Chapter F4

... just as there was no definitive answer to the question in the text about which type of investment is better. So much rides on the success or failure of the company’s future operations. If they are very successful, they should be able to easily repay the debt. However, if equity financing was used ...

... just as there was no definitive answer to the question in the text about which type of investment is better. So much rides on the success or failure of the company’s future operations. If they are very successful, they should be able to easily repay the debt. However, if equity financing was used ...

Portfolio Analysis and Theory in a Nutshell

... that the average return and average standard deviation of stock in the paper is 10% and 14%, respectively. If investor A throws one dart, then his expected return and risk will be 10% and 14%. If investor B throws ten darts, her expected return will still be 10% but her portfolio standard deviation ...

... that the average return and average standard deviation of stock in the paper is 10% and 14%, respectively. If investor A throws one dart, then his expected return and risk will be 10% and 14%. If investor B throws ten darts, her expected return will still be 10% but her portfolio standard deviation ...

New Submission Email - Central Bank of Ireland

... Type of Securities: [Debt/Fund/Equity] Document to be used for: Public Offer [Yes/No] Admission to trading on a regulated market [Yes/No] If Yes to admission to trading on a regulated market, name of regulated market: [Name of regulated market] Is this document related to a programme: [Yes/No] If Ye ...

... Type of Securities: [Debt/Fund/Equity] Document to be used for: Public Offer [Yes/No] Admission to trading on a regulated market [Yes/No] If Yes to admission to trading on a regulated market, name of regulated market: [Name of regulated market] Is this document related to a programme: [Yes/No] If Ye ...

WORKING CAPITAL MANAGEMENT What is Working Capital

... also known as circulating capital or revolving capital. It is a measure of company’s operational efficiency, liquidity and short-term solvency. Working capital is defined in terms of Net Working capital, i.e, Current assets - Current liabilities. Working Capital Ratio refers to how much capital a co ...

... also known as circulating capital or revolving capital. It is a measure of company’s operational efficiency, liquidity and short-term solvency. Working capital is defined in terms of Net Working capital, i.e, Current assets - Current liabilities. Working Capital Ratio refers to how much capital a co ...

Purchase Price Allocations for Solar Energy Systems

... business from assets. A business usually consists of inputs, processes and outputs; however, outputs are not required for an integrated set of assets to qualify as a business. Furthermore, even if e ...

... business from assets. A business usually consists of inputs, processes and outputs; however, outputs are not required for an integrated set of assets to qualify as a business. Furthermore, even if e ...

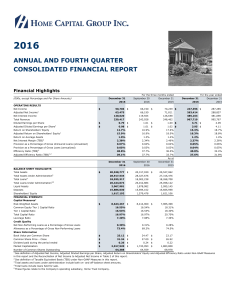

2016 Q4 Report - Home Capital Group

... multi-unit residential mortgages. These mortgages are generally funded through Canada Mortgage and Housing Corporation (CMHC) sponsored mortgage-backed security (MBS) and Canada Mortgage Bond (CMB) securitization programs. In some cases these mortgage portfolios may be sold off-balance sheet, result ...

... multi-unit residential mortgages. These mortgages are generally funded through Canada Mortgage and Housing Corporation (CMHC) sponsored mortgage-backed security (MBS) and Canada Mortgage Bond (CMB) securitization programs. In some cases these mortgage portfolios may be sold off-balance sheet, result ...

FS - Jaxon Minerals Inc.

... The Company is in the exploration stage and its principal business activity is the exploration and evaluation of exploration and evaluation assets that it believes contain mineralization that will be economically recoverable in the future. There has been no determination whether the Company’s intere ...

... The Company is in the exploration stage and its principal business activity is the exploration and evaluation of exploration and evaluation assets that it believes contain mineralization that will be economically recoverable in the future. There has been no determination whether the Company’s intere ...

FM11 Ch 04 Mini

... The standard deviation gets smaller as more stocks are combined in the portfolio, while rp (the portfolio’s return) remains constant. Thus, by adding stocks to your portfolio, which initially started as a 1-stock portfolio, risk has been reduced. In the real world, stocks are positively correlated w ...

... The standard deviation gets smaller as more stocks are combined in the portfolio, while rp (the portfolio’s return) remains constant. Thus, by adding stocks to your portfolio, which initially started as a 1-stock portfolio, risk has been reduced. In the real world, stocks are positively correlated w ...

SECTION I MACROECONOMIC ASPECTS OF FINANCIAL STABILITY

... The structure of all sectors in the economy, their interaction with each other and their endurance to shocks are the main issues monitored closely by central banks in recent years. For this reason, when analyzing the financial sector, not only financial institutions but also their interaction with a ...

... The structure of all sectors in the economy, their interaction with each other and their endurance to shocks are the main issues monitored closely by central banks in recent years. For this reason, when analyzing the financial sector, not only financial institutions but also their interaction with a ...

Leverage ratio

... derivatives exposures will either be unmargined, or they pay to borrow cash through a repo transaction which also attracts higher costs due to the leverage ratio requirements on repos with banks. This will ultimately increase the cost of services they provide to investors, or leave them exposed to a ...

... derivatives exposures will either be unmargined, or they pay to borrow cash through a repo transaction which also attracts higher costs due to the leverage ratio requirements on repos with banks. This will ultimately increase the cost of services they provide to investors, or leave them exposed to a ...

NBI Municipal Bond Plus Private Portfolio - Series

... 10. La Prairie Bassin, 1.75%, due September 28, 2020 Total percentage of top 10 investments: Total number of investments: ...

... 10. La Prairie Bassin, 1.75%, due September 28, 2020 Total percentage of top 10 investments: Total number of investments: ...

DOC, 126KB - Test Bank For

... altering the liquidity and maturity features of funds sources used to finance the FI's asset portfolio. granting loans to transform funds deficit units into funds surplus units. investing short-term funds in off-balance sheet activities. transferring of funds from one generation to another. ...

... altering the liquidity and maturity features of funds sources used to finance the FI's asset portfolio. granting loans to transform funds deficit units into funds surplus units. investing short-term funds in off-balance sheet activities. transferring of funds from one generation to another. ...

Liability

... Deloitte was the auditor for a client we’ll call Jeeps, Inc. The client sold accessories for jeeps such as tops, lights, cargo carriers, and hitches. One of the major issues in Deloitte’s audit of Jeeps, Inc., was outstanding litigation. Several lawsuits against the company alleged that the jeep top ...

... Deloitte was the auditor for a client we’ll call Jeeps, Inc. The client sold accessories for jeeps such as tops, lights, cargo carriers, and hitches. One of the major issues in Deloitte’s audit of Jeeps, Inc., was outstanding litigation. Several lawsuits against the company alleged that the jeep top ...

file

... • Mortgage holders will not default as long as income flows allows them to make their periodic payments. • Associated with loan-to-income ratio (LTI) measures Lambrecht et al (1997) – only micro-level study empirically compare equity and ability-to-pay theories in UK. – Contradicts US findings – Abi ...

... • Mortgage holders will not default as long as income flows allows them to make their periodic payments. • Associated with loan-to-income ratio (LTI) measures Lambrecht et al (1997) – only micro-level study empirically compare equity and ability-to-pay theories in UK. – Contradicts US findings – Abi ...

for RDI projects RSFF Financing Needs

... Loan tenors: depending on the “economic life” of the investment (generally between 10 and 20 years; exceptions). ...

... Loan tenors: depending on the “economic life” of the investment (generally between 10 and 20 years; exceptions). ...