Mar 2011 - Spears Abacus

... the world is and will remain uncertain. Every business is affected by economic growth or recession, but macroeconomic activity, deficits and GDP have less direct impact on long term stock performance than net profits and cash flow for the individual entity. We have now had a sustained market advance ...

... the world is and will remain uncertain. Every business is affected by economic growth or recession, but macroeconomic activity, deficits and GDP have less direct impact on long term stock performance than net profits and cash flow for the individual entity. We have now had a sustained market advance ...

The Impact of The Informal Economy on Economic Diversification in

... Labour Force 13,000 GDP of $951,823 Per Capita $38,500 ...

... Labour Force 13,000 GDP of $951,823 Per Capita $38,500 ...

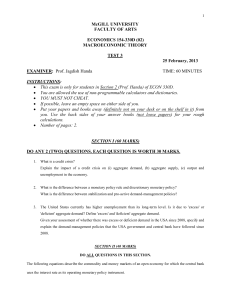

Macroeconomic Theory

... Answer question 1, 2 questions in Part II, and 2 questions from Part III. Be sure to show your work. You are free to use notes, texts, calculators, or any other inanimate devices. Exams will be collected at 11:00. Please reaffirm the Honor Code. You have 100 minutes and 100 points; use your time wis ...

... Answer question 1, 2 questions in Part II, and 2 questions from Part III. Be sure to show your work. You are free to use notes, texts, calculators, or any other inanimate devices. Exams will be collected at 11:00. Please reaffirm the Honor Code. You have 100 minutes and 100 points; use your time wis ...

Steve`s 1st Quarter Commentary 2014

... The Rothchilds were talking about the banking system, but I would argue that this monetary malignancy has now metastasized to the rest of the financial system. Just as there are two Disney Worlds, there are two financial systems – the seen and the unseen. The visible economic world shown by the Wall ...

... The Rothchilds were talking about the banking system, but I would argue that this monetary malignancy has now metastasized to the rest of the financial system. Just as there are two Disney Worlds, there are two financial systems – the seen and the unseen. The visible economic world shown by the Wall ...

Economic Stability - Cameron Economics

... Innovation leads to what Alan Greenspan termed “irrational exuberance” as investors believe that the innovation will be the new „next best thing‟. This exuberance creates a bubble as investment is attracted to fund the new innovation because it is expected that the innovation will lead to above-aver ...

... Innovation leads to what Alan Greenspan termed “irrational exuberance” as investors believe that the innovation will be the new „next best thing‟. This exuberance creates a bubble as investment is attracted to fund the new innovation because it is expected that the innovation will lead to above-aver ...

Speech - Nigel Ray

... only about one per cent of the Chinese overseas tourism market. And I don’t need to tell you that the Chinese middle class is a growing market. So we are a part of China’s transition. And China is a part of our transition. A transition to broader based drivers of growth is underway as we leave behin ...

... only about one per cent of the Chinese overseas tourism market. And I don’t need to tell you that the Chinese middle class is a growing market. So we are a part of China’s transition. And China is a part of our transition. A transition to broader based drivers of growth is underway as we leave behin ...

An Analysis of Vietnam`s Current Economic Situation

... Vietnam will remain one of the fastest growing economies in the world, but will fall short of its initial medium-term plans to grow 7-8 percent per year to achieve the Millennium Development Goals by 2015. Expanding credit to sectors that will deepen human capital investment (e.g., health, education ...

... Vietnam will remain one of the fastest growing economies in the world, but will fall short of its initial medium-term plans to grow 7-8 percent per year to achieve the Millennium Development Goals by 2015. Expanding credit to sectors that will deepen human capital investment (e.g., health, education ...

financialglobalization1

... So a run on the banks developed at the first sign of difficulties. We are not there yet, but we are also in the initial stages of the crisis. There are important similarities with the current crisis: 2/09: Economists at the World Bank predicted that the global economy and the volume of global trade ...

... So a run on the banks developed at the first sign of difficulties. We are not there yet, but we are also in the initial stages of the crisis. There are important similarities with the current crisis: 2/09: Economists at the World Bank predicted that the global economy and the volume of global trade ...

Export to PDF

... The stage is therefore set for a cyclical upturn. Moreover, in this expansionary phase, growth will be less hampered by a massive global debt overhang and, as deflationary pressures subside, central banks will feel less compelled to take action at the slightest sign of a faltering economy. This cycl ...

