BASEL I and BASEL II: HISTORY OF AN EVOLUTION

... • Under Basel-I, the bank has to hold 8% risk-based capital against all of these loans • To ensure the profitability of the better quality loans, the bank engages in capital arbitrage--it securitizes the loans so that they are reclassified into a lower regulatory risk category with a lower capital c ...

... • Under Basel-I, the bank has to hold 8% risk-based capital against all of these loans • To ensure the profitability of the better quality loans, the bank engages in capital arbitrage--it securitizes the loans so that they are reclassified into a lower regulatory risk category with a lower capital c ...

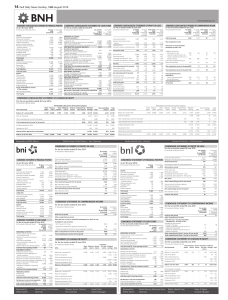

BYOG 3 Quick Guide to Key Ratios

... There are three sources of cash flow: (1) from operations, (2) from Investing and (3) from Financing. Use only the part derived from operations, which is usually the foremost source of cash. Many investment institutions value Free Cash Flow ahead of earnings as the single most important financial me ...

... There are three sources of cash flow: (1) from operations, (2) from Investing and (3) from Financing. Use only the part derived from operations, which is usually the foremost source of cash. Many investment institutions value Free Cash Flow ahead of earnings as the single most important financial me ...

euro high yield bond fund - Henderson Global Investors

... Contingent Convertible Bonds (CoCos) Bonds that, upon a predetermined ‘trigger event’can be converted into shares of the issuer or are partly or wholly written off. Derivatives Financial instruments whose value is linked to the price of an underlying asset (eg indices, rates, share prices). Money ma ...

... Contingent Convertible Bonds (CoCos) Bonds that, upon a predetermined ‘trigger event’can be converted into shares of the issuer or are partly or wholly written off. Derivatives Financial instruments whose value is linked to the price of an underlying asset (eg indices, rates, share prices). Money ma ...

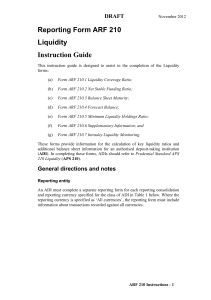

Reporting Form ARF 210 Liquidity Instruction Guide

... 2.4 Marketable Securities issued or guaranteed by non-central government PSEs or multilateral development banks with 20 per cent risk weight Unencumbered securities issued or guaranteed by non-government PSEs or multilateral development banks that receive a 20 per cent risk weight under the Basel II ...

... 2.4 Marketable Securities issued or guaranteed by non-central government PSEs or multilateral development banks with 20 per cent risk weight Unencumbered securities issued or guaranteed by non-government PSEs or multilateral development banks that receive a 20 per cent risk weight under the Basel II ...

Part 5 Clearing and settlement facilities

... (2) For paragraph 12BAB (18) (i) of the Act, the conduct of: (a) the Stock Exchange of Newcastle Limited, or an agent of that body; or (b) a participant of the Stock Exchange of Newcastle Limited, or an agent of the participant; or (c) Bendigo Stock Exchange Limited, or an agent of that body; or (d) ...

... (2) For paragraph 12BAB (18) (i) of the Act, the conduct of: (a) the Stock Exchange of Newcastle Limited, or an agent of that body; or (b) a participant of the Stock Exchange of Newcastle Limited, or an agent of the participant; or (c) Bendigo Stock Exchange Limited, or an agent of that body; or (d) ...

not self-supporting debt - Texas Bond Review Board

... • Lower Interest Rate – Investors will accept a lower interest rate than taxable bonds, such as corporate bonds, U.S. ...

... • Lower Interest Rate – Investors will accept a lower interest rate than taxable bonds, such as corporate bonds, U.S. ...

What is a Security?

... a transaction is the issuance of a security. An investment by more than one person, a common pool of money, into any entity, business or investment, is a security: A start-up, an operating company, a real estate investment, a trading fund, anything into which the investor expects to receive a retu ...

... a transaction is the issuance of a security. An investment by more than one person, a common pool of money, into any entity, business or investment, is a security: A start-up, an operating company, a real estate investment, a trading fund, anything into which the investor expects to receive a retu ...

