How Did Economists Get It So Wrong?

... And Keynes considered it a very bad idea to let such markets, in which speculators spent their time chasing one another’s tails, dictate important business decisions: “When the capital development of a country becomes a by-product of the activities of a casino, the job is likely to be ill-done.” By ...

... And Keynes considered it a very bad idea to let such markets, in which speculators spent their time chasing one another’s tails, dictate important business decisions: “When the capital development of a country becomes a by-product of the activities of a casino, the job is likely to be ill-done.” By ...

Resilience is Difficult to Define (But Easy to Spot)!

... Resiliency shines through the executive who would take a bullet for his staff so therefore, they will now take a bullet for him – and voila – a corporate turn‐around becomes reality. ...

... Resiliency shines through the executive who would take a bullet for his staff so therefore, they will now take a bullet for him – and voila – a corporate turn‐around becomes reality. ...

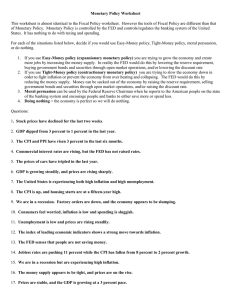

Monetary Policy Worksheet

... out of the economy by raising the reserve requirement, selling government bonds and securities through open market operations, and/or raising the discount rate. 3. Moral persuasion can be used by the Federal Reserve Chairman when he reports to the American people on the state of the banking system a ...

... out of the economy by raising the reserve requirement, selling government bonds and securities through open market operations, and/or raising the discount rate. 3. Moral persuasion can be used by the Federal Reserve Chairman when he reports to the American people on the state of the banking system a ...

Macroeconomic Issues and Vulnerabilities in the Global

... in the Global Economy: EM • Is the recent slowdown of EM cyclical or structural? What are its causes? • Will financial pressures intensify to the point of a crisis in some EM or will they diminish? • Which EM are most at risk and why? • What policy options are available for these EM ...

... in the Global Economy: EM • Is the recent slowdown of EM cyclical or structural? What are its causes? • Will financial pressures intensify to the point of a crisis in some EM or will they diminish? • Which EM are most at risk and why? • What policy options are available for these EM ...

ECON 4423-001 International Finance

... Course Description This course presents International Economics theory and applies it towards gaining an understanding of recent events and current policy issues. The theory presented in this course covers a broad range of topics including exchange rate determination, monetary and fiscal policy in a ...

... Course Description This course presents International Economics theory and applies it towards gaining an understanding of recent events and current policy issues. The theory presented in this course covers a broad range of topics including exchange rate determination, monetary and fiscal policy in a ...

An Age of Transition: US, China, Peak Oil, and the Demise of

... The US economic growth since 2001 has been led by the expansion of household consumption, which now accounts for 70 percent of GDP. As the majority of the households suffer from falling or stagnant real incomes, the expansion of consumption has been financed by the explosive growth of household deb ...

... The US economic growth since 2001 has been led by the expansion of household consumption, which now accounts for 70 percent of GDP. As the majority of the households suffer from falling or stagnant real incomes, the expansion of consumption has been financed by the explosive growth of household deb ...

classical_model - YSU

... • A macroeconomic model that explains the long-run behavior of the economy. • Classical model was developed by economists in 19th and early 20th, to explain a key observation about economy. – Over periods of several years or longer, economy performs rather well ...

... • A macroeconomic model that explains the long-run behavior of the economy. • Classical model was developed by economists in 19th and early 20th, to explain a key observation about economy. – Over periods of several years or longer, economy performs rather well ...

2014 Pre-Budget Briefing - Parliamentary Monitoring Group

... growth and high and persistent unemployment, with counter-cyclical fiscal policy. That is, increasing government spending during periods of weaker economic conditions to stimulate economic activity. South Africa consequently began running a fiscal deficit in 2009/10 in the wake of the global financi ...

... growth and high and persistent unemployment, with counter-cyclical fiscal policy. That is, increasing government spending during periods of weaker economic conditions to stimulate economic activity. South Africa consequently began running a fiscal deficit in 2009/10 in the wake of the global financi ...