... The stage is therefore set for a cyclical upturn. Moreover, in this expansionary phase, growth will be less hampered by a massive global debt overhang and, as deflationary pressures subside, central banks will feel less compelled to take action at the slightest sign of a faltering economy. This cycl ...

age of exploration

... things sacrificed, meaning the next best options forgone/passed over while we make choices, are called the opportunity costs. They represent the things we sacrifice in order to obtain something. Studying economics helps people to develop a habit of analysing the costs and benefits of their actions a ...

... things sacrificed, meaning the next best options forgone/passed over while we make choices, are called the opportunity costs. They represent the things we sacrifice in order to obtain something. Studying economics helps people to develop a habit of analysing the costs and benefits of their actions a ...

Module1a

... they can be mitigated by government intervention. Monetary policy uses changes in the quantity of money to alter interest rates and affect overall ...

... they can be mitigated by government intervention. Monetary policy uses changes in the quantity of money to alter interest rates and affect overall ...

MPR Summary - October 2015

... Global economic growth has been a little weaker than expected this year, but the dynamics pointing to a pickup in 2016 and 2017 remain largely intact. Uncertainty about China’s transition to a slower growth path has contributed to further downward pressure on prices for oil and other commodities. Th ...

... Global economic growth has been a little weaker than expected this year, but the dynamics pointing to a pickup in 2016 and 2017 remain largely intact. Uncertainty about China’s transition to a slower growth path has contributed to further downward pressure on prices for oil and other commodities. Th ...

Ravi Menon: The global economy - securing a return to normalcy

... The Bank of Japan is buying government bonds, but has also purchased corporate bonds and real estate investment funds. Quantitative easing by the BoJ has amounted to 100 trillion yen, or 21% of GDP. ...

... The Bank of Japan is buying government bonds, but has also purchased corporate bonds and real estate investment funds. Quantitative easing by the BoJ has amounted to 100 trillion yen, or 21% of GDP. ...

Leumi Economic Weekly

... announced a 25bps cut to its interest rate for March, bringing the rate to only 0.75%. In contrast to the interest rate cuts implemented since October 2008, which were in increments of 50-75bs each, the current move was of a more moderate rate. This is signaling that the central bank is approaching ...

... announced a 25bps cut to its interest rate for March, bringing the rate to only 0.75%. In contrast to the interest rate cuts implemented since October 2008, which were in increments of 50-75bs each, the current move was of a more moderate rate. This is signaling that the central bank is approaching ...

Economists try to predict trends in the world economy by applying

... persistent budget deficits and the increased reliance on short-term debt financing in the early stages of the financial crisis. For 2011, Japan and the United States face the largest public debt rollovers of any advanced economy at 56% and 29% of GDP, respectively (Figure 3). The Euro area governmen ...

... persistent budget deficits and the increased reliance on short-term debt financing in the early stages of the financial crisis. For 2011, Japan and the United States face the largest public debt rollovers of any advanced economy at 56% and 29% of GDP, respectively (Figure 3). The Euro area governmen ...

THE EFFECTS OF THE GLOBAL FINANCIAL CRISIS ON ASIA AND

... reduced asset values, the level of exposure of local banks and other domestic financial institutions (such as the government pension system) to structured products of problematic financial institutions abroad and other foreign assets etc., are not known precisely by the public nor by banks themselve ...

... reduced asset values, the level of exposure of local banks and other domestic financial institutions (such as the government pension system) to structured products of problematic financial institutions abroad and other foreign assets etc., are not known precisely by the public nor by banks themselve ...

The KonLin Letter page 1.pmd - Small Cap Stock Advice | Small Cap

... As TRANSPORTS (Fig.1) continued its vigorous uptrend, making an all-time record high, a NON-CONFIRMATION by the rest of the INDEXES caused a major negative DIVERGENCE. As the European SOVEREIGN DEBT CRISIS intensifies, the DJTA had a dramatic reversal, sending VIX (Fig.2), the “fear gauge,” north, e ...

... As TRANSPORTS (Fig.1) continued its vigorous uptrend, making an all-time record high, a NON-CONFIRMATION by the rest of the INDEXES caused a major negative DIVERGENCE. As the European SOVEREIGN DEBT CRISIS intensifies, the DJTA had a dramatic reversal, sending VIX (Fig.2), the “fear gauge,” north, e ...

The Global Economy

... large debts, large austerity needs and a large risk of falling into a liquidity trap. Paul Krugman is among those who feel that the multiplier is high under such circumstances and that there is good reason for more fiscal policy measures to stimulate demand. Emmanuel Fahri from Harvard University is ...