A Partial Internal Model for Credit and Market Risk Under Solvency II

... Liquidity risk is typically ignored when analysing underwriting risks, since policyholders do not have the same rights as depositors of a bank. For example, policyholders often have to pay compensation for an early revocation or withdrawal of the contract. However, as Lorent (2008) argues, over the ...

... Liquidity risk is typically ignored when analysing underwriting risks, since policyholders do not have the same rights as depositors of a bank. For example, policyholders often have to pay compensation for an early revocation or withdrawal of the contract. However, as Lorent (2008) argues, over the ...

StrongPCMP4e-ch11

... • Measures only the return associated with the interest payments • Does not include the anticipated capital gain or loss resulting from the difference between par value and the purchase price ...

... • Measures only the return associated with the interest payments • Does not include the anticipated capital gain or loss resulting from the difference between par value and the purchase price ...

Joint Center for Housing Studies Harvard University Natalie Pickering

... constrained by funding; FOVI cannot provide sufficient below-market interest rate loans to meet demand. Thus the SOFOLES want to raise funds by securitizing their mortgages. The formation of a secondary mortgage market and the securitization of mortgages have traditionally been prerogatives of the M ...

... constrained by funding; FOVI cannot provide sufficient below-market interest rate loans to meet demand. Thus the SOFOLES want to raise funds by securitizing their mortgages. The formation of a secondary mortgage market and the securitization of mortgages have traditionally been prerogatives of the M ...

Ken Peasnell - Lancaster University

... Impact on pension schemes • Employer DC schemes – The contribution rate is determined by the labour market – Pension managers therefore focus on balancing risks and returns • Resource constraints will affect these decisions through their impact on yields on equities, bonds and other investment asse ...

... Impact on pension schemes • Employer DC schemes – The contribution rate is determined by the labour market – Pension managers therefore focus on balancing risks and returns • Resource constraints will affect these decisions through their impact on yields on equities, bonds and other investment asse ...

MathFinLec6 - United International College

... If the same bond (example6.3-3) had been purchased to yield 3% , the purchase price would have been 25 a(14, 0.015) + 1000(1.015)^(-14) = 1125.43 In this case, the interest part of the first coupon after purchase is 1125.43(.015) = 16.88 and the mark down is 25 - 16.88 = 8.12. The book value after t ...

... If the same bond (example6.3-3) had been purchased to yield 3% , the purchase price would have been 25 a(14, 0.015) + 1000(1.015)^(-14) = 1125.43 In this case, the interest part of the first coupon after purchase is 1125.43(.015) = 16.88 and the mark down is 25 - 16.88 = 8.12. The book value after t ...

(Fiduciary) Fund

... financial statements of business enterprises because internal service funds do not issue revenue bonds or receive contributions or deposits from customers, as do enterprise funds ...

... financial statements of business enterprises because internal service funds do not issue revenue bonds or receive contributions or deposits from customers, as do enterprise funds ...

Clean Tech - GreenWorld Capital, LLC

... CAVEAT - It is noted that the accounting issues surrounding instruments such as convertible debt and warrants are very complicated and require careful consideration. The following summary serves to illustrate certain considerations to examine; however, the accounting for each transaction is dependen ...

... CAVEAT - It is noted that the accounting issues surrounding instruments such as convertible debt and warrants are very complicated and require careful consideration. The following summary serves to illustrate certain considerations to examine; however, the accounting for each transaction is dependen ...

an analysis of investor`s confidence and risk taking aptitude from the

... expectation to perform better than the stock market, short-term investment attitude. These are some of the factors on the basis of which an investor goes ahead and invests in the stock market. Mittal & Vyas (2007), through their study provides evidence that the investment choice depends on and is af ...

... expectation to perform better than the stock market, short-term investment attitude. These are some of the factors on the basis of which an investor goes ahead and invests in the stock market. Mittal & Vyas (2007), through their study provides evidence that the investment choice depends on and is af ...

IBLLC Firm-Specific Disclosure 12-09-16

... do not engage in proprietary trading. Our business primarily encompasses securities and commodities brokerage for customers. IB is also registered as a Forex Dealer Member (“FDM”), and provides customers with the ability to trade spot forex. Interactive differs from a traditional brokerage firm beca ...

... do not engage in proprietary trading. Our business primarily encompasses securities and commodities brokerage for customers. IB is also registered as a Forex Dealer Member (“FDM”), and provides customers with the ability to trade spot forex. Interactive differs from a traditional brokerage firm beca ...