Chart

... (Percent of GDP unless noted otherwise) Fiscal deficits and public debt are very high in many advanced economies. Although policy became much less stimulatory in 2010, real GDP growth picked up, suggesting a handoff from public to private demand. For 2011, fiscal consolidation is expected to be mode ...

... (Percent of GDP unless noted otherwise) Fiscal deficits and public debt are very high in many advanced economies. Although policy became much less stimulatory in 2010, real GDP growth picked up, suggesting a handoff from public to private demand. For 2011, fiscal consolidation is expected to be mode ...

Purchasing Managers` (PMI) Composite Output Index 采购经理人

... worst quarter for three years," said Chris Williamson, ...

... worst quarter for three years," said Chris Williamson, ...

ABC International Bank plc – Global Trade Finance services

... Whilst, on the surface, day-to-day life in Bahrain appears largely to have returned to normal, civil protests are continuing on a fairly regular basis. The government does not seem minded to offer much in the way of real reform – possibly reassured by the recent clear demonstration of Saudi support ...

... Whilst, on the surface, day-to-day life in Bahrain appears largely to have returned to normal, civil protests are continuing on a fairly regular basis. The government does not seem minded to offer much in the way of real reform – possibly reassured by the recent clear demonstration of Saudi support ...

Against the Odds: Lessons from the Recovery in The Baltics

... A smart adjustment does not need sustained and extensive deflation, as many warned was the corollary of the internal devaluation. Instead it such adjustment can reduce interest rates supporting both growth and debt dynamics. Growth can return faster if there is a credible fiscal consolidation and st ...

... A smart adjustment does not need sustained and extensive deflation, as many warned was the corollary of the internal devaluation. Instead it such adjustment can reduce interest rates supporting both growth and debt dynamics. Growth can return faster if there is a credible fiscal consolidation and st ...

Syllabus ECON 6090, Section 093 July 22 to August 7, 2013

... EconPortal is an electronic resource that includes an electronic copy of the text. It also includes a study guide; selftests and self-assessment; links to online information relevant to text material; a data plotter; flashcards, etc. You may benefit from these features. However, EconPortal is not re ...

... EconPortal is an electronic resource that includes an electronic copy of the text. It also includes a study guide; selftests and self-assessment; links to online information relevant to text material; a data plotter; flashcards, etc. You may benefit from these features. However, EconPortal is not re ...

Safe-Asset Slaughter How to Profit Through the Coming

... debt and asset bubble deflates, they are the ones that will be hit the hardest. They borrowed much of the money, made most of the loans or invested at high leverage in the asset bubble. The average American has already been hit pretty hard. In fact, deflation is part of the reason the government’s i ...

... debt and asset bubble deflates, they are the ones that will be hit the hardest. They borrowed much of the money, made most of the loans or invested at high leverage in the asset bubble. The average American has already been hit pretty hard. In fact, deflation is part of the reason the government’s i ...

Document

... creation, economic growth, and infrastructure development. It is estimated that at an oil price of 50 dollars, the present value of the GCC’s oil and gas exports is $18.3 trillion dollars - larger than the 2008 GDP of the US. If oil prices were to average 100 dollars per barrel and gas 15 dollars, t ...

... creation, economic growth, and infrastructure development. It is estimated that at an oil price of 50 dollars, the present value of the GCC’s oil and gas exports is $18.3 trillion dollars - larger than the 2008 GDP of the US. If oil prices were to average 100 dollars per barrel and gas 15 dollars, t ...

IMF

... • The IMF also performs similar reviews of regional policy by such organizations as the European Union (EU), the West African Economic and Monetary Union, and the Eastern Caribbean Currency Union. ...

... • The IMF also performs similar reviews of regional policy by such organizations as the European Union (EU), the West African Economic and Monetary Union, and the Eastern Caribbean Currency Union. ...

economic insight SOUTH EaST aSIa Quarterly briefing December 2011 global uncertainty unsettles

... Welcome to the second issue of the ICAEW Economic Insight: South East Asia, a new quarterly forecast for the region prepared directly for the finance profession. Produced by Cebr, ICAEW’s partner and acknowledged experts in global economic forecasting, it provides a unique perspective on the prospec ...

... Welcome to the second issue of the ICAEW Economic Insight: South East Asia, a new quarterly forecast for the region prepared directly for the finance profession. Produced by Cebr, ICAEW’s partner and acknowledged experts in global economic forecasting, it provides a unique perspective on the prospec ...