... large debts, large austerity needs and a large risk of falling into a liquidity trap. Paul Krugman is among those who feel that the multiplier is high under such circumstances and that there is good reason for more fiscal policy measures to stimulate demand. Emmanuel Fahri from Harvard University is ...

FRBSF L CONOMIC

... Economist of the Bank of Korea, credited aggressive U.S. and European monetary and fiscal policy responses to the financial crisis with preventing another Great Depression. However, the global economy is still hampered by excessive leverage. The need for continued expansionary fiscal policy in the s ...

... Economist of the Bank of Korea, credited aggressive U.S. and European monetary and fiscal policy responses to the financial crisis with preventing another Great Depression. However, the global economy is still hampered by excessive leverage. The need for continued expansionary fiscal policy in the s ...

doc Test 3 (Midterm) 2013

... The following equations describe the commodity and money markets of an open economy for which the central bank uses the interest rate as its operating monetary policy instrument. ...

... The following equations describe the commodity and money markets of an open economy for which the central bank uses the interest rate as its operating monetary policy instrument. ...

Private Sector, Academia Dialogue

... programme is also of high value especially with respect to courses in social science, humanities, Law and physical sciences. However, many of these will require additional professional qualification to make the holders more appealing to employers. Such areas of business they will fit into include ...

... programme is also of high value especially with respect to courses in social science, humanities, Law and physical sciences. However, many of these will require additional professional qualification to make the holders more appealing to employers. Such areas of business they will fit into include ...

Presentation to Community Leaders, Spokane, WA

... Consumer spending is powering the economy. We’ve seen real consumer spending increase more than 3 percent over the past year and auto sales are on pace to exceed 17 million vehicles this year—the highest level seen since the early 2000s. Strong fundamentals point to continued solid gains going forw ...

... Consumer spending is powering the economy. We’ve seen real consumer spending increase more than 3 percent over the past year and auto sales are on pace to exceed 17 million vehicles this year—the highest level seen since the early 2000s. Strong fundamentals point to continued solid gains going forw ...

The Great Crash 2008

... frightened and have stopped spending on discretionary items. Shocked by the financial crisis, fearful about the security of their bank and money-market deposits, and rocked by the sense of doom pervading Washington and the U.S. media, they have quickly raised their savings by curtailing spending and ...

... frightened and have stopped spending on discretionary items. Shocked by the financial crisis, fearful about the security of their bank and money-market deposits, and rocked by the sense of doom pervading Washington and the U.S. media, they have quickly raised their savings by curtailing spending and ...

Presentation to Community Leaders Luncheon Salt Lake City, UT

... today, the house price-to-rent ratio is where it was in 2003, and house prices are rapidly rising. I don’t think we’re at a tipping point yet—but I am looking at the path we’re on and looking out for potential potholes. In considering the FOMC’s monetary policy choices, it’s important to remember th ...

... today, the house price-to-rent ratio is where it was in 2003, and house prices are rapidly rising. I don’t think we’re at a tipping point yet—but I am looking at the path we’re on and looking out for potential potholes. In considering the FOMC’s monetary policy choices, it’s important to remember th ...

The World`s Fastest-Growing Economies Won`t Be Scary Unless

... the members account for a little more than one-quarter of global gross domestic product and around half of developing country output. All have been on a tear. From 2003 to 2013, China’ s GDP increased 164 percent; it now accounts for 15 percent of global GDP. India’ s GDP approximately doubled over ...

... the members account for a little more than one-quarter of global gross domestic product and around half of developing country output. All have been on a tear. From 2003 to 2013, China’ s GDP increased 164 percent; it now accounts for 15 percent of global GDP. India’ s GDP approximately doubled over ...

Nouriel Roubini

Nouriel Roubini (born March 29, 1958) is an American economist. He teaches at New York University's Stern School of Business and is the chairman of Roubini Global Economics, an economic consultancy firm.The child of Iranian Jews, he was born in Turkey and grew up in Italy. After receiving a BA in political economics at Bocconi University, Milan and a doctorate in international economics at Harvard University, he became an academic at Yale and a practising economist at the International Monetary Fund (IMF), the Federal Reserve, World Bank, and Bank of Israel. Much of his early research focused on emerging markets. During the administration of President Bill Clinton, he was a senior economist for the Council of Economic Advisers, later moving to the United States Treasury Department as a senior adviser to Timothy Geithner, who in 2009 became Treasury Secretary.