative hypotheses/arguments have been put forth to explain the impact. Most ...

... stock’s returns and trading volume. While there appears to be evidence of an impact on both these variables, much of the debate has been on whether the impact is temporary or permanent and on the reasons for the impact. Alternative hypotheses/arguments have been put forth to explain the impact. Most ...

SUNTRUST BANKS INC (Form: 8-K, Received: 01

... increased $20 million relative to 2015 as a result of 8% growth in the servicing portfolio and better net hedge performance. At December 31, 2016 and 2015, the servicing portfolio was $160.2 billion and $148.2 billion, respectively. Trust and investment management income was $73 million for the curr ...

... increased $20 million relative to 2015 as a result of 8% growth in the servicing portfolio and better net hedge performance. At December 31, 2016 and 2015, the servicing portfolio was $160.2 billion and $148.2 billion, respectively. Trust and investment management income was $73 million for the curr ...

A Framework for the use of Discount Rates in Actuarial Work

... future cash flows. For example, will a series of future cash inflows (an asset) be adequate to meet a separate series of future cash outflows (a liability)? The technique of “present values” or “discounted cash flows” is an approach to summarising a series of future cash flows in a more manageable w ...

... future cash flows. For example, will a series of future cash inflows (an asset) be adequate to meet a separate series of future cash outflows (a liability)? The technique of “present values” or “discounted cash flows” is an approach to summarising a series of future cash flows in a more manageable w ...

Bond Markets in Serbia: Regulatory Challenges for an Efficient Market

... four bond series accounted for 37.2% of the total debt, which meant that the government relied on acquiring bonds before they reach maturity through the process of privatization, or by allowing the possibility of purchasing government property with 'frozen savings' bonds. ...

... four bond series accounted for 37.2% of the total debt, which meant that the government relied on acquiring bonds before they reach maturity through the process of privatization, or by allowing the possibility of purchasing government property with 'frozen savings' bonds. ...

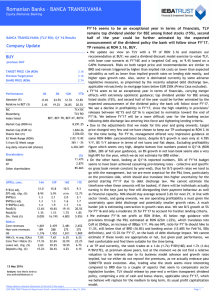

summary note

... securities being offered pursuant to this document. This part is merely a summary and therefore should only be read as an introduction to the Prospectus. It is not and does not purport to be exhaustive and investors are warned that they should not rely on the information contained in this summary in ...

... securities being offered pursuant to this document. This part is merely a summary and therefore should only be read as an introduction to the Prospectus. It is not and does not purport to be exhaustive and investors are warned that they should not rely on the information contained in this summary in ...

popular earnings management techniques

... Companies often buy stock in other companies either to invest excess funds or to achieve some type of strategic alliance. GAAP presumes that investments of less than 20 percent of the stock of another company are passive investments and therefore the investing company need not include a share of the ...

... Companies often buy stock in other companies either to invest excess funds or to achieve some type of strategic alliance. GAAP presumes that investments of less than 20 percent of the stock of another company are passive investments and therefore the investing company need not include a share of the ...

Understanding Yield Curves - PGIM Investments

... may be worth more or less than the original cost, and it is possible to lose money. Fixed income investments are subject to interest rate risk, where their value will decline as interest rates rise. The comments, opinions, and estimates contained herein are based on and/or derived from publicly avai ...

... may be worth more or less than the original cost, and it is possible to lose money. Fixed income investments are subject to interest rate risk, where their value will decline as interest rates rise. The comments, opinions, and estimates contained herein are based on and/or derived from publicly avai ...

TRUE-FALSE—Conceptual 1. Intangible assets derive their value

... Broadway Corporation was granted a patent on a product on January 1, 1998. To protect its patent, the corporation purchased on January 1, 2009 a patent on a competing product which was originally issued on January 10, 2005. Because of its unique plant, Broadway Corporation does not feel the competin ...

... Broadway Corporation was granted a patent on a product on January 1, 1998. To protect its patent, the corporation purchased on January 1, 2009 a patent on a competing product which was originally issued on January 10, 2005. Because of its unique plant, Broadway Corporation does not feel the competin ...

PPT - AgriFin

... •A year-on-year comparison of revenues for the same periods shows that the company’s revenues increased by 12% on average during 2011; however, comparing the average revenues for the period from January to June 2011 to the average revenues during the previous year would lead to the incorrect conclus ...

... •A year-on-year comparison of revenues for the same periods shows that the company’s revenues increased by 12% on average during 2011; however, comparing the average revenues for the period from January to June 2011 to the average revenues during the previous year would lead to the incorrect conclus ...

TRUE-FALSE STATEMENTS

... transaction was erroneously recorded as a debit to Cash $490 and a credit to Service Revenue $490. The correcting entry is a. debit Cash, $940; credit Accounts Receivable, $940. b. debit Cash, $450 and Accounts Receivable, $490; credit Service Revenue, $940. c. debit Cash, $450 and Service Revenue, ...

... transaction was erroneously recorded as a debit to Cash $490 and a credit to Service Revenue $490. The correcting entry is a. debit Cash, $940; credit Accounts Receivable, $940. b. debit Cash, $450 and Accounts Receivable, $490; credit Service Revenue, $940. c. debit Cash, $450 and Service Revenue, ...