Stimulus and Regulation - Yale Economics

... many countries, and bubbles in the price of energy and many commodities that affected much of the world. Speculative bubbles are in a sense social epidemics. Their contagion rate is amplified by the focal point for public attention – attention created by the spectacle of rapid price increases that a ...

... many countries, and bubbles in the price of energy and many commodities that affected much of the world. Speculative bubbles are in a sense social epidemics. Their contagion rate is amplified by the focal point for public attention – attention created by the spectacle of rapid price increases that a ...

THE ECONOMIC IMPACT OF GLOBAL FINANCIAL CRISIS ON FIJI

... • CREDIT CRUNCH: RELUCTANCE OF BANKS TO LEND • HIGH SPREAD BETWEEN INTERBANK LENDING RATE & TB RATE • CENTRAL BANKS’ EFFORTS TO UNFREEZE CREDIT FLOWS • PANIC: STOCK MARKET COLLAPSE: CONTINUOUS FALL • WHERE IS THE BOTTOM? ...

... • CREDIT CRUNCH: RELUCTANCE OF BANKS TO LEND • HIGH SPREAD BETWEEN INTERBANK LENDING RATE & TB RATE • CENTRAL BANKS’ EFFORTS TO UNFREEZE CREDIT FLOWS • PANIC: STOCK MARKET COLLAPSE: CONTINUOUS FALL • WHERE IS THE BOTTOM? ...

Is the World Becoming Immune from America?

... That said, the United States’ historical role in causing global business cycles is often exaggerated. The correlation between U.S. and other G7 country business cycles has historically been around 50 percent. However, a large part of this correlation owes to common shocks (oil, technology, housing), ...

... That said, the United States’ historical role in causing global business cycles is often exaggerated. The correlation between U.S. and other G7 country business cycles has historically been around 50 percent. However, a large part of this correlation owes to common shocks (oil, technology, housing), ...

History of economic thought Short characteristic of economics

... • Normative economics: what ought to (should) be, what is good or bad. The value judgments are necessary to assess the truth of statement. ...

... • Normative economics: what ought to (should) be, what is good or bad. The value judgments are necessary to assess the truth of statement. ...

Economic Theories

... general, the recognition lag is three to six months. • Decision or response lag: the time it takes policy makers to decide and implement the policy response to the current economic problem. – This lag differs between monetary between monetary and fiscal policy. – The monetary policy decision lag is ...

... general, the recognition lag is three to six months. • Decision or response lag: the time it takes policy makers to decide and implement the policy response to the current economic problem. – This lag differs between monetary between monetary and fiscal policy. – The monetary policy decision lag is ...

Three Challenges Facing Modern Macroeconomics White paper

... A second great challenge is to develop a better understanding of how government fiscal and debt policy affects the economy. On top of all the issues confronting analysis of monetary policy (introducing frictions in financial, labor and product markets), there a several additional problems. In t ...

... A second great challenge is to develop a better understanding of how government fiscal and debt policy affects the economy. On top of all the issues confronting analysis of monetary policy (introducing frictions in financial, labor and product markets), there a several additional problems. In t ...

Figure 17.1 Per Capita Real GDP by Region

... Jeffrey Sach (2000), “A New Map of the World,” The Economist, June 24. International Economics ...

... Jeffrey Sach (2000), “A New Map of the World,” The Economist, June 24. International Economics ...

Nouriel Roubini

Nouriel Roubini (born March 29, 1958) is an American economist. He teaches at New York University's Stern School of Business and is the chairman of Roubini Global Economics, an economic consultancy firm.The child of Iranian Jews, he was born in Turkey and grew up in Italy. After receiving a BA in political economics at Bocconi University, Milan and a doctorate in international economics at Harvard University, he became an academic at Yale and a practising economist at the International Monetary Fund (IMF), the Federal Reserve, World Bank, and Bank of Israel. Much of his early research focused on emerging markets. During the administration of President Bill Clinton, he was a senior economist for the Council of Economic Advisers, later moving to the United States Treasury Department as a senior adviser to Timothy Geithner, who in 2009 became Treasury Secretary.